Iras Individual Tax Rebate Web Qualifying for rebate PTR is given to tax residents to encourage them to have more children To qualify you must be a Singapore tax resident who is married divorced or

Web 11 f 233 vr 2022 nbsp 0183 32 An individual taxpayer is are eligible for personal reliefs and rebates if he she is a Singapore Tax Resident and fulfilled the qualifying conditions of the reliefs Web 10 mai 2021 nbsp 0183 32 L imposition des indemnit 233 s de d 233 part en retraite est 224 g 233 om 233 trie variable Leur taxation d 233 pend des conditions dans lesquelles s effectue le d 233 part

Iras Individual Tax Rebate

Iras Individual Tax Rebate

https://i1.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-25-at-11.16.02-PM.png?resize=645%2C267&ssl=1

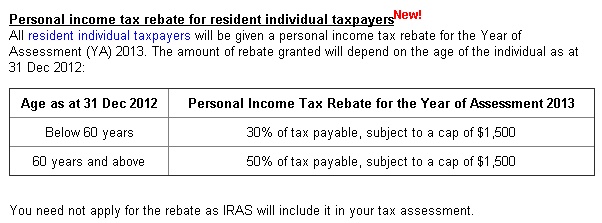

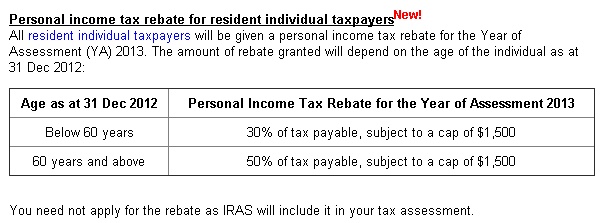

Bulicenas Singapore Tax Rebates

https://2.bp.blogspot.com/-mWIID9_ikkA/UVBehKRVxiI/AAAAAAAABhY/Ld9isw9tW0E/s1600/IRAS+tax+rebate.jpg

Random Thoughts Does Donating Money Actually Save You More Money From

https://medicine.nus.edu.sg/giving/wp-content/uploads/sites/8/2020/04/Illustration-3-5-1024x558-1.jpg

Web The maximum CPF Cash Top up Relief per Year of Assessment is 16 000 maximum 8 000 for self and maximum 8 000 for family members From Year of Assessment Web 30 nov 2022 nbsp 0183 32 For the table above the full contribution limit is 6 000 for 2022 and 6 500 for 2023 In addition individuals 50 years old and older qualify for an additional 1 000

Web Ce dernier va d 233 pendre de la nature des revenus d 233 clar 233 s Pour une indemnit 233 de d 233 part il s agira du coefficient 4 Gr 226 ce 224 ce syst 232 me le contribuable ne risque pas de changer de Web 14 oct 2019 nbsp 0183 32 Certains retrait 233 s peuvent 234 tre exon 233 r 233 s de l imp 244 t sur le revenu Ces exon 233 rations concernent les personnes qui touchent le minimum vieillesse et celles dont

Download Iras Individual Tax Rebate

More picture related to Iras Individual Tax Rebate

Is Property Tax Rebate Taxable Iras PRORFETY

https://d2vlcm61l7u1fs.cloudfront.net/media/502/50247e5c-d72c-4517-9924-8b71344944f7/phpBXgEDI.png

Is Property Tax Rebate Taxable Iras PRORFETY

https://www.growfinancial.org/wp-content/uploads/2021/02/TaxeStrategies_Newsletter_Header_012221-03.png

Asiapedia IRAS 2017 Singapore Personal Income Tax Dezan Shira

https://www.asiabriefing.com/site-mgmt/userfiles/resources/infographic/2015/05/Personal_Income_Tax_Singapore_for_2017.png

Web 2 juin 2023 nbsp 0183 32 Annual employee contribution limit 2022 20 500 Additional catch up contributions for those age 50 and older 2022 6 500 Income limits for Web 23 nov 2020 nbsp 0183 32 23 novembre 2020 Pour les accidents mat 233 riels qui surviendront en 2021 le montant du forfait IRSA atteindra 1 678 euros pour une responsabilit 233 224 100 et 839

