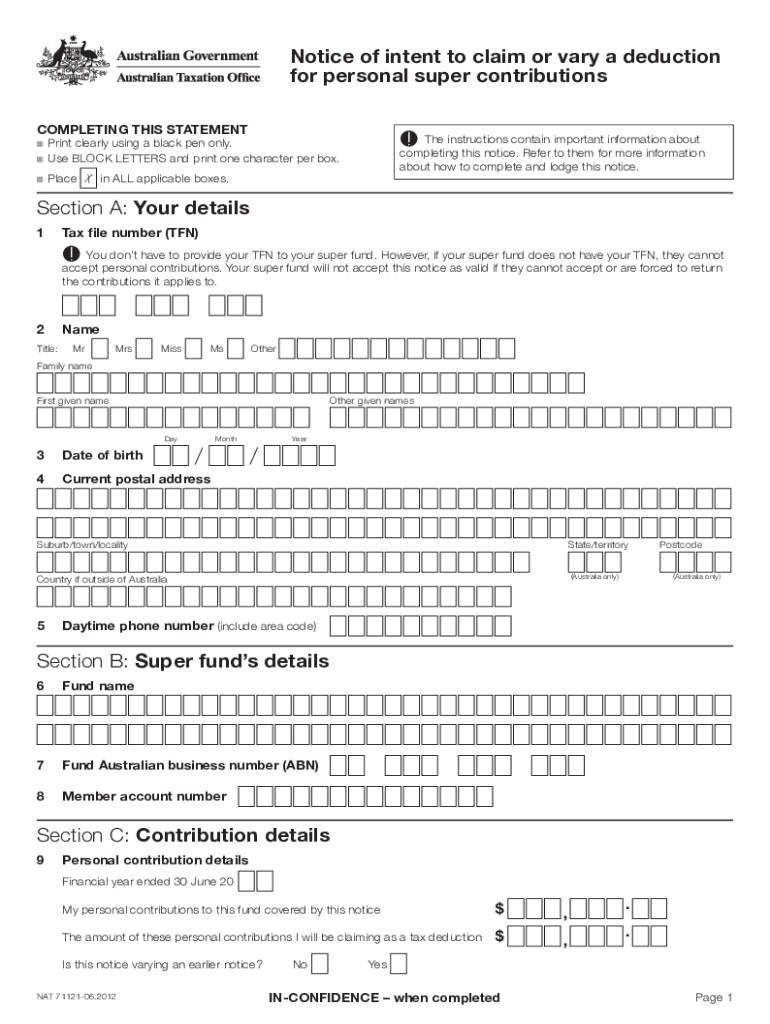

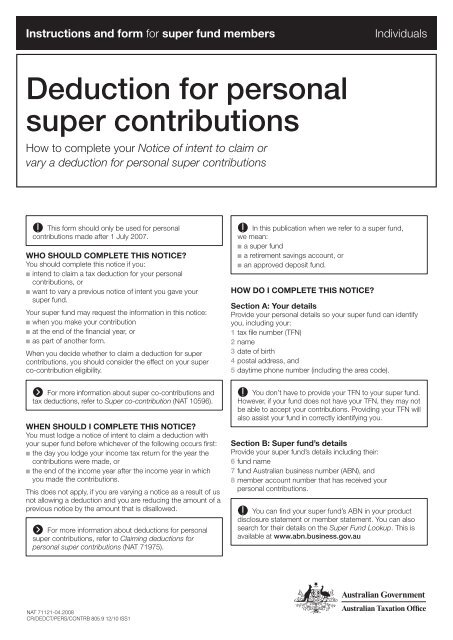

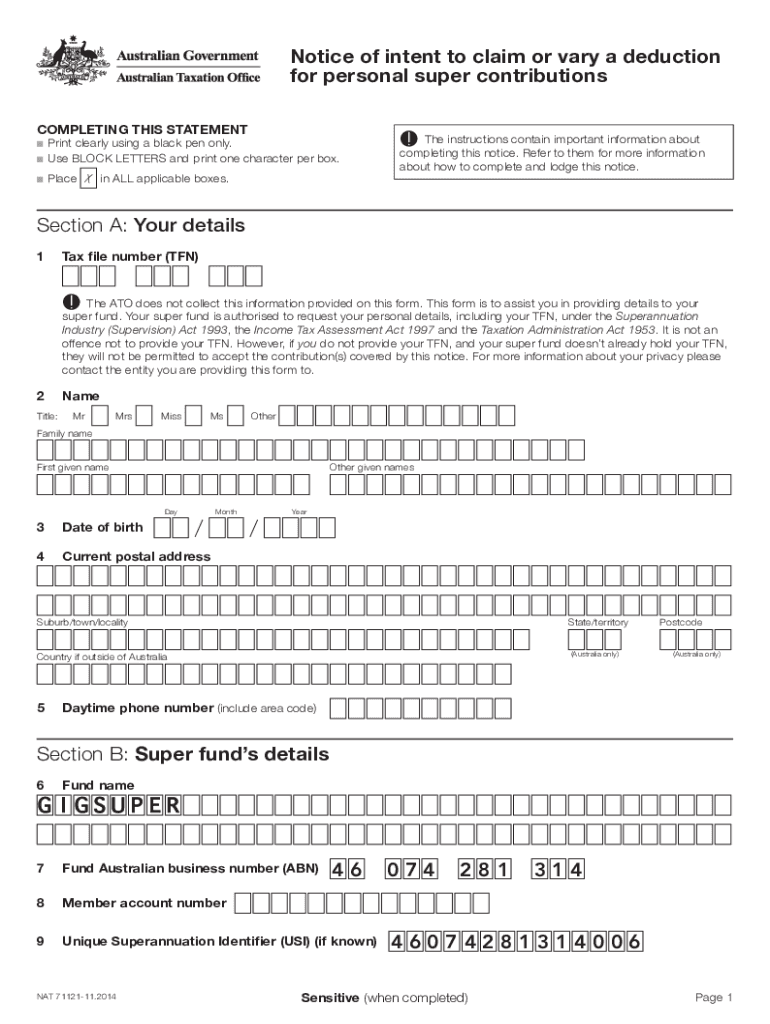

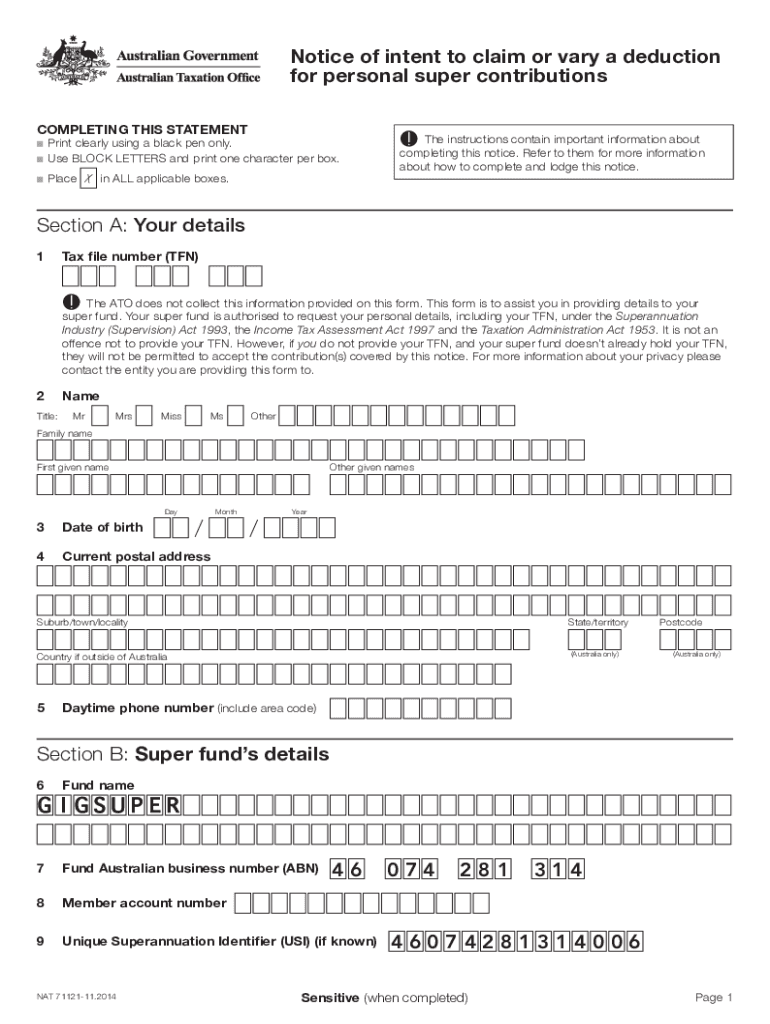

Intent To Claim A Tax Deduction For Personal Super Contributions Step 1 Complete the Notice of intent to claim a tax deduction for personal super contributions form This tells us the amount you want to claim Step 2 Send the form to AustralianSuper via

Once you advise AustralianSuper of your intention to claim a deduction for your personal contributions AustralianSuper is required to deduct 15 tax from those contributions To help your members claim or vary a tax deduction for personal super contributions you should accept notices ensure the notice is both valid and in the approved form

Intent To Claim A Tax Deduction For Personal Super Contributions

Intent To Claim A Tax Deduction For Personal Super Contributions

https://www.wladvisory.com.au/wp-content/uploads/2022/01/Start-up-with-WL-Advisory-Logo.png

Did You Make A Personal Super Contribution In 2019 For Which You

https://www.prismaccounting.com.au/wp-content/uploads/2020/03/super-contribution.jpg

Personal Super Contributions Tax Deduction Your Complete Guide

https://superguy.com.au/wp-content/uploads/2022/06/Personal-Super-Contributions-Tax-Deduction.jpg

Complete this declaration if you have not previously lodged a valid notice with your super fund for these contributions I have not included any of the contributions in an earlier valid notice To claim a tax deduction on your after tax contributions you ll need to Log in to your online account and complete the Notice of intent available on the Transactions page if you re eligible to claim

