Inflation Reduction Act Of 2024 Rebates And Incentives We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and homeowners closely monitor developments Here are the most recent IRA developments and opportunities for

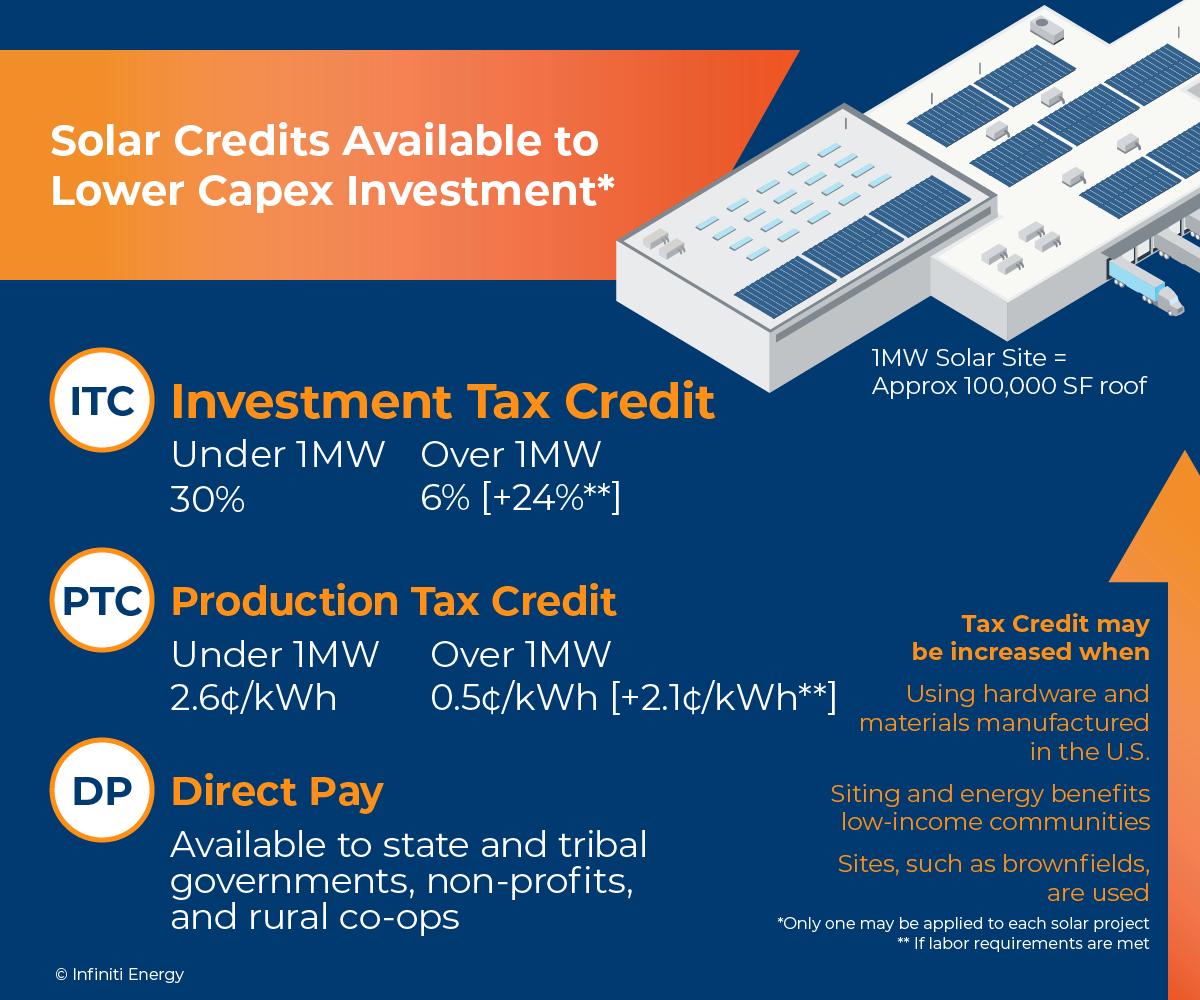

The Inflation Reduction Act modifies and extends the Renewable Energy Production Tax Credit to provide a credit of up to 2 75 cents per kilowatt hour in 2022 dollars adjusted for inflation annually of electricity generated from qualified renewable energy sources where taxpayers meet prevailing wage standards and employ a sufficient proportion Inflation Reduction Act Open Funding Opportunities 9 30 2024 Notice of Funding Opportunity Incentives Program EQIP Department of

