Ira Tax Credit Heat Pump Claim the credits using the IRS Form 5695 What Products are Eligible Starting January 1 2025 air source heat pumps that are recognized as ENERGY STAR Most Efficient are eligible for this credit There are two pathways for eligibility

The Inflation Reduction Act provides federal income tax credits that are specially targeted to home owners that make energy efficient home improvements involving heat pump technology 30 The Inflation Reduction Act IRA of 2022 provides for federal income tax credits for the installation of qualifying heat pumps The IRA s Energy Eficient Home Improvement Credit

Ira Tax Credit Heat Pump

Ira Tax Credit Heat Pump

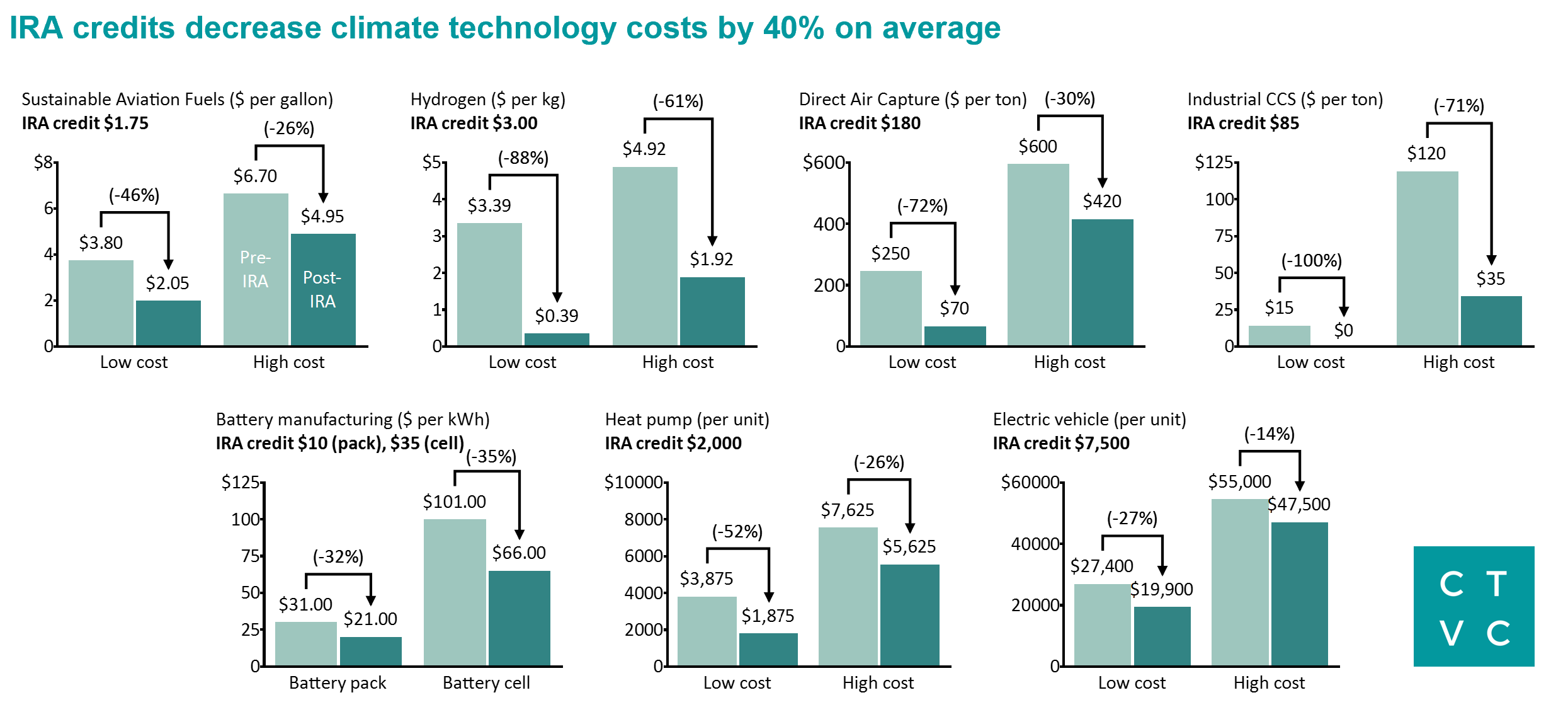

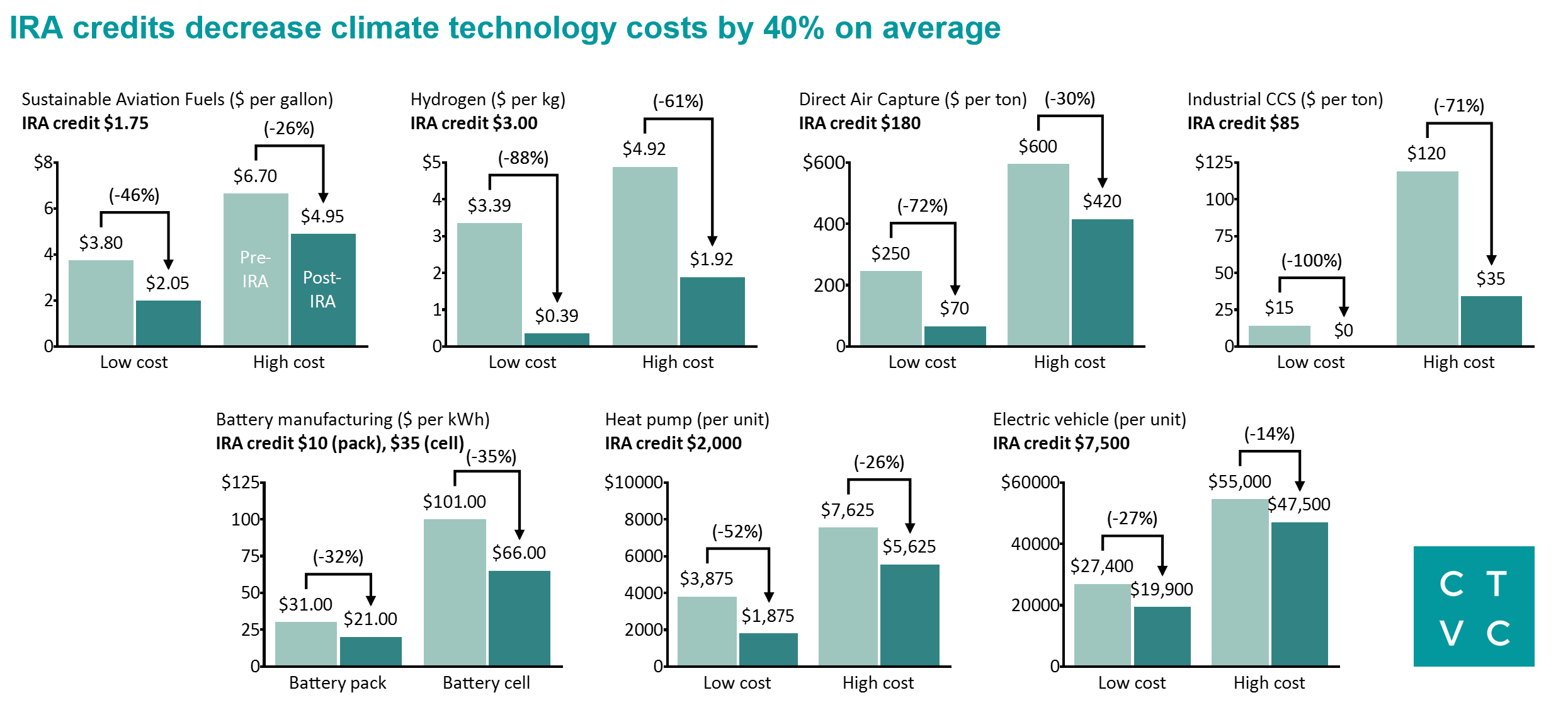

