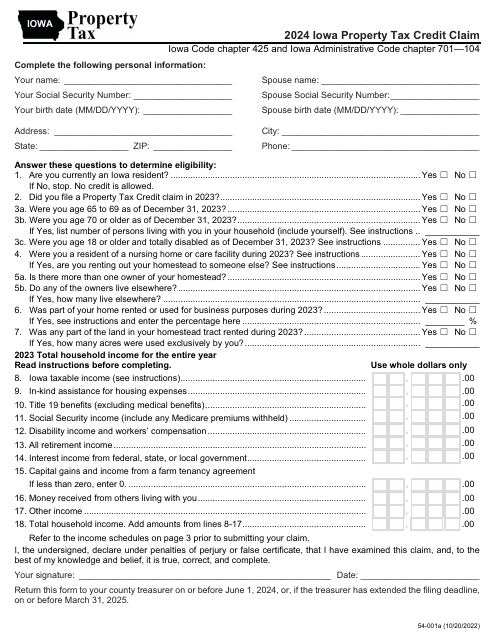

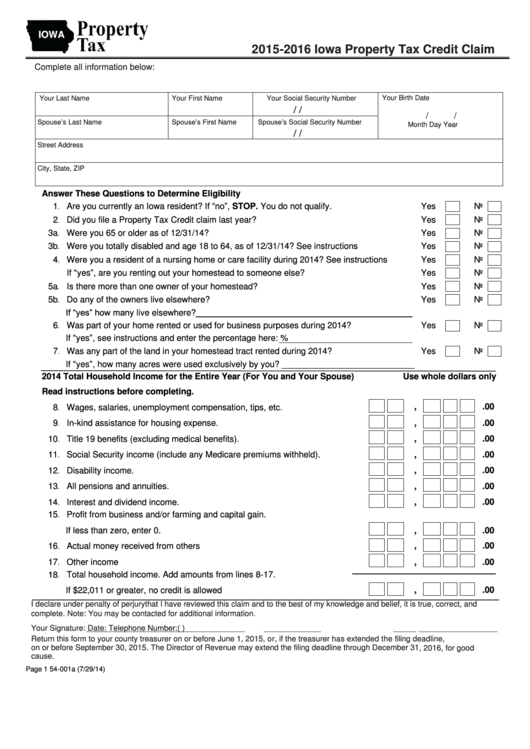

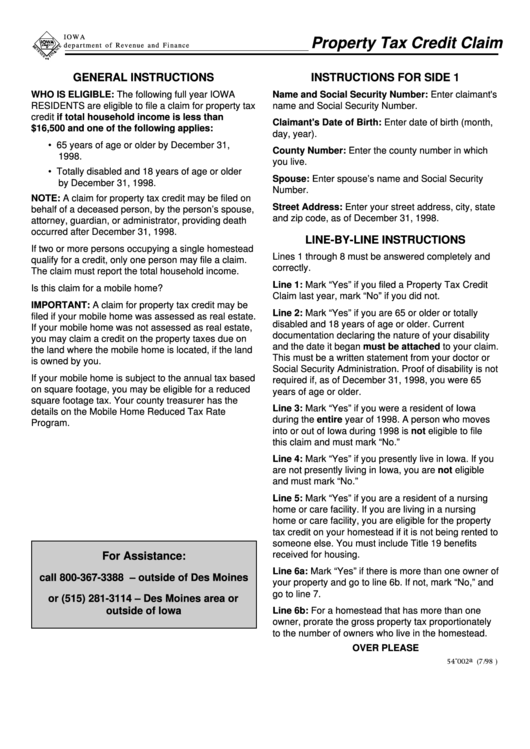

Iowa Property Tax Credit Claim Form A claim for property tax credit may be filed if your mobile manufactured or modular home was assessed as real estate If your mobile manufactured or modular home was not assessed as real estate you may claim a credit on the property taxes due on the land where the home is located if you own the land

