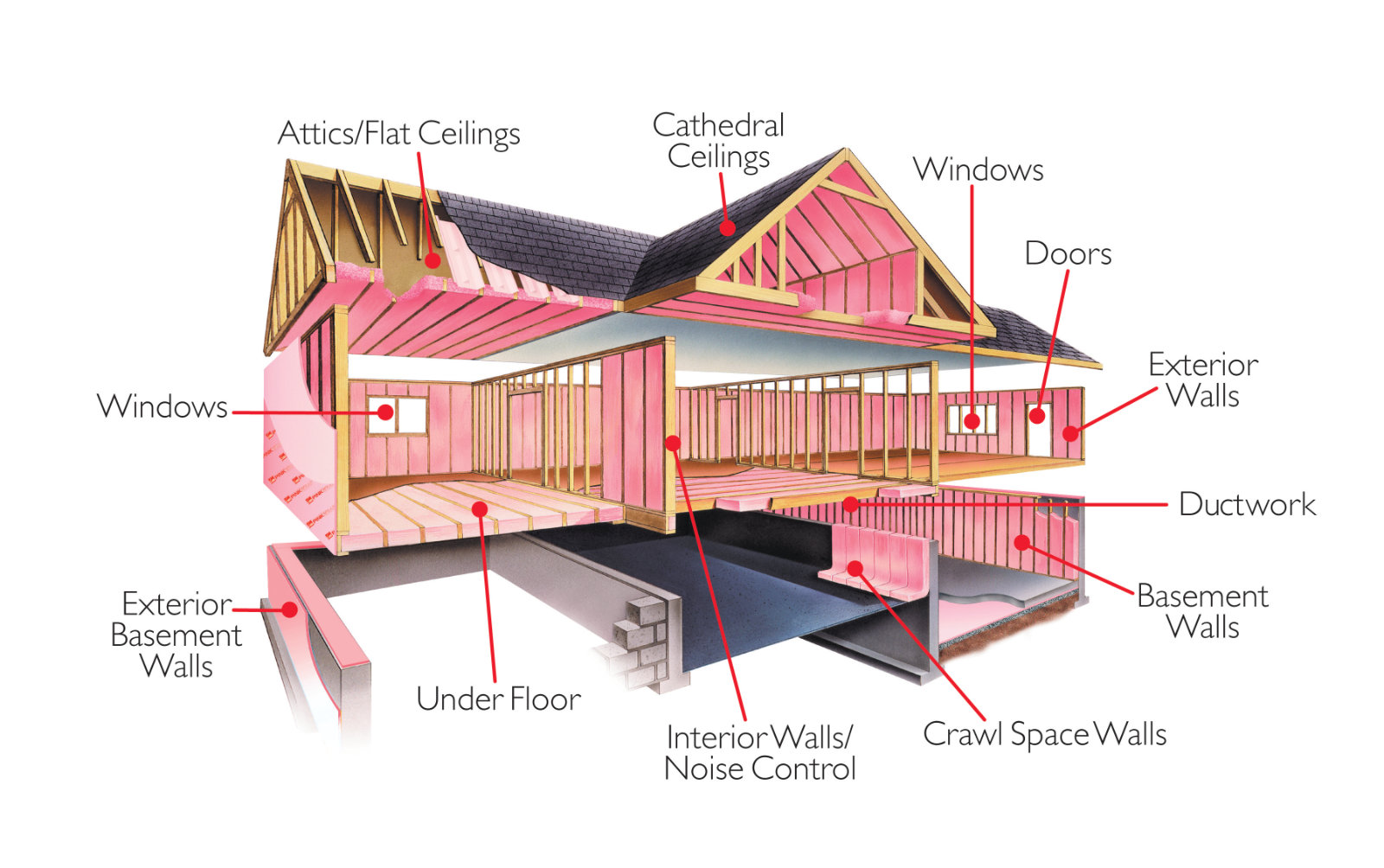

Insulation Tax Rebate 2024 For 2023 and 2024 the insulation tax credit is 30 of material costs The tax credit has an annual upper limit of 1 200 but can be reapplied for each year there is no lifetime limit until 2032 Note that the tax credit only covers the cost of insulation materials and not labor

Insulation Tax Credit Information updated 12 30 2022 Subscribe to ENERGY STAR s Newsletter for updates on tax credits for energy efficiency and other ways to save energy and money at home See tax credits for 2022 and previous years This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit 2034 22 no annual maximum or lifetime limit

Insulation Tax Rebate 2024

Insulation Tax Rebate 2024

https://cdn-www.terminix.com/-/media/Feature/Terminix/Articles/Insulation-Attic-Installment-Technician.jpg?rev=1a8cb3da7c0a447989639e28fe8462d4

Massachusetts Insulation Tax Rebates

https://5cenergyinc.com/wp-content/uploads/2023/02/massachusetts-insulation-tax-rebate-1024x576.jpg.webp

Rebate Insulation Program 911 Attic Insulation

https://911atticinsulation.com/wp-content/uploads/2023/04/23-1152x1536.jpg

The Inflation Reduction Act is a piece of federal legislation passed in August 2022 that included 370 billion in clean energy investments Despite its name it s largely seen as a climate change In the case of property placed in service after December 31 2022 and before January 1 2024 22 Insulation Residential energy property expenditures include the following qualifying products 2017 but was retroactively extended for tax years 2018 2019 and 2020 on December 20 2019 as part of the Further Consolidated Appropriations