Web 31 mars 2023 nbsp 0183 32 Fact checked by Ryan Eichler How much you will pay in taxes when you withdraw money from an individual retirement account IRA depends on the type of Web 9 mars 2023 nbsp 0183 32 If you re in the 24 income tax bracket for instance a 6 500 contribution to an IRA would equal a little more than 1 500 off your tax bill You have until tax day this

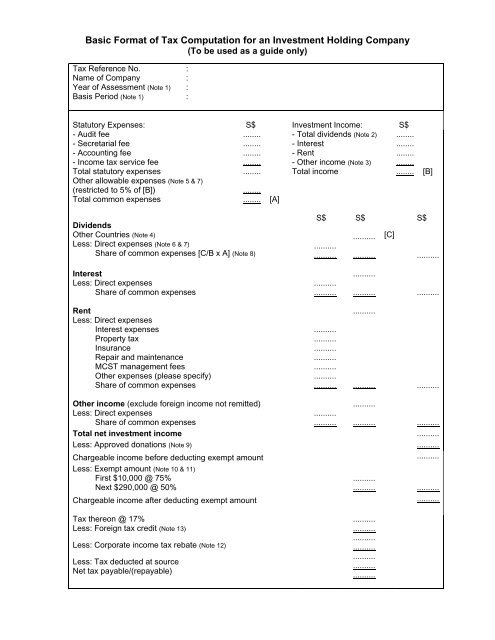

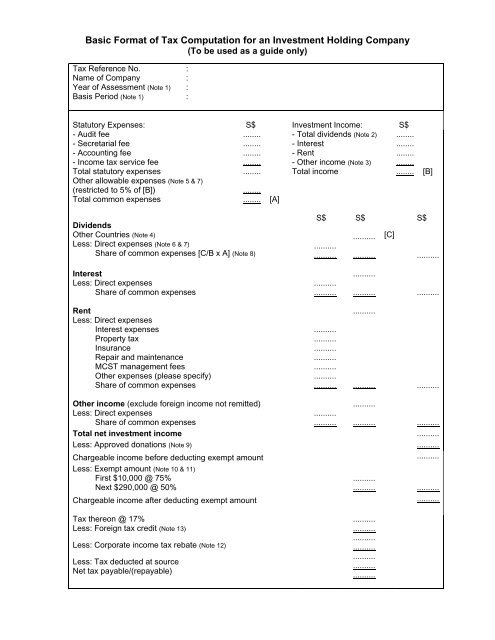

Basic Format Of Tax Computation For An Investment Holding IRAS

https://img.yumpu.com/23502881/1/500x640/basic-format-of-tax-computation-for-an-investment-holding-iras.jpg

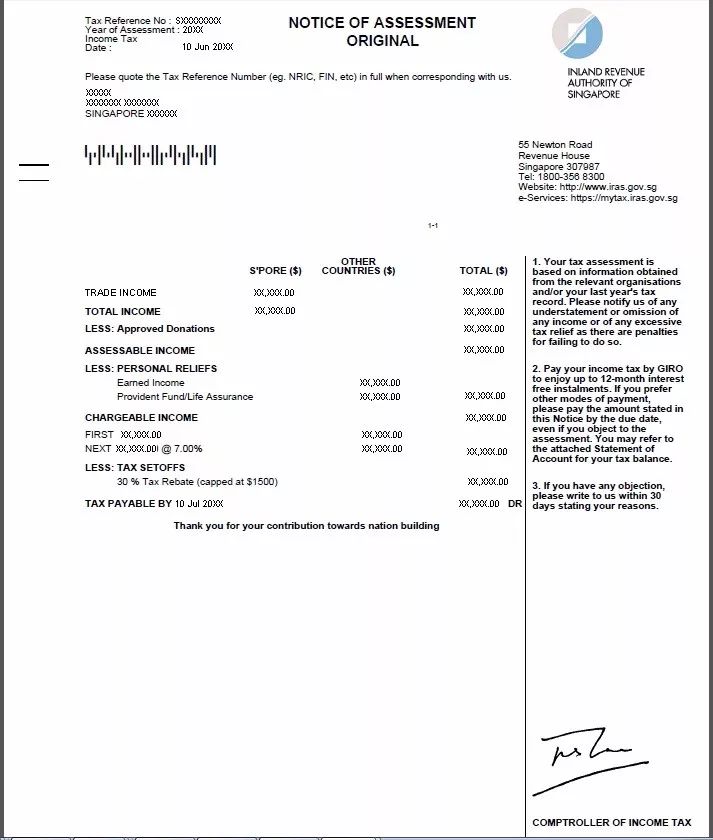

Understanding The Singapore Income Tax Notice Of Assessment NOA

http://18.140.150.233/wp-content/uploads/2020/01/iras-noa.jpg

https://www.iras.gov.sg/taxes/individual-income-tax/basics-of...