https://www.ctvc.co/content/images/2022/08/ira-costs.png

Tax Credits Offered For Heat Pump Installation YouTube

https://i.ytimg.com/vi/j5EODeZMn-0/maxresdefault.jpg

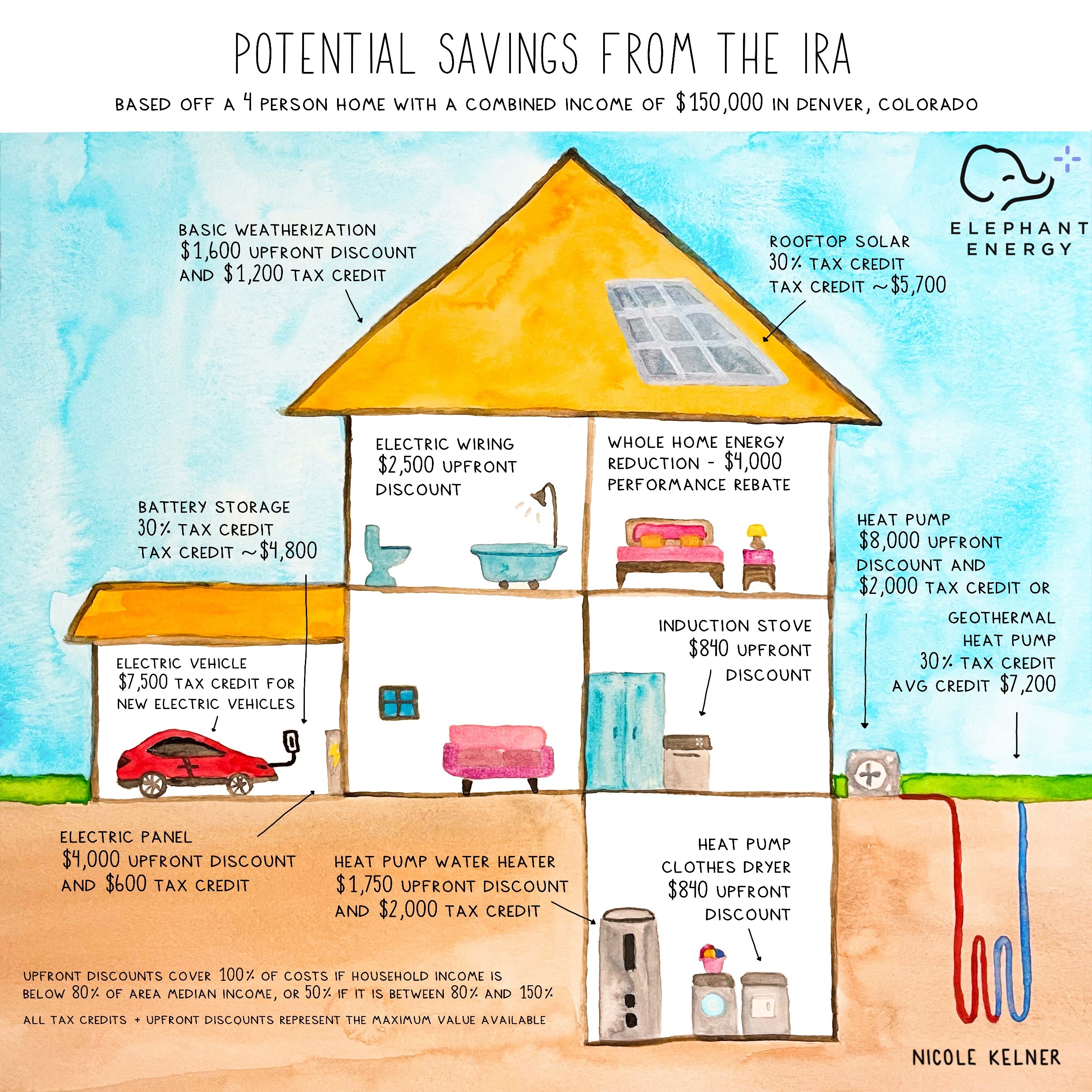

Inflation Reduction Act IRA The Ultimate Guide To Saving

https://elephantenergy.com/wp-content/uploads/2022/09/IRA-Summary-Image-by-Nicole-Kelner-Made-Exclusively-for-Elephant-Energy.jpg

