Inland Revenue Self Assessment Tax Rebate Web The calculation of tax on taxable income includes the following tax credits and or rebates the low income rebate up to the 2009 tax year the independent earner tax credit from the 2010 tax year any other tax rebates in the IR3 and Personal Tax Summary The

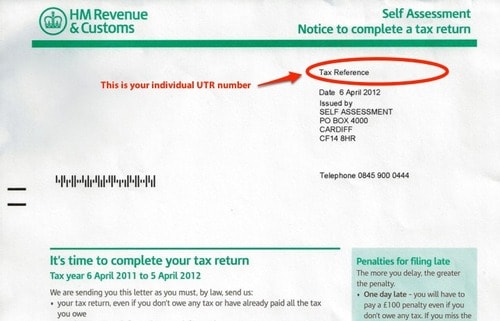

Web ensuring fair and sustainable tax revenues in a proportionate manner the preferred option of the initiative is a hybrid scope for cross border businesses in the Union Businesses in the Union other than the Union sub set of the largest groups which are also in scope of the Web The Tax refund calculator helps you estimate a rebate for a number of different circumstances You are self employed if you have a UTR number You are employed under PAYE For construction workers where a CIS

Inland Revenue Self Assessment Tax Rebate

Inland Revenue Self Assessment Tax Rebate

https://www.dnsassociates.co.uk/assets/img/hmrc_contact/what-is-a-utr-number/hmrc-selfassessment.jpg

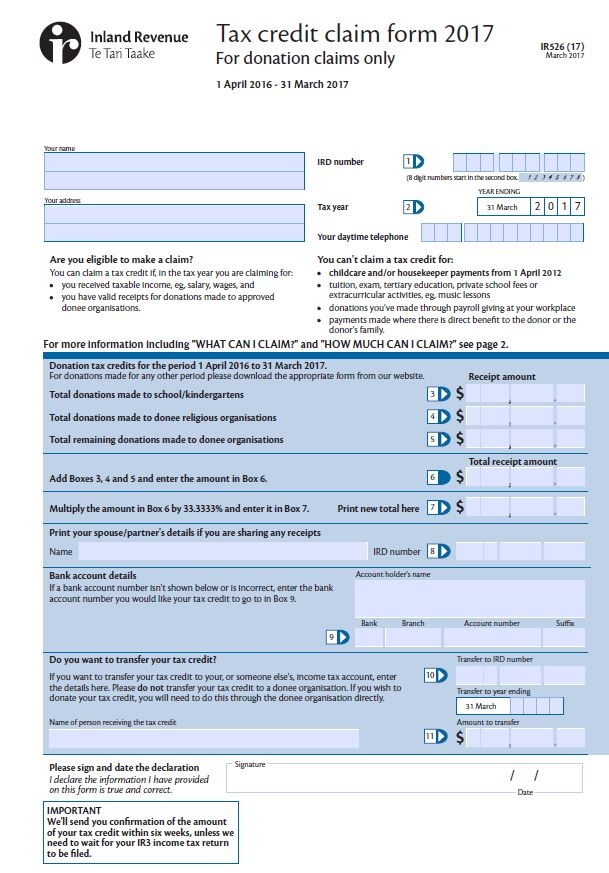

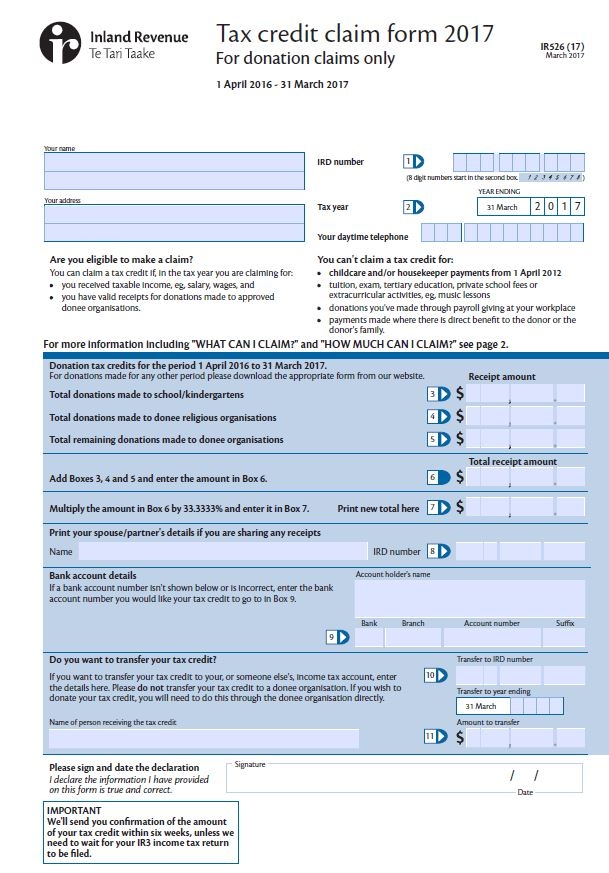

Emigrate Or Immigrate Ir526 Form

https://www.taxback.com/resources/blogimages/20180502135506.1525258506704.09c19926c5abdbcf91642f39647.jpg

