Ira Rebates Heat Pump Web 22 ao 251 t 2022 nbsp 0183 32 IRA provides a 30 tax credit for families investing in clean energy systems like solar electricity solar water heating wind geothermal heat pumps fuel cells and battery storage for their homes This can

Web 27 juil 2023 nbsp 0183 32 The Inflation Reduction Act IRA Pub L 117 169 August 16 2022 authorized the U S Department of Energy DOE to carry out two Home Energy Rebate programs Specifically IRA Section 50121 established the Home Efficiency Rebates and IRA Section 50122 established the IRA Home Electrification and Appliance Web 27 janv 2023 nbsp 0183 32 It adds The law does not authorize states to offer home electrification rebates retroactively The IRA also includes a 2 000 federal tax credit for heat pumps which can be taken now

Ira Rebates Heat Pump

Ira Rebates Heat Pump

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/airspool-heat-pump-rebates-proposed-in-ira.png

![]()

IRA And Heat Pump Rebates With Mark Kuntz METUS Tech Show Podcasts

https://m.media-amazon.com/images/I/41aHg14gYQL._SL10_UR1600,800_CR200,50,1200,630_CLa|1200,630|41aHg14gYQL.jpg|0,0,1200,630+107,79,402,402_PJAdblSocialShare-Gradientoverlay-smallasin-0to70,TopLeft,0,0_PJAdblSocialShare-AudibleLogo-Large,TopLeft,576,270_OU01_ZBLISTENING ON,593,216,52,500,AudibleSansMd,30,255,255,255_PJAdblSocialShare-PodcastIcon-Small,TopLeft,1094,50_ZBIRA and Heat Pump Rebat...,106,519,48,404,AudibleSansMd,24,255,255,255.jpg

Heat Pumps Experts In The Fox River Valley Illinois

https://compassheatingandair.com/wp-content/uploads/2023/03/IRA-Mini-Split-Heat-Pump-Tax-Credits-And-Rebates-2023-Elgin-IL-Elgin-IL-400x600-1.jpg

Web 12 ao 251 t 2023 nbsp 0183 32 Specifically the IRA offers two rebate programs that include money for heat pumps HOMES and HEEHRA The latter is most relevant for apartment dwelling renters it offers up to 14 000 in rebates Web 16 ao 251 t 2022 nbsp 0183 32 Investing 369 billion in climate and clean energy spending the IRA provides for 9 billion in total energy rebates including the 4 28 billion High Efficiency Electric Home Rebate Program Eligible homeowners can get rebates as high as 8 000 for heat pump installation 1 750 for a heat pump water heater

Web 1 juin 2023 nbsp 0183 32 The Inflation Reduction Act of 2022 is the most significant climate legislation in U S history offering funding programs and incentives to accelerate the transition to a clean energy economy and will likely drive significant deployment of Web 1 ao 251 t 2023 nbsp 0183 32 The High Efficiency Electric Home Rebate Act HEEHRA is the official name of the IRA s new heat pump incentive program The goal of the 10 year program is to encourage homeowners to switch to electric appliances such as heat pumps in hopes of reducing carbon emissions by 40 by 2030 reducing inflation and investing in domestic

Download Ira Rebates Heat Pump

More picture related to Ira Rebates Heat Pump

Inflation Reduction Act Summary What It Means For New HVAC Systems

https://www.ecicomfort.com/hubfs/IRA Heat Pump Rebates %26 Tax Credits-png.png

Understanding The IRA Home Energy Rebates Sierra Club

https://www.sierraclub.org/sites/www.sierraclub.org/files/2023-04/heat-pump.png

Dominion Power Rebates On Heat Pumps

https://i2.wp.com/files.jeffpud.org/wp-content/uploads/2020/07/10112211/HP-ad-1-1-1024x1024.png

Web 15 ao 251 t 2022 nbsp 0183 32 For homeowners who do not qualify for the rebates the IRA provides for a tax credit of up to 2 000 to install heat pumps And installing an induction stove or new windows and doors for example Web 11 ao 251 t 2022 nbsp 0183 32 Rebates and tax credits for installing new energy efficient appliances including heat pumps electric stoves and electric dryers as well as new circuit breaker boxes which sometimes need to be replaced when retrofitting older homes New incentives for developers to build energy efficient homes or to retrofit older ones

Web 1 janv 2023 nbsp 0183 32 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit You can claim the maximum annual credit every year that you make eligible improvements until 2033 The credit is nonrefundable so you can t get back more on the credit than you owe in taxes You can t apply any excess Web What the IRA Means for Heat Pump Manufacturers The Inflation Reduction Act IRA signed into law in August 2022 has the potential to reshape the HVAC economy through manufacturing investments demand side incentives and innovative low cost financing

Inflation Reduction Act Of 2022 Presidential

https://www.presidentialheatandair.com/wp-content/uploads/2023/04/Pres_HeatPumpRebates_TaxCred_1400x800-1400x800.png