The credit is limited to 2 000 for each taxpayer for any taxable year in the aggregate for electric or natural gas heat pump water heaters electric or natural gas heat pumps and biomass Passed in August 2022 the IRA is the largest governmental investment in greenhouse gas reduction ever It includes tax credits for heat pumps heat pump water heaters

Homeowners can qualify for a tax credit of 30 for the purchase and installation of a qualified heat pump up to 2 000 Through the High Efficiency Electric Home Rebate Act HEEHRA Yes heat pumps are eligible for federal tax credits under the Inflation Reduction Act IRA which provides incentives for energy efficient home improvements Homeowners can receive a tax credit of up to 30 of the cost for installing

Download Ira Tax Credit Heat Pump

More picture related to Ira Tax Credit Heat Pump

Air Source Heat Pump Tax Credit 2023 Comfort Control

https://comfortcontrolspecialists.com/wp-content/uploads/2023/06/CCS-Air-Source-Heat-Pumps-Tax-Credit-750x420.jpg

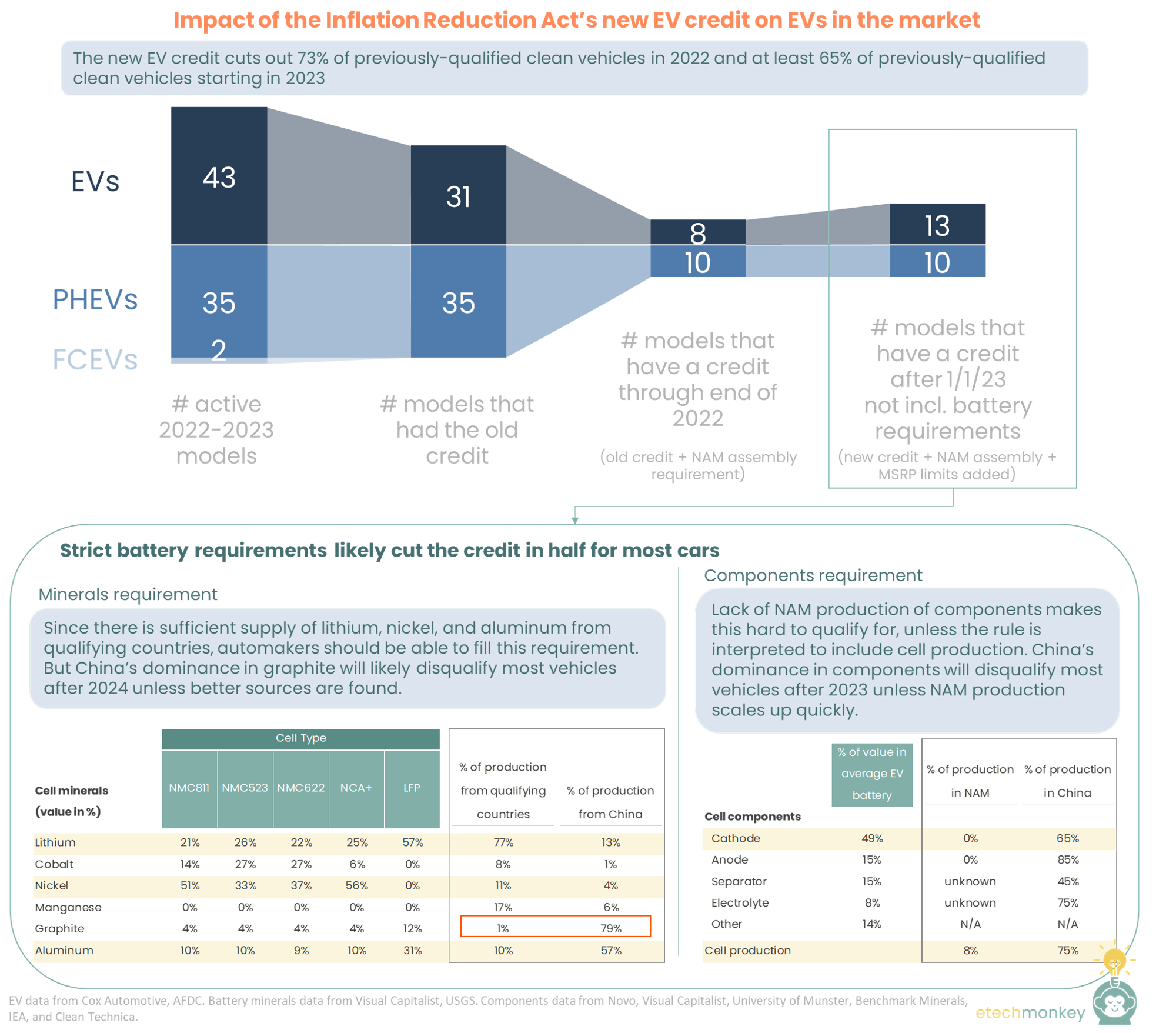

You Don t Get A Credit And You Don t Get A Credit The Impact Of IRA s

https://etechmonkey.com/wp-content/uploads/2022/08/ETM-IRAEVimpact.png

The IRA s EV Tax Credits AAF

https://www.americanactionforum.org/wp-content/uploads/2022/08/The-IRAs-EV-Tax-Credits-Infographic.png

Is placed into service initially used by the taxpayer making the expenditure and Meets the energy efficiency requirements Qualified energy property is Electric Learn about tax credits for home energy efficiency upgrades and renewable energy systems

Over 140 projects selected in Round 2 approximately 250 selected in total across both roundsWASHINGTON Today the Internal Revenue Service IRS announced 6 billion IRA provides a 30 tax credit for families investing in clean energy systems like solar electricity solar water heating wind geothermal heat pumps fuel cells and battery

