Indiana Tax Rebate 2024 INDIANAPOLIS Residents of Indiana should know about changes to the state s tax policy that took effect on Jan 1 2024 House Bill 1001 accelerates previously planned rate cuts The individual income tax rate has been reduced from 3 15 percent to 3 05 percent in 2024 with further reductions to 3 0 percent in 2025 2 95 percent in 2026 and 2 9 percent in 2027 and beyond

The Indiana State Treasurer s office announced a new tax credit worth up to 500 beginning taxable year 2024 for contributions into INvestABLE Indiana accounts All Indiana taxpayers who contribute to an Indiana ABLE account are eligible for the credit Welcome to the Indiana Department of Revenue Pay your income tax bill quickly and easily using INTIME DOR s e services portal Learn How Individual Income Taxes Business Tax Corporate Income Tax Make Payment or Establish Payment Plan Unemployment Benefits and Taxes Contact Us Motor Carrier Services 2023 Legislative Synopsis See more

Indiana Tax Rebate 2024

Indiana Tax Rebate 2024

https://www.pdffiller.com/preview/536/231/536231109/large.png

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

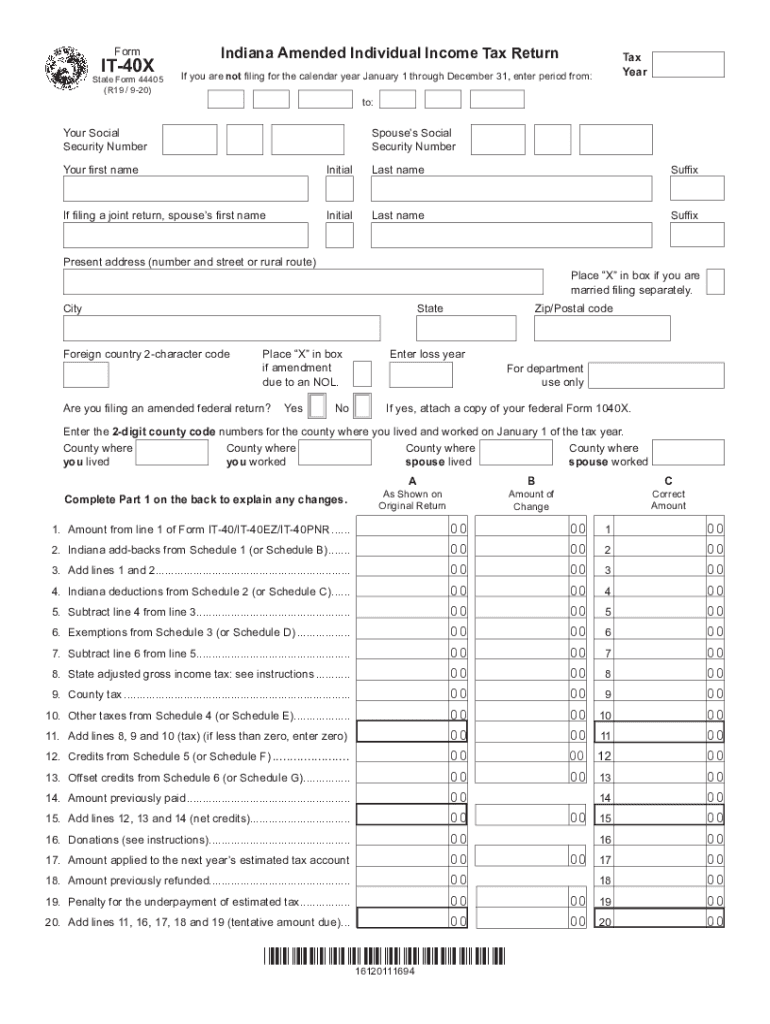

DOR Individual Income Taxes Filing My Taxes Tax Credits Learn what tax credits you can claim on your Indiana individual income tax return You can find all available credits listed below including a brief description which forms and schedules to use and who is eligible To learn more about each credit simply click on the credit name below Republican Rep Tim Brown center listens to Democratic Rep Gregory Porter right speak at the Statehouse in Indianapolis Friday Aug 5 2022 on a bill that would issue 200 rebate payments

Announcing our 2024 rebates By Indiana Connection Posted on Jan 03 2024 in Harrison REMC Below is a snapshot of the 2024 rebates This year there are some major changes to some of the rebates We will publish more information in the February issue of Indiana Connection or you can go to the website at harrisonremc to see the complete Compared to many other states in the U S Indiana is lacking in solar legislation The state previously offered a net metering program that paid Hoosiers for their excess solar production but

Download Indiana Tax Rebate 2024

More picture related to Indiana Tax Rebate 2024

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A-1024x536.jpg

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

https://www.moneymgmnt.com/wp-content/uploads/tax-rebate-thailand-2023-1024x565.png

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Most Hoosiers who filed a 2020 tax return in 2021 should have received their automatic taxpayer refund via direct deposit or mailed check by now More than 1 5 million checks with the 125 On May 4 2023 Indiana Governor Eric Holcomb signed into law HB 1001 which starting in 2024 accelerates the personal income tax cuts passed in 2022 under HB 1002 and eliminates the contingency of meeting state budget thresholds for those tax cuts to apply Current law HB 1002 enacted in 2022 lowered the personal income tax rate from 3 23 to 3 15 for tax years 2023 and 2024

The Indiana Department of Revenue DOR officially launches the 2024 individual income tax filing season following the Internal Revenue Service s schedule Commencing on January 29 2024 Hoosiers are encouraged to embrace electronic filing online payment and direct deposit for accurate and expedited tax returns and refunds Electronic Filing Encouraged for Streamlined Tax Processes In an State Tax Changes Taking Effect January 1 2024 December 21 202317 min read By Manish Bhatt Benjamin Jaros Latest Updates See Full Timeline Thirty four states will ring in the new year with notable tax changes including 17 states cutting individual or corporate income taxes and some cutting both

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/Eligible-2-2048x2048.png

CT Tax Rebate Info Session YouTube

https://i.ytimg.com/vi/mabIScfla48/maxresdefault.jpg

https://news.yahoo.com/indiana-tax-cuts-significant-changes-014849426.html

INDIANAPOLIS Residents of Indiana should know about changes to the state s tax policy that took effect on Jan 1 2024 House Bill 1001 accelerates previously planned rate cuts The individual income tax rate has been reduced from 3 15 percent to 3 05 percent in 2024 with further reductions to 3 0 percent in 2025 2 95 percent in 2026 and 2 9 percent in 2027 and beyond

https://www.953mnc.com/2023/11/15/new-indiana-tax-credit-announced-for-2024/

The Indiana State Treasurer s office announced a new tax credit worth up to 500 beginning taxable year 2024 for contributions into INvestABLE Indiana accounts All Indiana taxpayers who contribute to an Indiana ABLE account are eligible for the credit

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

TAX REBATE Ft The Receipts Podcast OFF THE CUFF PODCAST Listen Notes

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

How To Increase The Chances Of Getting A Tax Refund CherishSisters

How To Increase The Chances Of Getting A Tax Refund CherishSisters

Senior Tax Rebate Program Downtown KCK 701 N 7th St Trfy Kansas City KS 66101 3035 United

Tax Rebate Checks What Eligible Recipients Need To Know

Council Tax Rebate Struggling Households Face Postcode Lottery To Get 150 Energy Support Payment

Indiana Tax Rebate 2024 - DOR Individual Income Taxes Filing My Taxes Tax Credits Learn what tax credits you can claim on your Indiana individual income tax return You can find all available credits listed below including a brief description which forms and schedules to use and who is eligible To learn more about each credit simply click on the credit name below