Individual Tax Return 2023 Due Date Online returns is 12 months from the accounting date paper returns is 9 months from the accounting date 2022 to 2023 tax year and earlier The Self Assessment deadline for

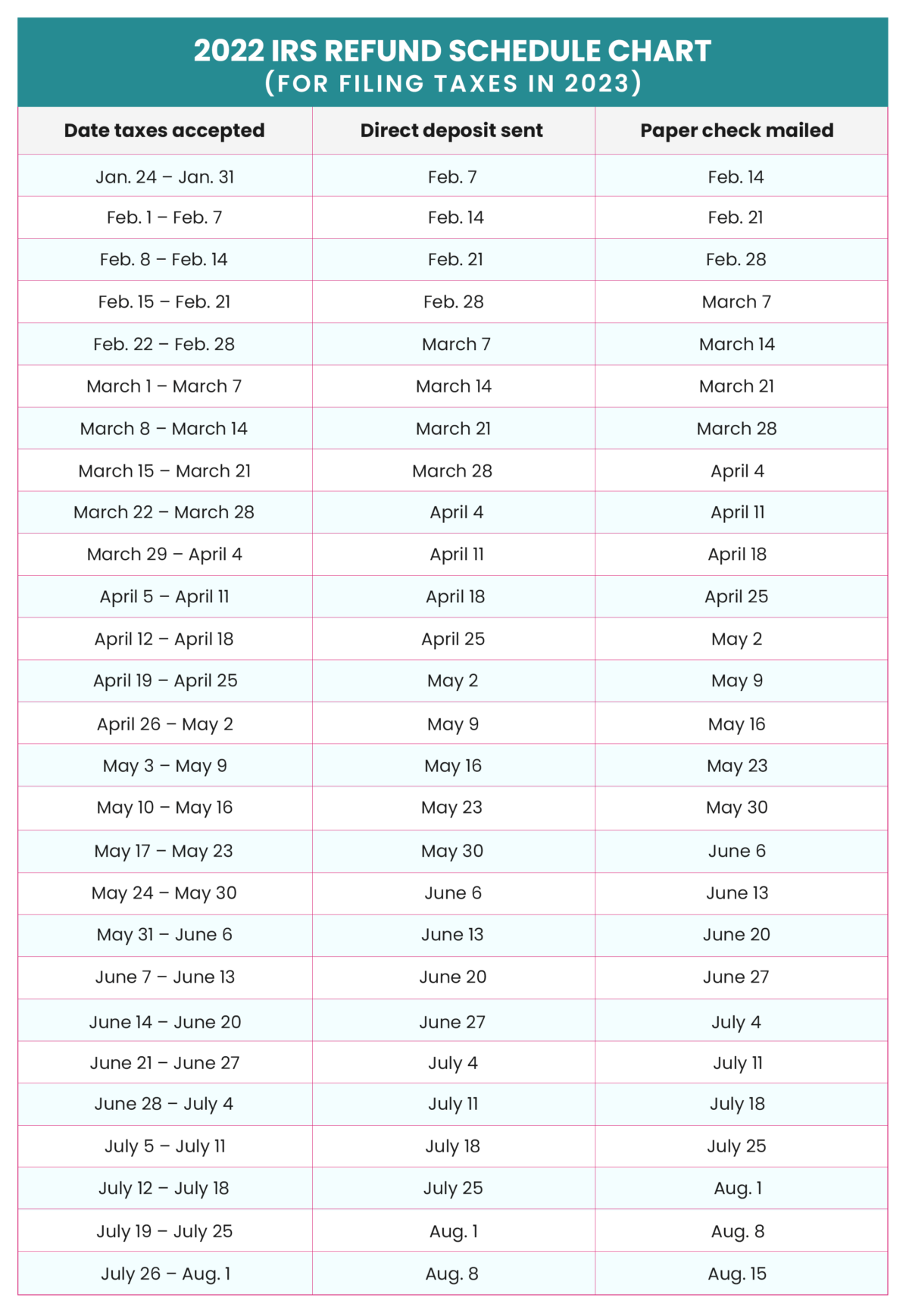

File on The fourth month after your fiscal year ends day 15 If day 15 falls on a Saturday Sunday or legal holiday the due date is delayed until the next business day Your IR 2023 46 March 15 2023 The Internal Revenue Service reminds taxpayers that the Where s My Refund tool on IRS gov is the most convenient way to check the status of

Individual Tax Return 2023 Due Date

Individual Tax Return 2023 Due Date

https://uploads-ssl.webflow.com/5e41d080471798e913648c3e/63b5e591f30ddf62c7b5d0c9_tax due date.jpg

Income Tax Due Dates For FY 2021 22 AY 2022 23 CACube

https://cacube.in/wp-content/uploads/2018/08/pexels-photo-6863259.jpeg

Due Date ITR Fiing For AY 2023 24 Is July 31st 2023 Academy Tax4wealth

https://academy.tax4wealth.com/storage/uploads/1686567553-file-income-tax-return-for-ay-2023-24-by-july-31st-2023.jpg

Most of the individual tax returns for the 2022 tax year are expected to be filed before the April 18 tax deadline Taxpayers have until April 18 to file their taxes this year but some Unless otherwise stated the due dates provided are for 30 June balancers only When a due date falls on a Saturday Sunday or public holiday you can lodge or pay on the next

