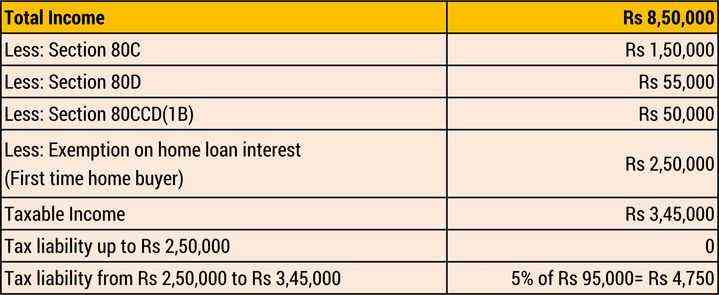

Interest On Home Loan Tax Rebate Web 28 mars 2017 nbsp 0183 32 The interest portion of the EMI paid for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions Web 24 ao 251 t 2023 nbsp 0183 32 Tax Deduction on Home Loan Interest Payment under Section 24 b As per Section 24 b of the Income Tax Act You can claim a tax deduction of up to Rs 2 lakh

Interest On Home Loan Tax Rebate

Interest On Home Loan Tax Rebate

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

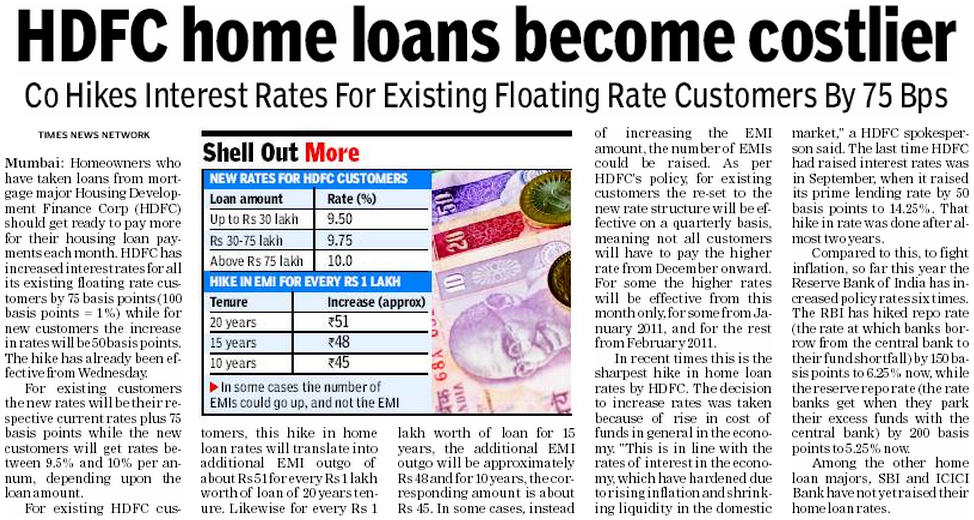

Lowest Interest Rates On Home Loans Under Rs 30 Lakh Here s What 15

https://financialexpresswpcontent.s3.amazonaws.com/uploads/2021/07/Home-loan-chart.jpg

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Web 5 janv 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can deduct Web 4 janv 2023 nbsp 0183 32 Standard deduction rates are as follows Single taxpayers and married taxpayers who file separate returns 12 950 for tax year 2022 Married taxpayers who

Web If your taxable income in 2021 exceeds 68 507 69 398 in 2022 it s important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021 Web Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on

Download Interest On Home Loan Tax Rebate

More picture related to Interest On Home Loan Tax Rebate

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

http://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

Housing Loan Interest Rates HDFC Home Loan Interest Rates Housing

https://blog.investyadnya.in/wp-content/uploads/2019/11/Interest-Rates-on-Home-Loan-of-Major-Banks-Dec-2019_Featured.png

