Inflation Reduction Act Ev Charger Tax Credit If you install qualified vehicle refueling or electric vehicle recharging property in your home or business you may be eligible for the Alternative Fuel Vehicle Refueling Property Tax Credit The credit was extended and modified by the Inflation Reduction Act IRA

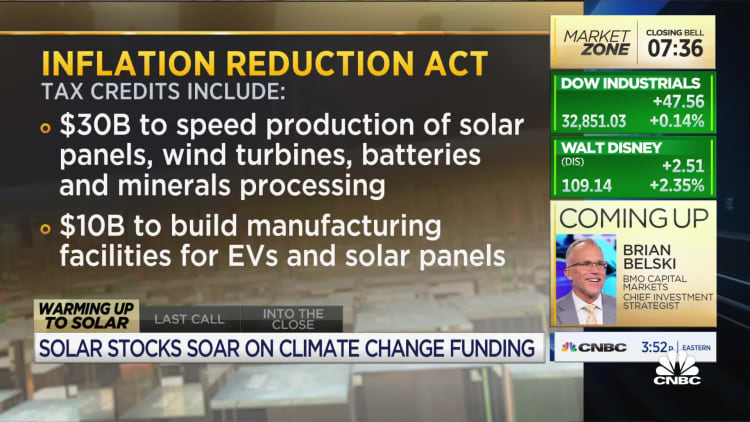

The EV charger tax credit is back thanks to the Inflation Reduction Act IRA massive climate energy tax and healthcare legislation You may have heard that the IRA contains billions of You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The credit is available to individuals and their businesses To qualify you

Inflation Reduction Act Ev Charger Tax Credit

Inflation Reduction Act Ev Charger Tax Credit

https://image.cnbcfm.com/api/v1/image/107102009-1660155495713-1659988945-24775609738-hd.jpg?v=1660155498&w=750&h=422&vtcrop=y

Inflation Reduction Act Changes To EV Tax Credits Policygenius

https://images.ctfassets.net/3uw9cov4u60w/2YQFbXzadP0MYqKvnqYucw/5a49dda3657ccef1ecd495ce6316a3ec/image.jpg

Inflation Reduction Act Cuts EV Tax Credits Boosts Mining

https://i.kinja-img.com/gawker-media/image/upload/c_fill,f_auto,fl_progressive,g_center,h_675,pg_1,q_80,w_1200/4ab8c164bf850281d4f645c757568136.jpg

This incentive provides a credit for up to 30 of the cost of qualified alternative fuel vehicle refueling property placed in service by the taxpayer The credit may be claimed by individuals for home electric vehicle charging and other refueling equipment and by businesses Simply put the Inflation Reduction Act includes a 7 500 tax credit at the point of sale for new EVs and 4 000 for used EVs The new tax credits replace the old incentive system which only

If you purchase EV charging equipment for a business fleet or tax exempt entity you may be eligible for a tax credit Starting on Jan 1 2023 the value of this credit is 6 of the cost of property subject to depreciation with a maximum credit of This tax credit provides up to 30 off the cost of the charger to individuals and businesses in low income communities and non urban areas making it more affordable to install EV charging

Download Inflation Reduction Act Ev Charger Tax Credit

More picture related to Inflation Reduction Act Ev Charger Tax Credit

Inflation Reduction Act Alles Halb So Wild F r Die Industrie

https://www.produktion.de/assets/images/b/inflation-reduction-act-adobestock-andrii-7f12489d.jpg

Inflation Reduction Act May Have Little Impact On Inflation AP News

https://storage.googleapis.com/afs-prod/media/477fcdbf300e4006816515ff6366dca9/3000.jpeg