If you make personal super contributions claiming them as a tax deduction might mean paying less income tax Who can claim a super tax deduction You may be eligible to You must give a notice of intent to claim a deduction to your super fund on or before whichever of the following days occurs earliest either the last day of the income year after the income year

Download Intent To Claim A Tax Deduction For Personal Super Contributions

More picture related to Intent To Claim A Tax Deduction For Personal Super Contributions

)

Claiming Deductions For Personal Super Contributions

https://assets.cdn.thewebconsole.com/S3WEB6319/blogImages/6298308df1d39.jpg?v=2&geometry(550>)

How To Claim Your Tax Deduction For Personal Super Contributions Before

http://static1.squarespace.com/static/6163818a87b45a450e96602d/6163830dc36999692e44abca/647fd7926dafa05b409e5ba9/1686102605992/shutterstock_531086104-scaled.jpg?format=1500w

V letlen l Szemafor Hossz Super Fund Personal Visszan z Sz n szn

https://www.gscpa.com.au/wp-content/uploads/2019/10/Table-newsletter-october.png

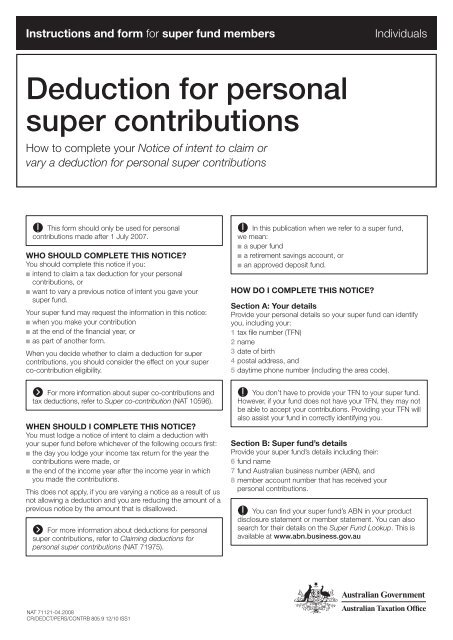

To help your members claim or vary a tax deduction for personal super contributions you should report a notice of intent to claim a deduction If a notice is invalid you must not accept it and You should complete this notice of intent if you intend to claim a tax deduction for your personal super contributions want to vary a previous valid notice of intent you gave your

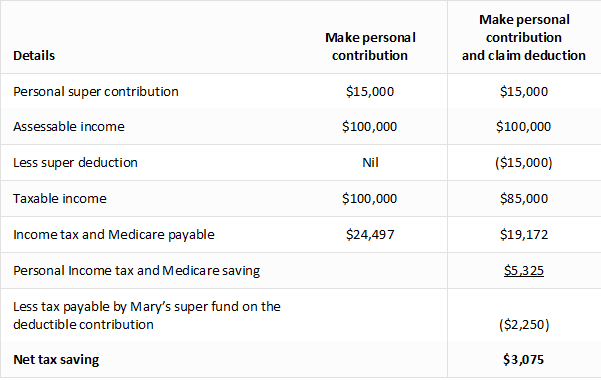

Claiming a tax deduction for personal super contributions can reduce your taxable income This could mean you pay less income tax For example if you earned 50 000 and had eligible tax To make a claim complete a notice of intent before you lodge your tax return You can submit a notice of intent via your online account Note If you re aged between 67 74 and want to claim

Deduction For Personal Super Contributions CareSuper

https://img.yumpu.com/37727014/1/500x640/deduction-for-personal-super-contributions-caresuper.jpg

Tax deductible Super Contributions Newcombe And Co

https://www.newcombeandco.com.au/site/wp-content/uploads/2020/07/Tax-deductible-super-contributions.jpg

https://www.australiansuper.com › ... › notice-of-intent

Step 1 Complete the Notice of intent to claim a tax deduction for personal super contributions form This tells us the amount you want to claim Step 2 Send the form to AustralianSuper via

https://www.australiansuper.com › media › australian...

Once you advise AustralianSuper of your intention to claim a deduction for your personal contributions AustralianSuper is required to deduct 15 tax from those contributions

Notice Of Intent To Claim Fillable Form Printable Forms Free Online

Deduction For Personal Super Contributions CareSuper

Get Paperwork Right For Super Contributions Or Lose Tax Deduction

Tax Return Personal Super Contributions Tax Deduction

Are You Entitled To A Tax Deduction On Personal Super Contributions

Fillable Online Notice Of Intent To Claim A Tax Deduction For Super

Fillable Online Notice Of Intent To Claim A Tax Deduction For Super

Paperwork Is Paramount When Claiming A Deduction For Personal Super

Should I Claim A Tax Deduction For My Personal Super Contributions

Year end Deductible Personal Super Contributions

Intent To Claim A Tax Deduction For Personal Super Contributions - If you wish to claim a tax deduction for personal contributions you must have received written acknowledgment of the Notice of Intent from the super fund An annual