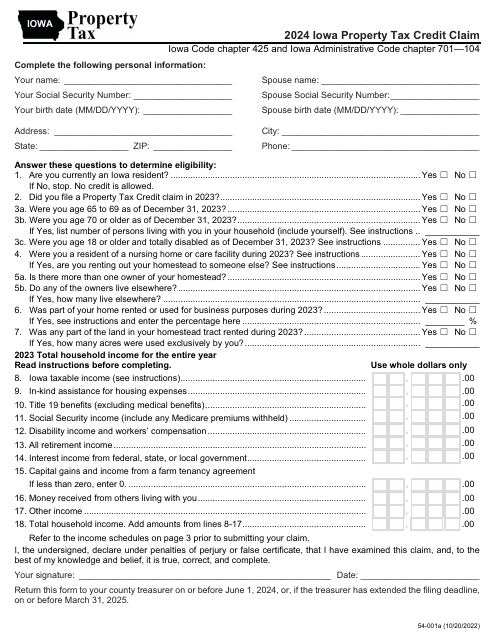

2023 Iowa Property Tax Credit Claim Form Elderly Disabled Tax Credit Property tax credit is for Iowa resident homeowners who are eligible to file a claim for assistance towards property tax if the applicant meets age disability and household income requirements Iowans can find the application at tax iowa gov forms under the name Homestead Tax Credit and Exemption 54 028 To claim the new exemption applicants must provide their date of

Iowa Property Tax Credit Claim Form

Iowa Property Tax Credit Claim Form

https://www.pdffiller.com/preview/465/679/465679973/large.png

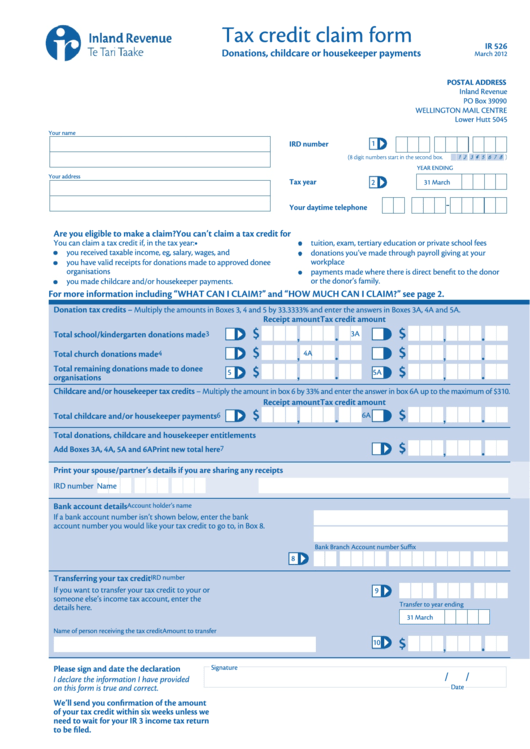

2024 Iowa Property Tax Credit Claim Form Dulcia Hollyanne

https://data.formsbank.com/pdf_docs_html/52/528/52815/page_1_thumb_big.png

Uses Of Iowa s General Fund Surplus And Reserve Funds

https://www.legis.iowa.gov/images/itunes/LSAITunesIssueReviews.png

Claims may be filed using the Iowa Property Tax Credit Claim 54 001 form with the County Treasurer between January 1 and June 1 Locate your County Treasurer online at iowatreasurers 2023 Income Qualifications The below schedule addresses household income qualifications for 2023 property tax credit claims for claimants 70 and older Source URL https tax iowa gov forms iowa property tax credit claim 54 001 23 https tax iowa gov forms iowa property tax credit claim 54 001 23

