Inflation Reduction Act Ev Tax Credit Income Limit The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in

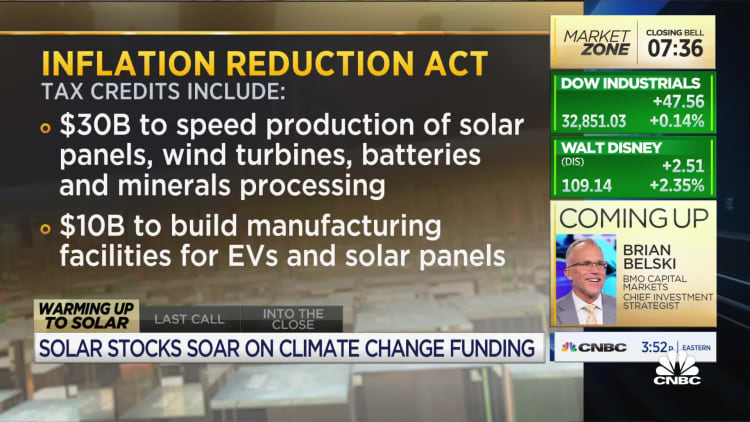

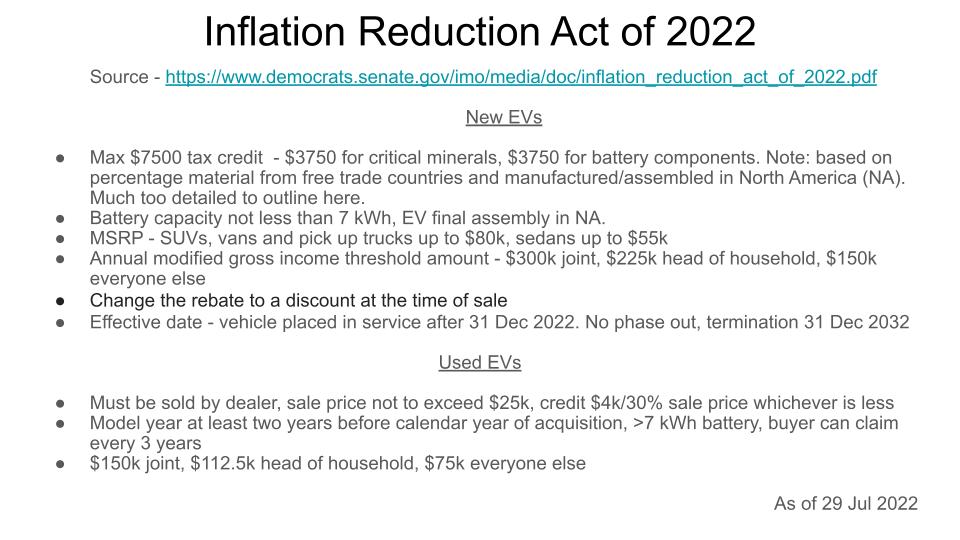

A federal tax credit for electric vehicles EVs is here thanks to the Inflation Reduction Act IRA massive legislation promoting clean energy The credit of up to 7 500 Simply put the Inflation Reduction Act includes a 7 500 tax credit at the point of sale for new EVs and 4 000 for used EVs The new tax credits replace the old incentive system which only

Inflation Reduction Act Ev Tax Credit Income Limit

Inflation Reduction Act Ev Tax Credit Income Limit

https://storage.googleapis.com/afs-prod/media/477fcdbf300e4006816515ff6366dca9/3000.jpeg

Inflation Reduction Act EV Tax Credits Could Hurt Sales

https://image.cnbcfm.com/api/v1/image/107102009-1660155495713-1659988945-24775609738-hd.jpg?v=1660155498&w=750&h=422&vtcrop=y

Inflation Reduction Act Of 2022 Overview Of Labor Requirements IEC

https://iecatlantaga.org/wp-content/uploads/2022/09/AdobeStock_Inflation-scaled.jpeg

The first is the new IRC Section 25E credit for previously owned clean vehicles This tax credit is 30 of a used EVs sales price up to 4 000 It can be claimed by taxpayers Under the Inflation Reduction Act which received Senate approval on Sunday and is expected to clear the House this week a tax credit worth up to 7 500 for buyers of

The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in Effective immediately after enactment of the Inflation Reduction Act after August 16 2022 the tax credit is only available for qualifying electric vehicles for which final assembly occurred in

Download Inflation Reduction Act Ev Tax Credit Income Limit

More picture related to Inflation Reduction Act Ev Tax Credit Income Limit

America s Inflation Reduction Act Just Gave Canada s Economy A Shot In

https://www.nationalobserver.com/sites/nationalobserver.com/files/styles/nat_social/public/img/2022/08/19/inflation_reduction_act_shutterstock_2188173467_updated.jpg?itok=3AhKQJ-r

Inflation Reduction Act Changes To EV Tax Credits Policygenius

https://images.ctfassets.net/3uw9cov4u60w/2YQFbXzadP0MYqKvnqYucw/5a49dda3657ccef1ecd495ce6316a3ec/image.jpg