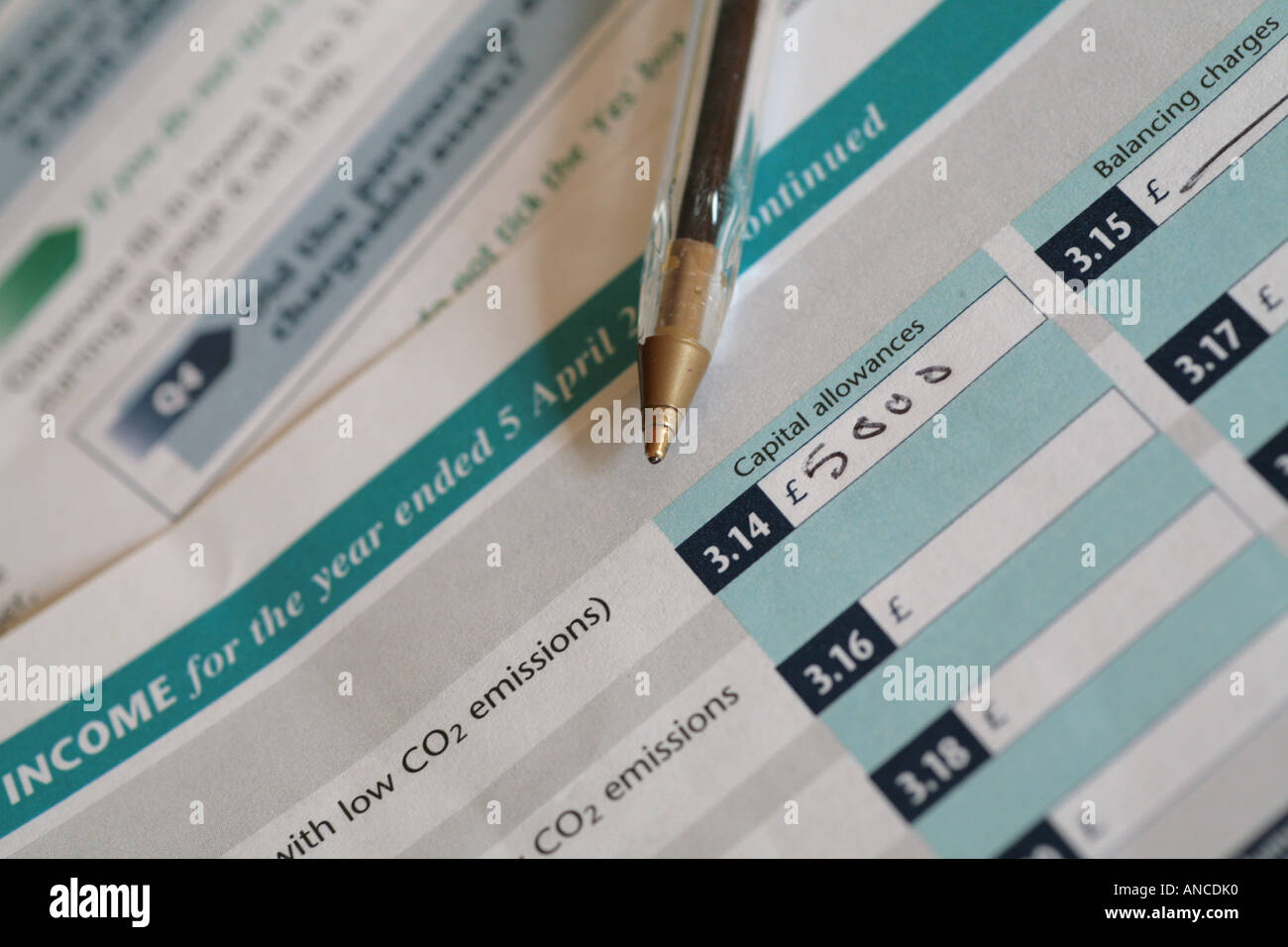

Inland Revenue Self Assessment Form Stock Photo Alamy

https://c8.alamy.com/comp/ANCDK0/inland-revenue-self-assessment-form-ANCDK0.jpg

Web 2 in 3 UK taxpayers can get a tax rebate We re the UK s favourite tax rebate service and we ve claimed 163 50m back for over 500 000 UK taxpayers Click on the button and you can get a quick FREE estimate of your potential tax rebate You can put in a claim in less Web To claim a tax rebate you only need to follow a few simple steps It takes seconds to start your tax refund claim and we ve made it easy at every stage Our Tax Preparation Services has agreed processes in place which streamlines the tax refund process and means you

