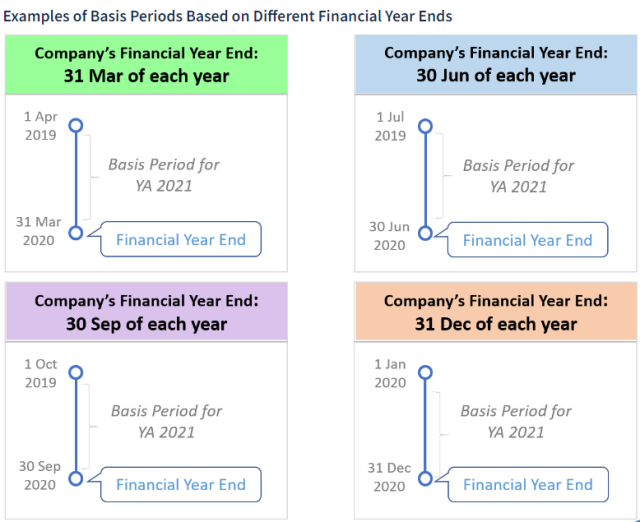

Iras Corporate Tax Rebate Web Singapore s Corporate Income Tax rate is 17 Expand all Definition of a Company Basis Period amp Year of Assessment Corporate Income Tax Rate Corporate Income Tax Filing

Web As announced in Budget 2023 under the Enterprise Innovation Scheme EIS an additional 300 tax deduction is granted on the first 400 000 of qualifying training expenditure Web 28 f 233 vr 2023 nbsp 0183 32 From YA2020 new start ups will be eligible for 75 tax exemption on the first 100 000 of normal chargeable income and 50

Iras Corporate Tax Rebate

Iras Corporate Tax Rebate

https://static1.squarespace.com/static/55b79c7fe4b0f338367f9329/t/56f7c11bac962c8475209b2d/1459077422156/50%25-corporate-tax-rebate-for-Singapore-companies

Bulicenas Singapore Tax Rebates

https://2.bp.blogspot.com/-mWIID9_ikkA/UVBehKRVxiI/AAAAAAAABhY/Ld9isw9tW0E/s1600/IRAS+tax+rebate.jpg

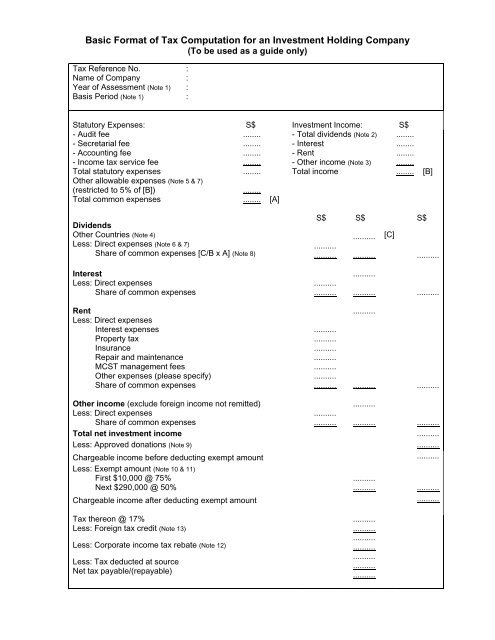

IRAS Corporate Personal Tax Computation GST Business Services

https://media.karousell.com/media/photos/products/2020/04/09/iras__corporate__personal_tax_computation__gst_1586412814_81609c91b

