Indiana State Tax Rebate 2024 On November 3 2023 OED announced a Request for Services RFS in partnership with the Indiana Department of Administration IDOA for potential contractors to assist with planning designing and administering the Home Energy Rebate Programs The deadline for proposals is December 8 2023 at 3 00 PM EST

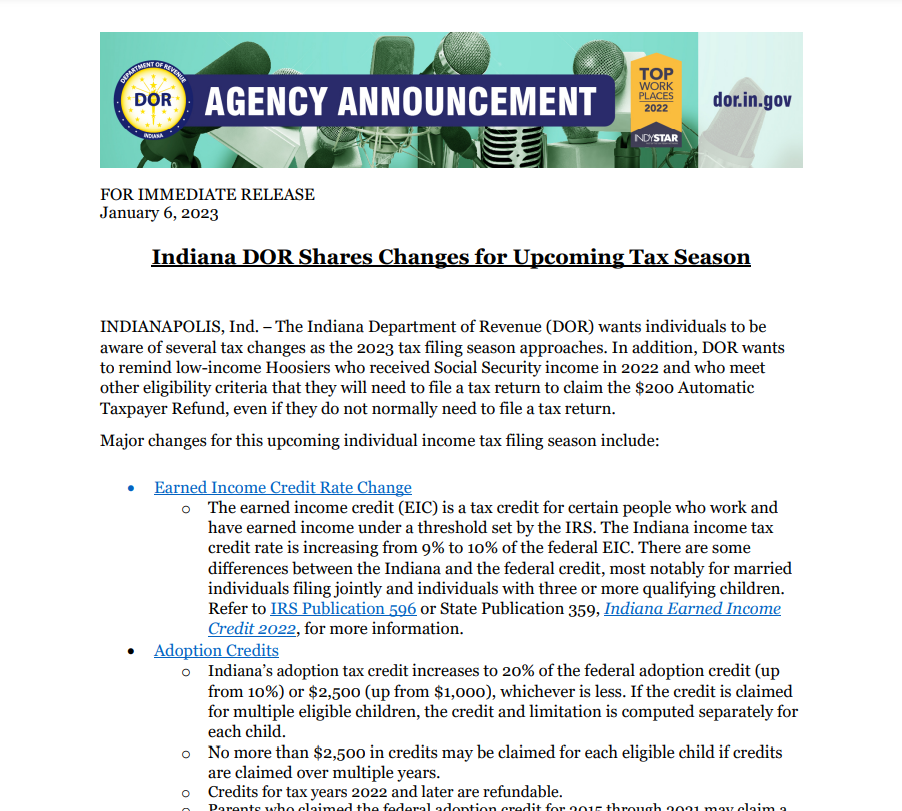

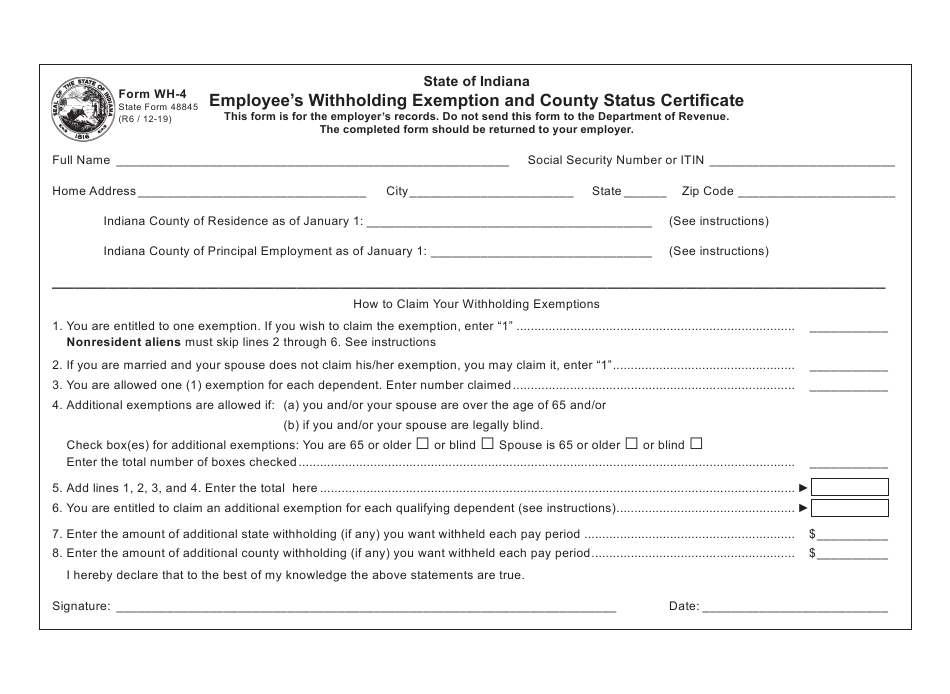

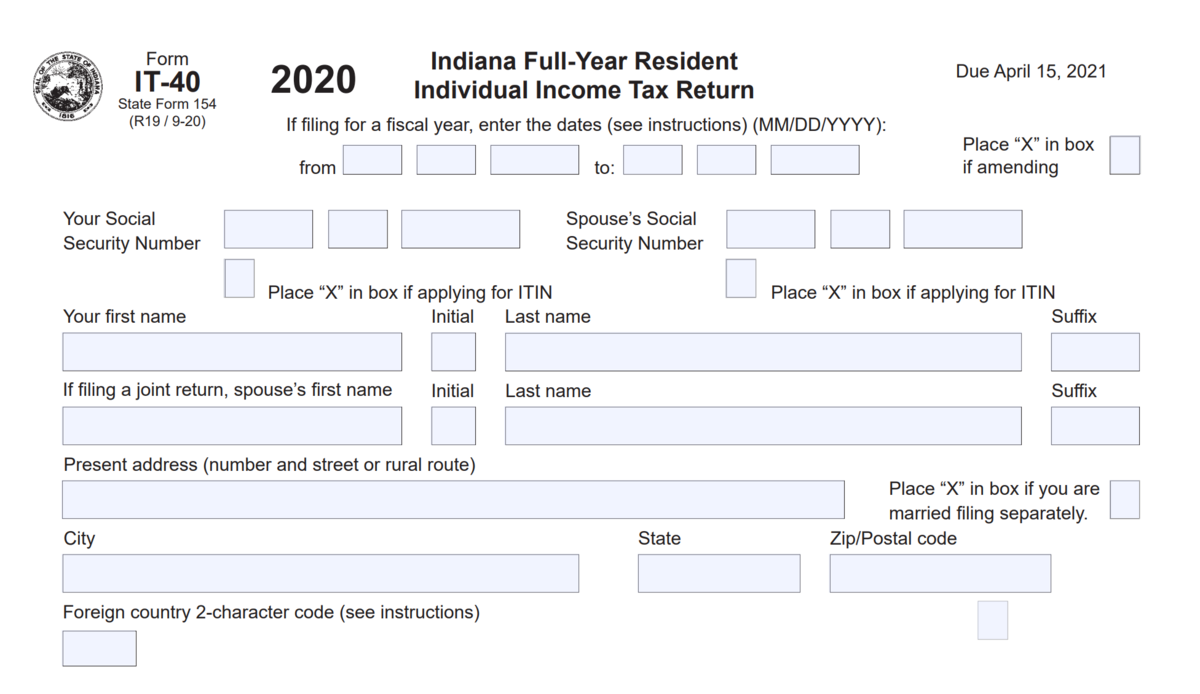

Get Started Check the Status of Your Refund Access INTIME Legal Resources Access the Tax Library information on appeals and the Rulemaking Docket from DOR Software Professionals Find information for certified software companies looking to provide online tax filing for Indiana taxpayers Tax Professionals Indiana provides a standard Personal Exemption tax deduction of 1 000 00 in 2024 per qualifying filer and qualifying dependent s this is used to reduce the amount of income that is subject to tax in 2024 Indiana Single Filer Tax Tables Indiana Married Joint Filer Tax Tables Indiana Married separate Filer Tax Tables

Indiana State Tax Rebate 2024

Indiana State Tax Rebate 2024

https://www.golddealer.com/wp-content/uploads/2020/05/Tax-Registration-Indiana.jpg

Indiana Tax Rebate 2023 Claim Your Tax Savings Today Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2023/03/Indiana-Tax-Rebate-2023.png

Indiana State Employee Tax Forms 2023 Employeeform

https://www.employeeform.net/wp-content/uploads/2022/06/form-wh-4-state-form-48845-download-fillable-pdf-or-fill-online-1.png

The individual income tax rate has been reduced from 3 15 percent to 3 05 percent in 2024 with further reductions to 3 0 percent in 2025 2 95 percent in 2026 and 2 9 percent in 2027 and The Indiana Department of Revenue DOR officially launches the 2024 individual income tax filing season following the Internal Revenue Service s schedule Commencing on January 29 2024 Hoosiers are encouraged to embrace electronic filing online payment and direct deposit for accurate and expedited tax returns and refunds Photo from Google