Web Who can get a tax rebate Any tax payer can be eligible to a tax rebate however why you have overpaid tax is dependent on the make up of your own tax affairs Some other instances where you may have overpaid income tax are You have not used up all of Web Coverage of individuals The statistics are based on personal tax return information filed by individuals and other information Inland Revenue holds when the individual has not filed a tax return There has been a structural break in the coverage of this data from the 2019

Download Inland Revenue Self Assessment Tax Rebate

More picture related to Inland Revenue Self Assessment Tax Rebate

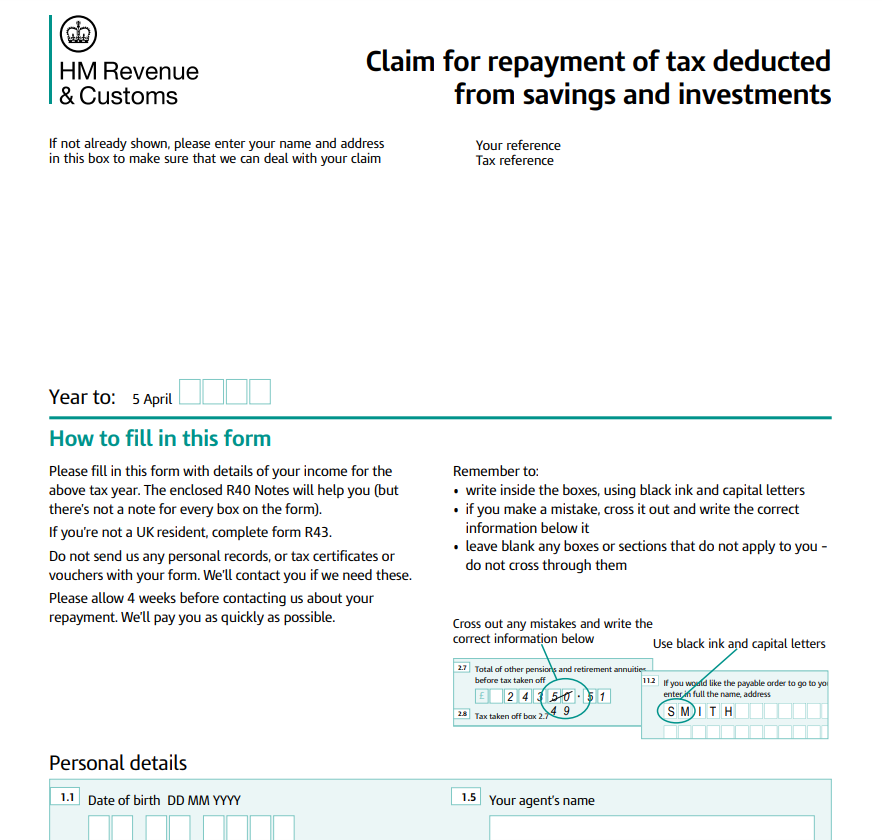

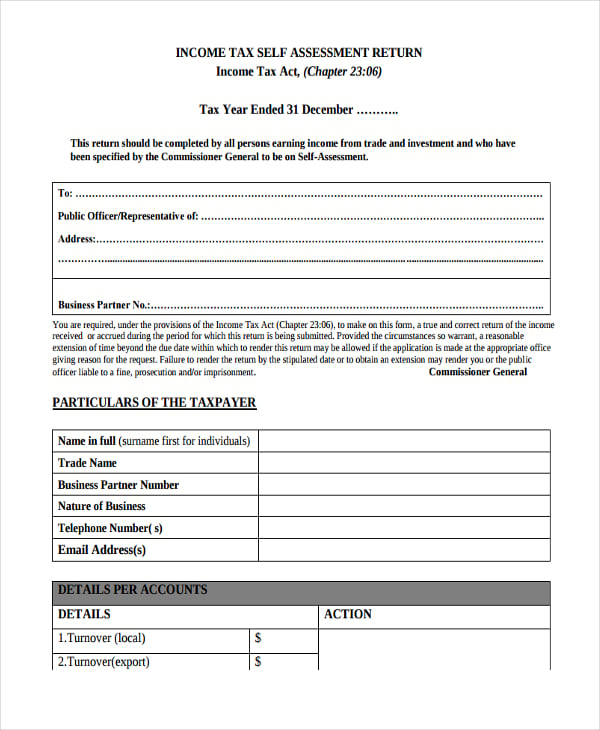

Automate Inland Revenue Self Assessment Form Microsoft Dynamics AirSlate

https://www.airslate.com/preview/documents/22/555/22555636/medium.png

Lhdn Personal Tax Relief Make Sure You Keep All The Receipts For The

https://i1.wp.com/the-money-magnet.com/wp-content/uploads/2019/05/medical-premium-tax-relief.png?w=640&ssl=1

INLAND REVENUE JANUARY 31 TAX RETURN DEADLINE SELF ASSESSMENT Stock

https://c8.alamy.com/comp/B7F060/inland-revenue-january-31-tax-return-deadline-self-assessment-B7F060.jpg

Web 31 mars 1998 nbsp 0183 32 Inland Revenue Self Assessment Volume 588 debated on Tuesday 31 March 1998 Mar 31 Whether they believe that the Inland Revenue has adequate resources to administer an income tax system based on self assessment Lord Web In 1867 Parliament enacted legislation which established two separate departments Inland Revenue and Customs The Canadian tax system is based on the principle of mandatory self assessment Taxpayers comprising both businesses and individuals must