Staggered payment date arrangements exist for individual and trust clients whose tax returns have a lodgment due date of 15 May 2025 Your client s payment due date will Tax return for individuals 2023 Use this form to lodge a paper tax return for individuals 2023 by mail Most returns are processed within 50 days Last updated 24 May 2023

Download Individual Tax Return 2023 Due Date

More picture related to Individual Tax Return 2023 Due Date

.png)

Income Tax Return Who Is Required Which Form Due Dates Fy 2022 23 Ay

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjgH5E3CzzJ-EczNDbw-wI_pL5VZC0SNmhsDQowAPaGKZ6vduNsvxSJgeHlrZQtukMAJ5XecqFbniw9tA-_vkdXcMzNSddLdSt_vXTyfHJpqrXqGUqYaoF0gOS4P268HUqM2FEsnkUirI00ycY1vH7KW4JJO-KNdRmEld1-DcyaNNeA0HqXHo7AIBxH-w/w1200-h630-p-k-no-nu/income tax return due date 2023-24 (1).png

Tax Preparation Course EBook

https://novataxacademy.com/wp-content/uploads/2023/06/C-E-TaxPrep-1.png

ITR Filing FY 2022 23 File Your ITR Now Indivisuals And Businesses

https://www.startupguruz.com/wp-content/uploads/2023/04/TAX-Assistance-ITR-Image-1024x4341-1.png

The last date to file Income Tax Return ITR for FY 2023 24 AY 2024 25 without a late fee is 31st July 2024 Taxpayers filing their return after the due date will have to pay For most people the 2023 return has to be filed on or before April 30 2024 and payment is due April 30 2024 File your return early or before the due date to avoid being

Income tax return filing dates The dates for the 2024 Filing Season are Auto assessment notices 1 July 2024 to 14 July 2024 Individual taxpayers non provisional 15 July Tax Return Individuals should be filed within 1 month from the date of issue of the Tax Return if the taxpayer did not solely own any unincorporated business during the year of

Irs Tax Return 2023 Form Printable Forms Free Online

https://e00-marca.uecdn.es/assets/multimedia/imagenes/2023/03/17/16790692102965.jpg

Personal Income Tax Returns In Surrey BC Accountants In Surrey

https://www.kosickcpa.ca/wp-content/uploads/2021/10/MicrosoftTeams-image-12.png

https://www.gov.uk/self-assessment-tax-returns/deadlines

Online returns is 12 months from the accounting date paper returns is 9 months from the accounting date 2022 to 2023 tax year and earlier The Self Assessment deadline for

https://www.irs.gov/filing/individuals/when-to-file

File on The fourth month after your fiscal year ends day 15 If day 15 falls on a Saturday Sunday or legal holiday the due date is delayed until the next business day Your

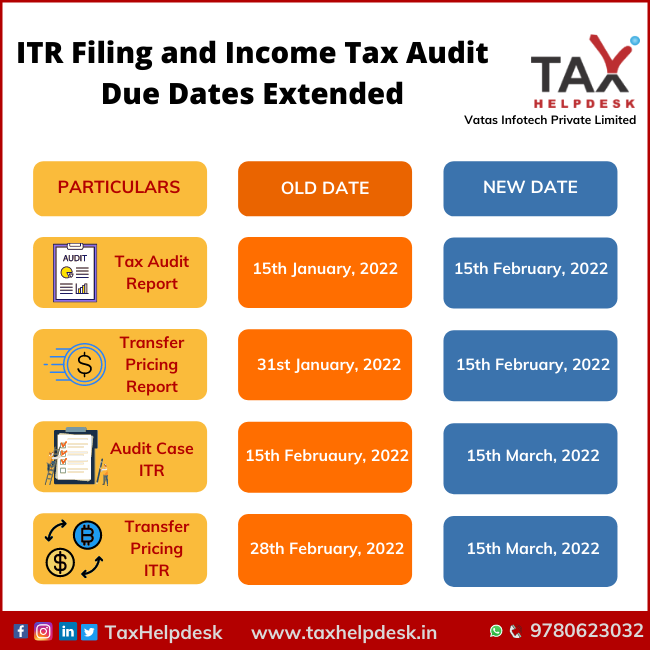

ITR Filing Income Tax Audit Due Dates Extended FY 2020 21 TaxHelpdesk

Irs Tax Return 2023 Form Printable Forms Free Online

Income Tax Return Filing Things To Remember When Filing ITR For AY

Income Tax Return 2023 Know The Last Date To File ITR Here Check

Top State Marginal Income Tax Rates 2023 Skloff Financial Group

Capital Gains Tax Explained The Kalculators

Capital Gains Tax Explained The Kalculators

Tax Filing Season Will Start January 24 New York Society Of Tax

Company Tax Return Due Date 2023 Australia Pay Period Calendars 2023

2023 Tax Refund Schedule Chart Printable Forms Free Online

Individual Tax Return 2023 Due Date - Tax return for individuals 2023 Use this form to lodge a paper tax return for individuals 2023 by mail Most returns are processed within 50 days Last updated 24 May 2023