The Indiana Automatic Taxpayer Refund ATR is a refundable tax credit that was approved by the state legislature in 2022 and 2023 It s a way of returning some of the state s surplus revenue to its taxpayers The amount of the refund depends on how much surplus revenue the state has at the end of each fiscal year About 1 7 million tax rebate checks from Indiana s big state budget surplus that have been delayed for months will be larger when they finally start hitting mailboxes State lawmakers last week

Download Indiana State Tax Rebate 2024

More picture related to Indiana State Tax Rebate 2024

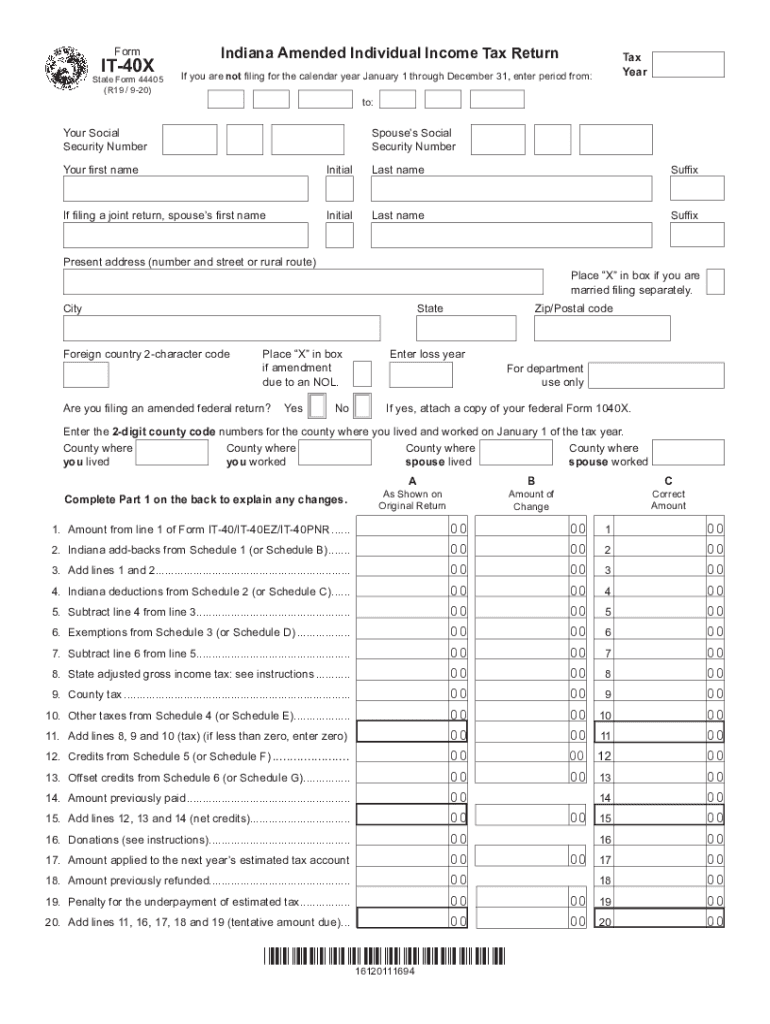

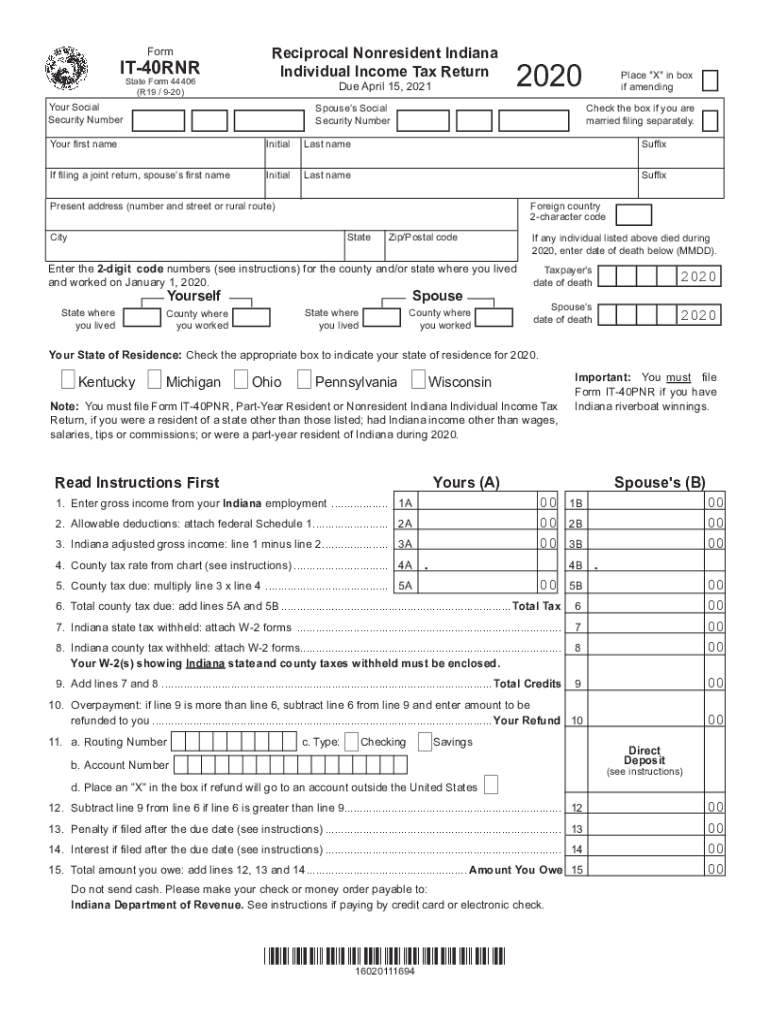

2023 Indiana Tax Form Printable Forms Free Online

https://www.pdffiller.com/preview/536/231/536231109/large.png

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

2023 Indiana Tax Form Printable Forms Free Online

https://www.pdffiller.com/preview/552/425/552425629/large.png

INDIANAPOLIS AP Indiana state tax rebate payments have started to be made by direct bank deposit or printed checks although some taxpayers will have to wait until October to receive the money The state Department of Revenue announced Thursday that it had already issued about 1 5 million direct deposits for the 200 per taxpayer rebates from the surging state budget surplus approved by The state Department of Revenue announced Thursday that it had already issued about 1 5 million direct deposits for the 200 per taxpayer rebates from the surging state budget surplus approved by

1st Installment payment due April 15 2024 00 2nd Installment payment due June 17 2024 3rd Installment payment due Sept 16 2024 4th Installment payment due Jan 15 2025 Mail entire form and payment to Indiana Department of Revenue P O Box 6102 Indianapolis IN 46206 6102 14923111694 On May 4 2023 Indiana Governor Eric Holcomb signed into law HB 1001 which starting in 2024 accelerates the personal income tax cuts passed in 2022 under HB 1002 and eliminates the contingency of meeting state budget thresholds for those tax cuts to apply Current law HB 1002 enacted in 2022 lowered the personal income tax rate from 3 23 to 3 15 for tax years 2023 and 2024