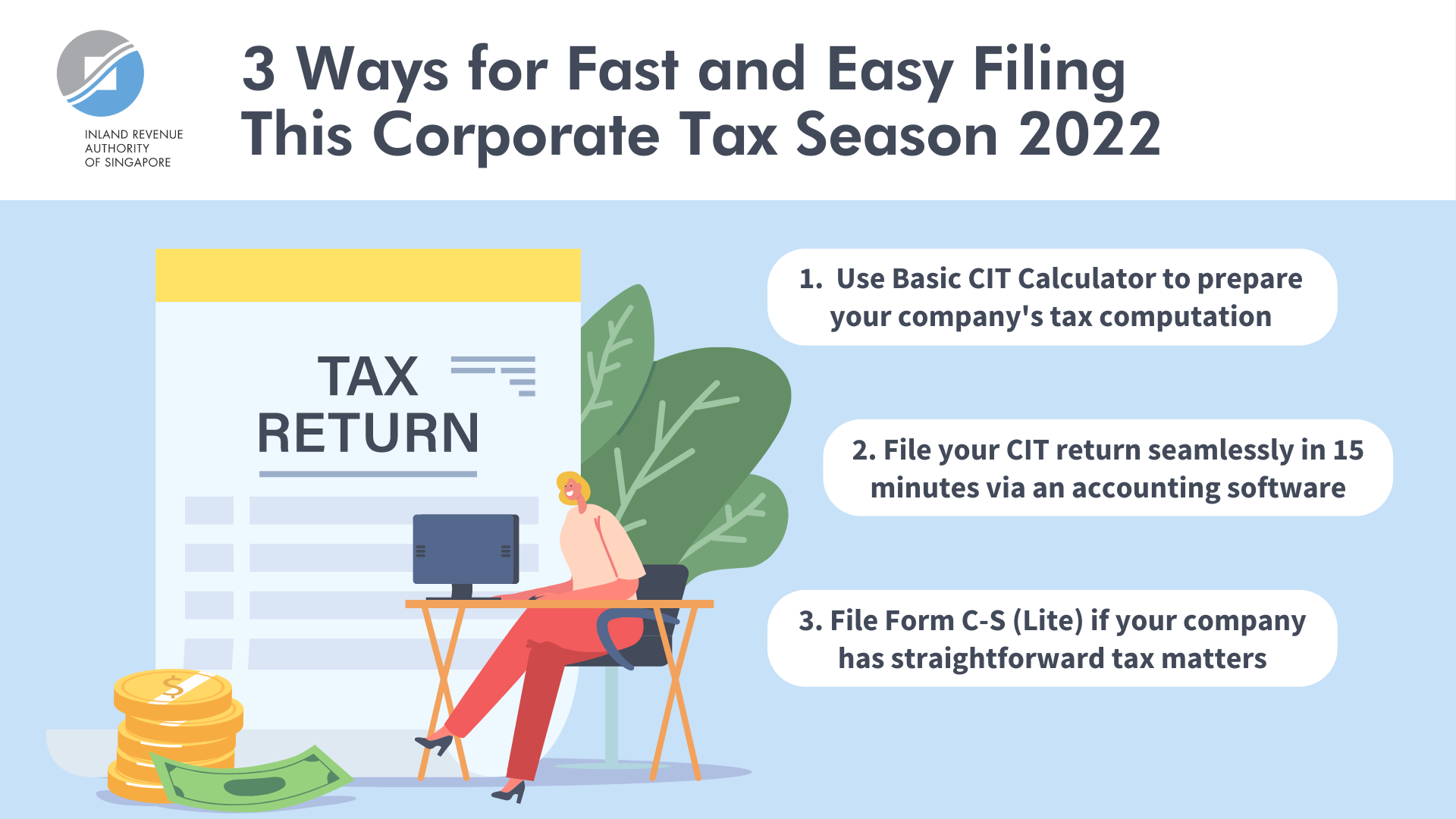

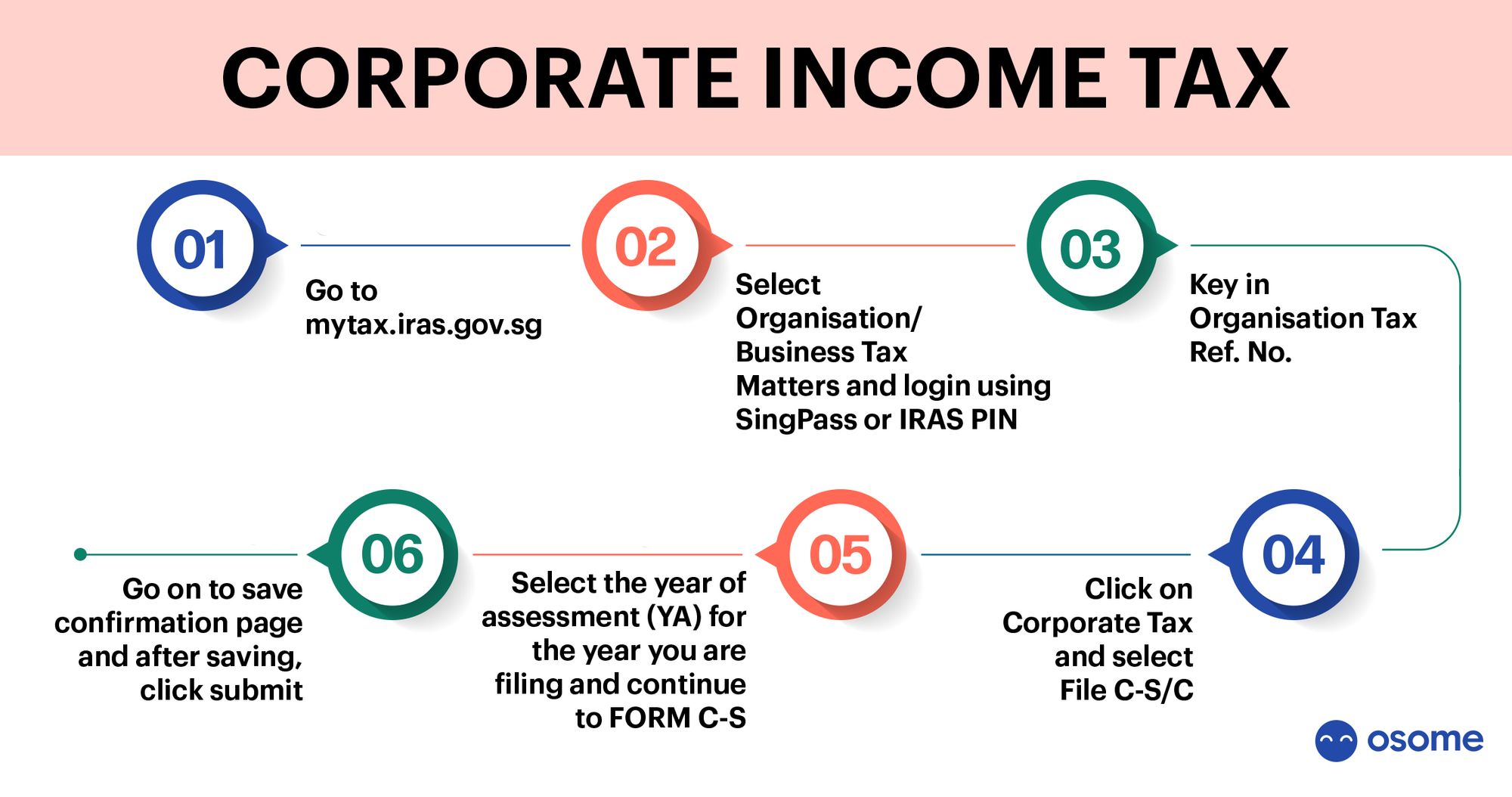

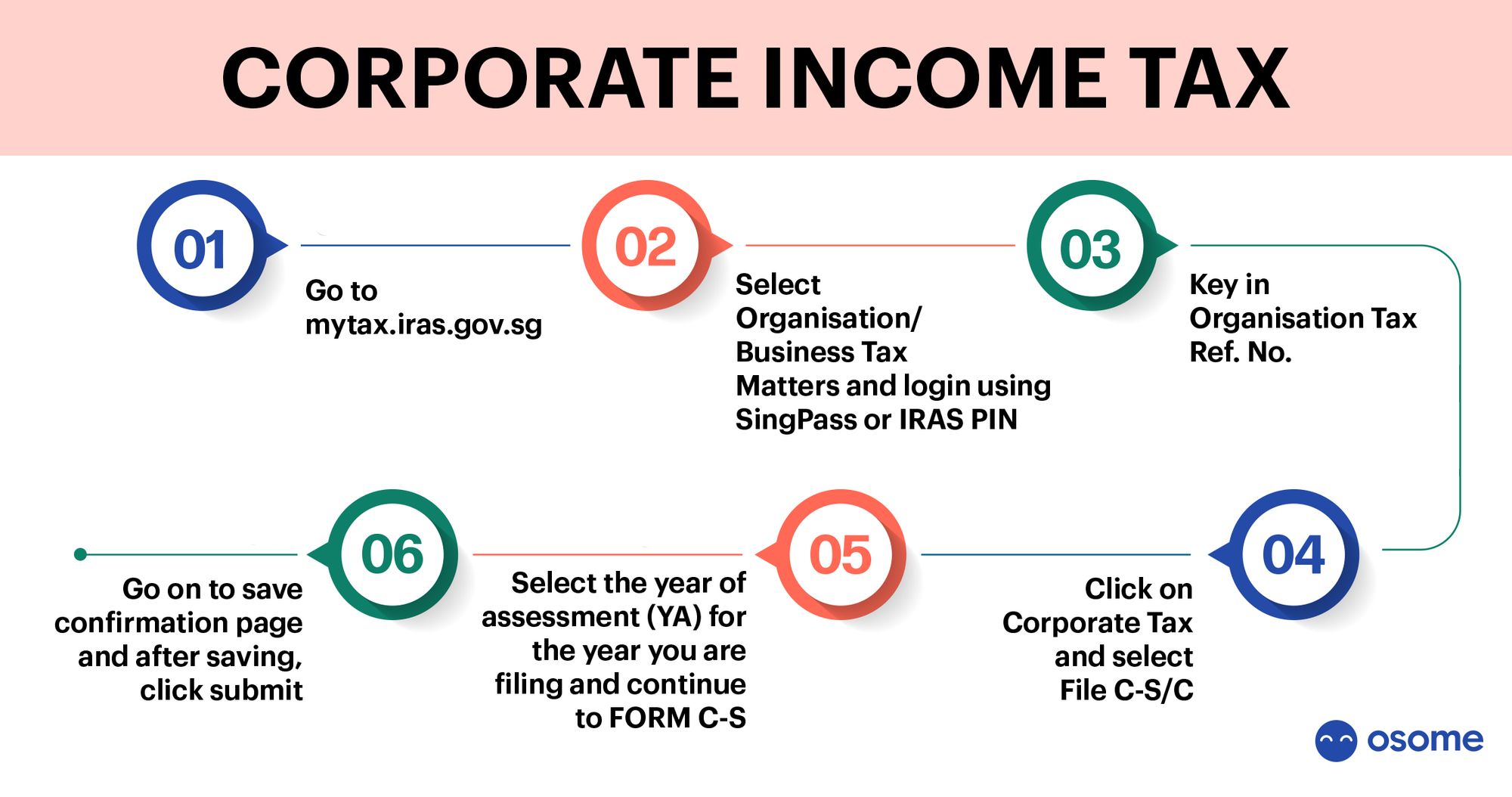

Web Basics of Corporate Income Tax Corporate Income Tax Filing Season 2023 Basic Guide to Corporate Income Tax for Companies New Company Start Up Kit Tax Residency Web The IRAS guidance states that the following payments are taxable in the hands of employers as the amounts are considered revenue receipts for businesses

