Inflation Reduction Act And Heat Pump Rebates Up to 2 000 for efficient heating cooling and water heating equipment such as a heat pump Up to 1 200 for measures that reduce home energy waste like efficient windows doors and insulation

The Inflation Reduction Act IRA Pub L 117 169 August 16 2022 authorized the U S Department of Energy DOE to carry out two Home Energy Rebate programs Specifically IRA Section 50121 established the Home Efficiency Rebates and IRA Section 50122 established the IRA Home Electrification and Appliance Rebates collectively the The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

Inflation Reduction Act And Heat Pump Rebates

Inflation Reduction Act And Heat Pump Rebates

https://www.ecicomfort.com/hubfs/IRA Heat Pump Rebates %26 Tax Credits-png.png

Inflation Reduction Act Heat Pump Rebates Chesterfield Service

https://www.chesterfieldservice.com/wp-content/uploads/2023/01/Inflation-Reduction-Act-Heat-Pump-Rebates-scaled.jpeg

The Inflation Reduction Act And The New Tax Incentives Rebates For High

https://www.damarheating.com/wp-content/uploads/2022/10/Inflation-reduction-act-learn-more-New-Tax-Incentives-and-Rebates-for-High-Efficiency-Heat-Pumps-1030x476.jpg

The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities We ll post guidance for taxpayers on all credits and deductions from the Inflation Reduction Act as it becomes available If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

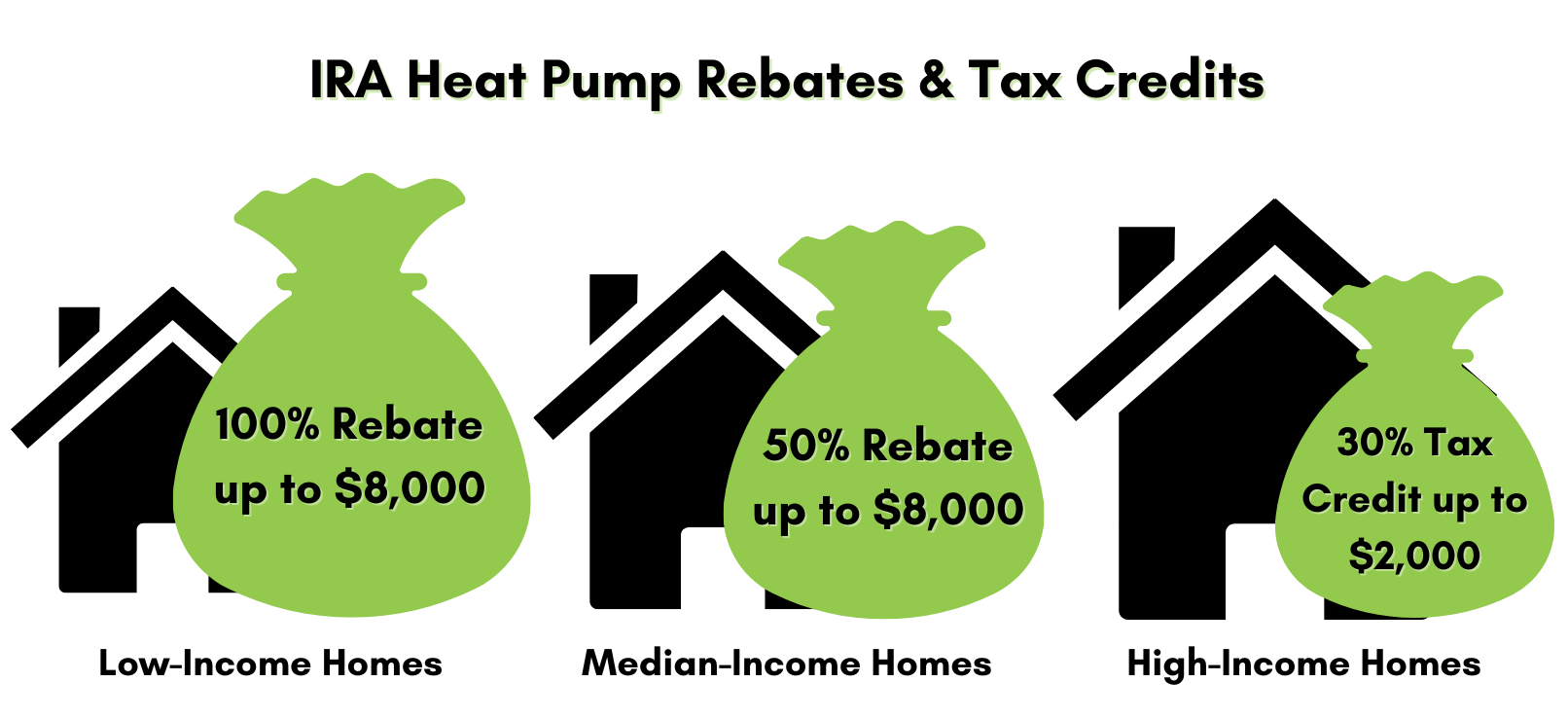

The Inflation Reduction Act includes thousands of dollars in tax credits and rebates for consumers who buy electric vehicles install solar panels or make other energy efficient upgrades to their Families who install an efficient electric heat pump for heating and cooling can receive a tax credit of up to 2 000 and save an average of 500 per year on energy bills

Download Inflation Reduction Act And Heat Pump Rebates

More picture related to Inflation Reduction Act And Heat Pump Rebates

The Inflation Reduction Acts Impact On HVAC Heat Pumps

https://whippleplumbing.com/wp-content/uploads/2023/02/1-768x994.jpg

Inflation Reduction Act Heat Pump Rebate Heartland

https://i0.wp.com/heartlandheatingandair.com/wp-content/uploads/2023/01/Inflation-Reduction-Act-Heat-Pump-Rebate-1-scaled.jpeg?resize=1536%2C1117&ssl=1

