Investment Rebate On Income Tax Bd Web Investors in government securities may experience a reduction in their investment rebate on tax filings starting from July 1 2023 According to the new Income Tax Bill 2023

Web 18 ao 251 t 2017 nbsp 0183 32 What is the tax rebate As per section 44 2 b of the Income Tax Ordinance 1984 an individual taxpayer will get tax rebate at 15 on investment allowance Now Web The highest annual tax rebate on investments in listed securities of the capital market will be reduced by one third or 33 per cent to Tk 1 million if the draft income tax act 2023 is approved by parliament In that case

Investment Rebate On Income Tax Bd

Investment Rebate On Income Tax Bd

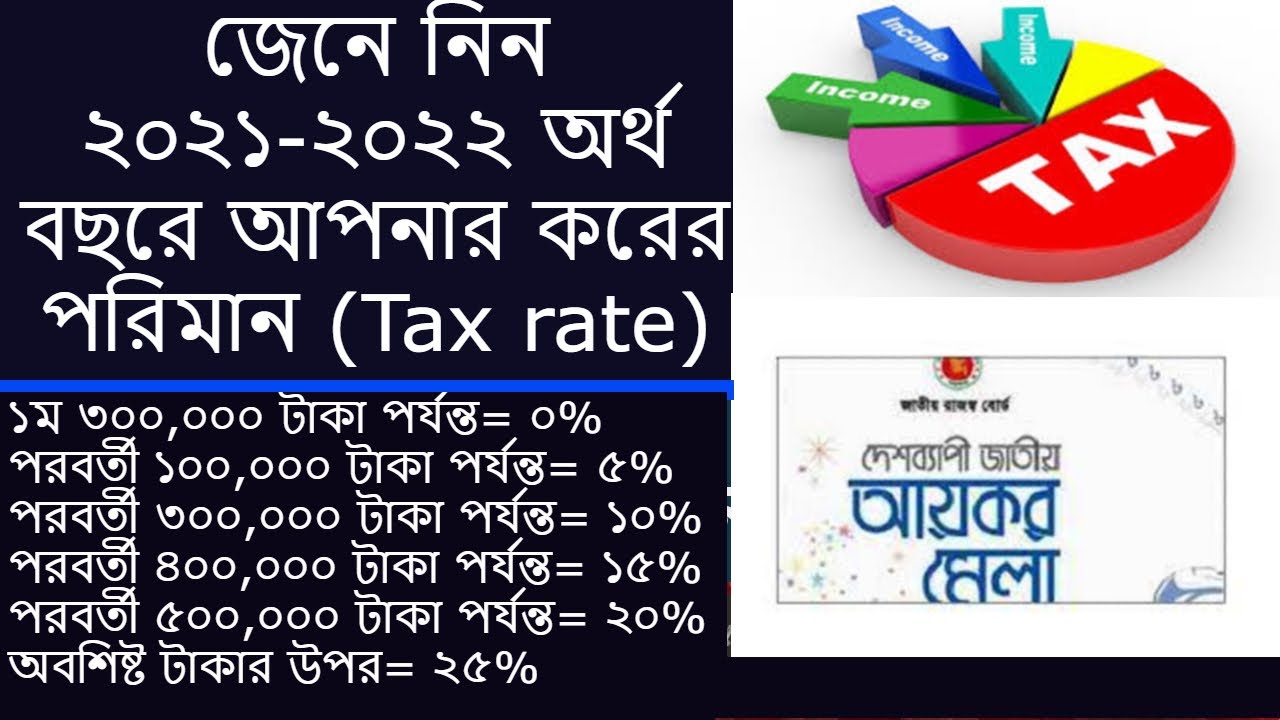

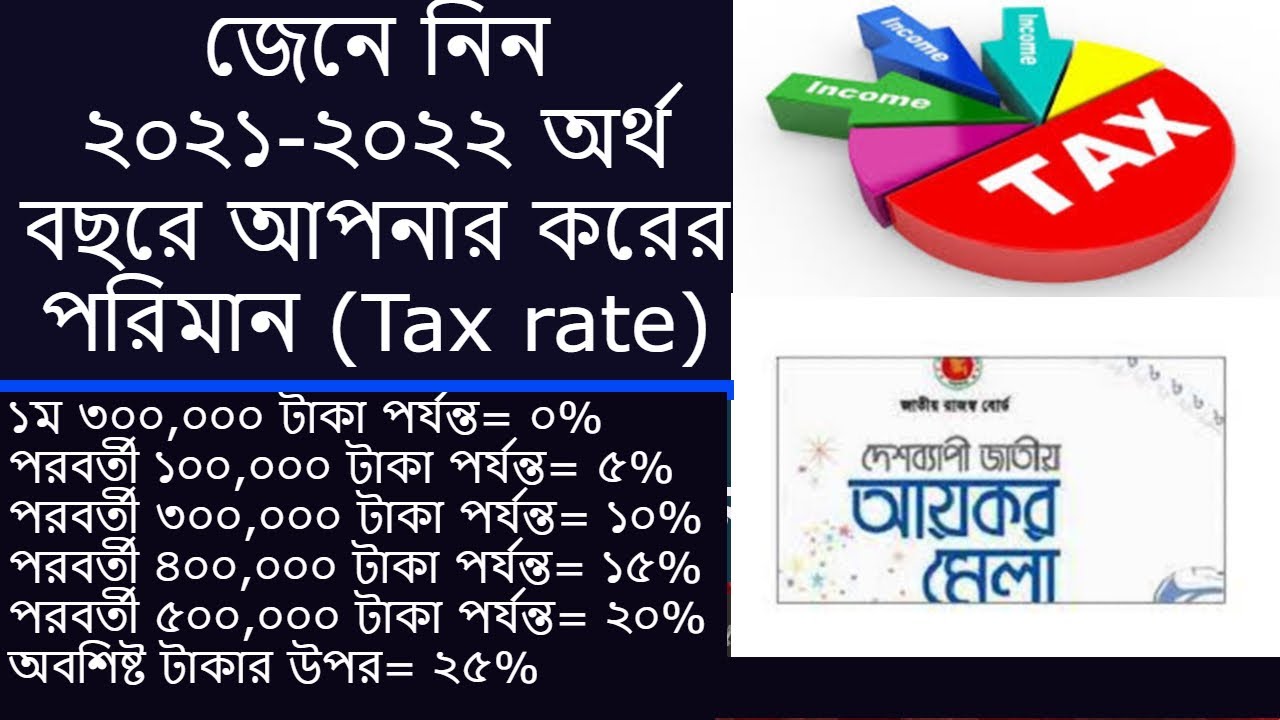

https://i.ytimg.com/vi/vZv_C0-xW_E/maxresdefault.jpg

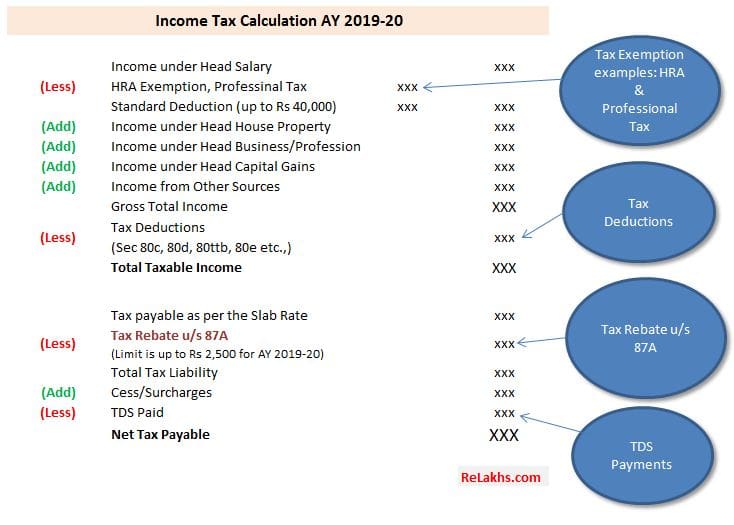

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

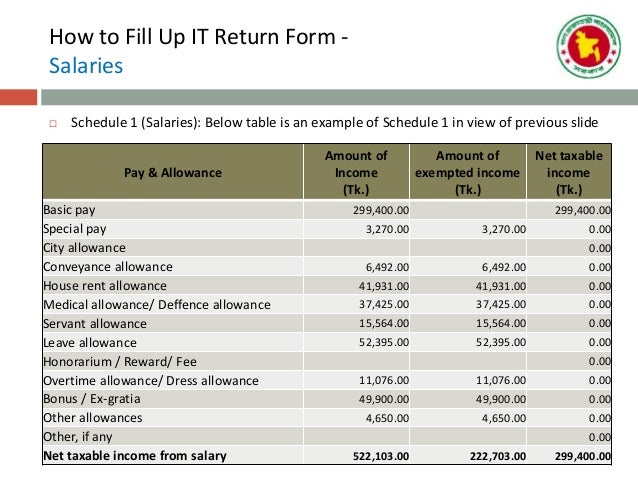

Where To Invest For Tax Rebate In Income Tax Of Bangladesh

http://www.jasimrasel.com/wp-content/uploads/2017/08/Invest-for-Tax-Rebate.jpg