Will The Inflation Reduction Act Raise Your Taxes

https://aurn.com/wp-content/uploads/2022/08/AP22209625086601-scaled.jpg

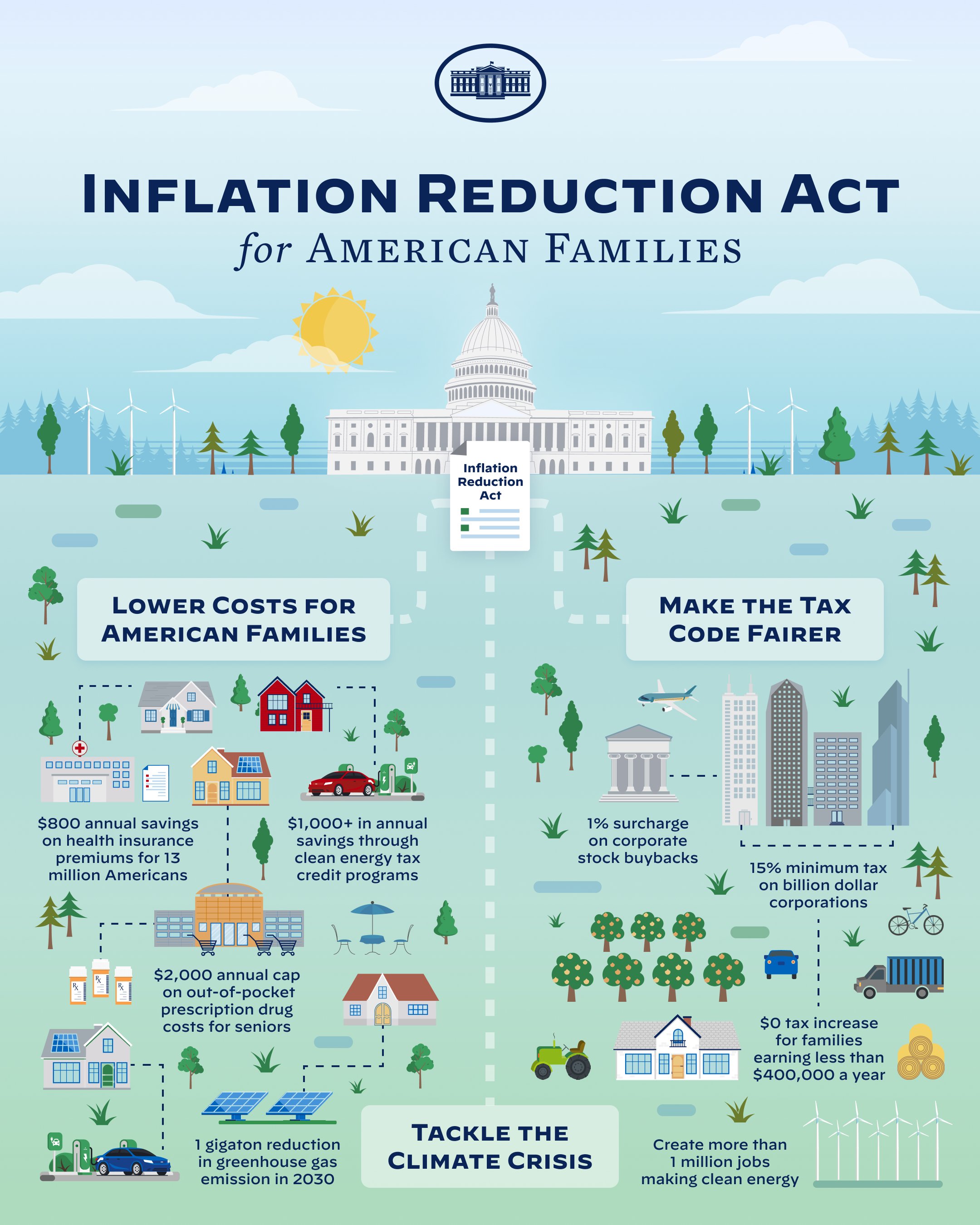

The Inflation Reduction Act IRA provides new opportunities for consumers to save money on clean vehicles offering multiple incentives for the purchase or lease of electric vehicles EVs plug in hybrid vehicles fuel cell vehicles and Only singles with incomes up to 150 000 a year and couples who file taxes jointly who earn up to 300 000 will qualify This income cap requirement is meant to help less affluent people

Under the new law in order to qualify for tax credits buyers must have an income below a certain threshold the vehicle they select must not exceed a certain price point and the vehicle s The tax credit is limited to cars under 55K MSRP and under 80K MSRP for trucks and SUVs The IRS updated their guidelines on February 3 qualifying more EVs as

