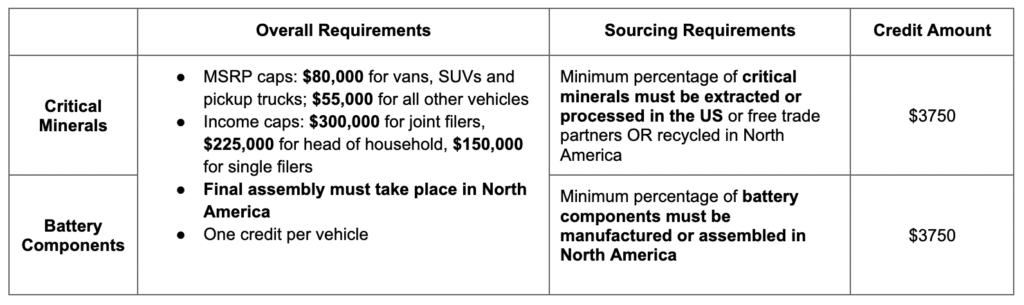

Inflation Reduction Act Ev Tax Credit Lease The Inflation Reduction Act IRA of 2022 made a tax credit of up to 7 500 available to qualifying purchasers of certain EVs But restrictions on buyer income and where the car components are

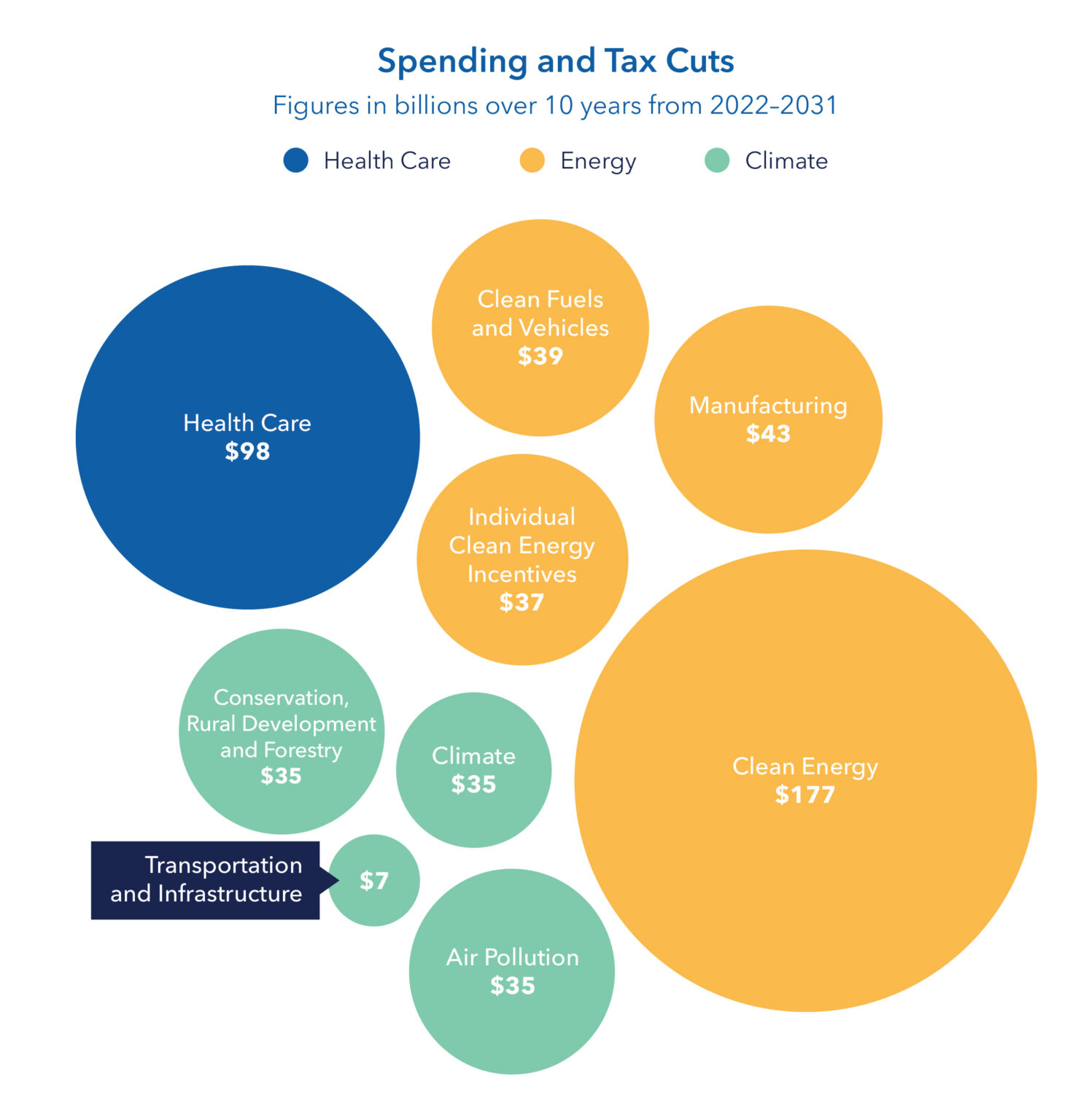

The Inflation Reduction Act IRA provides new opportunities for consumers to save money on clean vehicles offering multiple incentives for the purchase or lease of electric vehicles EVs plug in hybrid vehicles fuel The 430 billion U S Inflation Reduction Act IRA passed in August ended 7 500 consumer tax credits for purchases of electric vehicles assembled outside North America angering South Korea

Inflation Reduction Act Ev Tax Credit Lease

Inflation Reduction Act Ev Tax Credit Lease

https://history-computer.com/wp-content/uploads/2022/08/shutterstock_1668063934-scaled.jpg

How The Inflation Reduction Act Impacts EV Tax Credits TopNewsAlaska

https://api.time.com/wp-content/uploads/2022/08/inflation-reduction-act-electric-vehicles-batteries-tax-credits.jpg

Inflation Reduction Act How It ll Impact You If You Owe The IRS

https://lirp.cdn-website.com/739b5f09/dms3rep/multi/opt/Inflation+Reduction+Act-1920w.jpg

Buyers can get federal tax credits for EV models not on the list allowed by the Inflation Reduction Act if they lease them The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified

The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in Effective immediately after enactment of the Inflation Reduction Act after August 16 2022 the tax credit is only available for qualifying electric vehicles for which final