Web Significantly the new law increases the ceiling of investment rebates on monthly savings schemes to Tk1 2 lakh from the current Tk60 000 Web Condition All receipts and income must be transacted through bank transfer and all expenses and investments over BDT1 2m must be made through bank transfer A

Web 30 juin 2021 nbsp 0183 32 The Finance Act 2021 was published by the Government of Bangladesh on 30 June 2021 it came into effect from 1 July 2021 This publication summarises the Web xxx Special Tax Treatment in respect of investment in the purchase of Bond under Bangladesh Infrastructure Finance Fund Section 19C 26 xxxi Special tax treatment in

Download Investment Rebate On Income Tax Bd

More picture related to Investment Rebate On Income Tax Bd

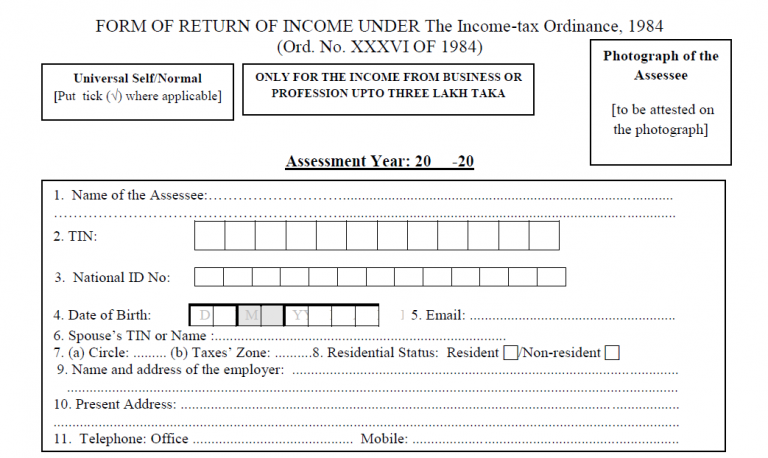

1 Page Income Tax Return Form BD 2021 22 PDF Excel Format Protibad Com

https://allresultbd.com/wp-content/uploads/2021/07/1-Page-Income-Tax-Return-Form-768x458.png

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

https://www.practicaltaxplanning.com/ptp/wp-content/uploads/2022/06/7PY4cfZG8ZE.jpg

BD NBR Income Tax Itp Apps On Google Play

https://lh3.googleusercontent.com/Aed9OTDsCE3Ar9zEHYR_icKWboX50qxF-WvjuXzUr3Jk0JlyMUTIO5IIihZHNwudHjM

Web Besides the tax free benefit has been reintroduced for the income from investment in zero coupon bonds against the demand by the businessmen The government has also Web IPO Initial Public Offering it would get 10 rebate on total tax in the year of transfer Tax Rebate for investment Rate of Rebate Amount of allowable investment is actual

Web All income receipts and any individual transaction exceeding BDT 500 000 and all types of expenses and investments exceeding BDT 3 6 million annually must be transferred by Web 14 ao 251 t 2017 nbsp 0183 32 The area of investments have specified in the sixth schedule part B of Income Tax Ordinance ITO 1984 If you invest in the specified areas your investment

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

https://1.bp.blogspot.com/-qh1AR8nq79Y/XSdFFK--RCI/AAAAAAAAJ88/-dhKKjr_UCce2k6QpcrxXwK6TKpllSbuACLcBGAs/s640/Tax%2BSlab%2Bfor%2BA.Y.%2B20120-21.jpg

