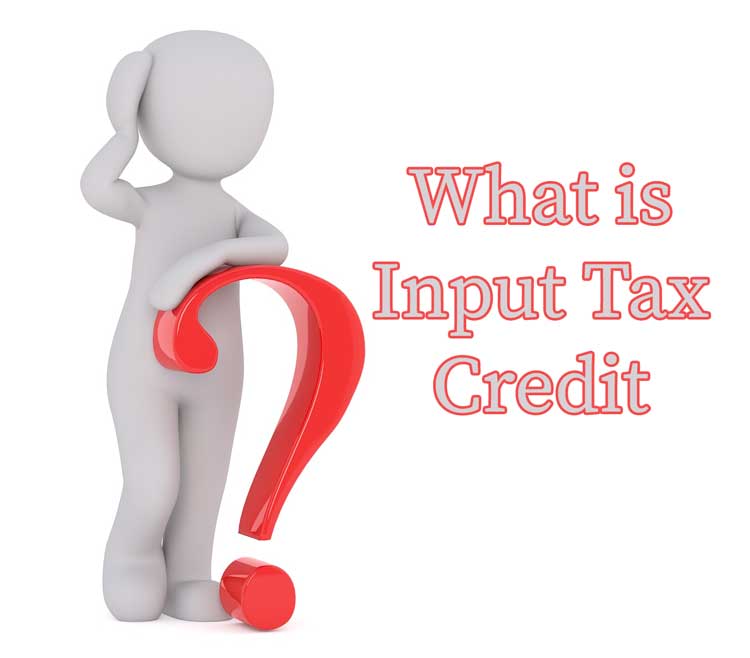

Input Tax Credit Means In English Input tax credit ITC is the tax paid by the buyer on purchase of goods or services Such tax which is paid at the purchase when reduced from liability payable

Input Tax Credit means reducing the tax liability on outputs by the amount of taxes paid on inputs It is a procedure to avoid charging of tax on the tax Input tax refers to the mechanism whereby you can get tax deductions that you have paid on the inputs at the time when you are paying the tax on the

Input Tax Credit Means In English

Input Tax Credit Means In English

https://i.ytimg.com/vi/pDMQR1e2g4w/maxresdefault.jpg

Input Tax Credit Under Goods And Services Tax Act RJA

https://carajput.com/blog/wp-content/uploads/2021/09/Compulsory-Reversal-of-GST-Credit-by-Buyers-for-Non-Payment-.jpg

![]()

Input Tax Credit Or ITC Guide On Meaning Eligibility And How To

https://cdn.shortpixel.ai/client/q_glossy,ret_img,w_1000/https://www.saralgst.com/wp-content/uploads/2018/06/input-tax-credit-or-ITC-under-GST.jpg

