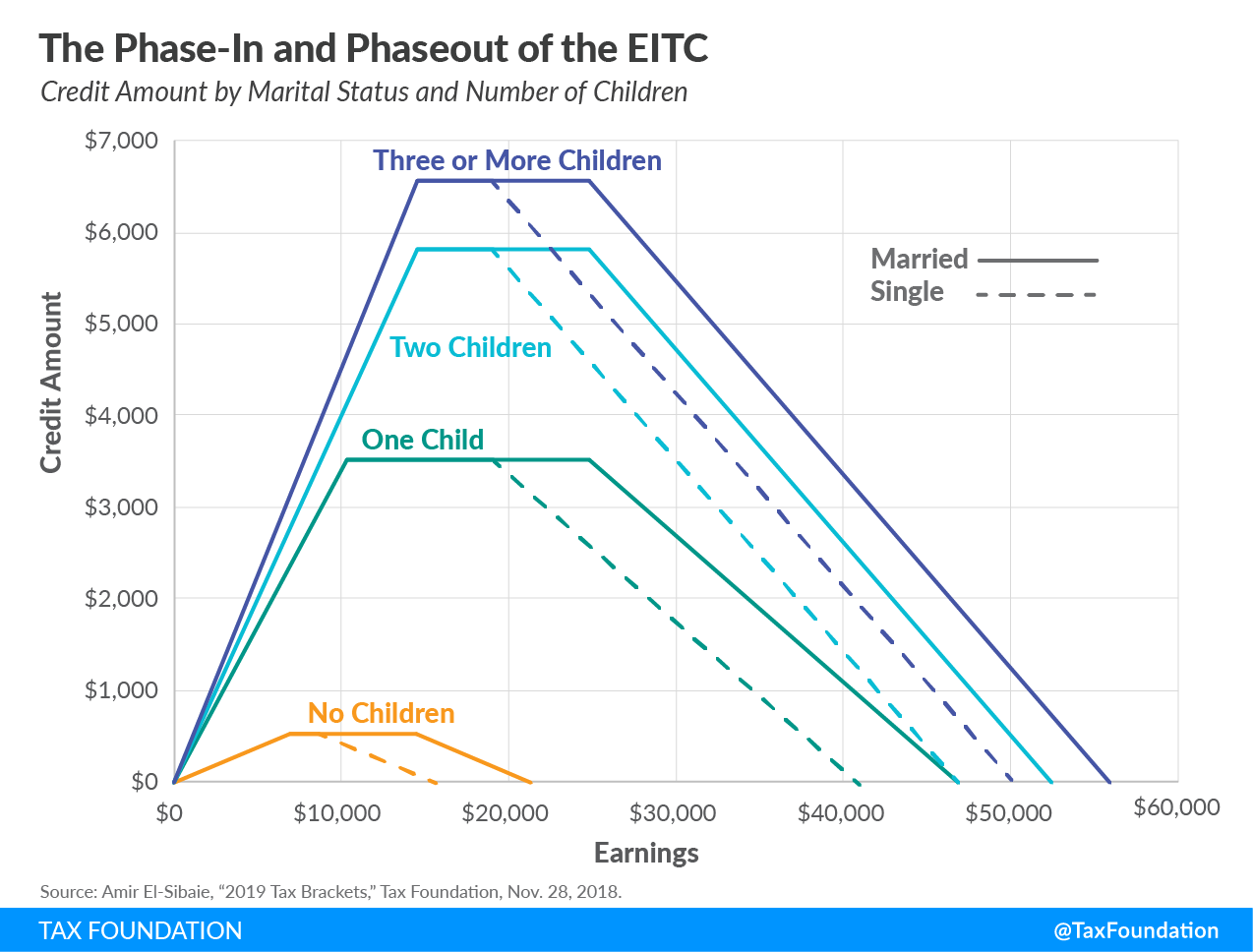

Indiana State Earned Income Tax Credit Indiana s Earned Income Tax Credit works like the federal version it reduces tax liability for low income earners with any amount leftover given back as a refund Eligibility rules for the EITC are complex and based on income family size citizenships status marital status and more