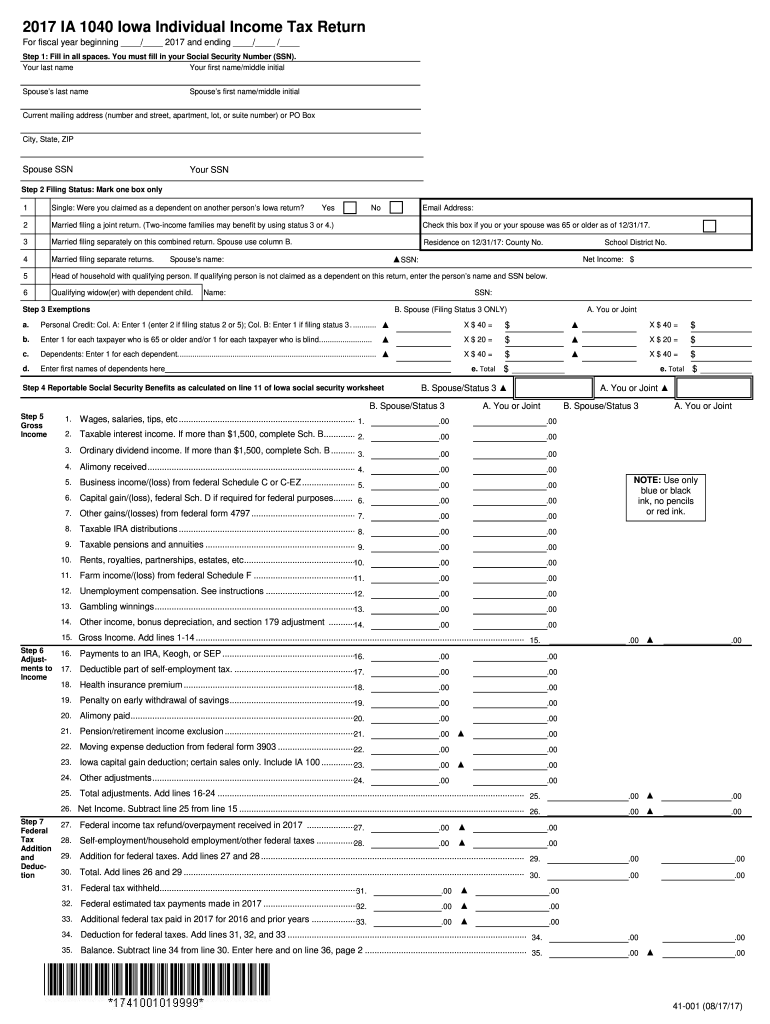

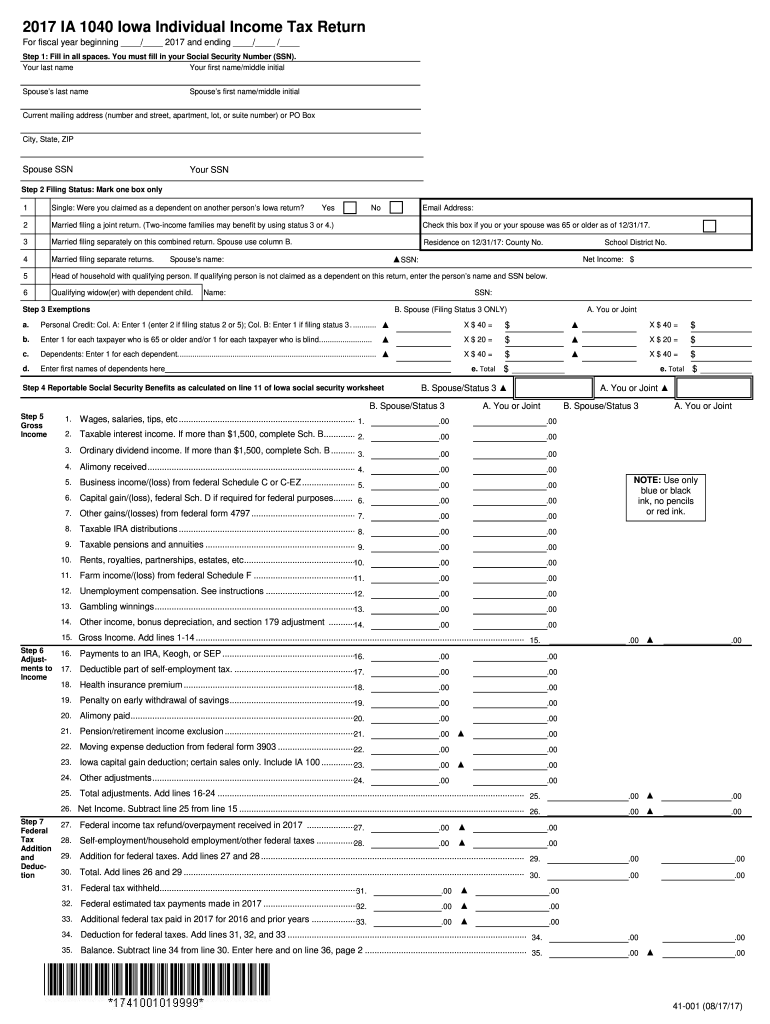

File a separate claim Line 1 Iowa taxable income Enter the amount of Iowa taxable income from your state individual income tax return IA 1040 Step 4 Line 4 If you did not file a 2023 IA 1040 enter the amount of your wages salaries unemployment compensation tips bonuses commissions dividends distributions or any profit from a The Iowa Department of Revenue IDR has amended the Homestead Tax Credit and Exemption 54 028 to allow claimants to apply for the exemption If claimants want to provide birthdates of all owners on a homestead for their own convenience they are welcome to do so