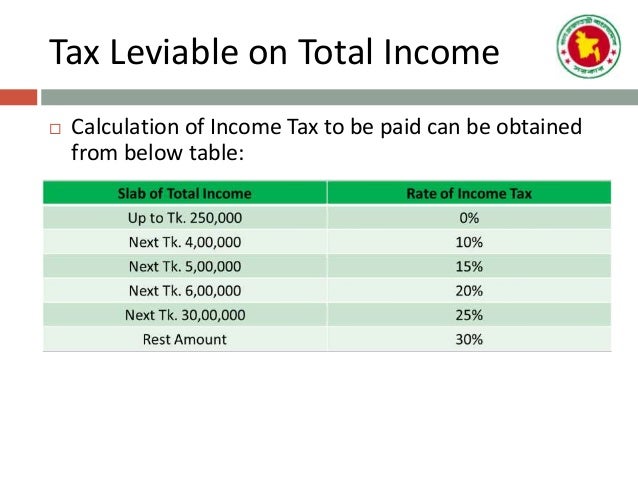

General Presentation On Income Tax In Bangladesh

https://image.slidesharecdn.com/generalpresentationonincometax1-170901141150/95/general-presentation-on-income-tax-in-bangladesh-27-638.jpg?cb=1504275189

https://thefinancialexpress.com.bd/economy/bangladesh/investment...

Web Investors in government securities may experience a reduction in their investment rebate on tax filings starting from July 1 2023 According to the new Income Tax Bill 2023

http://www.jasimrasel.com/calculate-tax-rebate

Web 18 ao 251 t 2017 nbsp 0183 32 What is the tax rebate As per section 44 2 b of the Income Tax Ordinance 1984 an individual taxpayer will get tax rebate at 15 on investment allowance Now

