Indiana State Income Tax Standard Deduction Indiana provides a standard Personal Exemption tax deduction of 1 000 00 in 2024 per qualifying filer and qualifying dependent s this is used to reduce the amount of income that is subject to tax in 2024 The federal standard

Indiana provides a standard Personal Exemption tax deduction of 1 000 00 in 2025 per qualifying filer and qualifying dependent s this is used to reduce the amount of income that is subject to tax in 2025 The federal standard Indiana deductions are used to reduce the amount of taxable income For example if you earn 60 000 in a year and pay 2 000 in Indiana property taxes on your primary residence during

Indiana State Income Tax Standard Deduction

Indiana State Income Tax Standard Deduction

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/09/form-it-40-indiana-full-year-resident-individual-income-tax-return-1.png

How To Calculate Standard Deduction In Income Tax Act Scripbox

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/05/standard-deduction-income-tax.jpg

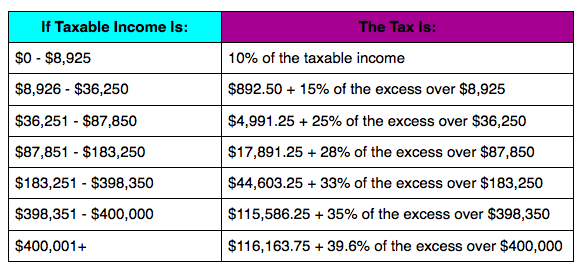

Federal Income Tax Rates

http://vermonttaxhelp.com/wp-content/uploads/2014/02/Single2013.png

Detailed Information about Indiana state income tax brackets and rates standard deduction information and tax forms by tax year etc can be found on this page If you still Find out how much you ll pay in Indiana state income taxes given your annual income Customize using your filing status deductions exemptions and more

No Indiana does not use standard or itemized deductions in arriving at your taxable income Instead an exemption of 1 000 is allowed for the taxpayer spouse and each qualifying To claim the Standard Homestead deduction and Supplemental Homestead deduction The taxpayer must complete Form HC 10 Claim for Homestead Property Tax

Download Indiana State Income Tax Standard Deduction

More picture related to Indiana State Income Tax Standard Deduction

Potentially Bigger Tax Breaks In 2023

https://static.fmgsuite.com/media/InlineContent/originalSize/984f6148-60aa-49b7-971c-fb3554606b40.jpg

How Does Tax Deduction Work In India Tax Walls

https://img.etimg.com/photo/msid-62914500/resident_gti_25l_salary-std-ded.jpg

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude

https://image.cnbcfm.com/api/v1/image/107136825-1666125851699-6clBX-marginal-tax-brackets-for-tax-year-2023-single-individuals_1.png?v=1666125859

Indiana has flat tax rate of 3 23 Indiana does not have any standard deductions Personal exemption is 1 000 for single filers and 2 000 for joint filers for the year 2022 Indiana Tax Rate The state of Indiana has a 3 15 flat income tax rate This means that all residents will pay a 3 15 income tax regardless of income amount Indiana

Indiana Tax Deductions for Seniors Indiana State Income Tax Rate 2024 The State of Indiana has a standard state income tax rate of 3 05 Counties may also levy income taxes Indiana does not have a standard deduction for Unlike many other states Indiana has no standard deduction Certain itemized deductions including property tax qualified charitable contributions etc may be allowed depending on

:max_bytes(150000):strip_icc()/state-income-tax-deduction-3192840_FINAL_v3-42fac1f5ce444c9a8a317c9a598e8084.png)

The State And Local Income Tax Deduction On Federal Taxes

https://www.thebalancemoney.com/thmb/FhxBbMDdu5wtFz2VoZLJOC-STeU=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/state-income-tax-deduction-3192840_FINAL_v3-42fac1f5ce444c9a8a317c9a598e8084.png

Which States Have The Highest And Lowest Income Tax USAFacts

https://staticweb.usafacts.org/media/images/1-highest-state-income-taxes-usafacts.width-1000.png

https://in-us.icalculator.com › income-tax-r…

Indiana provides a standard Personal Exemption tax deduction of 1 000 00 in 2024 per qualifying filer and qualifying dependent s this is used to reduce the amount of income that is subject to tax in 2024 The federal standard

https://in-us.icalculator.com › income-tax-r…

Indiana provides a standard Personal Exemption tax deduction of 1 000 00 in 2025 per qualifying filer and qualifying dependent s this is used to reduce the amount of income that is subject to tax in 2025 The federal standard

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

:max_bytes(150000):strip_icc()/state-income-tax-deduction-3192840_FINAL_v3-42fac1f5ce444c9a8a317c9a598e8084.png)

The State And Local Income Tax Deduction On Federal Taxes

Historical Income Tax Rates Chart SexiezPicz Web Porn

Tax Itemized Deductions Worksheet

Indiana Paycheck Taxes

Individual Income Tax Rates And Deductions In India India Briefing News

Individual Income Tax Rates And Deductions In India India Briefing News

5 Income Tax Calculator Tn RannalTuesday

Pa Income Tax Refunds Are Available Find Out If You re Eligible

Fed Employer Withholding Tax Chart Hot Sex Picture

Indiana State Income Tax Standard Deduction - The three most common deductions encountered by taxpayers are the Indiana Standard Deduction the Indiana Personal Exemption and the Indiana Dependent Deduction The