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE-662x400.jpg

Web The best way to calculate home loan tax benefits is to use home loan tax saving calculator This automated tool makes the whole calculation process easy and hassle Web 5 sept 2023 nbsp 0183 32 Under Section 80EEA of the Income Tax Act in India first time homebuyers investing in affordable property with the help of a home loans get Rs 1 50 lakh income

Web 18 juil 2023 nbsp 0183 32 Deductible interest for new loans for your personal residence is limited to principal amounts 750 000 Mortgage interest deduction When you repay a mortgage Web Under Sections 80C and 24 both the borrowers are eligible for up to Rs 2 lakh tax rebate on interest payment each and up to Rs 1 5 lakh benefit on the principal repayment each

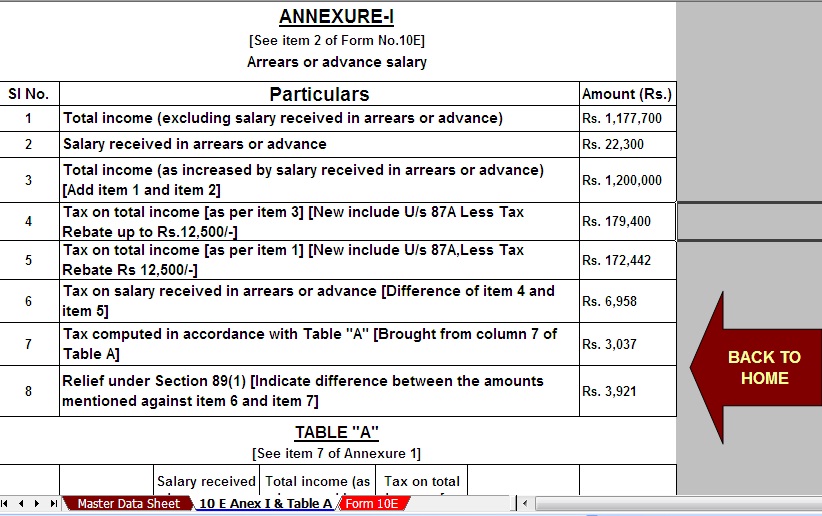

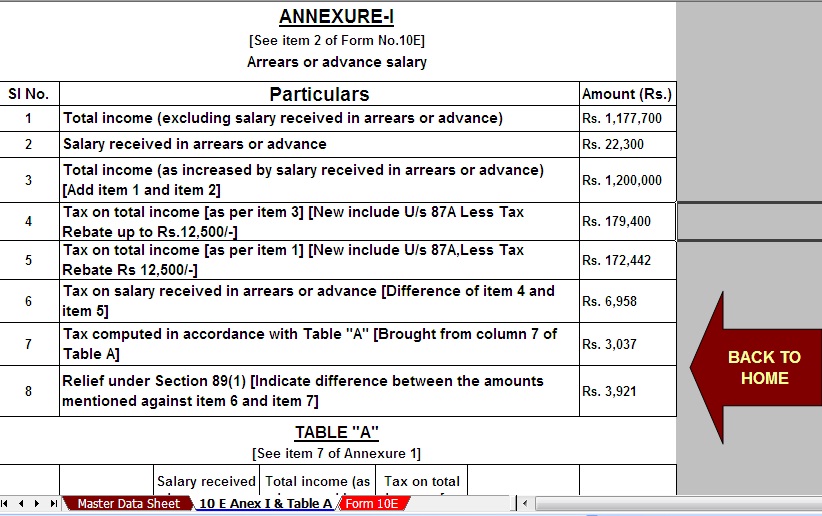

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

https://1.bp.blogspot.com/-1hmzbVNZKYo/XSHkKoX1yfI/AAAAAAAAJ48/rH6dqw_ChNcMLHBhRqZVUOtTkyFQPjeOQCLcBGAs/s1600/Picture-4%2Bof%2BArrears%2BRelief%2BCalculator%2B19-20.jpg