Inflation Reduction Act Of 2024 Rebates And Incentives

Inflation Reduction Act Of 2024 Rebates And Incentives

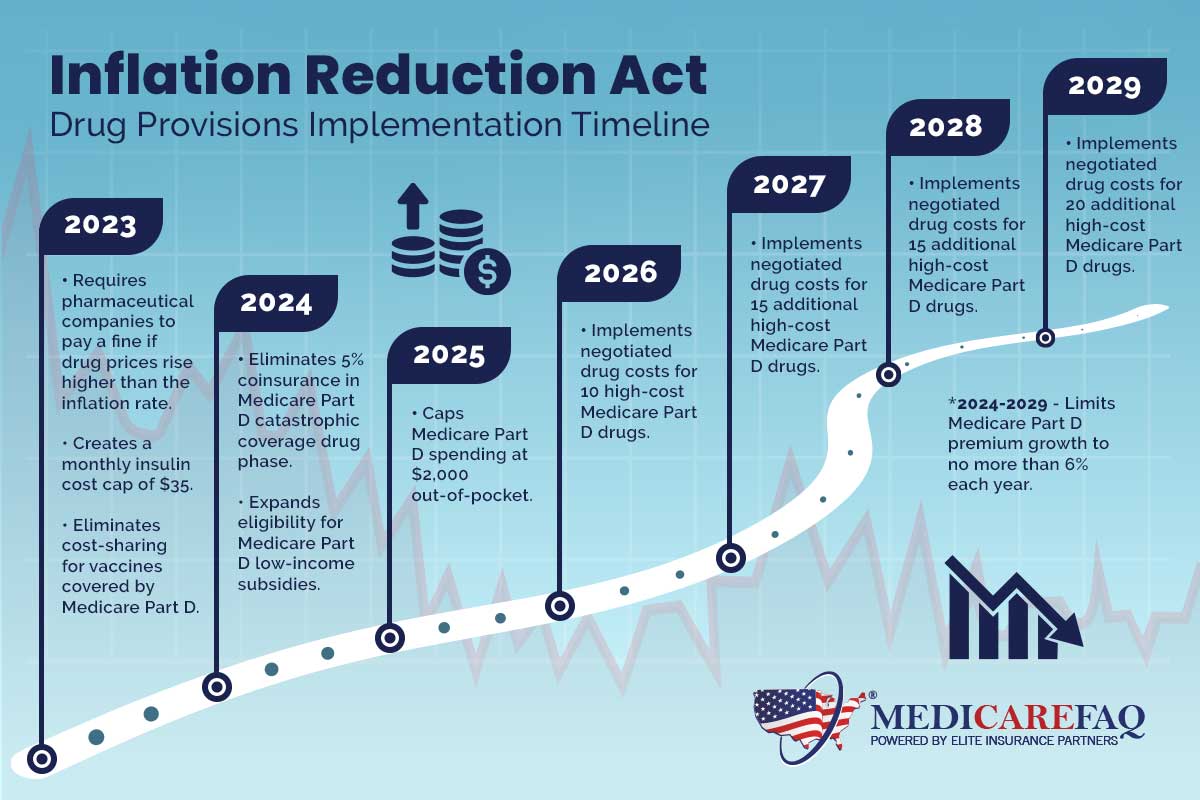

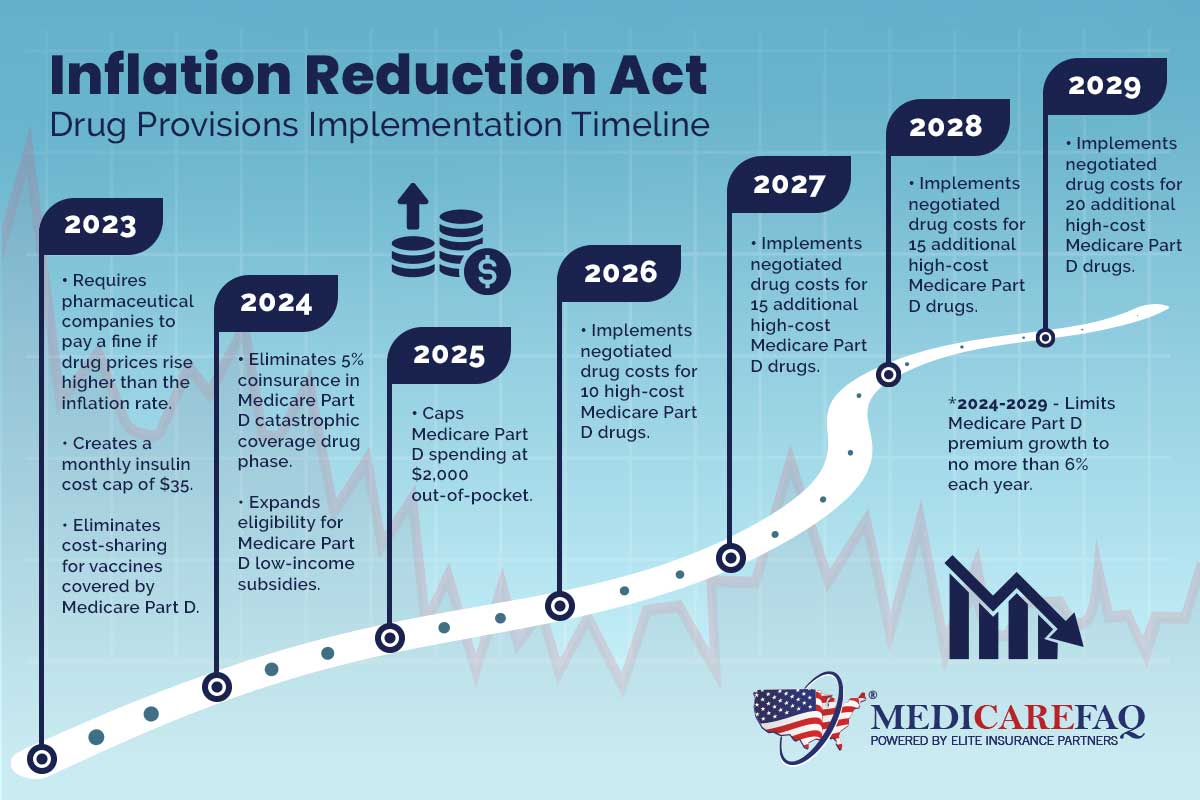

https://www.medicarefaq.com/wp-content/uploads/inflation-reduction-infographic.jpg