Web Duration The call for evidence will run for 12 weeks starting on 7 February 2022 and ending on 2 May 2022 Lead official This is a joint consultation led by HM Revenue and Customs HMRC and Web Income tax rate in Hong Kong is 2 when net taxable income is from 1 to 50000 Hong Kong dollars 6 when net taxable income is between 50001 and 100000 Hong Kong dollars 10 when net taxable income is between 100001 and 150000 Hong Kong dollars and

UK Self Assesment Inland Revenue Tax Forms Stock Photo Alamy

https://c8.alamy.com/comp/A30R27/uk-self-assesment-inland-revenue-tax-forms-A30R27.jpg

Hmrc Tax Return 2019 Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/477/291/477291825/large.png

https://www.ird.govt.nz/about-us/tax-statistics/revenue-refunds/income...

Web The calculation of tax on taxable income includes the following tax credits and or rebates the low income rebate up to the 2009 tax year the independent earner tax credit from the 2010 tax year any other tax rebates in the IR3 and Personal Tax Summary The

https://taxation-customs.ec.europa.eu/system/files/2023-09/…

Web ensuring fair and sustainable tax revenues in a proportionate manner the preferred option of the initiative is a hybrid scope for cross border businesses in the Union Businesses in the Union other than the Union sub set of the largest groups which are also in scope of the

