Ira Ev Tax Credit 2024 You claim the credit using Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit and submit it with your individual tax return Beginning in 2024 buyers can transfer clean vehicle credits to qualified sellers at the time of sale and use the credit amount as a down payment or a reduction of the manufacturer s suggested retail price

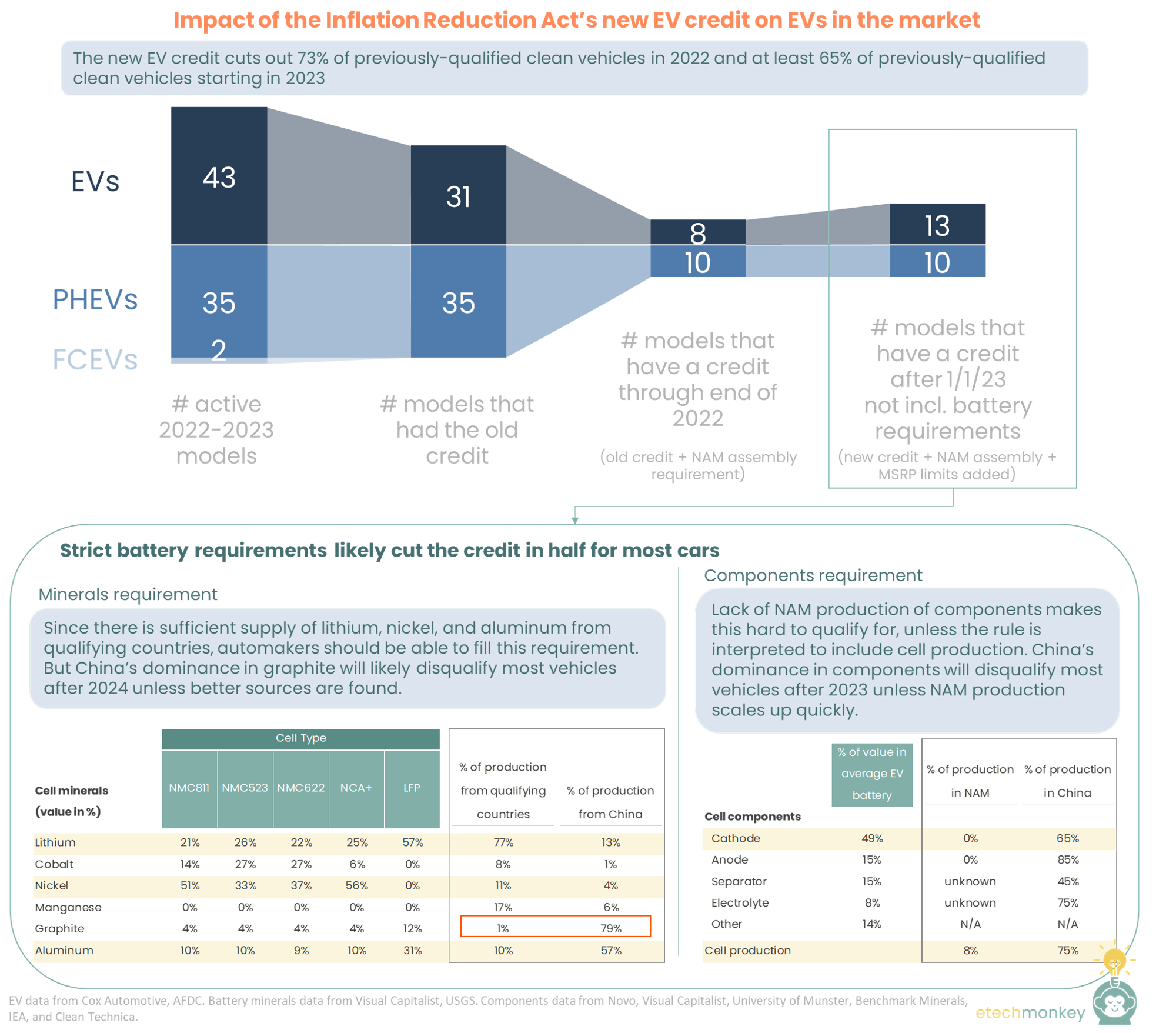

The Inflation Reduction Act IRA provides new opportunities for consumers to save money on clean vehicles offering multiple incentives for the purchase or lease of electric vehicles EVs plug in hybrid vehicles fuel cell vehicles and associated equipment such as InsideEVs spoke with U S Treasury officials to discuss how the EV tax credit will change for 2024 and beyond Oct 6 2023 at 8 45am ET By Andrew Lambrecht America s electric vehicle

