Interest Rate On Income Tax Refund U S 244a Understand section 244A of the Income Tax Act 1961 Learn about the changes since 1 4 1989 and how to claim interest on late refunds

Interest on income tax refund can be calculated using the interest on income tax refund calculator 244A available online As per section 244A of the Income Tax Act interest is The interest granted u s 244A on the refund amount is taxable in the hands of the assessee under the head Income from other

Interest Rate On Income Tax Refund U S 244a

Interest Rate On Income Tax Refund U S 244a

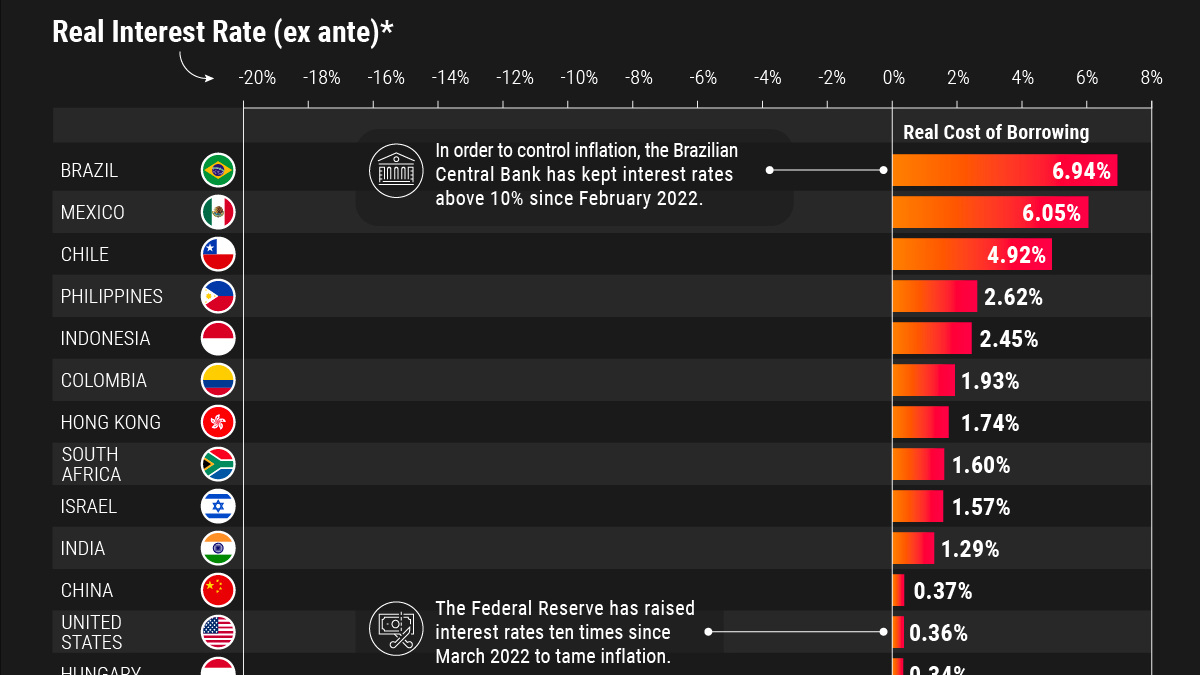

https://www.visualcapitalist.com/wp-content/uploads/2023/05/interest-rate.jpg

WHETHER INTEREST IS PAYABLE U S 244A ON REFUND DUE TO EXCESS SELF

https://i.ytimg.com/vi/jWW-pt0ni9s/maxresdefault.jpg

A Compendium Of Issues On Income Tax In 2 Volume

http://mandjservice.com/cdn/shop/files/9789356035119.jpg?v=1693289048

The interest on refund under Section 244A of the Income Tax Act will be calculated at an annual rate of 3 The initiation of this calculation will happen after the date of expiry of the allowed time until Under section 244A the interest on refunds is calculated at the rate of 0 5 per month or part of a month The interest is calculated from the date of payment of tax to the date on which the refund is

Interest payable by an assessee as specified in Section 244A refers to income tax refunds and its various provisions In this article we look at the applicable interest rate for an income tax refund for ITAT explains section 244A provisions Interest on Income Tax Refund CA Charul Mittal 04 Sep 2020 31 059 Views 0 comment Print Income Tax Judiciary Case

Download Interest Rate On Income Tax Refund U S 244a

More picture related to Interest Rate On Income Tax Refund U S 244a

UK Mortgage Rates History Chart Mortgageable

http://www.mortgageable.co.uk/wp-content/uploads/2022/12/Average-Mortgage-Interest-Rates-UK-649x1024.png