Download Inflation Reduction Act Ev Tax Credit Lease

More picture related to Inflation Reduction Act Ev Tax Credit Lease

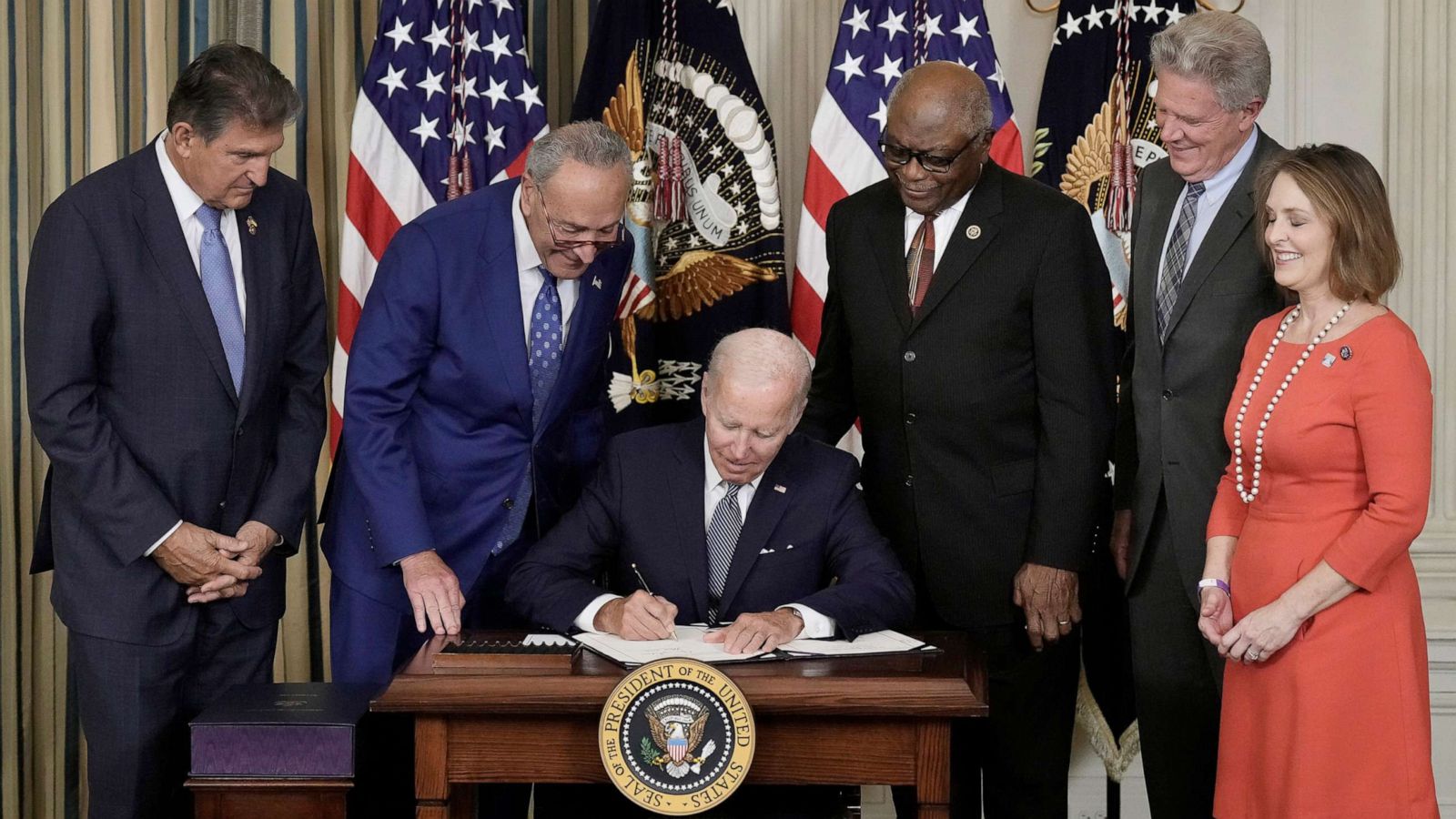

Inflation Reduction Act Gridmatic

https://www.gridmatic.com/wp-content/uploads/2022/08/signing-inflation-reduction-act-01-gty-iwb-220817_1660745706279_hpMain_16x9_1600.jpeg

Inflation Reduction Act Provisions Of Interest To Small Businesses

https://www.nksfb.com/wp-content/uploads/2022/09/tax-insights-inflation-reduction-act-small-business.jpg

Papers With Inflation Reduction Act Of 2022 And Notepad Keyser

https://www.keyseragency.com/wp-content/uploads/2022/10/Adobe_Inflation_Reduction_Act_2022-scaled.jpeg

The Inflation Reduction Act s clean vehicle credits save consumers up to 7 500 on a new vehicle and hundreds of dollars per year on gas while creating good To assist consumers identifying eligible vehicles the Department of Transportation and Department of Energy published new resources today to help those

Simply put the Inflation Reduction Act includes a 7 500 tax credit at the point of sale for new EVs and 4 000 for used EVs The new tax credits replace the old incentive system which only Last year s Inflation Reduction Act provided a federal tax credit of up to 7 500 to use toward an EV Under the rules a dealer can apply that credit to any

What Will Change With EV Tax Credits In 2023

https://assets-global.website-files.com/60ce1b7dd21cd5b42639ff42/63079f0f1d82de0d8bd6f54d_Used EV Tax Credits Are Here v2.jpg

