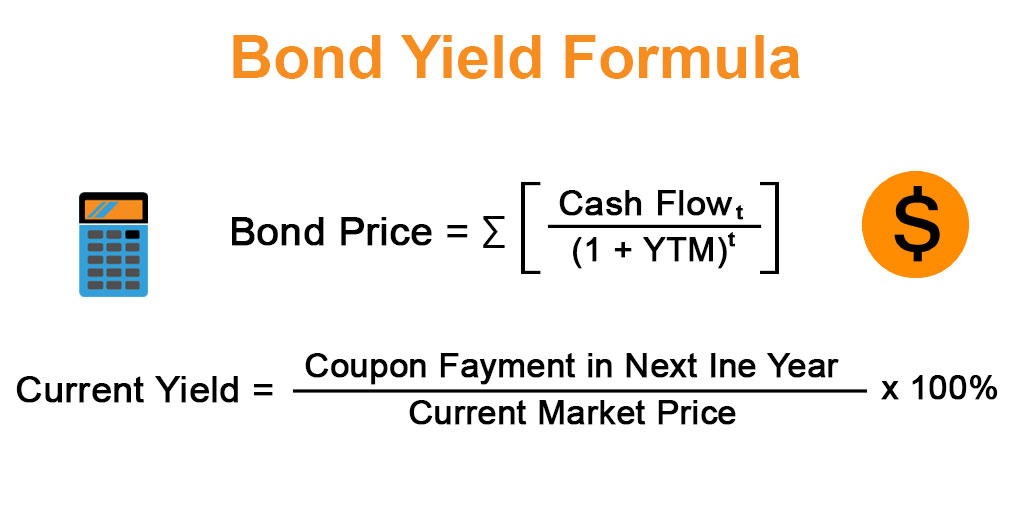

Interest Rate Formula Discount Bond The bond pricing formula involves calculating the present value of the anticipated future cash flows including coupon payments

The discount rate used is the yield to maturity which is the rate of return that an investor will get if they reinvest every coupon payment from the bond at a fixed interest rate until the bond Bond discount face value exceeds market price due to low coupon rate relative to interest rates Understand the factors affecting it and how to calculate

Interest Rate Formula Discount Bond

Interest Rate Formula Discount Bond

https://i.ytimg.com/vi/OnkmoSTeHuc/maxresdefault.jpg

Coupon Rate Formula AngelicasrMurray

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/02/10222811/Coupon-Rate-Formula-960x300.jpg

Discount Rate Formula How To Calculate Discount Rate With Examples

https://cdn.educba.com/academy/wp-content/uploads/2019/12/Discount-Rate-Formula.jpg