Interest On Income Tax Refund Calculator 2023

http://instafiling.com/wp-content/uploads/2023/03/Topic-167-interest-on-income-tax-refund-calculator.png

Calculate Interest Rate For Loan Excel Formula Exceljet

https://exceljet.net/sites/default/files/styles/original_with_watermark/public/images/formulas/calculate interest rate for loan.png

Section 244a interest on refunds income tax act 1961 2019a Products Products Clear Library Income Tax GST Login Try For Free Income tax refund status Income In any other case such interest shall be calculated at the rate of one half per cent for every month or part of a month comprised in the period or periods from the date or as the

Therefore the appellant is entitled to receive interest u s 244A The AO is directed to grant interest u s 244A as under i interest on Rs 1 09 84 736 for the Rate of interest on refund would be 0 5 per month for the month or part of month from the date mentioned in section or date of payment till the date on which

Introduction To Income Tax Project Appraisal And Finance Hr 302 Hr

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/65b947b52be219b19bbad57746539520/thumb_1200_1872.png

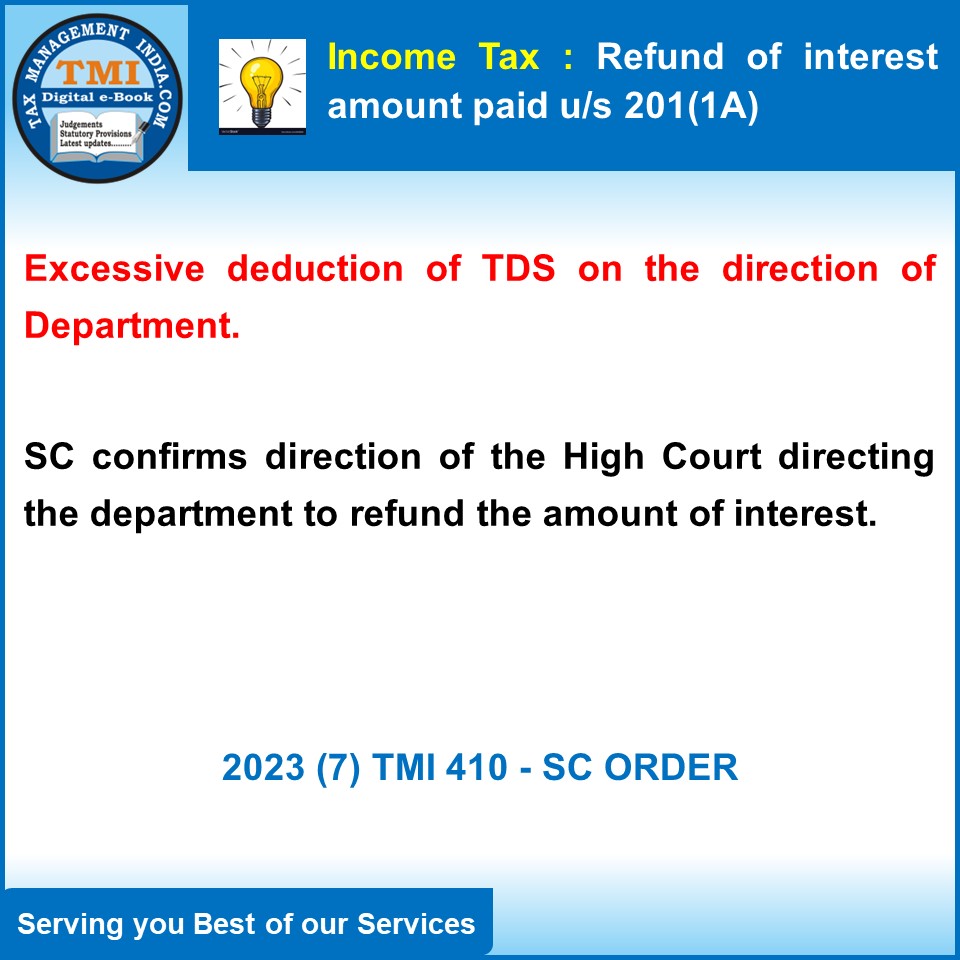

Income Tax Refund Of Interest Amount Payable U s 201 1A Interest U

https://www.taxmanagementindia.com/file_folder/folder_6/2023_7_TMI_410_SC_ORDER.jpg

https://taxguru.in/income-tax/section-244a-income...