Geothermal Heat Pump Information For Consumers Department Of Energy

https://www.energy.gov/sites/default/files/2023-05/2679-geothermal-heatpumps-overview-2023.png

Heat Pumps Rebates 2019 Coastal Energy PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/heat-pumps-rebates-2019-coastal-energy-118.png

https://www.energystar.gov › ... › air-source-heat-pumps

Claim the credits using the IRS Form 5695 What Products are Eligible Starting January 1 2025 air source heat pumps that are recognized as ENERGY STAR Most Efficient are eligible for this credit There are two pathways for eligibility

https://www.energystar.gov › sites › default › files

The Inflation Reduction Act provides federal income tax credits that are specially targeted to home owners that make energy efficient home improvements involving heat pump technology 30

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Geothermal Heat Pump Information For Consumers Department Of Energy

IRA Heat Pump Tax Incentives What You Really Need To Know YouTube

How The Inflation Reduction Act And Bipartisan Infrastructure Law Work

2022 IRA Tax Credit Calculator How Much You May Save On Electric

IRA Tax Credits 25c Ideal Air Conditioning And Insulation

IRA Tax Credits 25c Ideal Air Conditioning And Insulation

Top Five IRA Production Tax Credits For Energy Producers FORVIS

Heat Pump Rebates Oregon PumpRebate

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Ira Tax Credit Heat Pump - Yes heat pumps are eligible for federal tax credits under the Inflation Reduction Act IRA which provides incentives for energy efficient home improvements Homeowners can receive a tax credit of up to 30 of the cost for installing