Iras Corporate Tax Deadline The deadline for filing your Corporate Income Tax Return Form C S Form C S Lite Form C for the Year of Assessment YA 2024 is 30 Nov 2024 On this page Filing of the

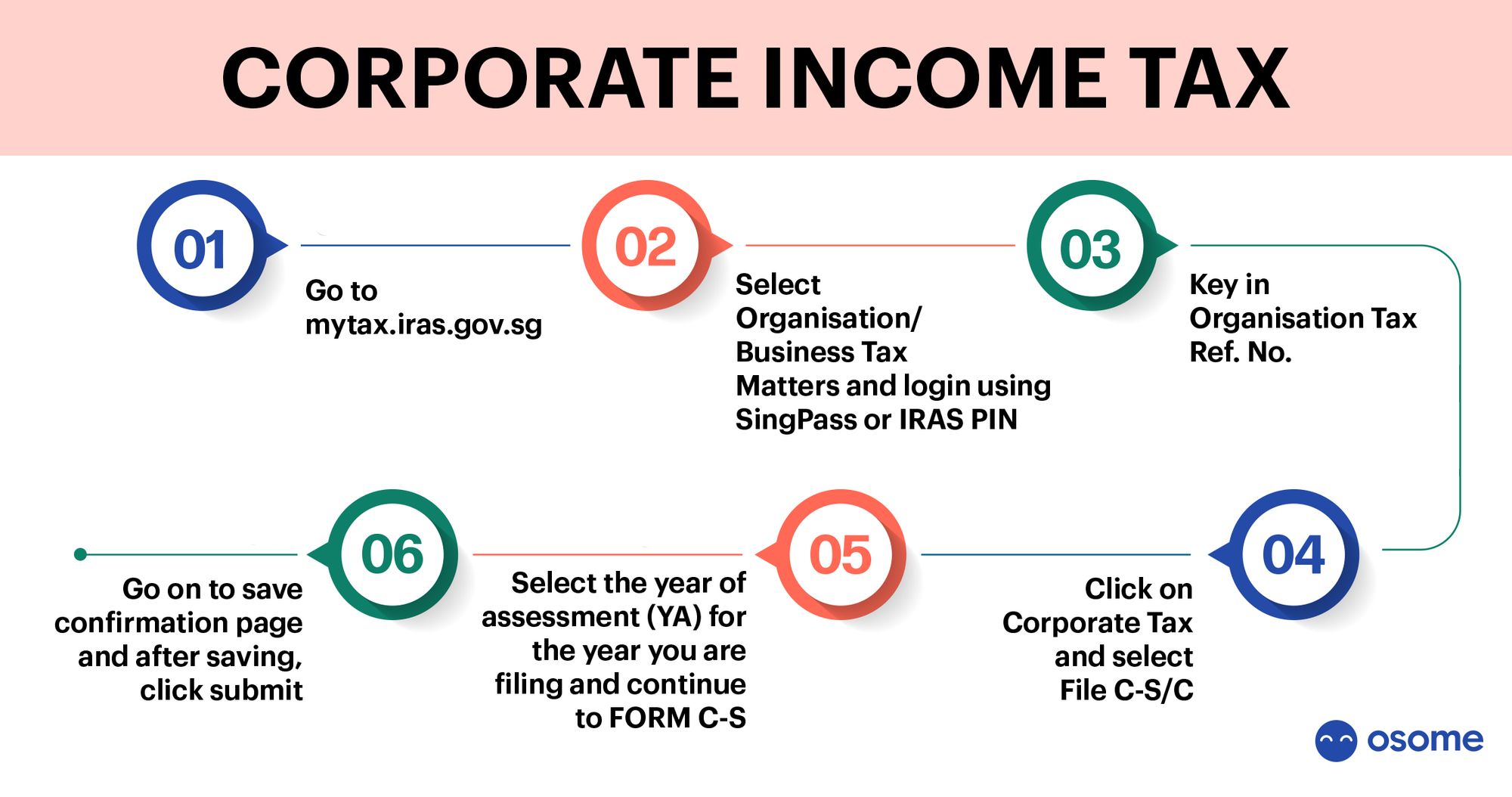

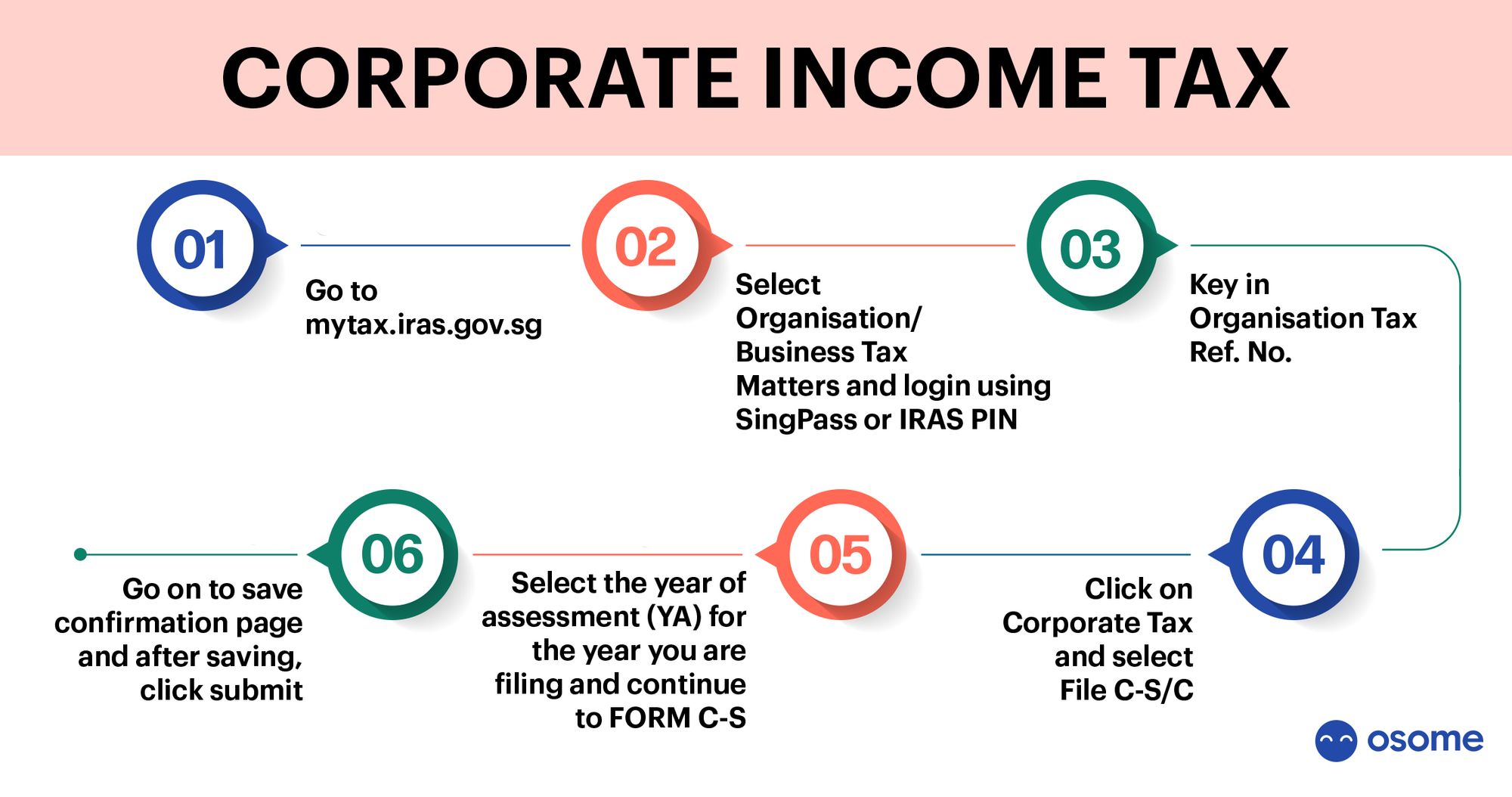

You may start filing your Income Tax Return for the Year of Assessment 2024 from 1 Jul 2024 On this page General Corporate Income Tax Rules Corporate Income Tax Filing Determine the filing deadline The corporate income tax return known as Form C S or Form C must be filed with the Inland Revenue Authority of Singapore