Ultimate Guide To Mass Save Rebates 2023 Colt Home Services

https://colthomeservices.com/wp-content/uploads/2022/10/Mass-Save-Rebate-used-for-Heat-pump-installation.jpg

https://www.energy.gov/energysaver/articles/i…

Web 22 ao 251 t 2022 nbsp 0183 32 IRA provides a 30 tax credit for families investing in clean energy systems like solar electricity solar water heating wind geothermal heat pumps fuel cells and battery storage for their homes This can

https://www.energy.gov/scep/articles/home-energy-rebate-pr…

Web 27 juil 2023 nbsp 0183 32 The Inflation Reduction Act IRA Pub L 117 169 August 16 2022 authorized the U S Department of Energy DOE to carry out two Home Energy Rebate programs Specifically IRA Section 50121 established the Home Efficiency Rebates and IRA Section 50122 established the IRA Home Electrification and Appliance

Comfort Blog ECI Comfort Rebates

Inflation Reduction Act Of 2022 Presidential

Heat Pump Rebates Available In BC PumpRebate

Federal Rebates For Heat Pumps HERETAB

Enbridge Heat Pump Rebates Delta Air Systems

Nova Scotia Power Rebates On Heat Pumps PumpRebate PowerRebate

Nova Scotia Power Rebates On Heat Pumps PumpRebate PowerRebate

IRA Rebates And Tax Credits For New Jersey Homeowners

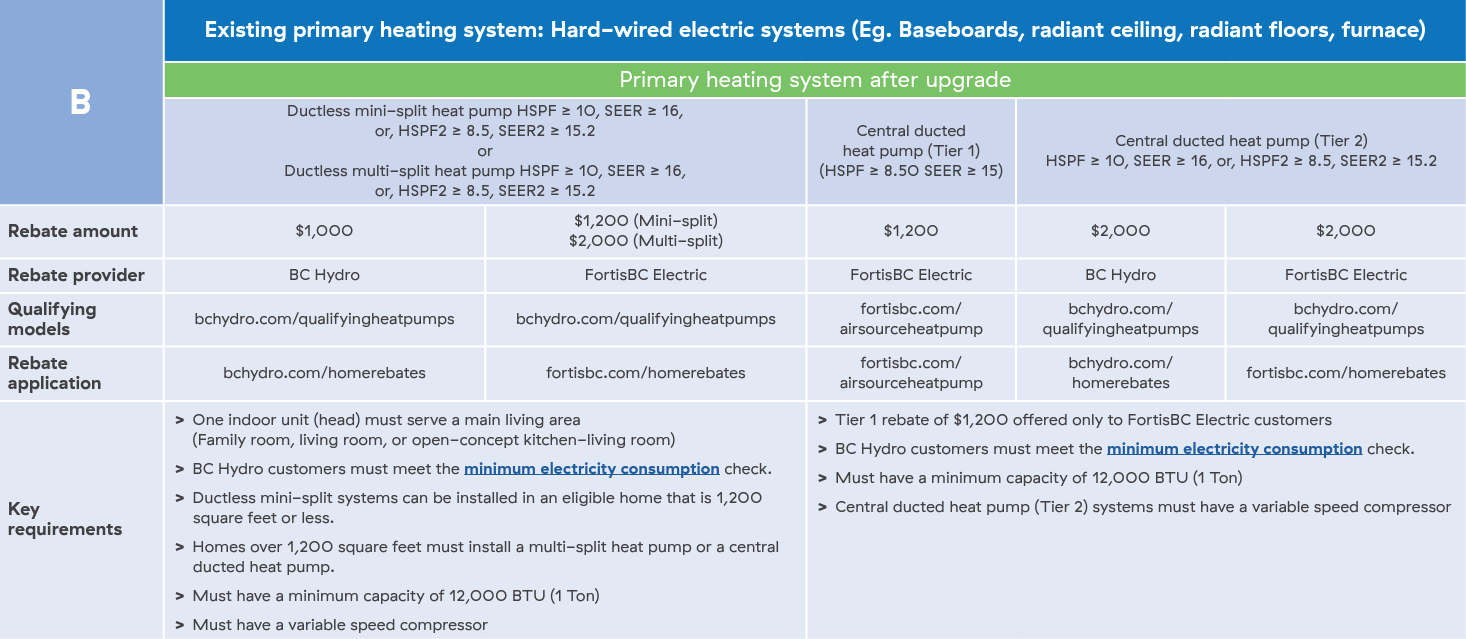

BC Heat Pump Rebates Home Heating Rebates Lockhart Industries

7100 Rebate On Heat Pumps Don t Miss Out On A Free Heat Pump 24 7

Ira Rebates Heat Pump - Web Electrification Rebates Battery Storage Installation 30 Available Now Geothermal Heating Installation 30 Available Now Electric Panel 600 Available Now Electric Vehicle Charger 1 000 Available Now New Electric Vehicle 7 500 Available Now Used Electric Vehicle 4 000 Available Now