Inflation Reduction Act Of 2022 The Hollander Group

https://static.twentyoverten.com/60dcacac52410e1095fd898c/TPPpgK25c7/Inflation-Reduction-Act-of-2022-pic.jpg

https://www.consumerreports.org/cars…

The Inflation Reduction Act IRA of 2022 made a tax credit of up to 7 500 available to qualifying purchasers of certain EVs But restrictions on buyer income and where the car components are

https://www.energy.gov/energysaver/ne…

The Inflation Reduction Act IRA provides new opportunities for consumers to save money on clean vehicles offering multiple incentives for the purchase or lease of electric vehicles EVs plug in hybrid vehicles fuel

Will The Inflation Reduction Act Raise Your Taxes

What Will Change With EV Tax Credits In 2023

Inflation Reduction Act Cuts EV Tax Credits Boosts Mining

EVs Eligible For 7 500 EV Tax Credit In Inflation Reduction Act

Some Electric Vehicles Ineligible For 7 500 Tax Credit Myfoxzone

Inflation Reduction Act Of 2022 Significantly Changes 179D And 45L

Inflation Reduction Act Of 2022 Significantly Changes 179D And 45L

2022 EV Tax Credits From Inflation Reduction Act Plug In America

Inflation Reduction Act Contains Some Health Reforms The Benefit Works

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Inflation Reduction Act Ev Tax Credit Lease - The new used EV tax credit will also boost auto dealerships specializing in used vehicle sales and giving used EVs a new lease on life will reduce demand for new