Iras Corporate Tax Deadline

Iras Corporate Tax Deadline

https://unitedwaysaskatoon.ca/wp-content/uploads/2021/12/2021-Tax-web-banner-desktop-01_resize-e1639496151979.jpg

Section 194A Of Income Tax Act Sorting Tax

https://sortingtax.com/wp-content/uploads/2022/08/blogimg2.png

Tax Day 2023 Why Aren t Taxes Due On April 17 Marca

https://phantom-marca.unidadeditorial.es/f285350cd42c197a8bcc65302162f258/resize/1320/f/jpg/assets/multimedia/imagenes/2023/04/15/16815435739469.jpg

Owners of Sole Proprietorships and Partnerships can expect to receive a filing notification or an Income Tax Return Form B or B1 or P from IRAS by March of each year Upon receiving the notification a 2 line or 4 There are two main submissions for annual corporate income tax filing Estimated Chargeable Income ECI and Form C C S C S Lite Estimated Chargeable

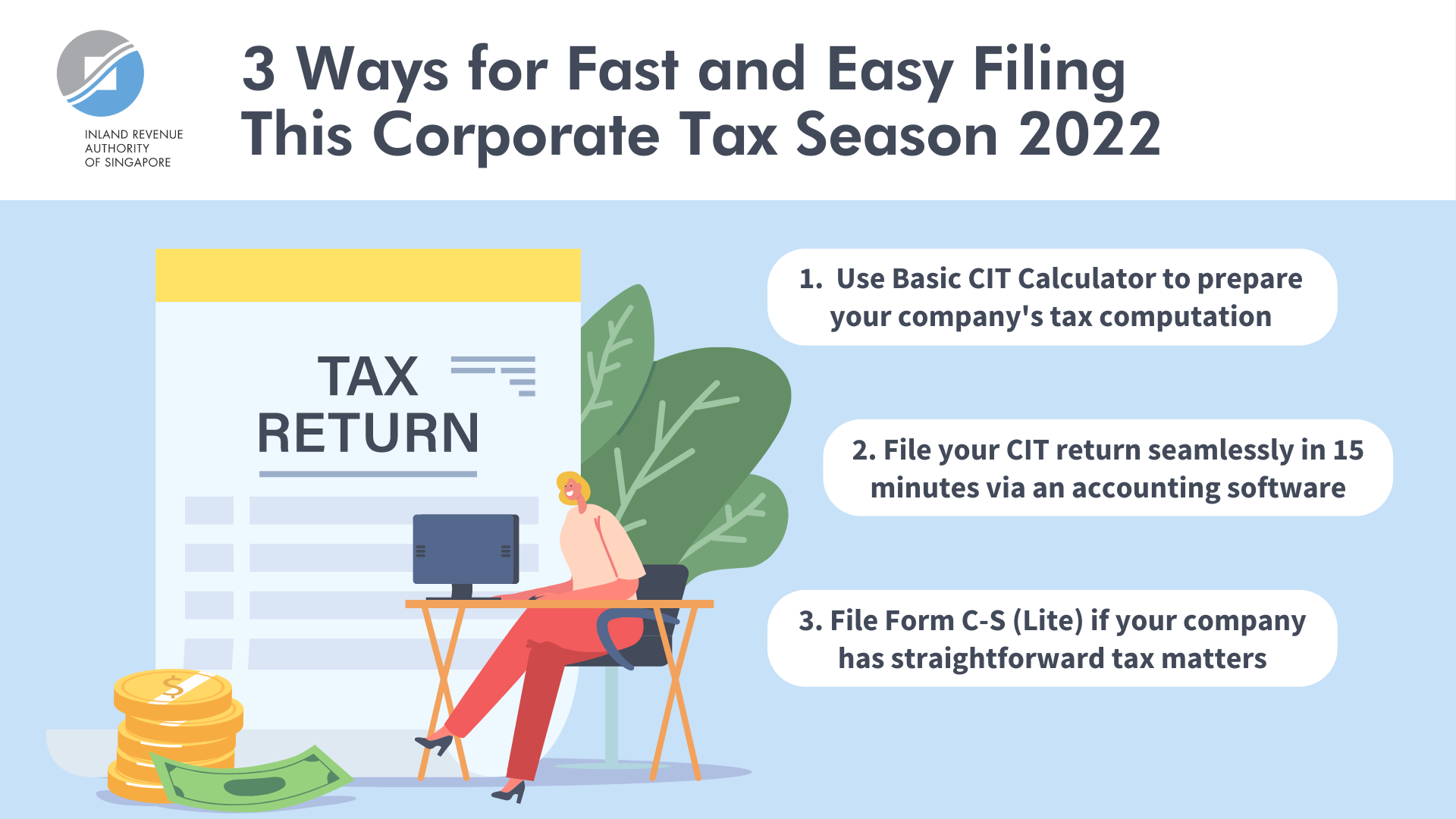

Meet the Dec 15 Corporate Tax filing deadline with two new digital initiatives by IRAS Small and medium sized companies can now submit returns to both IRAS and 301 rowsThe tax return must be filed at the latest on 30 September of the tax year for financial years ending between 31 December of the previous year and the last day of

Download Iras Corporate Tax Deadline

More picture related to Iras Corporate Tax Deadline

2023 Tax Deadline Important Extension Filing Dates Incite Tax

https://incitetax.com/wp-content/uploads/2023/01/2023-tax-deadline.jpg

Tax Accounting Services Lee s Tax Service

https://leestaxservicellc.com/files/IMG_1348.png