Understand section 244A of the Income Tax Act 1961 Learn about the changes since 1 4 1989 and how to claim interest on late refunds

https://scripbox.com/tax/section-244a-interest-on-income-tax-refund

Interest on income tax refund can be calculated using the interest on income tax refund calculator 244A available online As per section 244A of the Income Tax Act interest is

Is The Average Student Loan Interest Rate As High As You Think It Is

Introduction To Income Tax Project Appraisal And Finance Hr 302 Hr

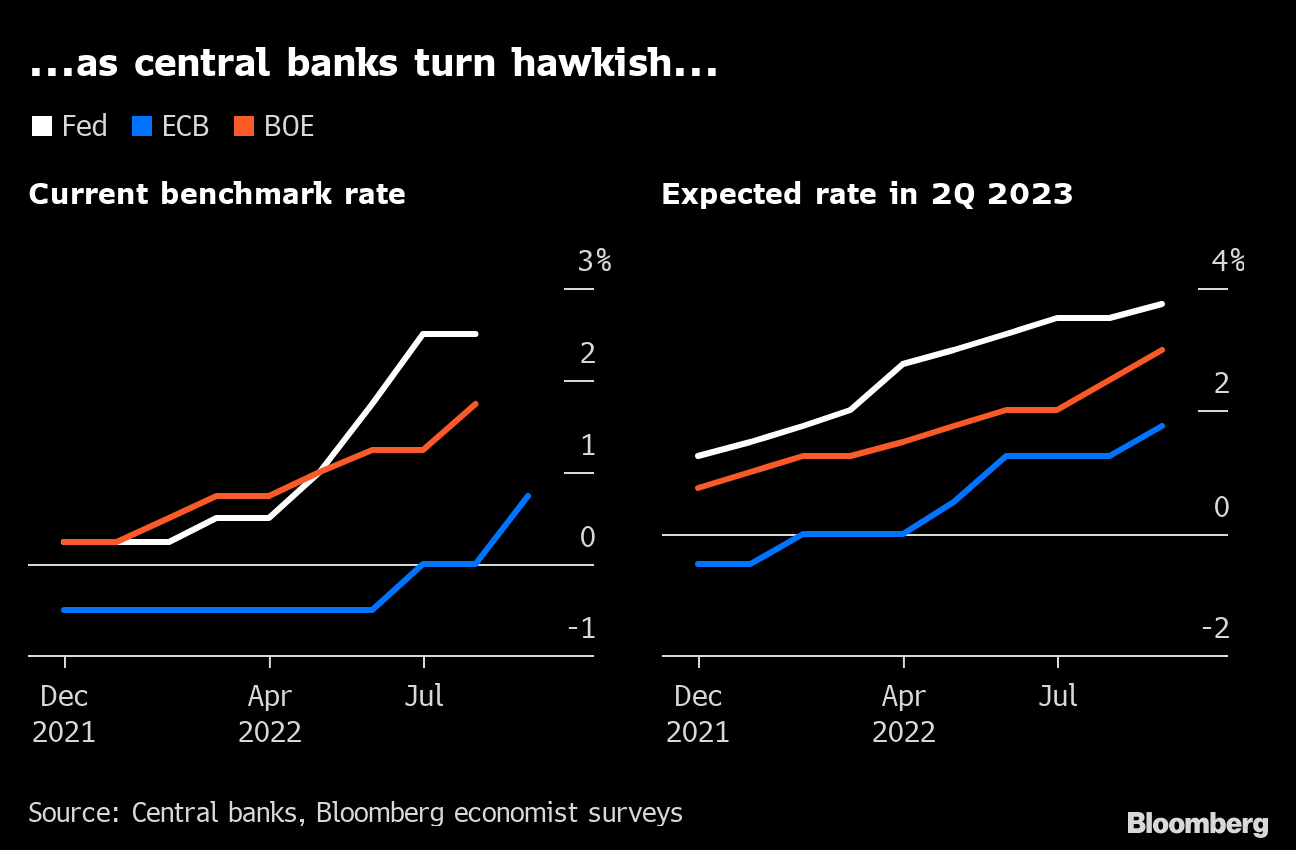

Interest Rates Forecast Uk 2023 D Renee Banks

Income Tax Refund Status No Records Found Contact Your Assessing