Ira Ev Tax Credit 2024

Ira Ev Tax Credit 2024

https://www.americanactionforum.org/wp-content/uploads/2022/08/The-IRAs-EV-Tax-Credits-Infographic.png

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

https://www.carscoops.com/wp-content/uploads/2023/01/EV-PHEV-Tax-Credit-7500-Carscoops-1024x576.jpg

You Don t Get A Credit And You Don t Get A Credit The Impact Of IRA s

https://etechmonkey.com/wp-content/uploads/2022/08/ETM-IRAEVimpact.png

As of January 2024 the following fully electric and plug in hybrid vehicles may be eligible for either a full or partial tax credit if delivered on or after Jan 1 2024 The IRS urges If you are considering buying an electric car in 2024 there s good news and bad news A hefty federal tax credit for electric vehicles is going to get easier to access this year but fewer

If you re thinking about buying an electric car or a plug in hybrid you should be aware that the list of vehicles that are eligible for a federal EV tax credit of up to 7 500 is different as of Consumers that purchase a qualifying electric vehicle can continue to claim the electric vehicle tax credit on their annual tax filing Starting in 2024 the Inflation Reduction Act establishes a mechanism that will allow car buyers to transfer the credit to dealers at the point of sale so that it can directly reduce the purchase price 1

Download Ira Ev Tax Credit 2024

More picture related to Ira Ev Tax Credit 2024

New EV Tax Credits The Details Virginia Automobile Dealers Association

https://vada.com/wp-content/uploads/2022/08/EV-Tax-Credits-Facebook-Post.png

7 500 EV Tax Credit Use It Or Lose It YouTube

https://i.ytimg.com/vi/W6QEuZFy5GI/maxresdefault.jpg

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The credit is available to individuals and their businesses Rules for claiming the federal tax credit for electric vehicles have changed for 2024 Here s what you need to know if you want to buy an EV Image credit Getty Images By Kelley R Taylor last

For 2024 the applicable percentage is 50 percent For 2025 the applicable percentage is 60 percent For 2026 the applicable percentage is 70 percent Beginning in 2027 the applicable percentage is 80 percent Federal tax credit for EVs will remain at 7 500 The timeline to qualify is extended a decade from January 2023 to December 2032 Tax credit cap for automakers after they hit 200 000

How Will The Inflation Reduction Act Impact Supply Chain Logcomex

https://blog.logcomex.com/en-us/wp-content/uploads/2022/11/inflation-reduction-act-1.jpg

Has Federal EV Tax Credit Been Saved The Green Car Guy

https://thegreencarguy.com/wp-content/uploads/2016/05/GCG-CashandCar-1024x1024.jpg

https://www.irs.gov/newsroom/qualifying-clean...

You claim the credit using Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit and submit it with your individual tax return Beginning in 2024 buyers can transfer clean vehicle credits to qualified sellers at the time of sale and use the credit amount as a down payment or a reduction of the manufacturer s suggested retail price

https://www.energy.gov/energysaver/new-and-used...

The Inflation Reduction Act IRA provides new opportunities for consumers to save money on clean vehicles offering multiple incentives for the purchase or lease of electric vehicles EVs plug in hybrid vehicles fuel cell vehicles and associated equipment such as

The Inflation Reduction Act Discourages Electric Vehicle Buyers From

How Will The Inflation Reduction Act Impact Supply Chain Logcomex

Revamping The Federal EV Tax Credit Could Help Average Car Buyers

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

Spike On Twitter Ok Credits For Used EVs Is Exciting

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

Federal Solar Tax Credit What It Is How To Claim It For 2024

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

EV Tax Credits For 2023 How To Navigate The New Federal Rules

Ira Ev Tax Credit 2024 - If you re thinking about buying an electric car or a plug in hybrid you should be aware that the list of vehicles that are eligible for a federal EV tax credit of up to 7 500 is different as of