Corporate Tax Filing Deadline 2023 Singapore Pay Period Calendars 2023

https://www.taxproadvice.com/wp-content/uploads/business-tax-return-due-date-by-company-structure.jpeg

2022 C corp deadlines at a glance If you re a C corporation or LLC electing to file your taxes as one for 2023 your corporate tax return is due on April 15th 2024 unless you Visit our Basic Guide to Corporate Income Tax for Companies to find out about Filing obligations of a company i e forms to submit deadlines How to determine income

Late Submission of Tax Returns to IRAS Failure to file tax returns punctually might result in an estimated Notice of Assessment NOA requiring payment within one IRAS has declared it is now mandatory to complete all Corporate Income Tax Returns through their e Filing system This is compulsory for all companies For YA

Tax Extension Deadline 2020 How To File TheStreet

https://www.thestreet.com/.image/t_share/MTY3NTM5NTQ4MDYxMTgxMzE5/tax-extension-deadline-2019-how-to-file.png

3 Ways For Fast And Easy Filing This Corporate Tax Season 2022 SME

https://www.smehorizon.com/wp-content/uploads/2022/10/IRAS-Tax-image.png

https://www.iras.gov.sg/taxes/corporate-income-tax...

The deadline for filing your Corporate Income Tax Return Form C S Form C S Lite Form C for the Year of Assessment YA 2024 is 30 Nov 2024 On this page Filing of the

https://www.iras.gov.sg/taxes/corporate-income-tax/...

You may start filing your Income Tax Return for the Year of Assessment 2024 from 1 Jul 2024 On this page General Corporate Income Tax Rules Corporate Income Tax Filing