Download Iowa Property Tax Credit Claim Form

More picture related to Iowa Property Tax Credit Claim Form

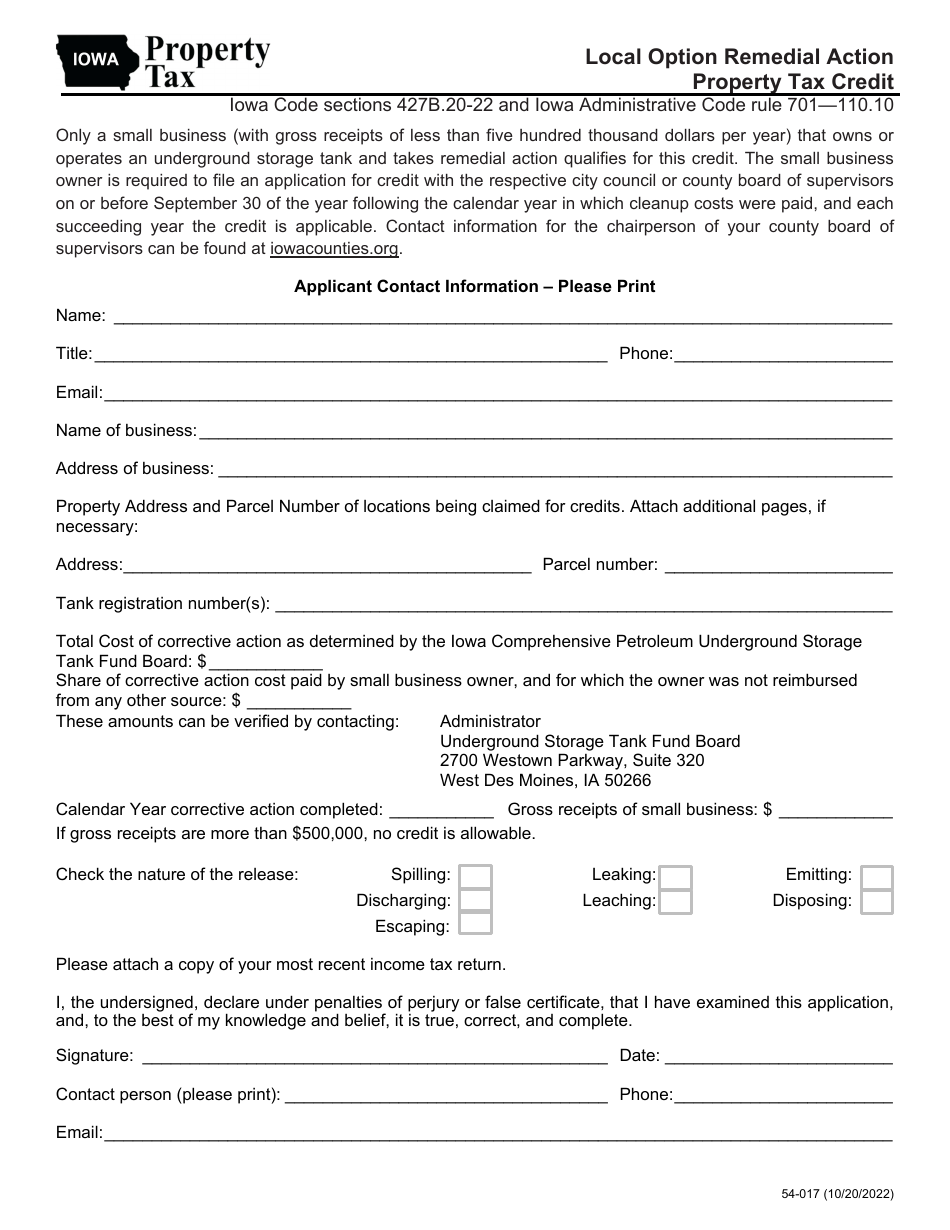

Form 54 017 Fill Out Sign Online And Download Fillable PDF Iowa

https://data.templateroller.com/pdf_docs_html/2563/25635/2563564/page_1_thumb_950.png