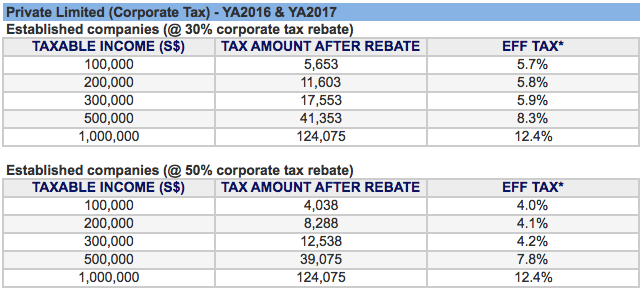

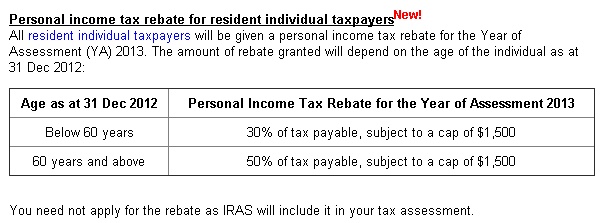

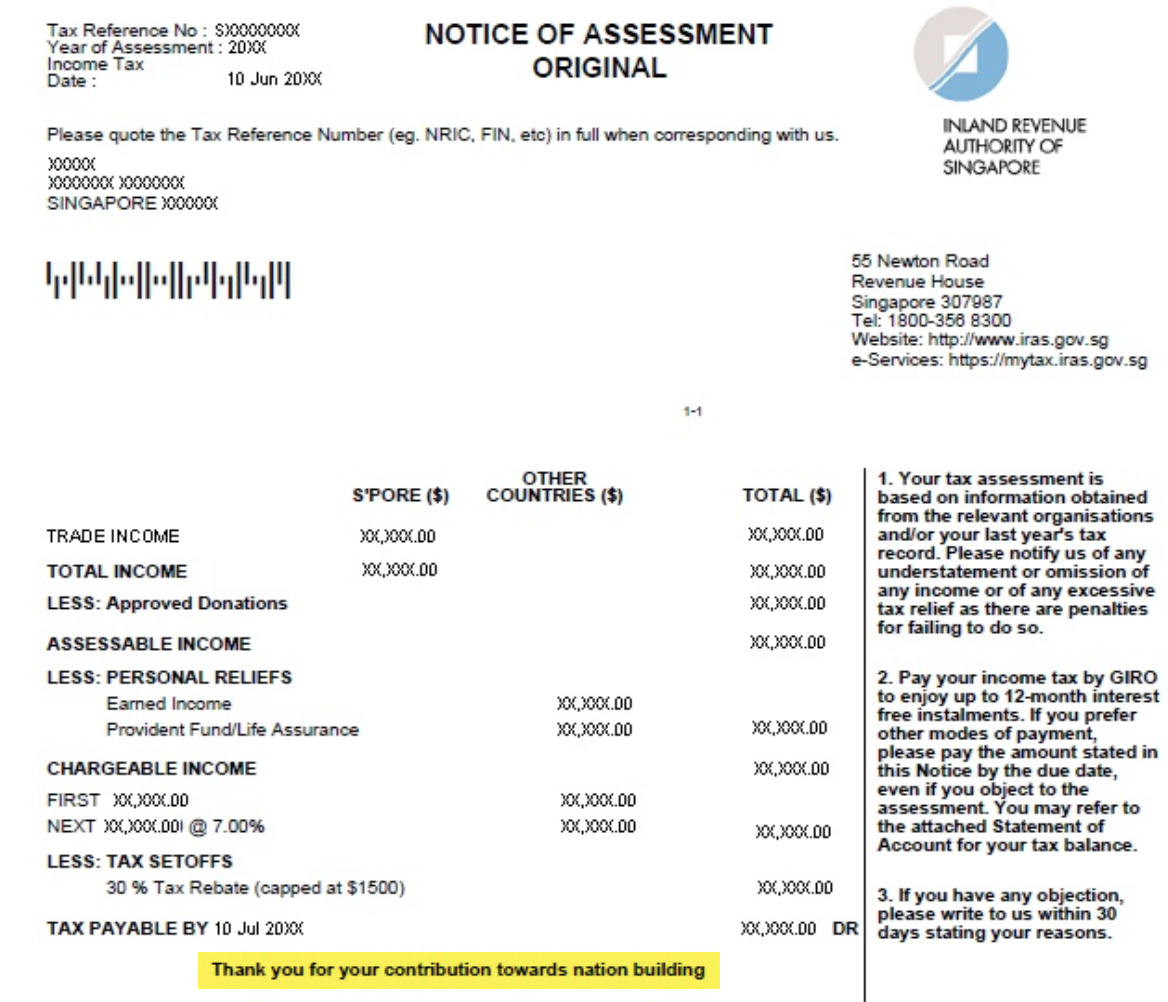

Web 10 janv 2023 nbsp 0183 32 Corporate Income Tax rebates are given to companies to ease their business costs and to support their restructuring These rebates are applicable for the Web For the Years of Assessments YA 2016 and 2017 all corporations get a 50 percent rebate on all corporate tax The rebate is capped at S 20 000 per YA In assisting firms by