Web Qualifying for rebate PTR is given to tax residents to encourage them to have more children To qualify you must be a Singapore tax resident who is married divorced or

http://ehluar.com/main/2022/02/11/personal-tax-reliefs-and-rebates-iras...

Web 11 f 233 vr 2022 nbsp 0183 32 An individual taxpayer is are eligible for personal reliefs and rebates if he she is a Singapore Tax Resident and fulfilled the qualifying conditions of the reliefs

IRAS Tax Rebate And Defer Your Income Tax Payment

Basic Format Of Tax Computation For An Investment Holding IRAS

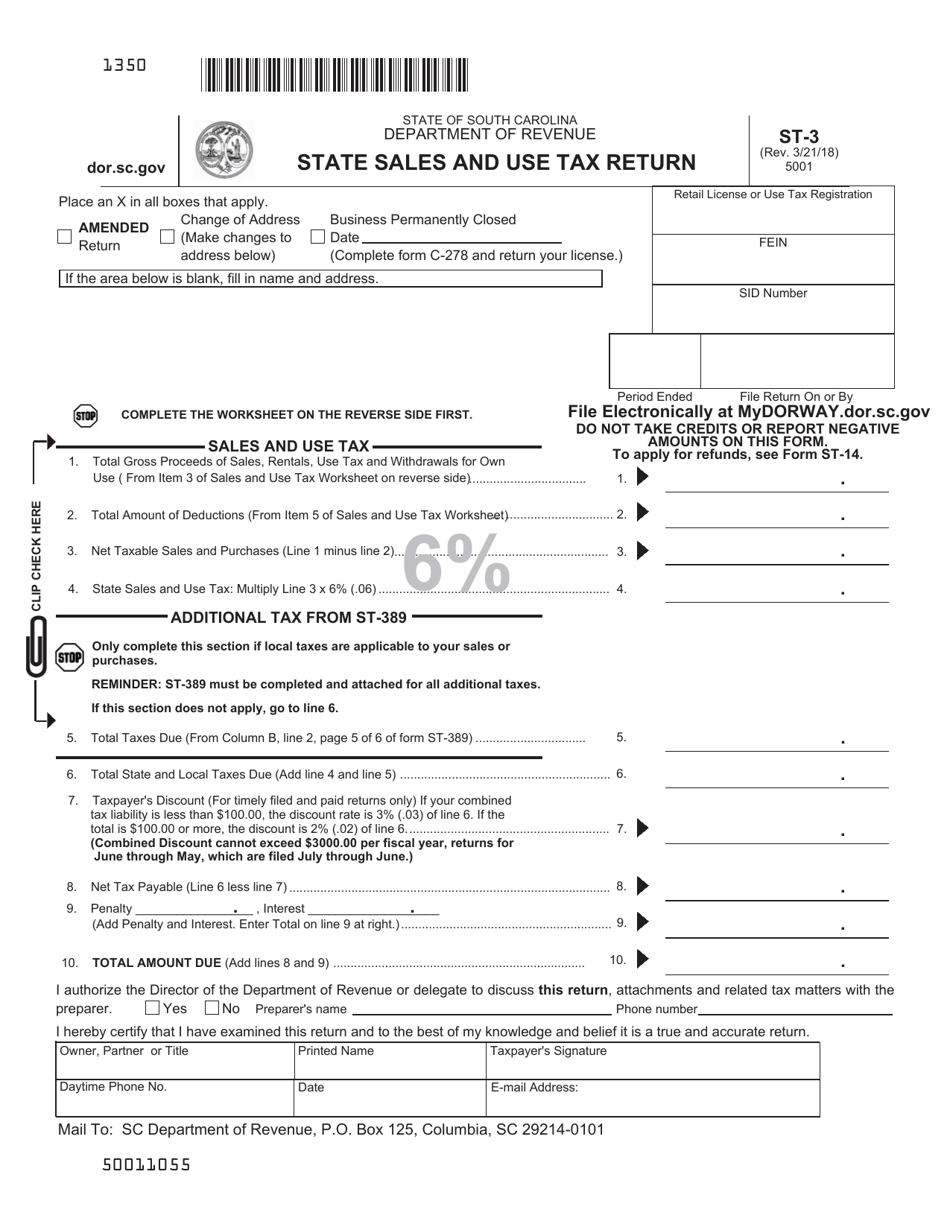

Sales And Use Tax Return Form St John The Baptist Parish Printable

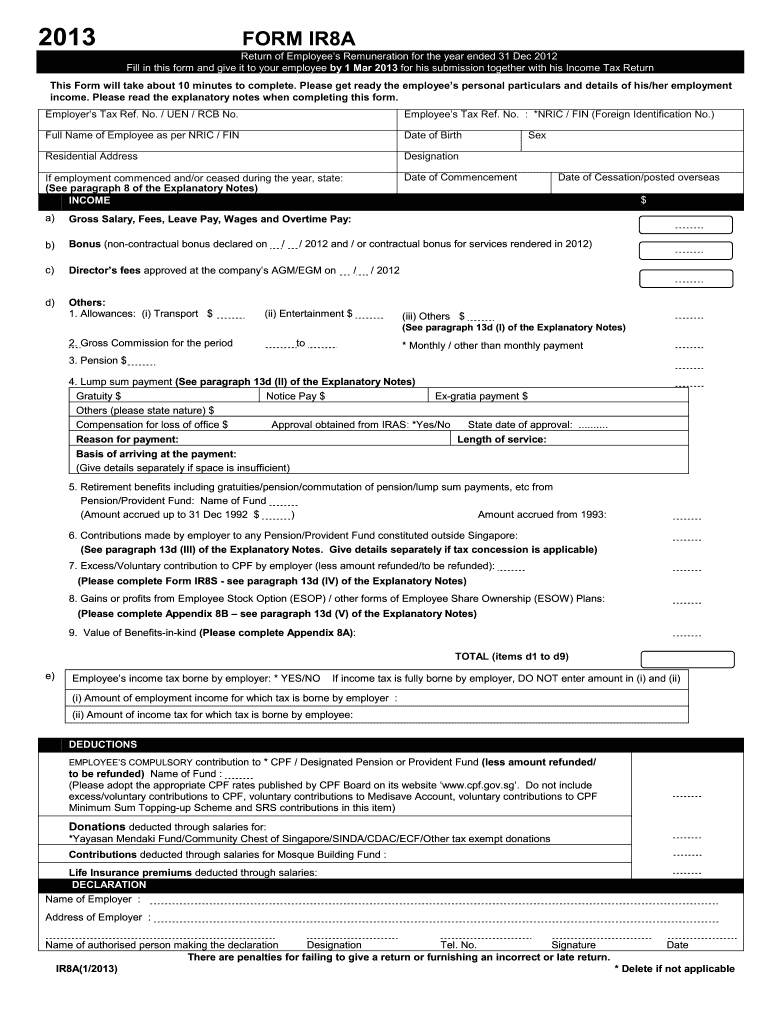

SG IRAS IR8A 2013 Fill And Sign Printable Template Online US Legal