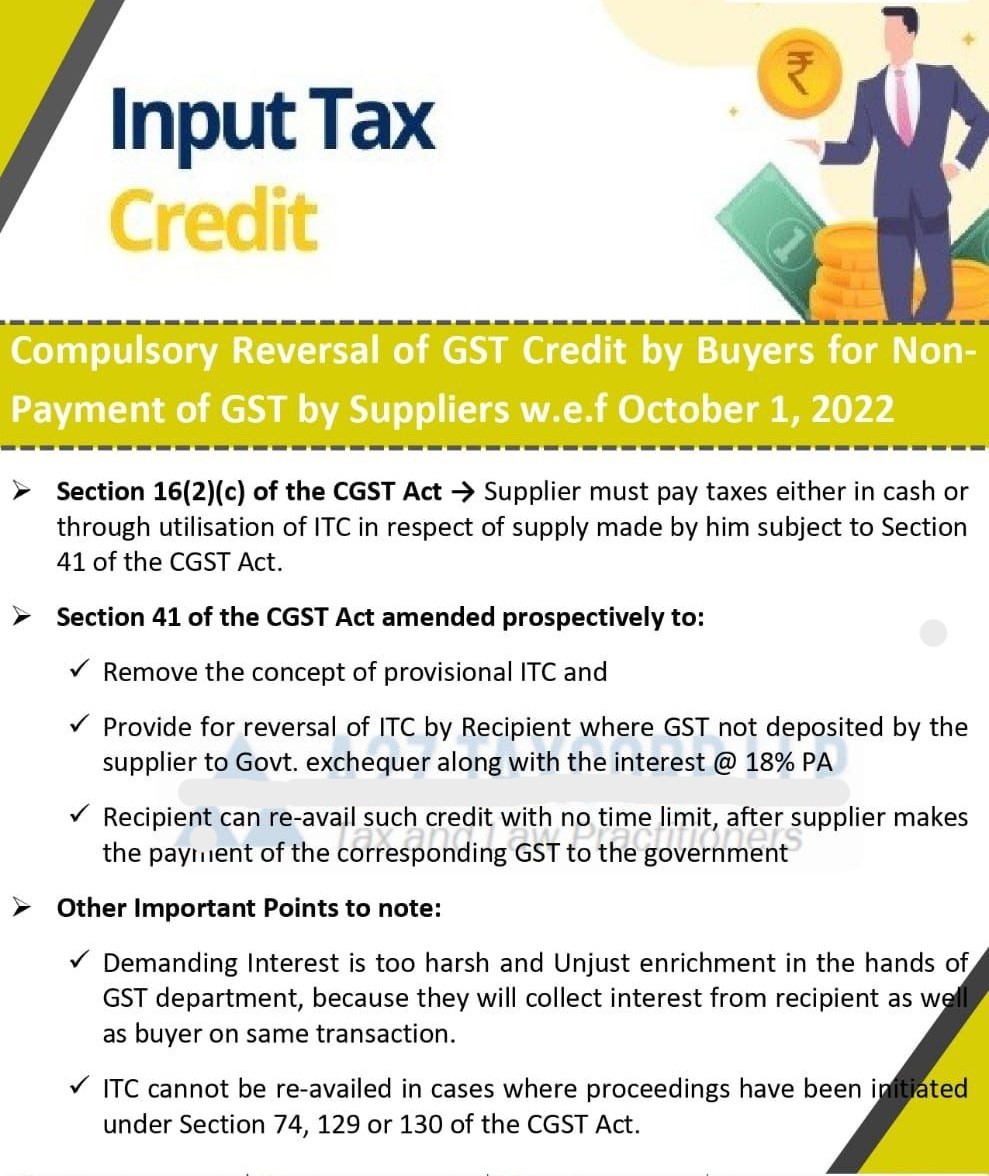

The meaning of ITC can be easily understood when we take the words input and tax credit Inputs are materials or services that a manufacturer purchase in Input tax Credit ITC is a major element of understanding which has various implications under GST In changing scenario the government keeps on making various amendments to the GST Law

ITC Last updated on April 20th 2021 Input Tax Credit under GST means the credit of input tax paid on purchases which the taxpayer can use it towards payment of output tax charged on sales An input tax credit means that while paying tax on the sale output of goods and services you can avail yourself of the tax you have already paid on the

Download Input Tax Credit Means In English

More picture related to Input Tax Credit Means In English

Chart 32 Input Tax Credit Section 17 5 Blocked Credit IDT May 22

https://i.ytimg.com/vi/E6gDHh1LpkM/maxresdefault.jpg

![]()

Input Tax Credit Or ITC Guide On Meaning Eligibility And How To

https://cdn.shortpixel.ai/client/q_glossy,ret_img,w_930/https://www.saralgst.com/wp-content/uploads/2018/06/Input-Tax-credit.jpg

Itc No Input Tax Credit On Festive Offers To Retailers GST AAR

https://static.toiimg.com/thumb/msid-87293593,width-1070,height-580,imgsize-39274,resizemode-75,overlay-toi_sw,pt-32,y_pad-40/photo.jpg

In simple terms input credit means at the time of paying tax on output you can reduce the tax you have already paid on inputs and pay the balance Input tax credit means the credit of tax paid on inputs The tax payer can claim the credit of tax paid from the output tax payable and pay the balance amount For

The input tax credit mechanism allows GST registered businesses to receive refunds on GST paid for the purchase of such inputs to prevent the Input Tax Credit ITC is a kind of tax that businesses pay on a purchase ITC can be used to reduce tax liability when businesses make a sale It means that businesses can

Input Tax Credit Utilisation Changes Through GST Amendment 2019

https://assets1.cleartax-cdn.com/s/img/2019/02/22172350/OG-images-1-014.png

What Is Input Credit ITC Under GST

https://www.deskera.com/blog/content/images/2021/08/ITC-CLAIM.png

https:// gsthero.com /input-tax-credit-itc-under-gst-with-examples

Input tax credit ITC is the tax paid by the buyer on purchase of goods or services Such tax which is paid at the purchase when reduced from liability payable

https:// tax2win.in /guide/input-tax-credit-gst

Input Tax Credit means reducing the tax liability on outputs by the amount of taxes paid on inputs It is a procedure to avoid charging of tax on the tax

Input Tax Credit Under GST With Examples Unlimited Guide

Input Tax Credit Utilisation Changes Through GST Amendment 2019

REVERSAL OF INPUT TAX CREDIT REAL ESTATE SECTOR

GST Input Tax Credit Very Important GST Input Tax Credit ITC

Practical FAQs On Input Tax Credit Under GST Taxmann

PDF Goods And Services Tax INPUT TAX CREDIT Input Tax Credit Key

A Complete Guide On Input Tax Credit ITC Under GST

Input Tax Credit Know How Does It Work

Input Tax Credit Means In English - An input tax credit means that while paying tax on the sale output of goods and services you can avail yourself of the tax you have already paid on the