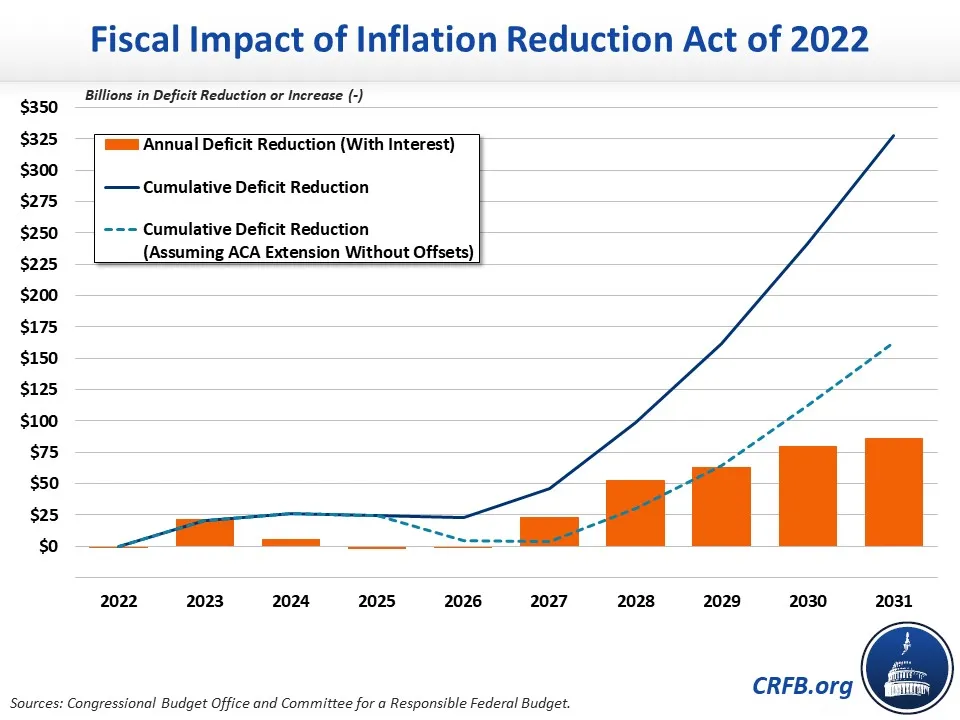

What s In The Inflation Reduction Act Committee For A Responsible Federal Budget

https://www.crfb.org/sites/default/files/styles/media_image_default/public/images/CBO Score of Inflation Reduction Act Chart.jpg.webp?itok=Y6xXa639