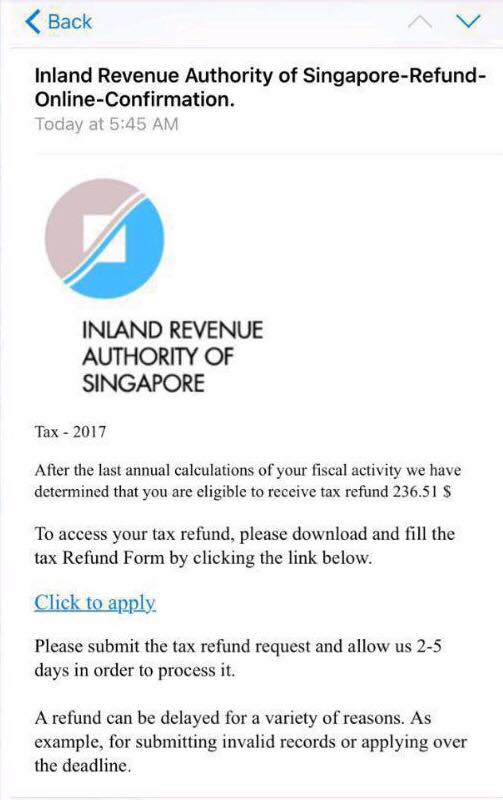

New IRAS Email Scam Involves Asking For Credit Card Details To

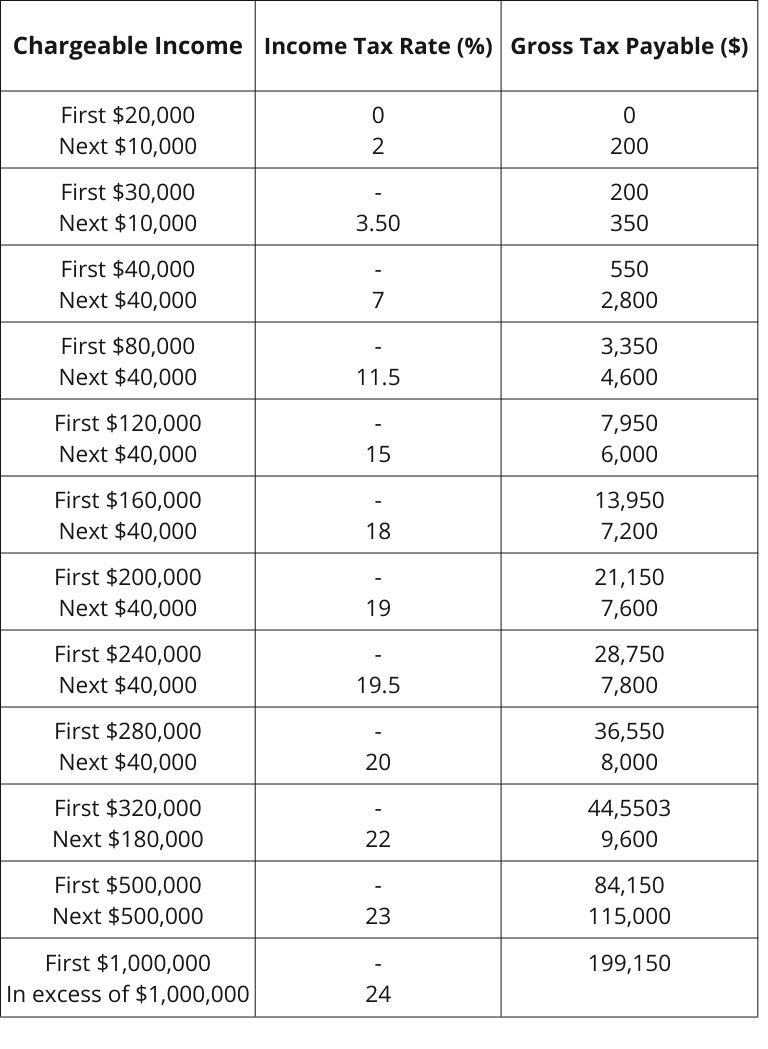

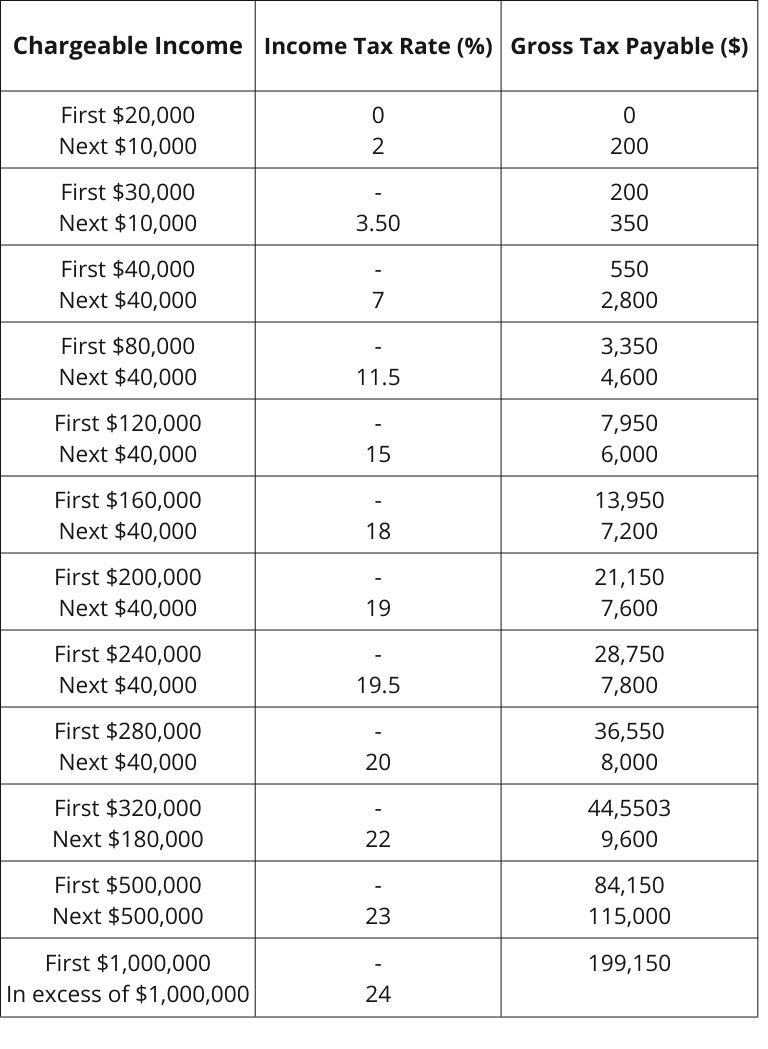

Individual Income Tax Rate Diacron

Individual Income Tax Rate Diacron

Donation Exemption For Income Tax Malaysia Amy Dyer

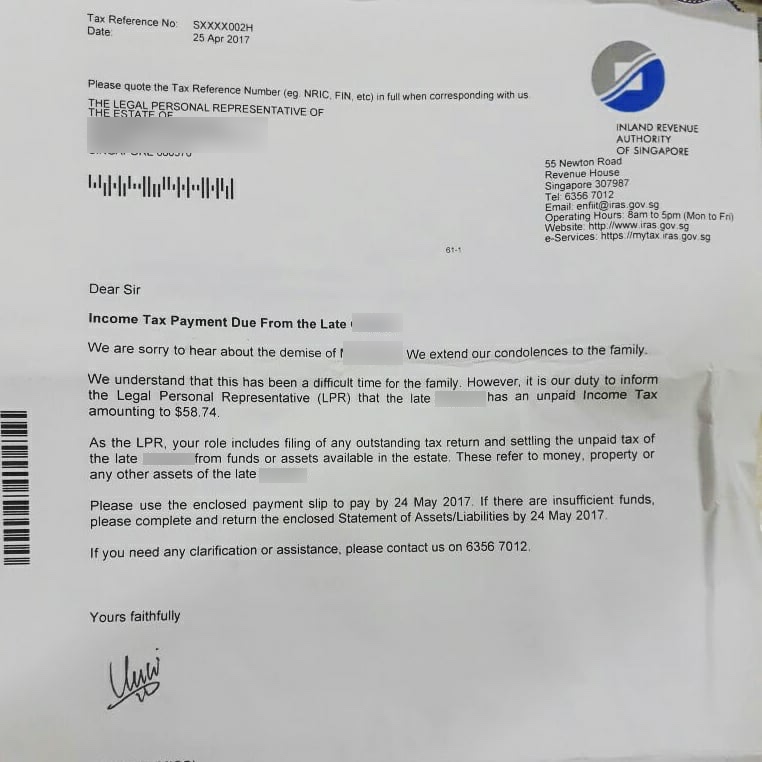

Death And Taxes Man Expresses Annoyance Over IRAS Chasing Him For 58

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

Iras Individual Tax Rebate - Web 14 oct 2019 nbsp 0183 32 Certains retrait 233 s peuvent 234 tre exon 233 r 233 s de l imp 244 t sur le revenu Ces exon 233 rations concernent les personnes qui touchent le minimum vieillesse et celles dont