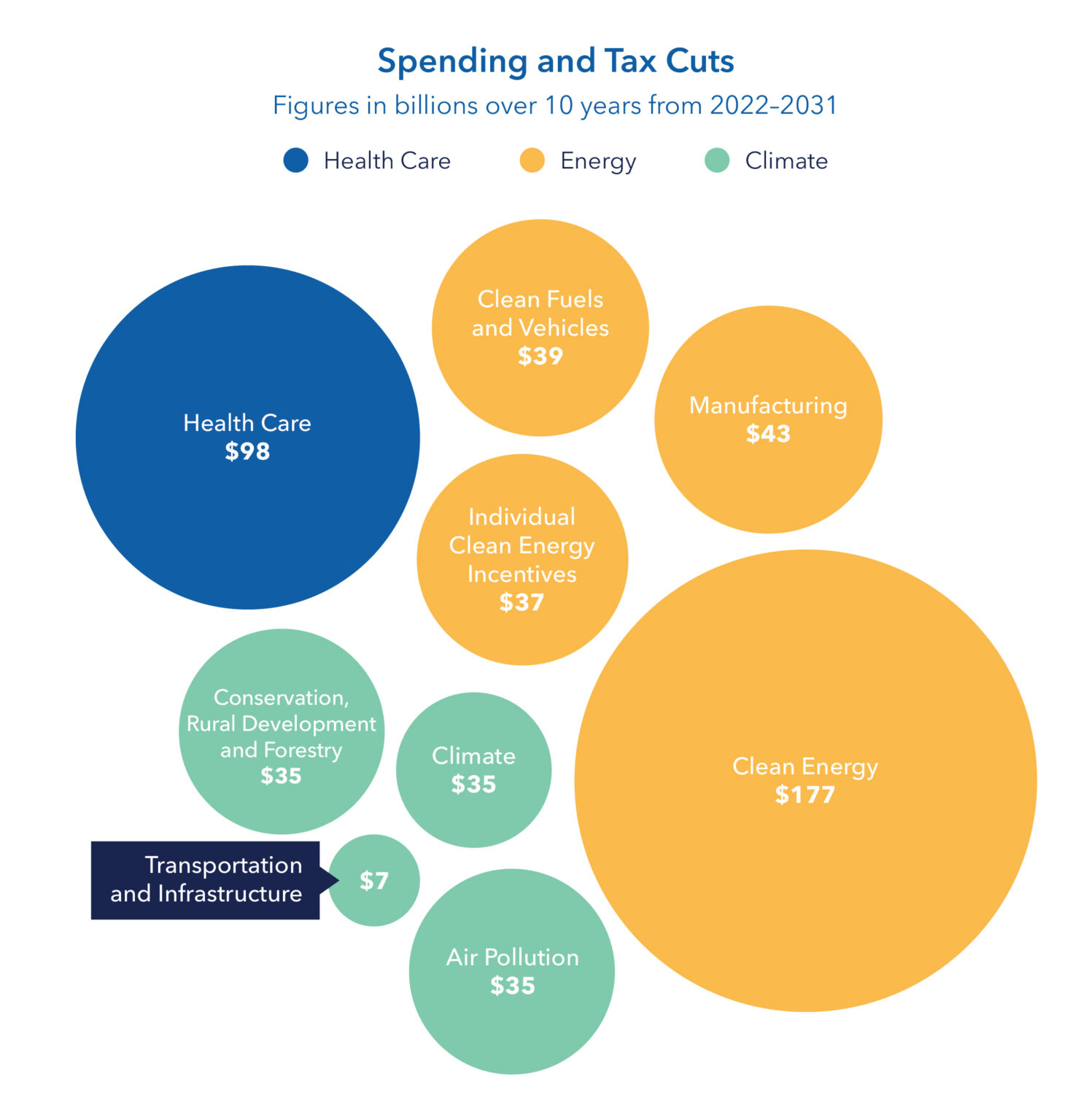

The Inflation Reduction Act Includes Wide Ranging Tax Provisions

https://www.nksfb.com/wp-content/uploads/2022/08/tax-insights-inflation-reduction-act.jpg

To assist consumers identifying eligible vehicles the Department of Transportation and Department of Energy published new resources today to help those interested in claiming tax credits for an electric vehicle purchased after the Inflation P L 117 169 commonly referred to as the Inflation Reduction Act of 2022 IRA 2022 as signed into law on August 16 2022 modified tax credits for electric vehicles EVs and fuel cell vehicles The law also enacted new tax credits for used and commercial clean vehicles

The 30C EV charging tax credit When the Inflation Reduction Act became law in August 2022 it provided a tax credit for up to 30 of the cost of qualified EV charging property If you entered into a written binding contract to purchase a qualifying electric vehicle before the date of enactment of the Inflation Reduction Act August 16 2022 the changes in the Inflation Reduction Act will not impact your tax credit

IRS Issues Immediate Guidance For EV Credits Under Inflation Reduction

https://arizent.brightspotcdn.com/2d/83/576adac34d23bf8c4dbc31a313e8/389708937.jpg

Every EV That Qualifies For The Inflation Reduction Act Tax Credit In

https://i.kinja-img.com/gawker-media/image/upload/c_fill,f_auto,fl_progressive,g_center,h_675,pg_1,q_80,w_1200/c3b571d166b61cd57a7c0683127701bd.jpg

https://www.irs.gov › credits-deductions › alternative...

If you install qualified vehicle refueling or electric vehicle recharging property in your home or business you may be eligible for the Alternative Fuel Vehicle Refueling Property Tax Credit The credit was extended and modified by the Inflation Reduction Act IRA

https://www.kiplinger.com › taxes › federal-tax...