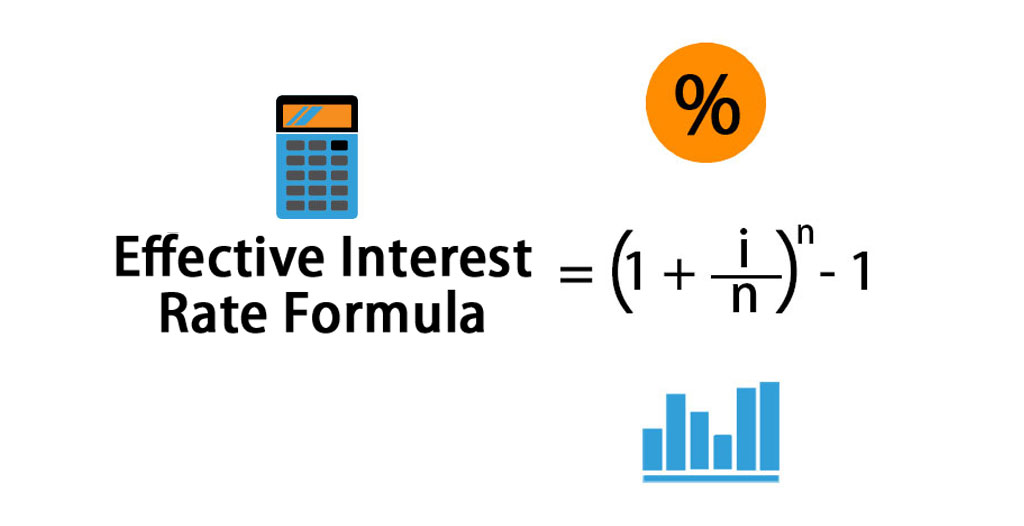

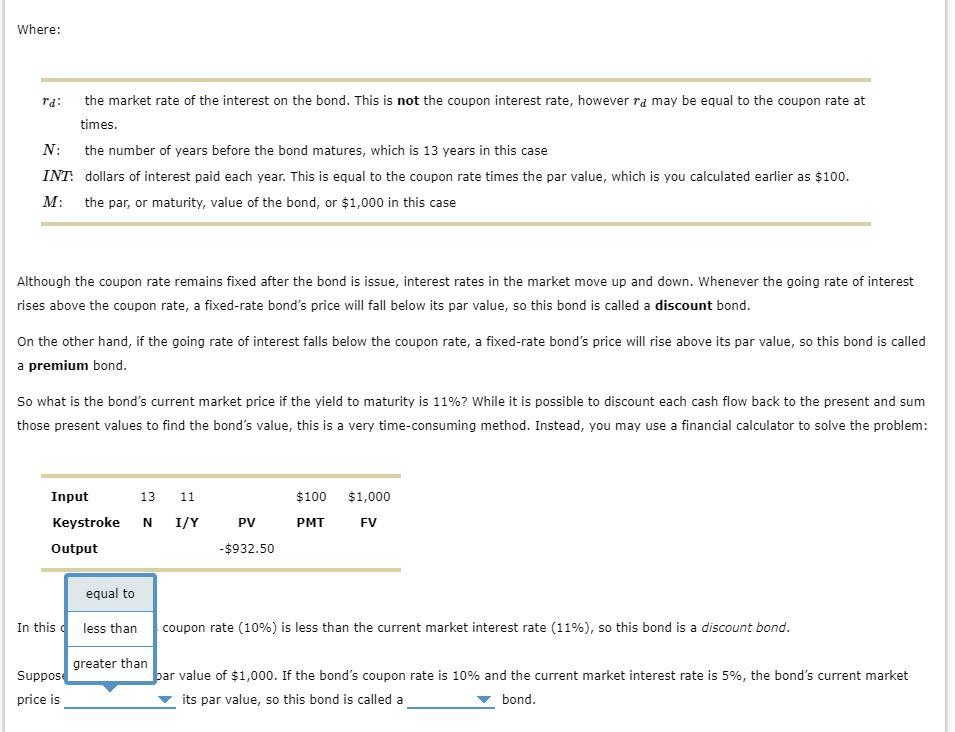

Formula for the Effective Interest Rate of a Discounted Bond i Future Value Present Value 1 n 1 Discount yield computes the expected return of a bond purchased at a discount and held until maturity Discount yield is computed using a standardized 30 day month and 360

To calculate the bond discount rate we need to understand the following concepts and formulas 1 Present value PV This is the current value of a future cash flow discounted First calculate the amount of the discount by subtracting the bond s price from its face value Second divide the result by the number of bond payments remaining before the

Download Interest Rate Formula Discount Bond

More picture related to Interest Rate Formula Discount Bond

Discount Rate Formula Calculator

https://media.wallstreetprep.com/uploads/2022/03/31051654/Discount-Rate-Formula.jpg

What Is The Discount Rate Formula Calculator

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/04/04085921/Discount-Rate-Formula.jpg

Calculating The Yield Of A Coupon Bond Using Excel YouTube

https://i.ytimg.com/vi/AwDYUNlPHAM/maxresdefault.jpg

The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond or sometimes referred to as a discount bond A zero coupon bond is a bond that Calculating the bond price involves discounting the future cash flows which include interest payments and the principal repayment to their present value using the required yield or

If interest rates are higher than the bond s coupon rate bond prices must decrease below the par value discount bond so that the YTM moves closer to the interest rates Similarly if interest We created this discount rate calculator to help you estimate the discount rate of a given flow of payments More specifically you can compute either the discount rate of a given