Summary Of Tax Incentives In The Inflation Reduction Act Of 2022 Clean Air Task Force

https://cdn.catf.us/wp-content/uploads/2022/08/15115831/ira-tax-incentives_Page_1-scaled.jpg

Participants discussed how Treasury s implementation of climate and clean energy tax incentives in the Inflation Reduction Act will help to mobilize capital for critical climate related where construction begins in 2023 and 15 percent in 2024 and later years For more information on these tax credits as well as related rebates The legislation includes 4 5 billion in funding for states to provide rebates for the purchase of new electric appliances including ranges cooktops and wall ovens The Department of Energy

A Consumer Guide to the Inflation Reduction Act Here s how to save on electric vehicles solar panels heat pumps and more via tax credits and rebates July 20 2023 iStock Courtney The rebates are double up to 4 000 and 8 000 respectively for lower income households Their income must be 80 or less of an area s median income to qualify The most generous

Download Inflation Reduction Act Of 2024 Rebates And Incentives

More picture related to Inflation Reduction Act Of 2024 Rebates And Incentives

Inflation Reduction Act Key Takeaways Entegrity Energy Partners

https://entegritypartners.com/wp-content/uploads/2022/10/AdobeStock_523990574-scaled.jpeg

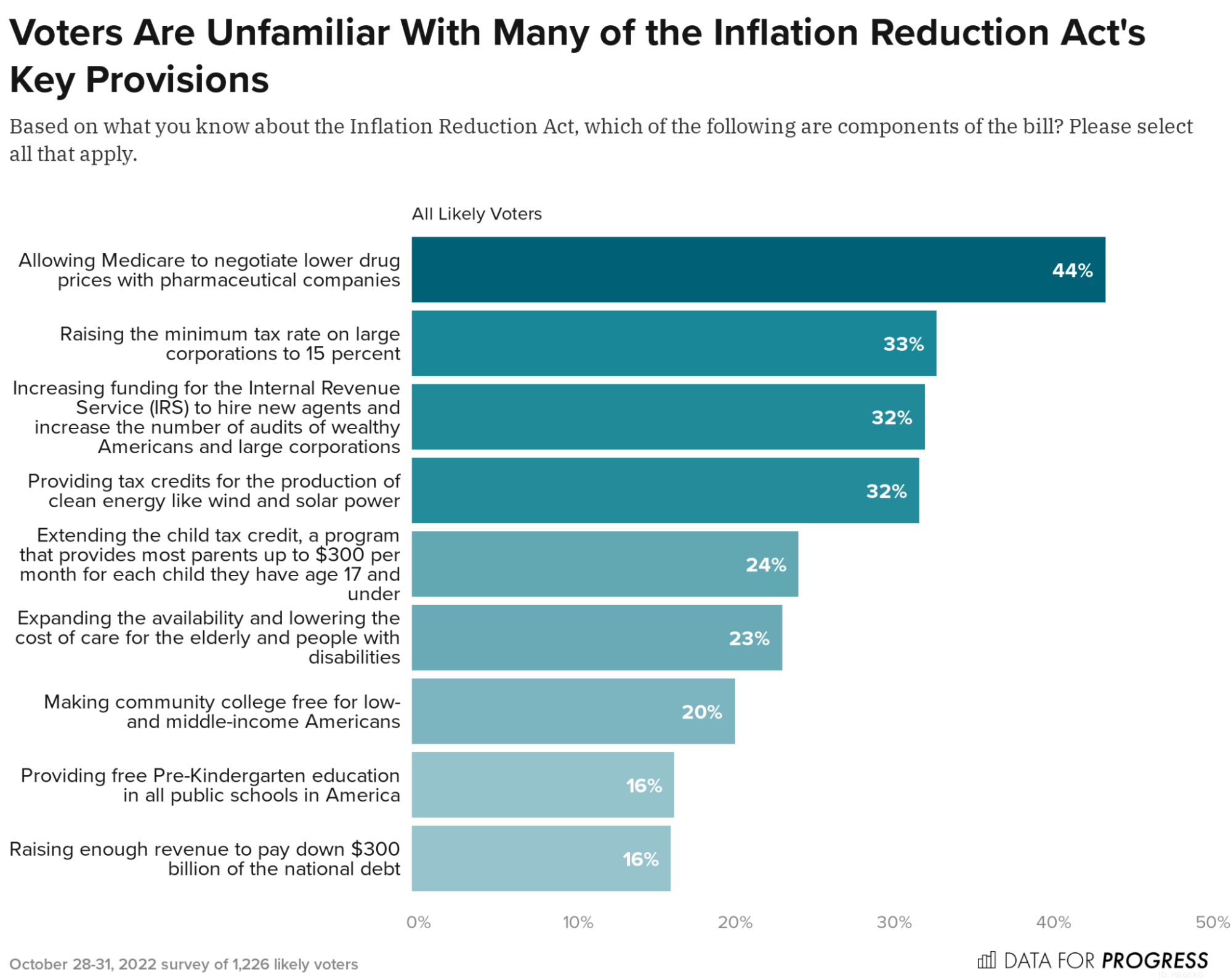

On The Inflation Reduction Act Voters Have Heard Very Little

https://images.squarespace-cdn.com/content/v1/5aa9be92f8370a24714de593/42d06ec1-2a4a-4251-b9b7-e2183769a5b8/image4.png?format=2500w

The Inflation Reduction Act Is A Victory For Working People AFL CIO

https://aflcio.org/sites/default/files/2022-08/inflation.png

On August 16 2022 President Biden signed the Inflation Reduction Act into law marking the most significant action Congress has taken on clean energy and climate change in the nation s history To conduct competitive solicitations for program implementation of the Inflation Reduction Act IRA section 50122 Home Electrification and Appliances Rebates HEAR Please note that states must follow their own state policies and procurement practices when soliciting any sub recipient or contractor that may receive federal funds