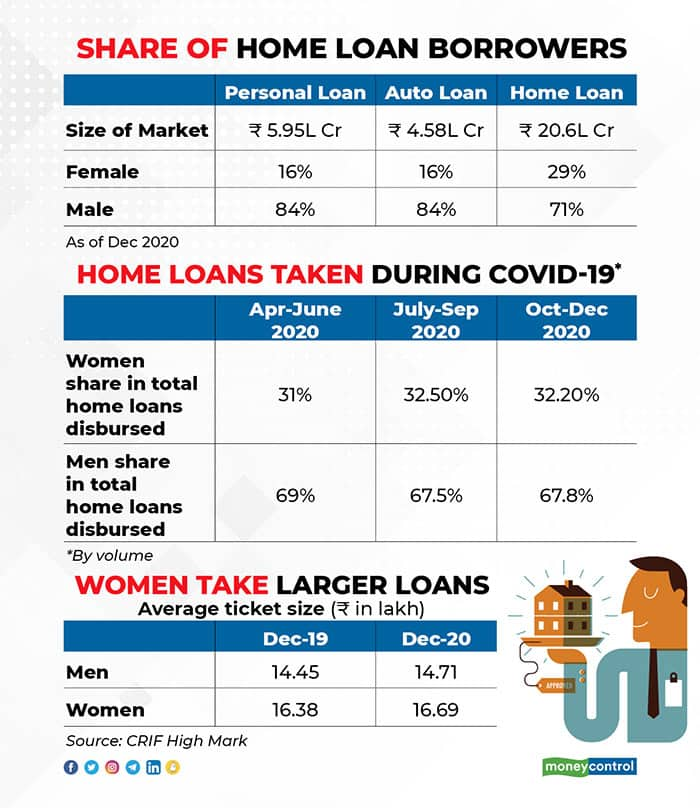

How Women Can Make The Most Of Lower Rates On Home Loans And Stamp Duties

https://images.moneycontrol.com/static-mcnews/2021/03/Share-of-home-loan-borrowers_rev.jpg

https://cleartax.in/s/home-loan-tax-benefit

Web 28 mars 2017 nbsp 0183 32 The interest portion of the EMI paid for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

https://cred.club/calculators/articles/how-to-calculate-home-loan-tax...