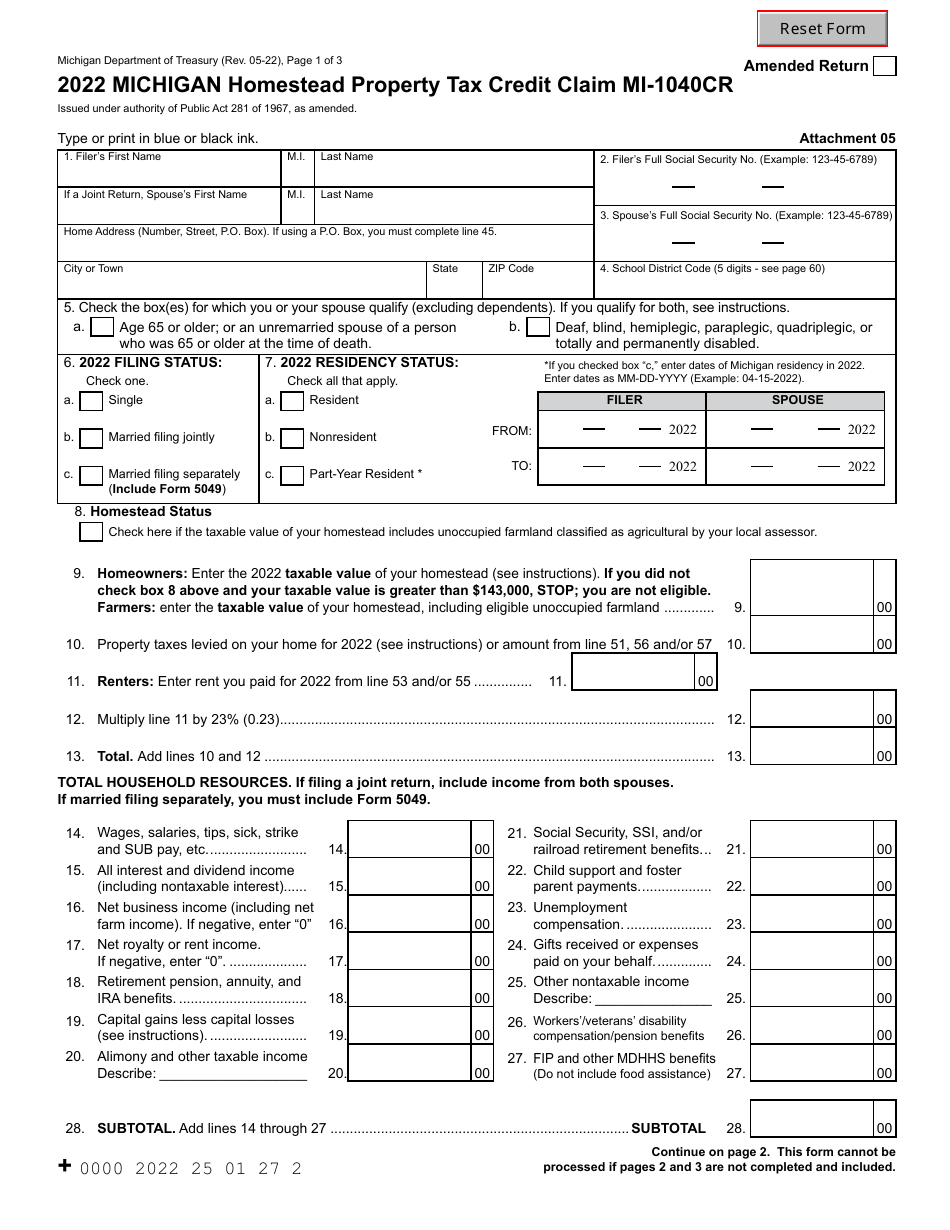

Michigan Property Tax Rates By Township Eden Newsletter Bildergallerie

https://www.macomb-mi.gov/ImageRepository/Document?documentID=5881

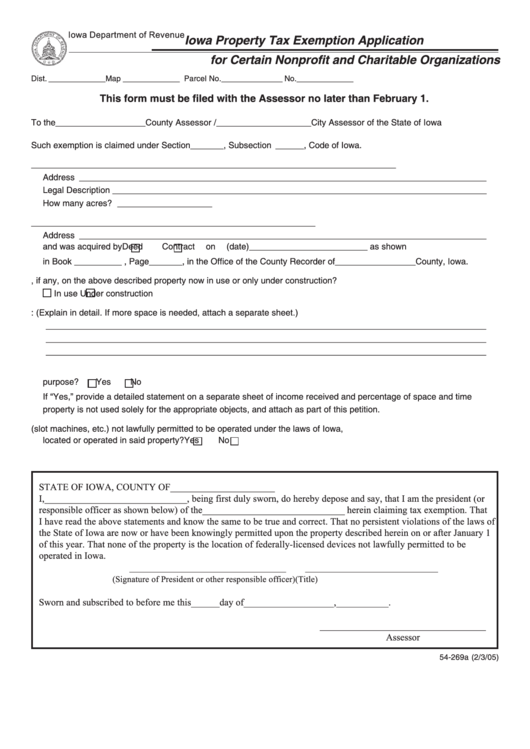

Form 54 269a Iowa Property Tax Exemption Application For Certain

https://data.formsbank.com/pdf_docs_html/207/2071/207175/page_1_thumb_big.png

Complete the 2024 Iowa Property Tax Credit Claim 54 001 File the completed form with the Polk County Treasurer between January 1 and June 1 Submit the completed claim form by the due date eachyear to receive the maximum benefit of the tax credit Forms Forms sub navigation IA 1040 Instructions Common Forms About About sub navigation Modernization Intern Contact Careers Property Assessment Appeal Board Iowa Property Tax Credit Claim 54 001 250 43 KB pdf October 26 2023 Individual Income Tax Corporation Income Tax Fiduciary Tax

Form 54 001 requires you to list multiple forms of income such as wages interest or alimony We last updated the Iowa Property Tax Credit Claim in January 2024 so this is the latest version of Form 54 001 fully updated for tax year 2023 Property tax credit rent reimbursement or tax reduction programs are based on your 2022 household income for claim year 2022 and 2021 household income for claim year 2021 Household income includes social security wages pension interest income money received from others