January 7 20248 10 AM ET Heard on Weekend Edition Sunday Ayesha Rascoe 4 Minute Listen Playlist The Inflation Reduction Act includes incentives for home owners to get their properties more President Biden s Inflation Reduction Act takes on climate change by helping Americans reduce their carbon footprint A key element in that push is offering up to 14 000 in rebates and tax

Biden Marks Anniversary Of Inflation Reduction Act Previewing 2024 Message

https://d.newsweek.com/en/full/2270550/inflation-reduction-act-signing.jpg

Inflation Reduction Act Deadlines Unison Energy LLC

https://unisonenergy.com/wp-content/uploads/2023/03/Deadlines-for-the-Inflation-Reduction-Act.jpg

https://www.clearesult.com/insights/january-updates-on-inflation-reduction-act-home-energy-rebates

We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and homeowners closely monitor developments Here are the most recent IRA developments and opportunities for

https://home.treasury.gov/news/press-releases/jy1830

The Inflation Reduction Act modifies and extends the Renewable Energy Production Tax Credit to provide a credit of up to 2 75 cents per kilowatt hour in 2022 dollars adjusted for inflation annually of electricity generated from qualified renewable energy sources where taxpayers meet prevailing wage standards and employ a sufficient proportion

Inflation Reduction Act Green Credits And Rebates Green Mountain Energy

Biden Marks Anniversary Of Inflation Reduction Act Previewing 2024 Message

3 Ways To Exploit The Inflation Reduction Act Seeking Alpha

I Heart Amana Inflation Reduction Act I Heart Amana

The Latest Inflation Reduction Act Incentives Timeline Energy Circle

Inflation Reduction Act Summary What It Means For New HVAC Systems Gas Rebates

Inflation Reduction Act Summary What It Means For New HVAC Systems Gas Rebates

Clean Energy Incentives In The Inflation Reduction Act Infiniti Energy

How Will The Inflation Reduction Act Affect Me Engineer Your Finances

The Inflation Reduction Act Incentives For Solar WCRE

Inflation Reduction Act Of 2024 Rebates And Incentives - A Consumer Guide to the Inflation Reduction Act Here s how to save on electric vehicles solar panels heat pumps and more via tax credits and rebates July 20 2023 iStock Courtney