The earned income credit EIC is a tax credit for certain people who work and have earned income under 47 900 A tax credit usually means more money in your pocket It reduces the amount of tax you owe The EIC may also give you a refund Can I Claim Indiana s EIC To claim Indiana s EIC you must meet certain rules These rules are 302 Found VDOMDHTMLTML PUBLIC IETF DTD HTML 2 0 EN Found The document has moved here

Indiana State Earned Income Tax Credit

Indiana State Earned Income Tax Credit

https://www.wfyi.org/files/wfyi/articles/original/indianador-mobilesite-dj072621.jpg

This Is Earned Income Tax Credit Awareness Day

https://dfcby4322olzt.cloudfront.net/wp-content/uploads/2018/01/eitc.jpg

Earned Income Tax Credit EITC Eligibility And Benefits Stealth

https://stealthcapitalist.com/wp-content/uploads/2023/02/AdobeStock_551436661-scaled.jpeg

Summary of Changes Aside from nonsubstantive technical changes this bulletin has been changed to reflect that the Indiana earned income tax credit is now 10 of the federal earned income tax credit as of January 1 2023 The Indiana earned income tax credit is a credit lower income taxpayers can claim on their state taxes The table shows the income eligibility amounts for the 2023 tax year and maximum credit available if HB 1290 becomes law

Therefore Indiana will not recognize this provision Thus the amount of earned income in 2020 alone must be used for purposes of determining the 2020 Indiana earned income tax credit In addition Sections 9621 through 9626 of the ARPA made several changes to the federal earned income tax credit These changes include the following provisions The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund

Download Indiana State Earned Income Tax Credit

More picture related to Indiana State Earned Income Tax Credit

Earned Income Tax Credit Horizon Goodwill Industries

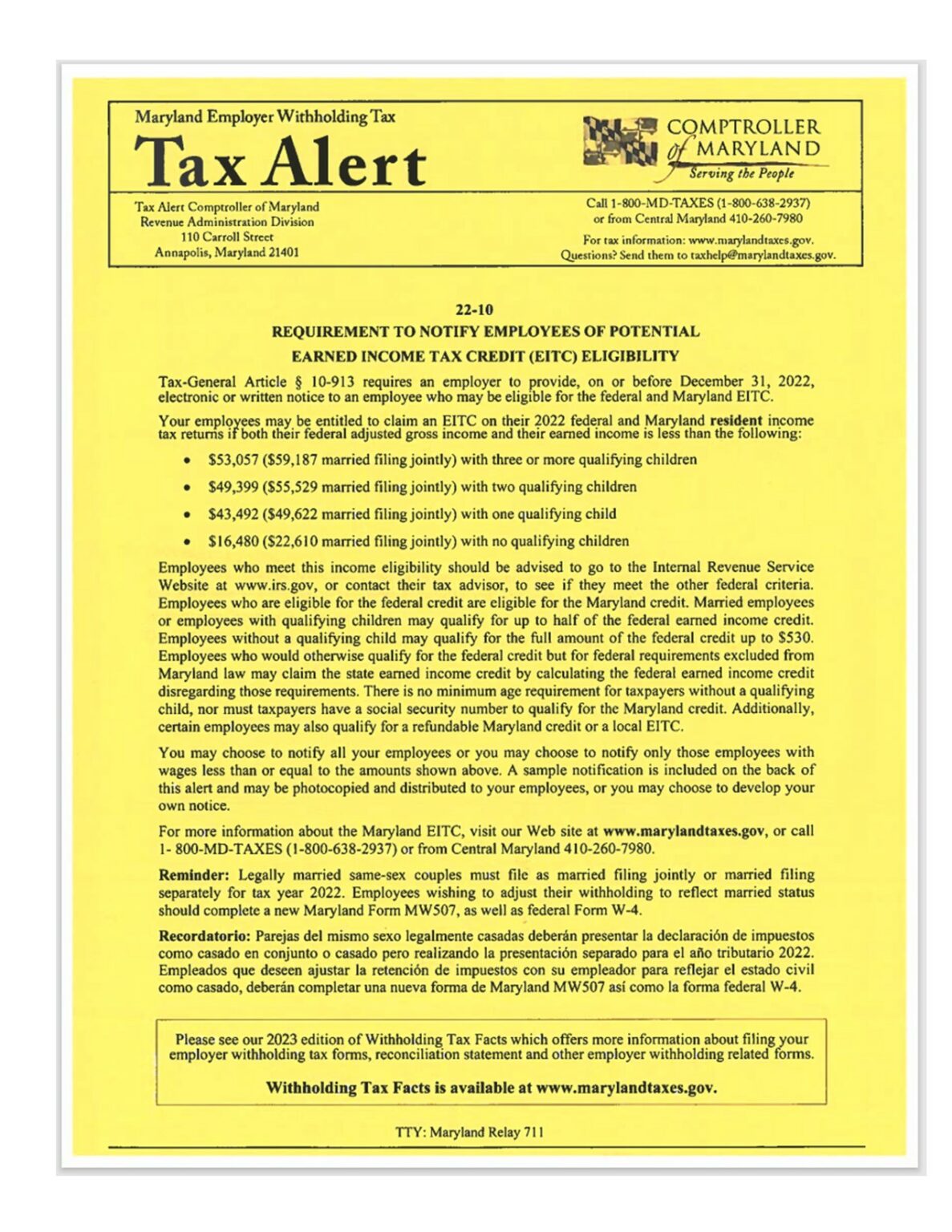

https://horizongoodwill.org/wp-content/uploads/2022/12/tax-1-1-1187x1536.jpg

Who Is Eligible For The Earned Income Tax Credit Medium

https://miro.medium.com/v2/da:true/resize:fit:1200/0*192vbxywjokVeji1

Earned Income Tax Credit All You Need To Know About Claiming It

http://www.sarkariexam.com/wp-content/uploads/2023/08/Earned-Income-Tax-Credit-All-you-need-to-know-about-claiming-it.jpg

The Indiana earned income tax credit is a credit lower income taxpayers can claim on their state taxes The table shows the income eligibility amounts for the 2022 tax year maximum credit currently available and maximum credit available if Published January 18 2023 at 11 11 PM EST Lauren Chapman A state lawmaker says his bill to increase Indiana s earned income tax credit would be a huge boost to addressing generational poverty The credit is meant for lower income people and families Income limits are based on the number of children you have

EARNED INCOME TAX CREDIT EITC Rate Fully Refundable 10 of the federal credit 1 Eligibility Requirements All Indiana taxpayers must have filed for the federal credit and are subject to slightly different income thresholds than the federal guidelines See the 2015 IT 40 Individual Income Tax Booklet for more details Lower income Hoosiers would get a boost on a state tax credit under legislation unanimously approved by the Indiana House Monday The legislation HB 1290 doesn t just increase the

2022 Tax Tables Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/624/911/624911793/large.png

Minnesota Tax Credits For Workers And Families

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

https://www. thebalancemoney.com /indiana-earned...

Indiana s Earned Income Tax Credit works like the federal version it reduces tax liability for low income earners with any amount leftover given back as a refund Eligibility rules for the EITC are complex and based on income family size citizenships status marital status and more

https:// forms.in.gov /Download.aspx?id=15174

The earned income credit EIC is a tax credit for certain people who work and have earned income under 47 900 A tax credit usually means more money in your pocket It reduces the amount of tax you owe The EIC may also give you a refund Can I Claim Indiana s EIC To claim Indiana s EIC you must meet certain rules These rules are

Earned Income Tax Credit EITC Eligibility

2022 Tax Tables Fill Out Sign Online DocHub

State Earned Income Tax Credits Urban Institute

California Earned Income Tax Credit Worksheet Part Iii Line 6 Worksheet

Boosting Incomes Improving Equity State Earned Income Tax Credits In

Earned Income Tax Credit 2013 1040Return File 1040 1040ez And

Earned Income Tax Credit 2013 1040Return File 1040 1040ez And

Earned Income Tax Credit EITC A Primer Tax Foundation

And Taxes Fonrevem My Nean Do Your Federal Taxes While Romancing Your

40th Anniversary Of The Earned Income Tax Credit

Indiana State Earned Income Tax Credit - Summary of Changes Aside from nonsubstantive technical changes this bulletin has been changed to reflect that the Indiana earned income tax credit is now 10 of the federal earned income tax credit as of January 1 2023