Form 54 001 Download Printable PDF Or Fill Online Iowa Property Tax

https://data.templateroller.com/pdf_docs_html/2844/28448/2844895/form-54-001-iowa-property-tax-credit-claim-iowa_big.png

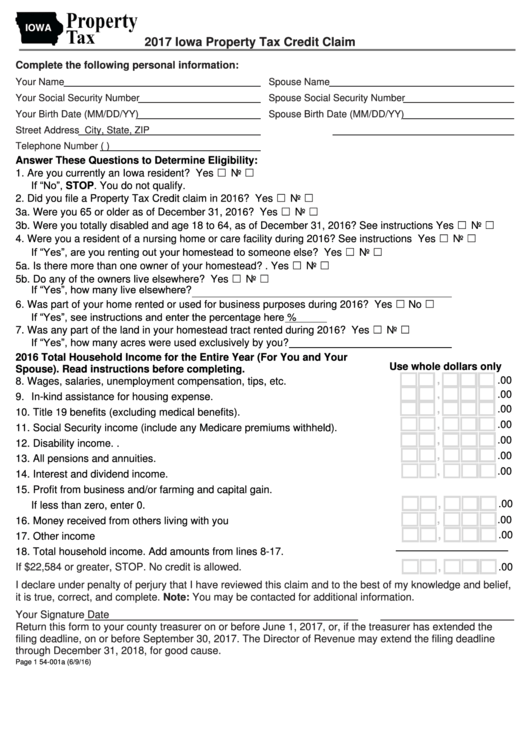

Form 54 001a Iowa Property Tax Credit Claim 2017 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/124/1246/124600/page_1_thumb_big.png

https://revenue.iowa.gov/sites/default/files/2022...

A claim for property tax credit may be filed if your mobile manufactured or modular home was assessed as real estate If your mobile manufactured or modular home was not assessed as real estate you may claim a credit on the property taxes due on the land where the home is located if you own the land

https://www.iowataxandtags.org/property-tax/property-tax-forms

2023 Iowa Property Tax Credit Claim Form Elderly Disabled Tax Credit Property tax credit is for Iowa resident homeowners who are eligible to file a claim for assistance towards property tax if the applicant meets age disability and household income requirements