The EV charger tax credit is back thanks to the Inflation Reduction Act IRA massive climate energy tax and healthcare legislation You may have heard that the IRA contains billions of

Will The Inflation Reduction Act Raise Your Taxes

IRS Issues Immediate Guidance For EV Credits Under Inflation Reduction

Inflation Reduction Act Contains Some Health Reforms The Benefit Works

Inflation Reduction Act Of 2022 Vehicles

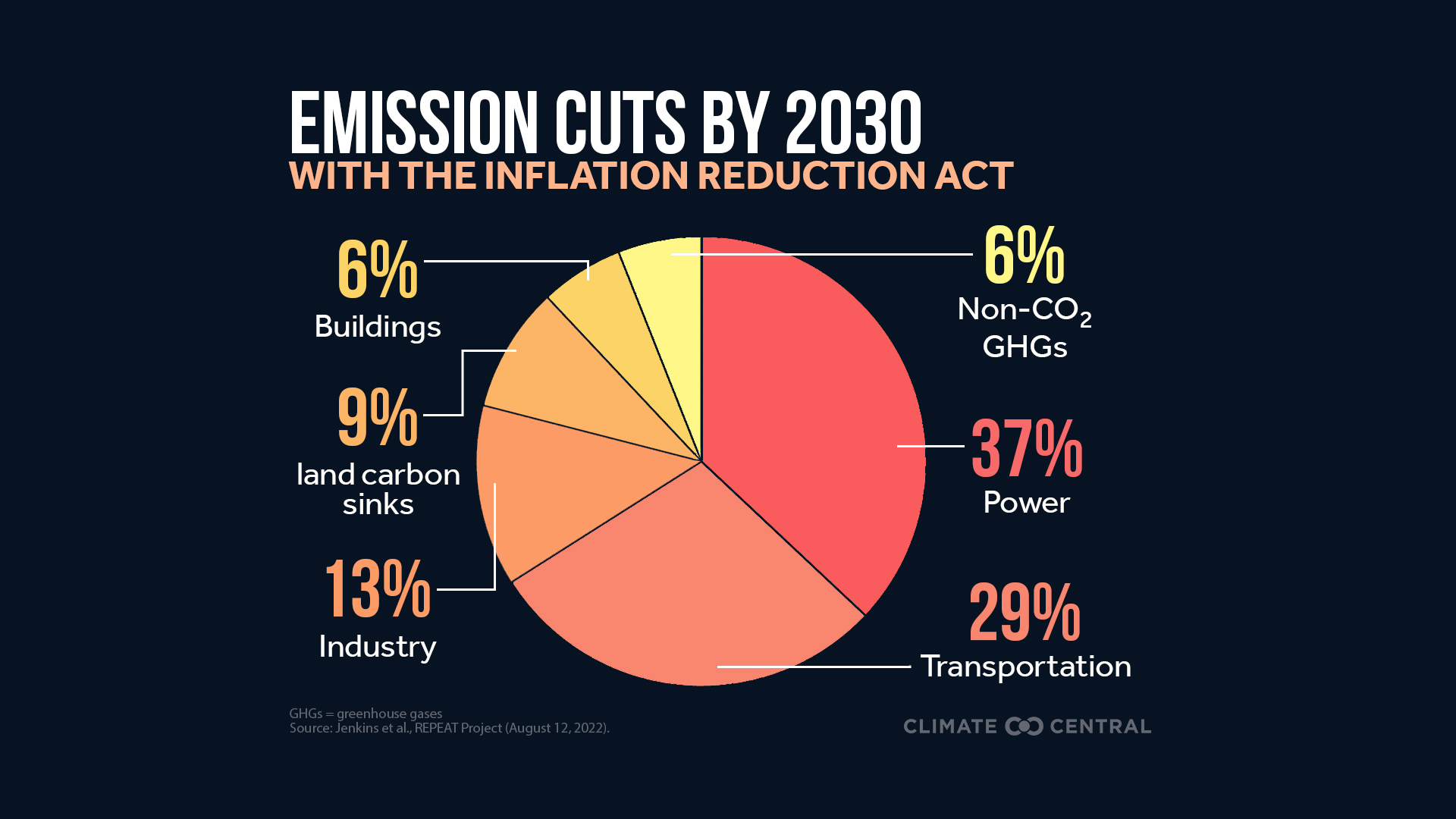

Inflation Reduction Act Resources Climate Central

Summary Of Tax Incentives In The Inflation Reduction Act Of 2022

Summary Of Tax Incentives In The Inflation Reduction Act Of 2022

What Will Change With EV Tax Credits In 2023

4 Step Inflation Reduction Act Guide

What The Inflation Reduction Act Could Mean For The Economy

Inflation Reduction Act Ev Charger Tax Credit - This incentive provides a credit for up to 30 of the cost of qualified alternative fuel vehicle refueling property placed in service by the taxpayer The credit may be claimed by individuals for home electric vehicle charging and other refueling equipment and by businesses