Tax Rebate Under Section 87A Investor Guruji Tax Planning

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

CAPITAL GAINS TAX ELIGIBLE FOR TAX REBATE SET OFF Celebrate With Tax

Lululemon Customer Support Salary Slip

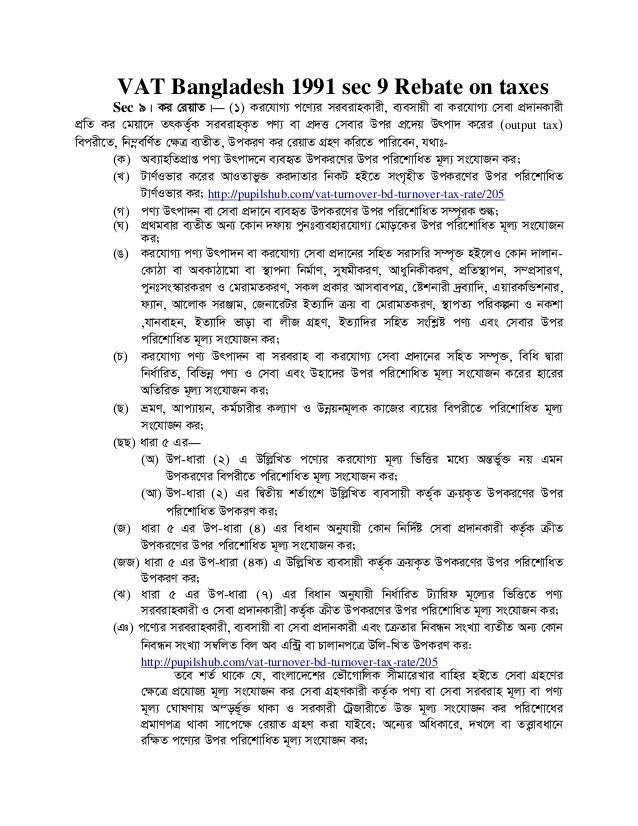

Vat Bangladesh 1991 Sec 9 Rebate On Taxes

Income Tax BD Income Tax Rate In Bangladesh 2023 BDesheba Com

Income Tax BD Income Tax Rate In Bangladesh 2023 BDesheba Com

Income Tax BD Income Tax Return In Bangladesh BDesheba Com

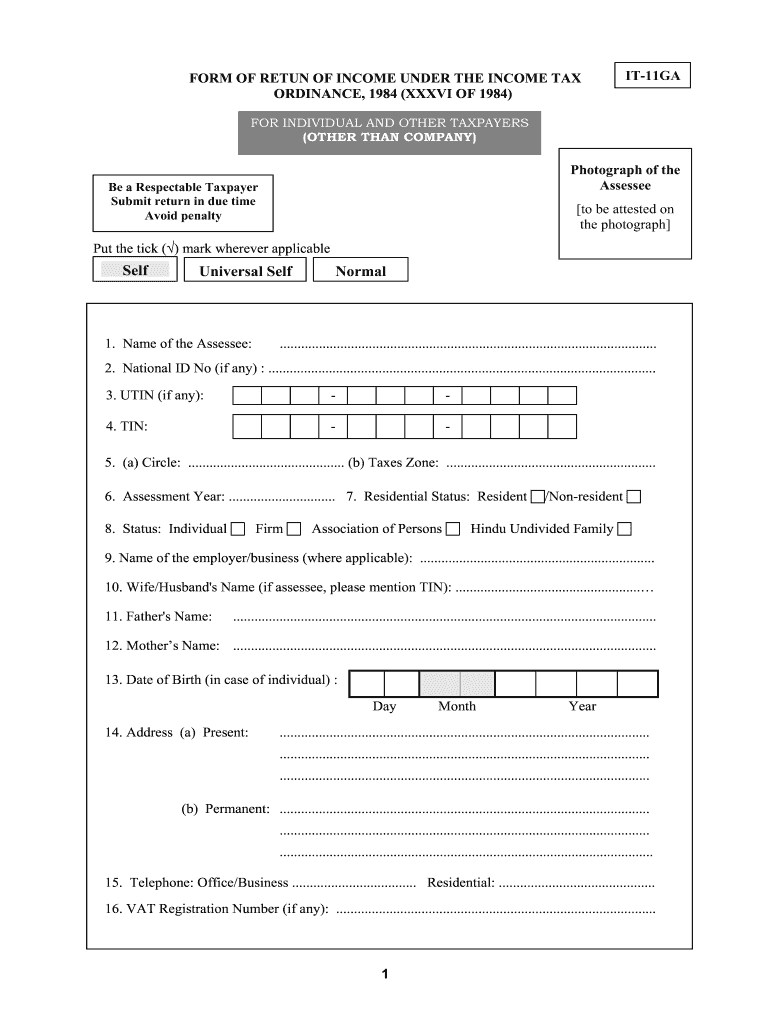

Income Tax Return Form Bd 2020 21 Excel Fill Online Printable

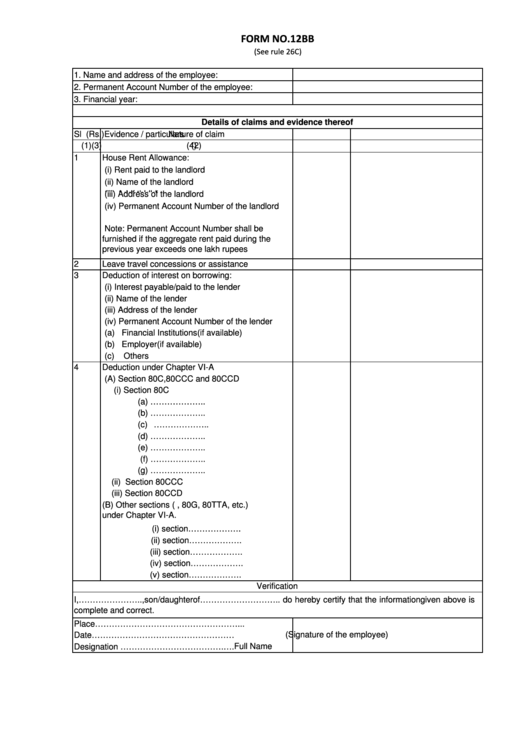

Form 12 Bb Form To Claim Income Tax Benefits Rebate Printable Pdf

Investment Rebate On Income Tax Bd - Web 2 juin 2021 nbsp 0183 32 At present tax rebates are available on investments in nine sectors including savings certificates and donations in 13 sectors Investment up to 25 of a taxpayer s