Here s How The Inflation Reduction Act s Rebates And Tax Credits For

https://s3.amazonaws.com/ocn-media/9c333b0e-1206-4932-bf44-e7139bade7c1.jpeg

Here s how Seiji Matsumoto By Nadja Popovich and Elena Shao Updated June 13 2024 Looking to make your home more energy efficient install solar panels or buy an electric car You may be able to Through tax credits and rebates President Biden s Inflation Reduction Act IRA provides new opportunities to homeowners and renters to make energy efficient upgrades such as heat pump installations to their homes Heat pumps are a year round heating and cooling solution for many homes and climates they are energy efficient and save money

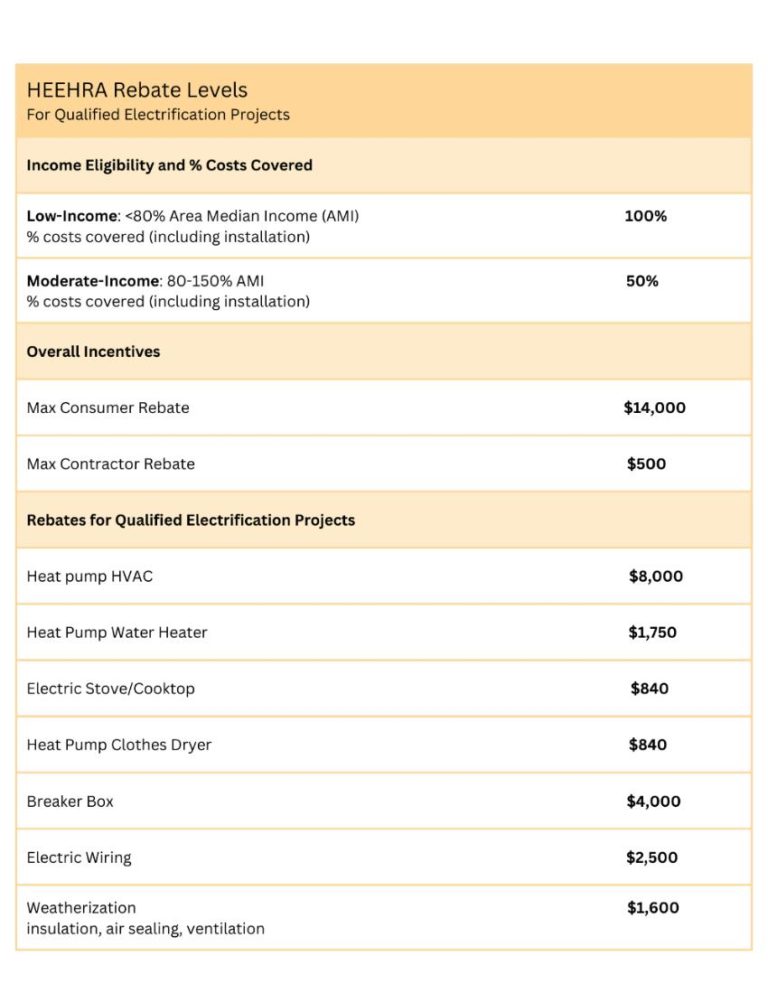

Yes heat pumps are included in the Inflation Reduction Act Homeowners can qualify for a tax credit of 30 for the purchase and installation of a qualified heat pump up to 2 000 Through the High Efficiency Electric Home Rebate Act HEEHRA some homeowners may receive rebates of 100 or 50 off heat pump installation up to 8 000 if they The Inflation Reduction Act can help renters afford plug ins like window unit heat pumps through rebates Otherwise success of the law will depend on landlords and property managers taking

Heat Pump Rebate For TX Homes Inflation Reduction Act

https://www.totalair.com/wp-content/uploads/2022/11/iStock-647135238-1024x697.jpg

Your Guide To The Inflation Reduction Act Rewiring America Heat Pump

https://i.pinimg.com/originals/1a/ce/ac/1aceac9fa2fe448db3d7244bbad37136.png

https://www.energy.gov/energysaver/articles/...

Up to 2 000 for efficient heating cooling and water heating equipment such as a heat pump Up to 1 200 for measures that reduce home energy waste like efficient windows doors and insulation

https://www.energy.gov/sites/default/files/2023-07/...

The Inflation Reduction Act IRA Pub L 117 169 August 16 2022 authorized the U S Department of Energy DOE to carry out two Home Energy Rebate programs Specifically IRA Section 50121 established the Home Efficiency Rebates and IRA Section 50122 established the IRA Home Electrification and Appliance Rebates collectively the

Here s How The Inflation Reduction Act s Rebates And Tax Credits For

Heat Pump Rebate For TX Homes Inflation Reduction Act

Inflation Reduction Act Heat Pumps Are The Future 2023

Inflation Reduction Act Heat Pump Heat Pump Tax Credit PumpRebate

All100Senators On Twitter RT MartinHeinrich The Inflation Reduction

Inflation Reduction Act Heat Pump Heat Pump Tax Credit PumpRebate

Inflation Reduction Act Heat Pump Heat Pump Tax Credit PumpRebate

Inflation Reduction Act Heat Pump Rebate Novak Heating

Inflation Reduction Act Of 2022 Presidential

The Inflation Reduction Act Pumps Up Heat Pumps HVAC Solutions

Inflation Reduction Act And Heat Pump Rebates - Eligible homeowners can get rebates as high as 8 000 for heat pump installation 1 750 for a heat pump water heater 840 to offset the cost of a heat pump clothes dryer or an electric stove Rebates for non appliance upgrades are also available up to the following amounts 4 000 for electrical panel upgrades