Property Tax Relief Polk County Iowa

Form 54 001 Download Printable PDF Or Fill Online Iowa Property Tax

Form MI 1040CR Download Fillable PDF Or Fill Online Michigan Homestead

Iowa Homestead Tax Credit Johnson County

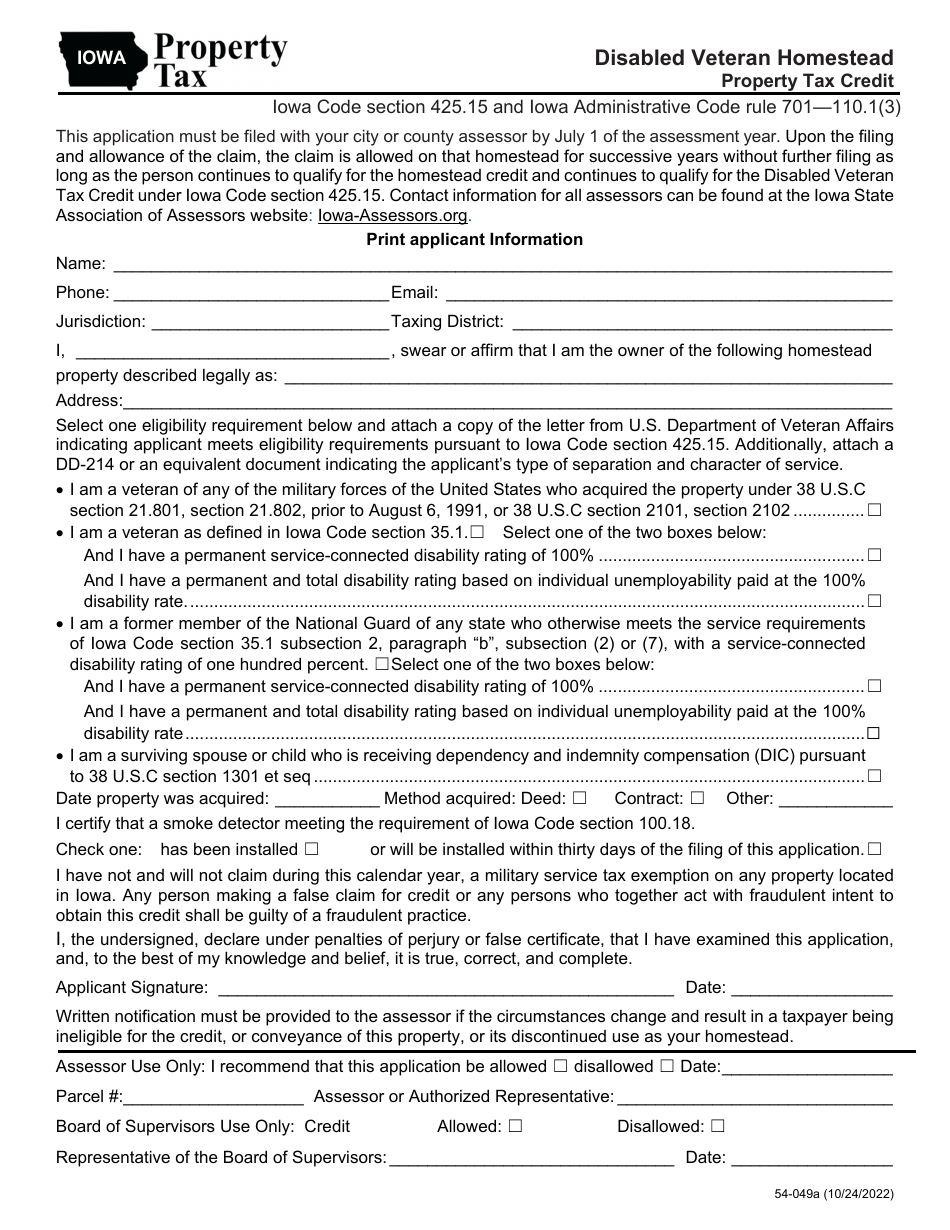

Form 54 049 Download Fillable PDF Or Fill Online Disabled Veteran

Iowa Income Tax Forms Fillable Fill Out And Sign Printable PDF

Iowa Income Tax Forms Fillable Fill Out And Sign Printable PDF

Form 54 001a Iowa Property Tax Credit Claim 2015 2016 Printable Pdf

Form 54 002a Property Tax Credit Claim Iowa Department Of Revenue

2022 Form MO DoR MO PTS Fill Online Printable Fillable Blank PdfFiller

Iowa Property Tax Credit Claim Form - Source URL https tax iowa gov forms iowa property tax credit claim 54 001 23 https tax iowa gov forms iowa property tax credit claim 54 001 23