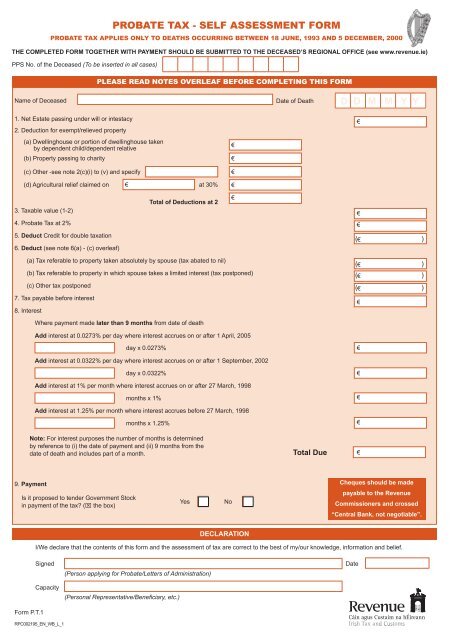

Probate Tax Self Assessment Form Revenue Commissioners

UK Self Assesment Inland Revenue Tax Forms Stock Photo Alamy

Hmrc Tax Return Self Assessment Form Printable Rebate Form

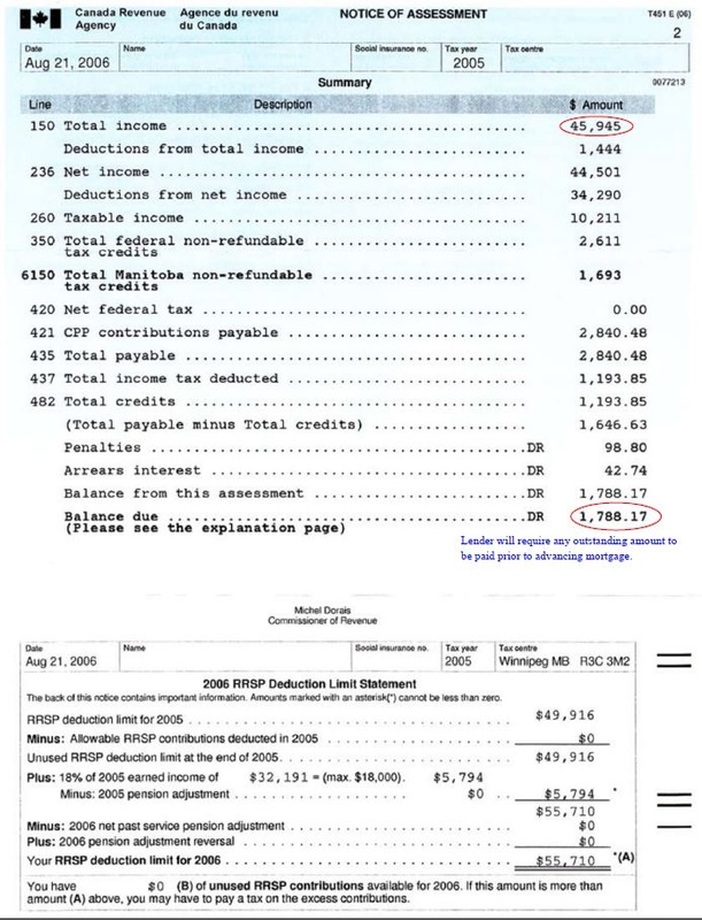

Income Tax Notice Of Assessment JIMMY KWON LISA YUN 604 808 1050

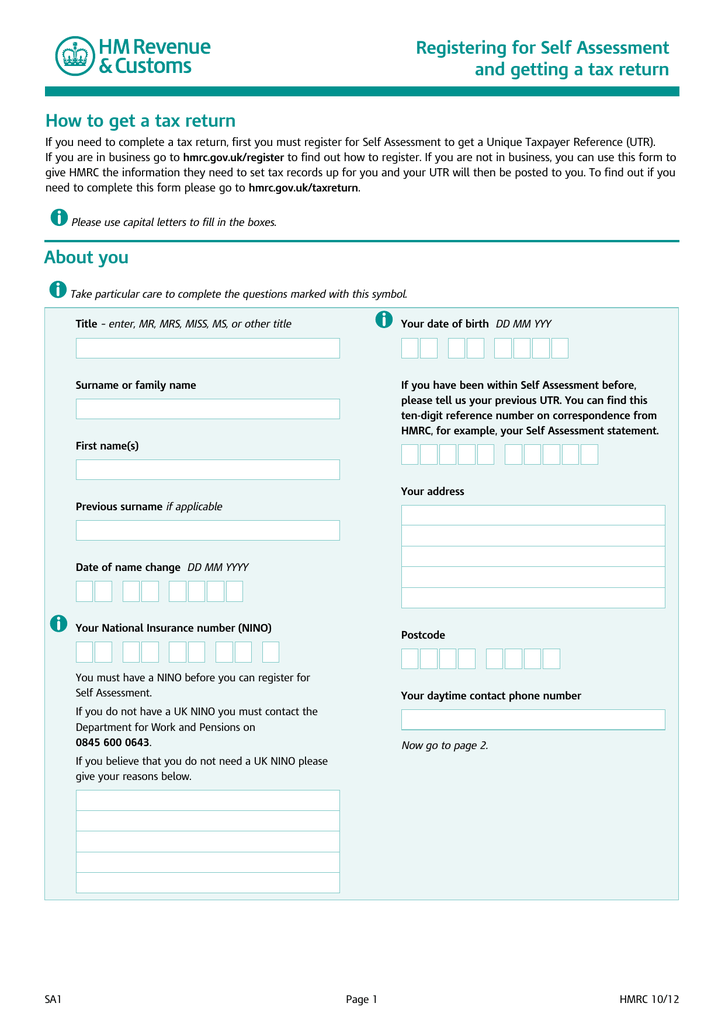

Registering For Self Assessment And Getting A Tax Return

Electronic Tax Filing Photos And Premium High Res Pictures Getty Images

Electronic Tax Filing Photos And Premium High Res Pictures Getty Images

47 Assessment Form Examples

Filing Tax Return Photos And Premium High Res Pictures Getty Images

Self Assessment Essex The Accountancy Practice Essex Ltd

Inland Revenue Self Assessment Tax Rebate - Web These payments are often computed by reference to wages or earnings from self employment Tax rates are generally fixed both corporate and personal with a national retail sales tax and monthly tax rebate to households of citizens and legal resident