President Biden On Twitter Last Year We Passed The Inflation

https://pbs.twimg.com/media/F1pwRZWWcAIa2Nq?format=jpg&name=4096x4096

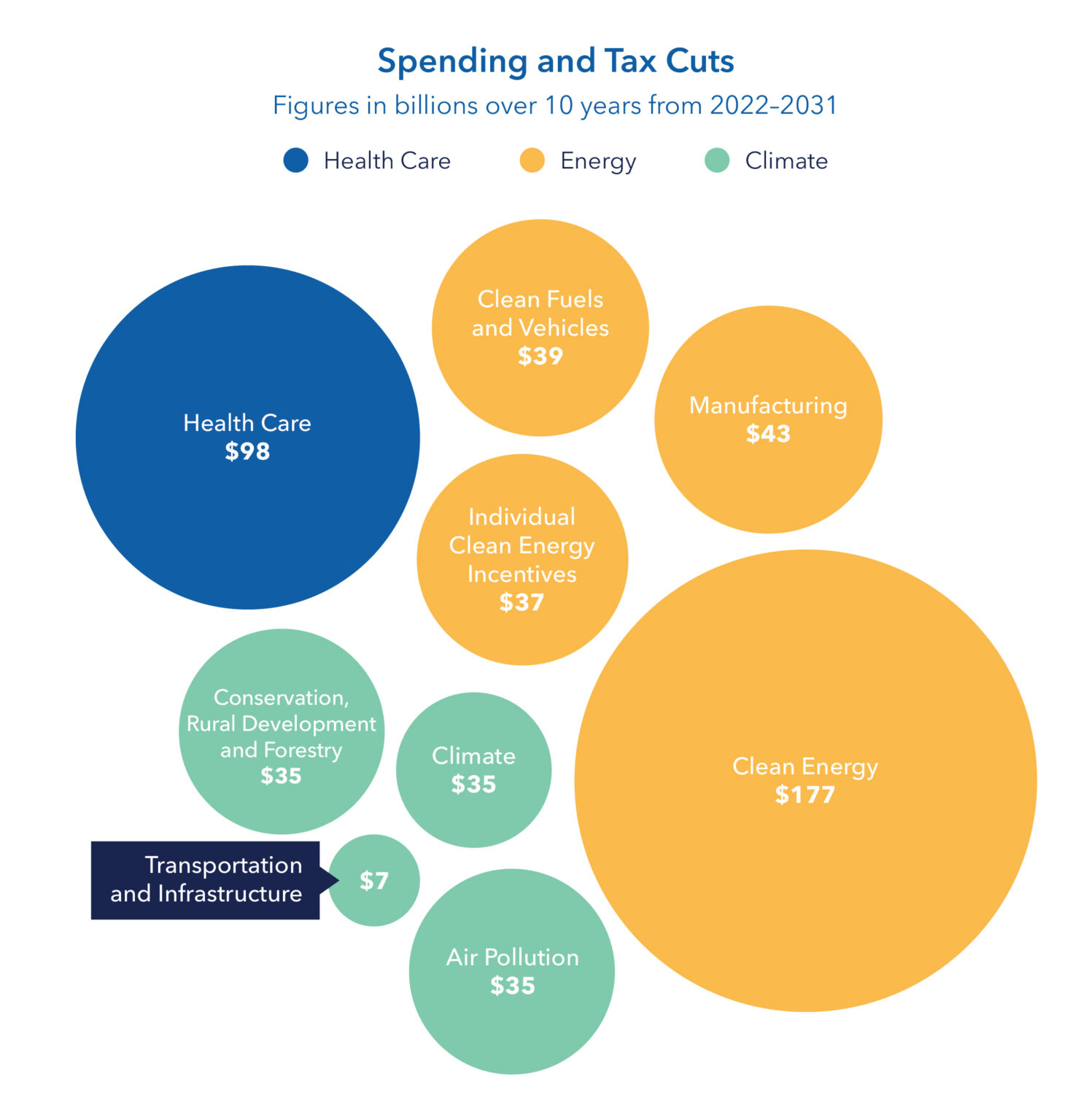

Inflation Reduction Act Contains Some Health Reforms The Benefit Works

https://thebenefitworks.com/eli/wp-content/uploads/2022/09/Spendingtax-cuts-22-31.jpg

https://www.irs.gov › newsroom › topic-b-frequently...

The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in

https://www.kiplinger.com › taxes › ev-tax-credit

A federal tax credit for electric vehicles EVs is here thanks to the Inflation Reduction Act IRA massive legislation promoting clean energy The credit of up to 7 500

Inflation Reduction Act Of 2022 Vehicles

President Biden On Twitter Last Year We Passed The Inflation

Summary Of Tax Incentives In The Inflation Reduction Act Of 2022

IRS Issues Immediate Guidance For EV Credits Under Inflation Reduction

Inflation Reduction Act Of 2022 PriusChat

The Signing Of The Inflation Reduction Act Provides Incentives For

The Signing Of The Inflation Reduction Act Provides Incentives For

Inflation Reduction Act Windward Private Wealth Management

What The Inflation Reduction Act Could Mean For The Economy

Newly Passed Inflation Reduction Act Is A Middle Class Tax Hike

Inflation Reduction Act Ev Tax Credit Income Limit - What are the income limits to qualify for any federal EV tax credits Modified adjusted gross income limits are 150 000 for individuals 225 000 for heads of households