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions

Housing Loan Interest Rate Cumants

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

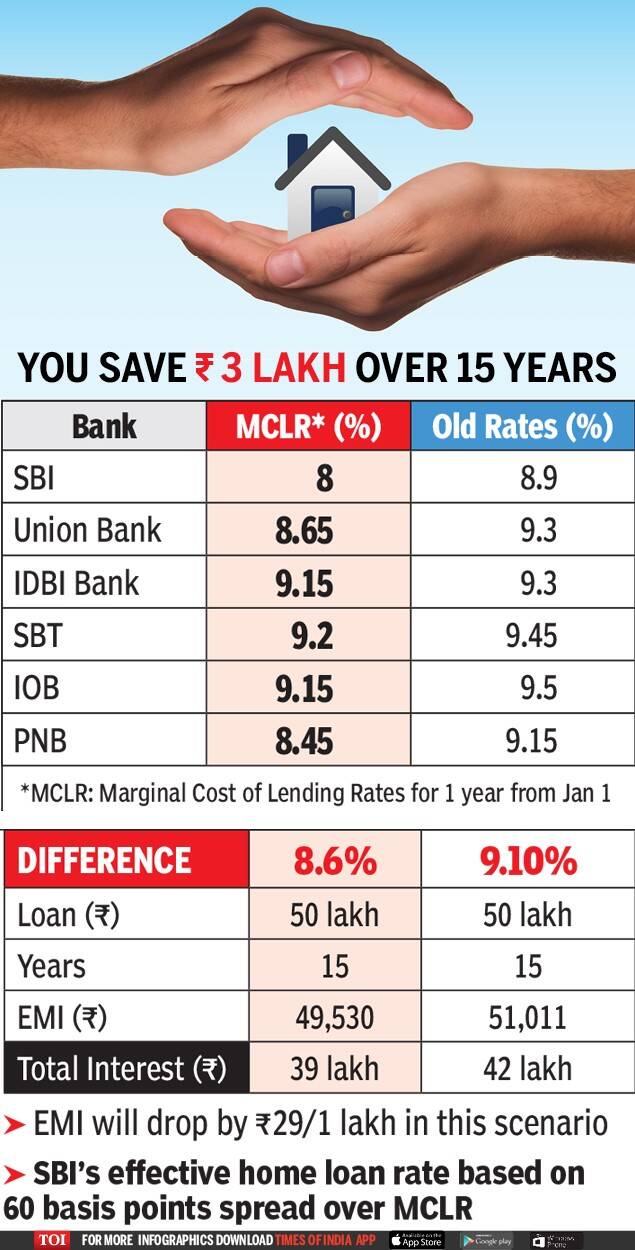

Home Loan To Become Cheapest In 6 Years As SBI Other Banks Slash Rates

Home Loan Interest Exemption In Income Tax Home Sweet Home

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

Where To Get A Car Loan

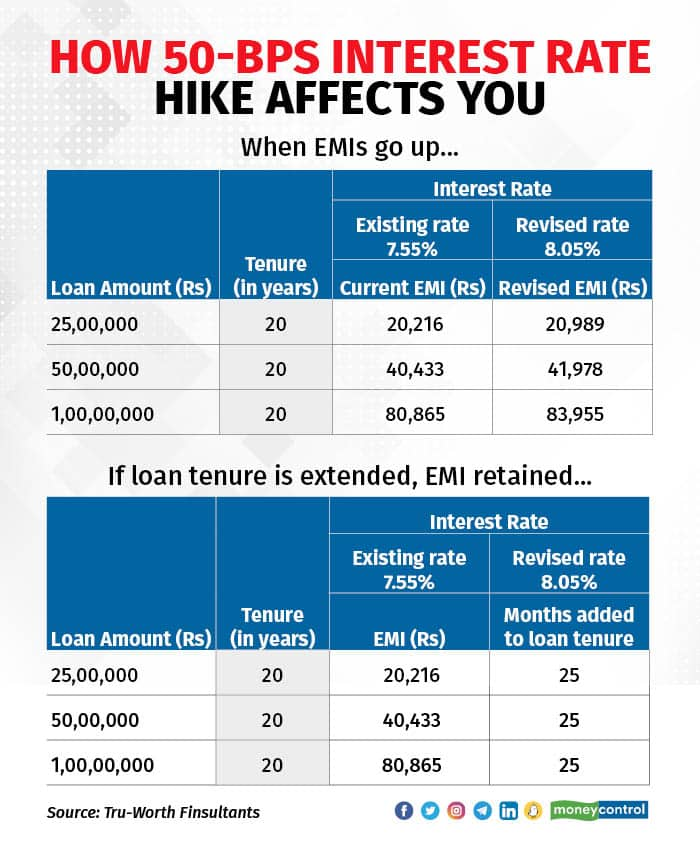

RBI Hikes Repo Rate By 50 Bps EMIs To Shoot Up For Borrowers

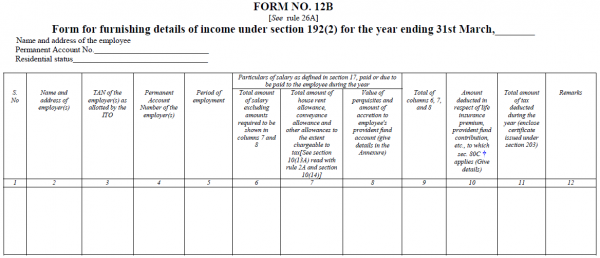

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be

Interest On Home Loan Tax Rebate - Web If you receive a refund of mortgage interest you overpaid in a prior year you will generally receive a Form 1098 showing the refund in box 4 Generally you must include the refund