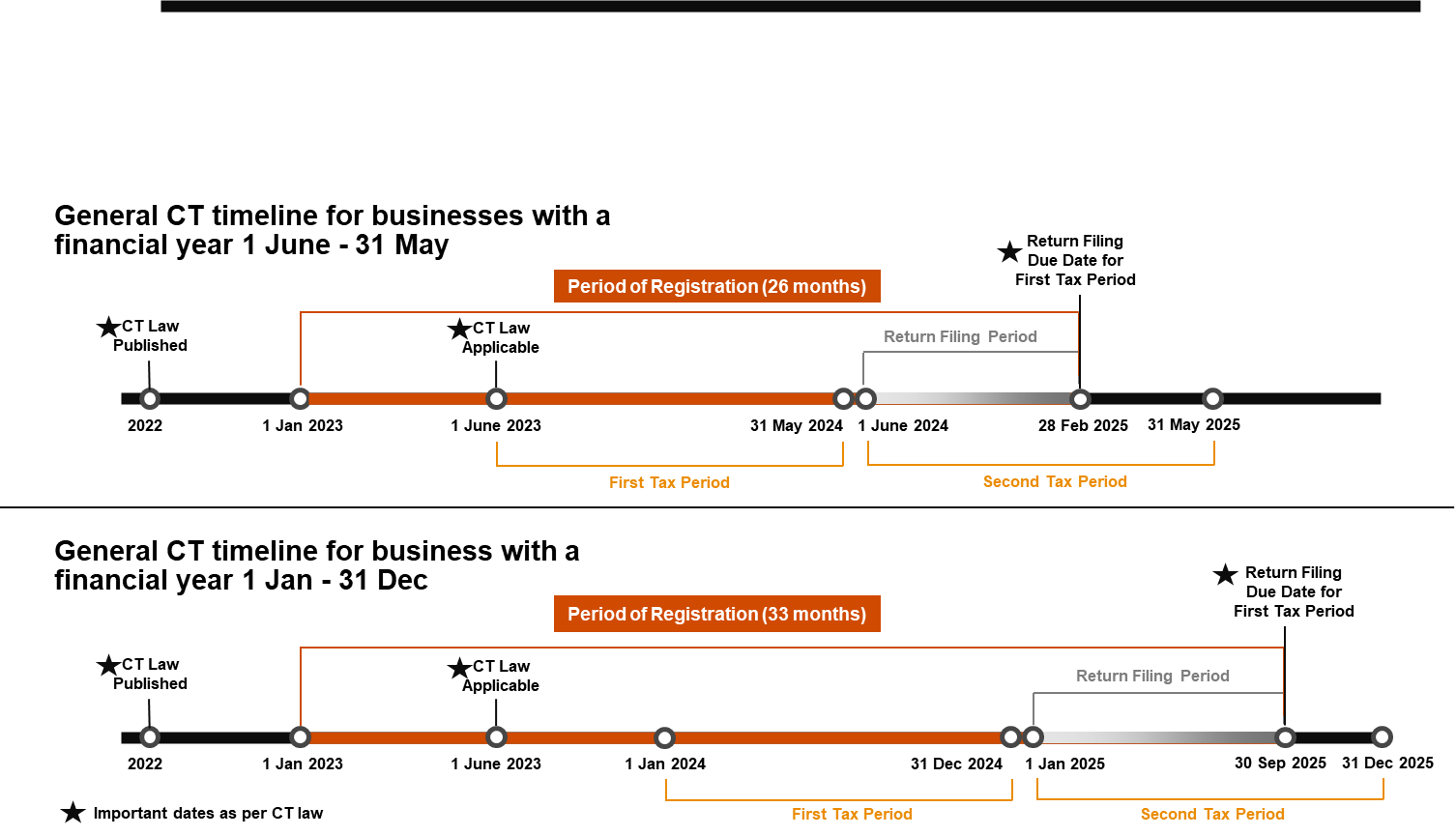

Federal Tax Authority Corporate Tax Topics

Tax Extension Deadline 2020 How To File TheStreet

Meet The Dec 15 Corporate Tax Filing Deadline With Two New Digital

IRAS 2017 Singapore Personal Income Tax Dezan Shira Associates

Singapore Personal Income Tax 2023 Filing Dates Aura Partners Singapore

Singapore Company s Annual Filing Requirements ACRA IRAS

Singapore Company s Annual Filing Requirements ACRA IRAS

Fecha L mite Para Presentar Impuestos En 2021 Canad Y Otros Consejos

Downloads 2023 Tax Deadlines Incite Tax

The Tax Deadline For Small Businesses And Gig Workers Is June 15th

Iras Corporate Tax Deadline - As the year comes to a close companies are gearing up for the Corporate Income Tax CIT filing for the Year of Assessment YA 2023 In this article the Inland