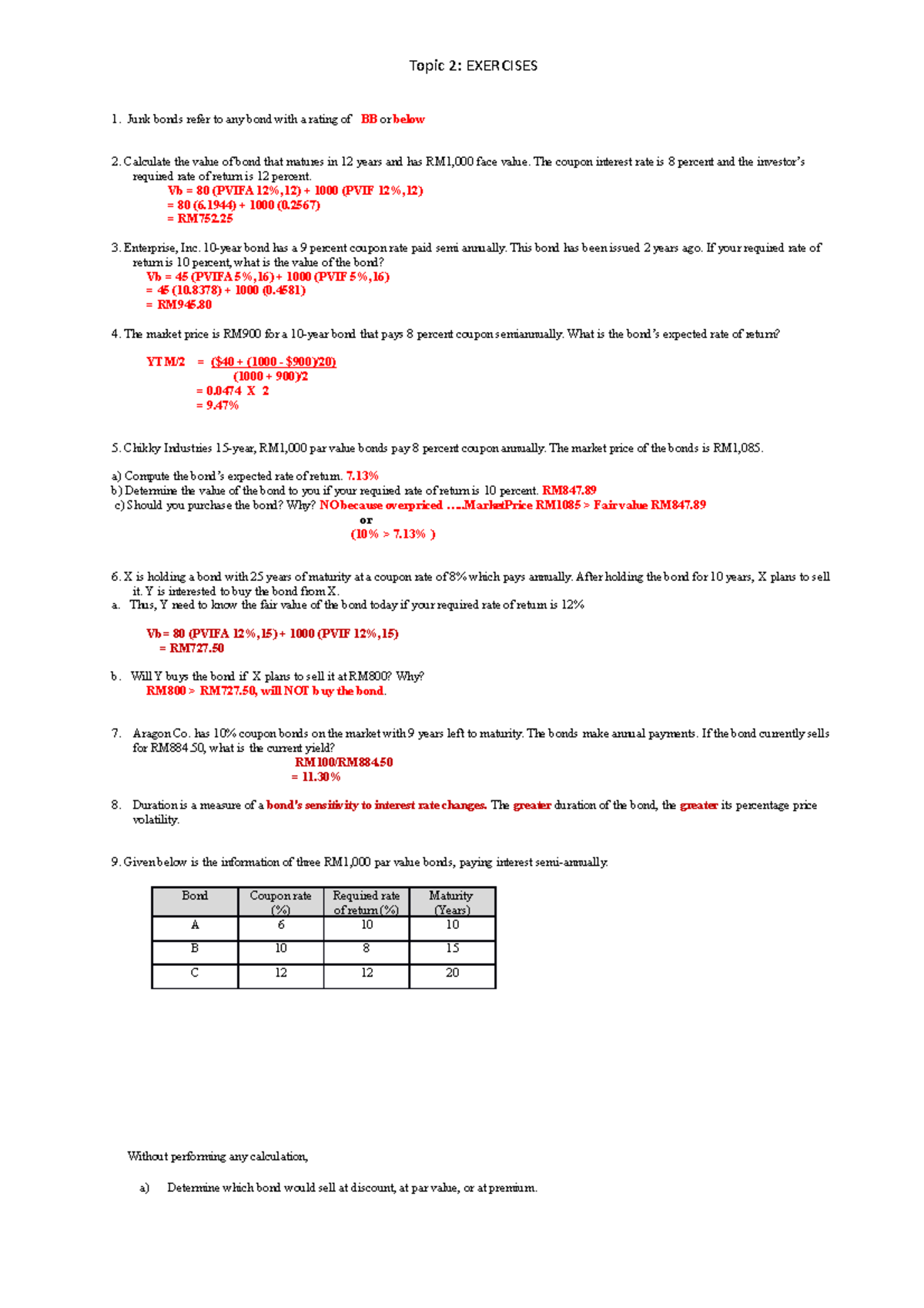

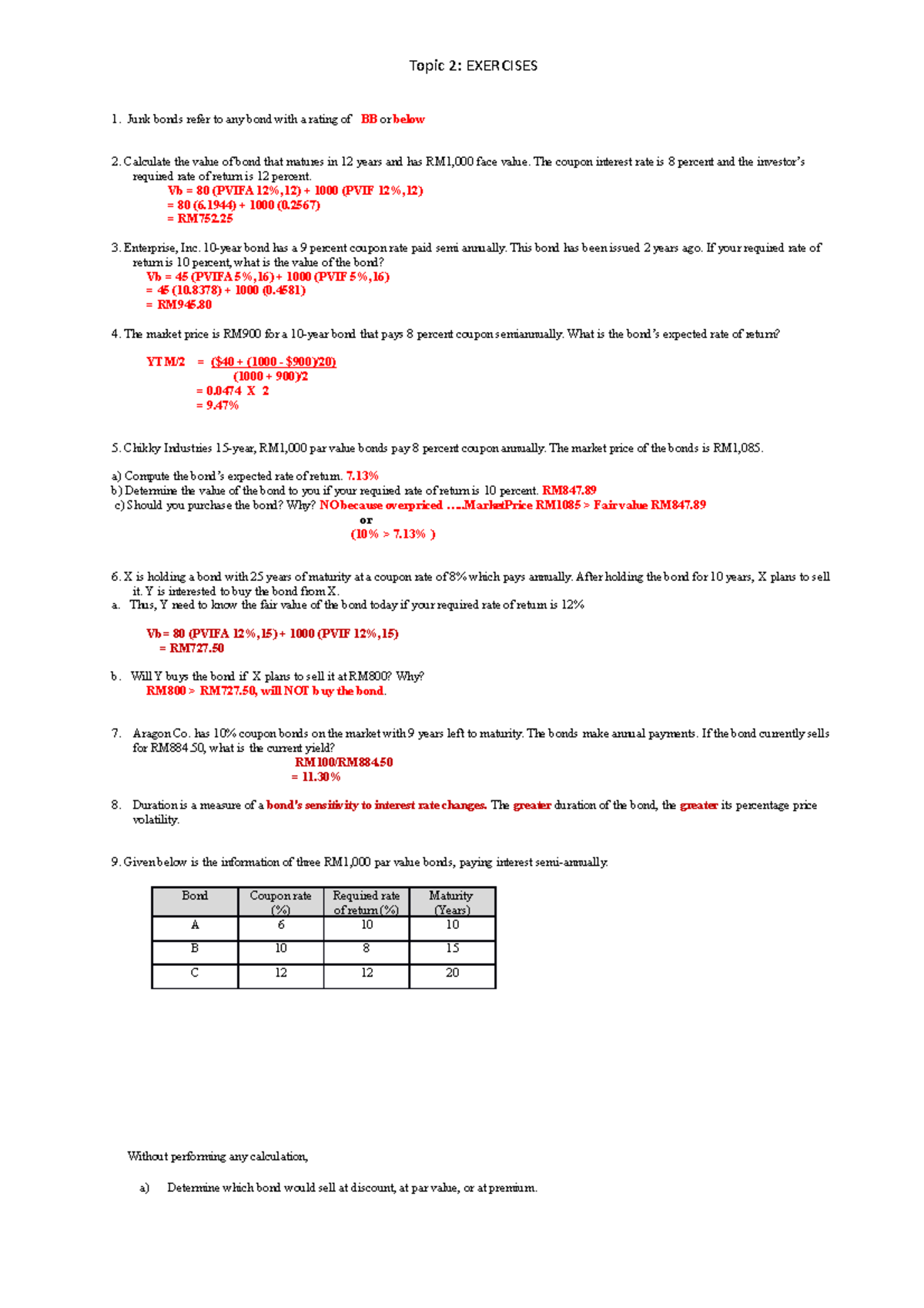

Exercises BOND VALUATION With Answers Topic 2 EXERCISES Junk Bonds

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/7fa47e8c729aaeacc91e281447b34da8/thumb_1200_1698.png

Effective Interest Rate Formula Calculator With Excel Template

https://www.educba.com/academy/wp-content/uploads/2019/07/Effective-Interest-Rate-Formula.jpg

https://www.wallstreetmojo.com › bond-pri…

The bond pricing formula involves calculating the present value of the anticipated future cash flows including coupon payments

https://www.investopedia.com › terms › bond...

The discount rate used is the yield to maturity which is the rate of return that an investor will get if they reinvest every coupon payment from the bond at a fixed interest rate until the bond

Zero Coupon Bond Formula Calculator

Exercises BOND VALUATION With Answers Topic 2 EXERCISES Junk Bonds

How To Calculate Bond Discount Rate 5 Easy Steps

What Is An Annuity Present Value Formula Calculator

Bond Yield Formula Calculator Example With Excel Template

Bond Rate Of Return Formula JustineRujen

Bond Rate Of Return Formula JustineRujen

Solved Suppose A Bond Has A Par Value Of 1 000 If The Chegg

How To Calculate Effective Interest Rate 7 Steps with Pictures

Fixed Income Investing RBC Global Asset Management

Interest Rate Formula Discount Bond - Discount yield computes the expected return of a bond purchased at a discount and held until maturity Discount yield is computed using a standardized 30 day month and 360