Only attic area above living space excludes laundry storage garage etc can receive a rebate Existing attic insulation must be as specified in the measure description R 11 between R 12 and R 19 or between R 20 and R 38 excluding assembly section Existing insulation of R 19 or less must be improved to R 38 or greater Beginning in 2023 the Inflation Reduction Act increased the tax credit to 30 of the cost of insulation and air sealing up to 1 200 annually Visit Energy Star for additional eligibility requirements How to Claim the Energy Efficient Home Improvement Tax Credit

Download Insulation Tax Rebate 2024

More picture related to Insulation Tax Rebate 2024

New Insulation Tax Rebatefrom IRS Impressive Basement Kitchens

https://impressivebasements.com/wp-content/uploads/2023/02/IMG_8224-1024x768.jpg

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate.jpg

Resolution 2 Save the Planet Clean energy improvements reduce your carbon footprint Far too often a community s resilience is tested by severe weather and extreme natural disasters exacerbated due to the climate crisis Communities across the U S experience severe droughts wildfires and floods displacing folks from their homes TRAVERSE CITY MI US August 24 2023 EINPresswire In an effort to support energy efficient home improvements and combat climate change the Federal Government has launched the

Home energy audits 150 Exterior doors 250 per door up to 500 per year Exterior windows and skylights central A C units electric panels and related equipment natural gas propane and oil water heaters furnaces or hot water boilers 600 In addition to the 1 200 credit limit above a separate aggregate yearly credit limit of 2 000 Published January 25 2024 Written by CLEAResult We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and

The New Federal Tax Credits And Rebates For Home Energy Efficiency

https://www.ny-engineers.com/hs-fs/hubfs/home insulation.jpg?width=2250&name=home insulation.jpg

Federal Tax Credit For Attic Insulation Bird Family Insulation

https://birdinsulation.com/wp-content/uploads/elementor/thumbs/IMG_3358-pze8n0tf8snl7o1gxaaq5ak87jitysx13y600w87m0.jpg

https://www.joinarbor.com/resources/insulation-tax-credit

For 2023 and 2024 the insulation tax credit is 30 of material costs The tax credit has an annual upper limit of 1 200 but can be reapplied for each year there is no lifetime limit until 2032 Note that the tax credit only covers the cost of insulation materials and not labor

https://www.energystar.gov/about/federal_tax_credits/insulation

Insulation Tax Credit Information updated 12 30 2022 Subscribe to ENERGY STAR s Newsletter for updates on tax credits for energy efficiency and other ways to save energy and money at home See tax credits for 2022 and previous years This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032

Commercial Roof Insulation And Efficient Unit Heater Rebate Application PGW EnergySense

The New Federal Tax Credits And Rebates For Home Energy Efficiency

Ceiling Insulation Cashbuild

Attic Insulation Rebate Charlottesville VA

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

8 CPS Energy Rebates That Could Save San Antonio Homeowners Hundreds

8 CPS Energy Rebates That Could Save San Antonio Homeowners Hundreds

Vaulted Ceiling Insulation R Value Shelly Lighting

CD Weld Insulation Pins Insulation Fasteners hvacinsulationsupplies hvacinsulationsupplies

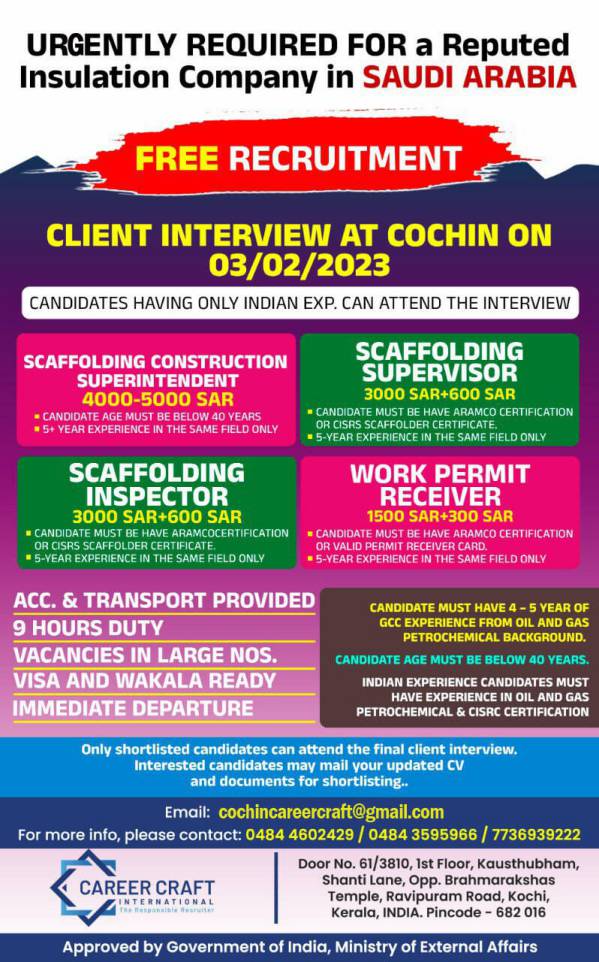

Insulation Job Want For Insulation Co Saudi Arabia

Insulation Tax Rebate 2024 - Beginning in 2023 the Inflation Reduction Act increased the tax credit to 30 of the cost of insulation and air sealing up to 1 200 annually Visit Energy Star for additional eligibility requirements How to Claim the Energy Efficient Home Improvement Tax Credit