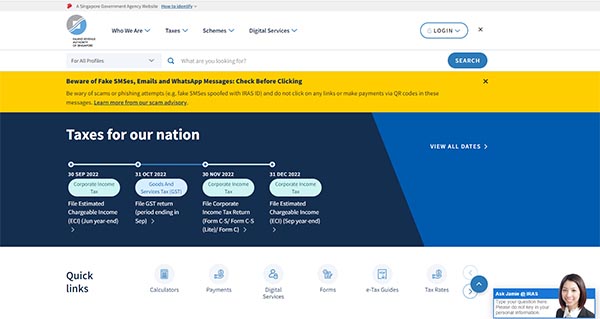

Iras Corporate Tax Rebate 30 Web Singapore s Corporate Income Tax rate is 17 Expand all Definition of a Company Basis Period amp Year of Assessment Corporate Income Tax Rate Corporate Income Tax Filing

Web Visit our Basic Guide to Corporate Income Tax for Companies to find out about Filing obligations of a company i e forms to submit deadlines How to determine income Web 28 f 233 vr 2023 nbsp 0183 32 From YA2020 new start ups will be eligible for 75 tax exemption on the first 100 000 of normal chargeable income and 50

Iras Corporate Tax Rebate 30

Iras Corporate Tax Rebate 30

https://global-uploads.webflow.com/622b0dcb03b6eeccf4254e3f/62a6b92d9c8a3593373e323d_NOA.jpeg

IRAS Corporate Personal Tax Computation GST Business Services

https://media.karousell.com/media/photos/products/2020/04/09/iras__corporate__personal_tax_computation__gst_1586412814_81609c91b

https://cdn.nbntv.kr/news/photo/202105/47155_31028.jpg

Web For the Years of Assessments YA 2016 and 2017 all corporations get a 50 percent rebate on all corporate tax The rebate is capped at S 20 000 per YA In assisting firms by Web 13 d 233 c 2019 nbsp 0183 32 IRAS Basic Corporate Tax Calculator BTC Corporate tax calculator list on IRAS website The Basic Corporate Tax Calculator is an excel workbook intended to help companies and tax agents prepare tax

Web 3 mai 2023 nbsp 0183 32 Corporate Income Tax Rebate The Corporate Income Tax Rebate is designed to provide relief to all companies in Singapore This relief provides a 25 Web The IRAS guidance states that the following payments are taxable in the hands of employers as the amounts are considered revenue receipts for businesses

Download Iras Corporate Tax Rebate 30

More picture related to Iras Corporate Tax Rebate 30

Pin By Xeno Phrenia On Capitalism Is The Crisis 02 Corporate

https://i.pinimg.com/originals/53/f5/2a/53f52acc7d0febb2c91531efdfb4bf28.jpg

HMRC Rebate Of Corporation Tax Accounting QuickFile

https://qfassets.b-cdn.net/original/3X/6/b/6b7441e1435bd42f80bcd9d9f1768e79bc8fca85.png

IRAS The Parenthood Tax Rebate And Qualifying Child Facebook

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=348504300640971

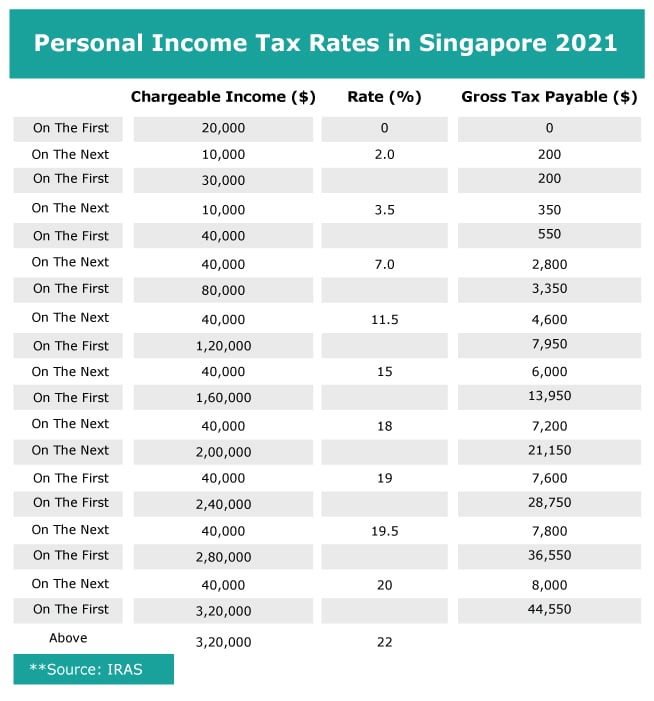

Web 10 janv 2023 nbsp 0183 32 Corporate Income Tax Rate Your company is taxed at a flat rate of 17 of its chargeable income This applies to both local and foreign companies Corporate Web Deloitte US Audit Consulting Advisory and Tax Services

Web 12 ao 251 t 2022 nbsp 0183 32 Extends the full 30 percent credit for eligible expenditures through the end of 2032 then phases down to 26 percent in 2033 and 22 percent in 2034 The credit Web Since you took the withdrawal before you reached age 59 1 2 unless you met one of the exceptions you will need to pay an additional 10 tax on early distributions on your

Www Iras Gov Sg Income Tax Singapore Tax Calculator Absd 2023

https://web.bd-gov.com/wp-content/uploads/2022/09/www-iras-gov-sg-Income-Tax-Singapore-Tax-Calculator-absd.jpg

Happy Bright Day Quotes

https://i.ytimg.com/vi/YvJ_zpK4k30/maxresdefault.jpg

https://www.iras.gov.sg/taxes/corporate-income-tax/basics-of-corporate...

Web Singapore s Corporate Income Tax rate is 17 Expand all Definition of a Company Basis Period amp Year of Assessment Corporate Income Tax Rate Corporate Income Tax Filing

https://www.iras.gov.sg/media/docs/default-source/uploaded…

Web Visit our Basic Guide to Corporate Income Tax for Companies to find out about Filing obligations of a company i e forms to submit deadlines How to determine income

Singapore Corporate Tax Rebate Ya 2022 Rebate2022

Www Iras Gov Sg Income Tax Singapore Tax Calculator Absd 2023

Guide To Understanding The Inland Revenue Authority Of Singapore IRAS

2020 Singapore Corporate Tax Update Singapore Taxation

Corporate Income Tax E File 2016 12 15

IRAS Introduces Two New Corporate Tax Frameworks In Singapore

IRAS Introduces Two New Corporate Tax Frameworks In Singapore

Deferred Tax And Temporary Differences The Footnotes Analyst

Donation Exemption For Income Tax Malaysia Amy Dyer

Iras Corporate Tax Rebate 30 - Web The IRAS guidance states that the following payments are taxable in the hands of employers as the amounts are considered revenue receipts for businesses