Indiana Tax Refund 2023 Here s When You Can Expect To Receive Yours

https://www.indystar.com/gcdn/presto/2022/01/31/NHOS/b96b551b-4e18-4c5b-82c7-30d7876fe00c-tax_prep-4.jpg?crop=5183,2916,x0,y0&width=3200&height=1801&format=pjpg&auto=webp

Indiana Tax Rebates 2022 Who s Eligible For ATRs

https://www.panasiabiz.com/wp-content/uploads/2022/10/us-treasury-check-used-tax-752904886.jpg

https://www.in.gov/oed/grants-and-funding-opportunities/homeowner-incentives/

On November 3 2023 OED announced a Request for Services RFS in partnership with the Indiana Department of Administration IDOA for potential contractors to assist with planning designing and administering the Home Energy Rebate Programs The deadline for proposals is December 8 2023 at 3 00 PM EST

https://www.in.gov/dor/

Get Started Check the Status of Your Refund Access INTIME Legal Resources Access the Tax Library information on appeals and the Rulemaking Docket from DOR Software Professionals Find information for certified software companies looking to provide online tax filing for Indiana taxpayers Tax Professionals

Homeowner Renters District 16 Democrats

Indiana Tax Refund 2023 Here s When You Can Expect To Receive Yours

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/tronc/E3DIH6P26ND7KE26Q3FQDESPTI.aspx)

Auditor All Indiana State Tax Rebate Payments Mailed Out

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Kansas Tax Rebate 2023 Eligibility Application Deadline PrintableRebateForm

Kansas Tax Rebate 2023 Eligibility Application Deadline PrintableRebateForm

2023 Indiana County Income Tax Rates And County Codes PELAJARAN

Indiana Pushes Back State Tax Filing Deadline To Conform With Federal Tax Deadline WVPE

Property Tax Rebate Pennsylvania LatestRebate

Indiana State Tax Rebate 2024 - The Indiana Automatic Taxpayer Refund ATR is a refundable tax credit that was approved by the state legislature in 2022 and 2023 It s a way of returning some of the state s surplus revenue to its taxpayers The amount of the refund depends on how much surplus revenue the state has at the end of each fiscal year