2 1 Interest Rates Banking Institutions Audrey Langdon

Income Tax In Budget 2023 Highlights Sitharaman Concludes Speech 5

Income Tax In Budget 2023 Highlights Sitharaman Concludes Speech 5

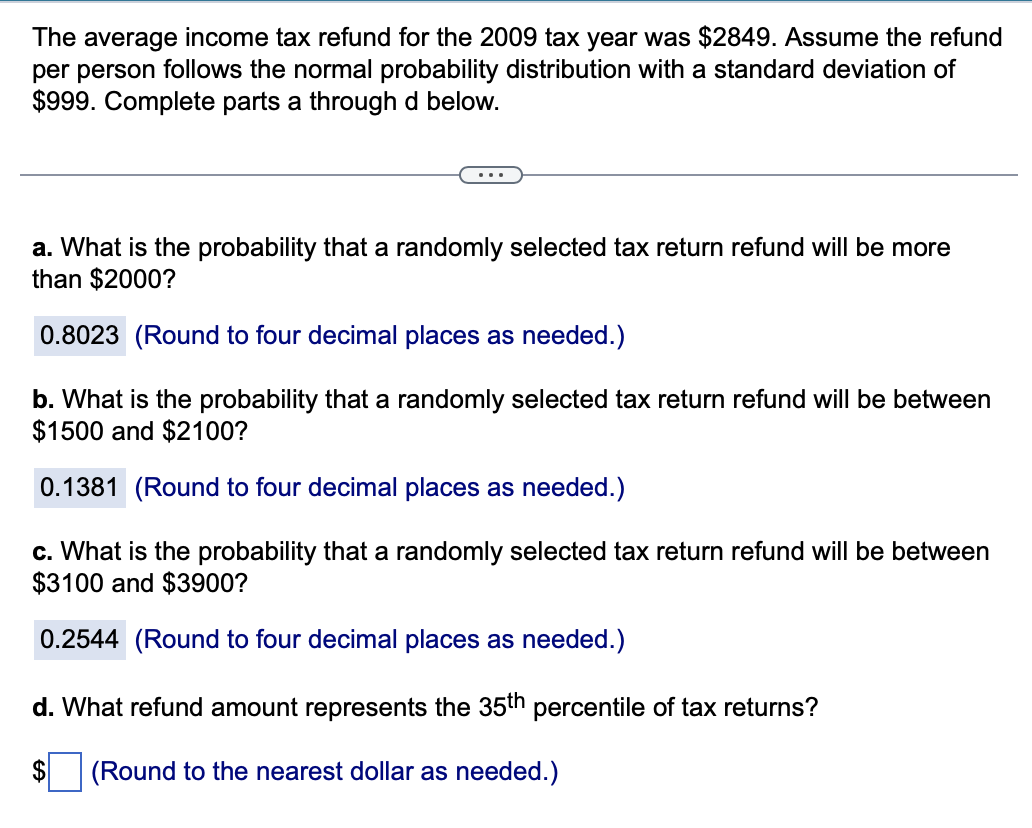

Solved The Average Income Tax Refund For The 2009 Tax Year Chegg

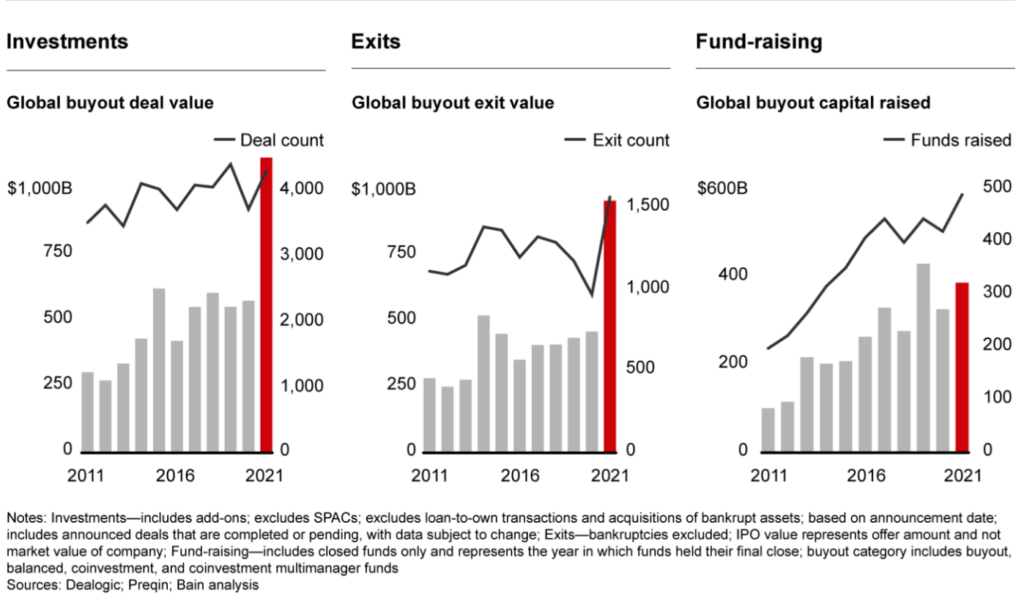

Inflation Rising Interest Rates And The Impact On Private Equity

Check Refund Status Browserguide

Interest Rate On Income Tax Refund U S 244a - Difficulties the Central Processing Centre CPC is unable to grant interest under section 244A of the Income tax Act 1961 the Act upto the date of issuance of refund the Tax