Download Iras Corporate Tax Rebate

More picture related to Iras Corporate Tax Rebate

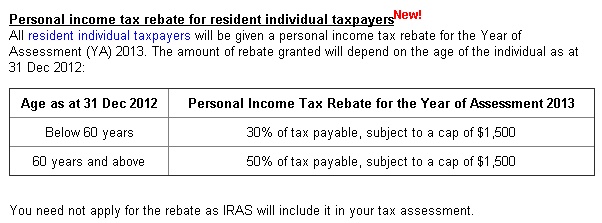

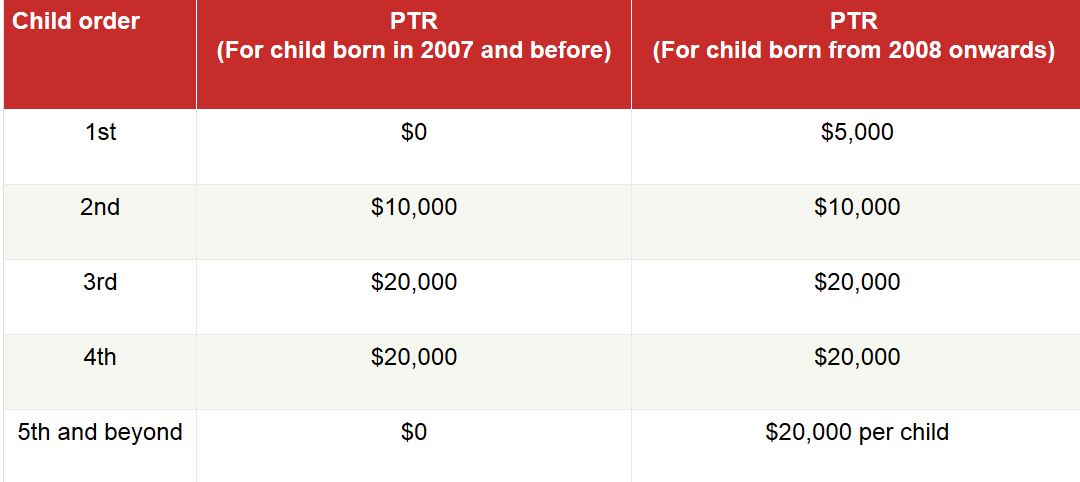

10 Things All Working Mums Should Know

https://thenewageparents.com/wp-content/uploads/2015/04/Parenthood-tax-rebate.jpg

Tax Evasion What Happens If You Don t Report Your Taxes Accurately

https://s.yimg.com/ny/api/res/1.2/seZil2ojOF5D2zZe_qWddw--/YXBwaWQ9aGlnaGxhbmRlcjt3PTY0MDtoPTUyMg--/https://media.zenfs.com/en/dollarsandsense.sg/f2a67cad2dde792be667d8f24a945238

3 Ways For Fast And Easy Filing This Corporate Tax Season 2022 SME

https://www.smehorizon.com/wp-content/uploads/2022/10/IRAS-Tax-image.png

Web 13 d 233 c 2019 nbsp 0183 32 Individuals employees or sole proprietors and companies are required to file annual income tax returns to the Inland Revenue Authority of Singapore IRAS and pay income tax at the prevailing Web 30 juil 2021 nbsp 0183 32 Corporate Tax Rates Budget 2021 Update Corporate Income Tax Rebate As announced in Budget 2021 there will no longer be corporate income tax rebate in

Web 8 sept 2023 nbsp 0183 32 IR 2023 166 Sept 8 2023 Capitalizing on Inflation Reduction Act funding and following a top to bottom review of enforcement efforts the Internal Revenue Web Since you took the withdrawal before you reached age 59 1 2 unless you met one of the exceptions you will need to pay an additional 10 tax on early distributions on your

2020 Singapore Corporate Tax Update Singapore Taxation

https://www.paulhypepage.my/wp-content/uploads/2020/05/Infographic-Tax-Corporate-Relief-Singapore-New-Startup.jpg

Letter From IRAS On Tax Reliefs And Rebate

https://i2.wp.com/financesmiths.com/wp-content/uploads/2020/01/tax.jpg?fit=1024%2C685

https://www.iras.gov.sg/taxes/corporate-income-tax/basics-of-corporate...

Web Singapore s Corporate Income Tax rate is 17 Expand all Definition of a Company Basis Period amp Year of Assessment Corporate Income Tax Rate Corporate Income Tax Filing

https://www.iras.gov.sg/taxes/corporate-income-tax/income-deductions...

Web As announced in Budget 2023 under the Enterprise Innovation Scheme EIS an additional 300 tax deduction is granted on the first 400 000 of qualifying training expenditure

Corporate Tax Rebate Budget 2022 Rebate2022

2020 Singapore Corporate Tax Update Singapore Taxation

Basic Format Of Tax Computation For An Investment Holding IRAS

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

Donation Exemption For Income Tax Malaysia Amy Dyer

Singapore Company s Annual Filing Requirements ACRA IRAS

Singapore Company s Annual Filing Requirements ACRA IRAS

CPF RSTU Is It Worth It TheFinance sg

Pin By Xeno Phrenia On Capitalism Is The Crisis 02 Corporate

Hi Noticed A Handful Of People Are Clueless About Income Tax Thought

Iras Corporate Tax Rebate - Web Basics of Corporate Income Tax Corporate Income Tax Filing Season 2023 Basic Guide to Corporate Income Tax for Companies New Company Start Up Kit Tax Residency