Iras Tax Deduction For Donation 2 1 IPCs and Grant makers may use this guide to determine whether the contribution which they receive should a be regarded as a donation or sponsorship and b if the contribution is considered a donation whether the donation qualifies for enhanced tax deduction for income tax purposes

Donation of service is not eligible for tax deduction except under the Corporate Volunteer Scheme CVS where businesses that send their employees to volunteer and provide services at IPCs can claim 2 5 times tax deduction on qualifying expenditures Donors must follow the IRS rules for qualified charitable distributions QCDs to avoid paying taxes on the donation These are called charitable IRA rollovers

Iras Tax Deduction For Donation

Iras Tax Deduction For Donation

https://adalawcompliance.com/wp-content/uploads/2021/08/TAX-CREDIT-AND-DEDUCTIONS.png

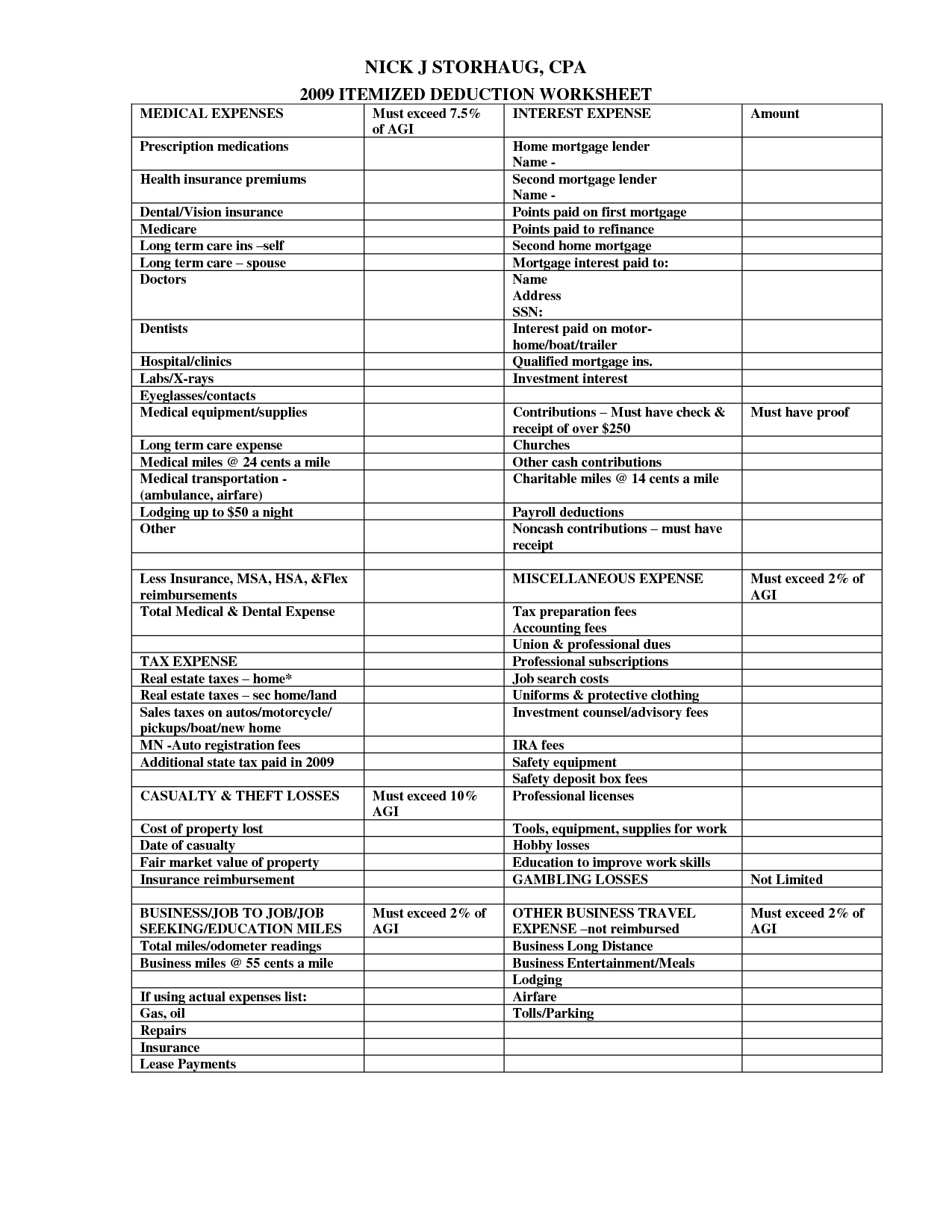

10 Business Tax Deductions Worksheet Worksheeto

https://www.worksheeto.com/postpic/2011/08/tax-itemized-deduction-worksheet_472223.png

IRAS Conditions For Claiming Input Tax 2023

https://www.iras.gov.sg/media/images/default-source/uploadedimages/taxinvoice-rate-change-3.png?sfvrsn=4cf6aad2_4

WASHINGTON The Internal Revenue Service today reminded individual retirement arrangement IRA owners age 70 or over that they can transfer up to 100 000 to charity tax free each year It is always possible to donate retirement assets including IRAs 401 k s and 403 b s 1 by cashing them out paying the income tax attributable to the distribution and then contributing the proceeds to charity

This e Tax Guide sets out the concessionary tax treatment for cash donations made on or after 19 March 2021 with certain benefits received in return and is relevant for Institutions of Public Character IPCs or a registered charity hereinafter Charity The IRAS currently grants a 2 5 times tax deduction1 known hereafter as Making a QCD can benefit the taxpayer by reducing their taxable income while they support qualifying charitable organizations of their choice The taxpayer doesn t have to worry about meeting the standard deduction or itemizing deductions with a QCD Financial institutions report QCDs on Form 1099 R for the calendar year the distribution occurs

Download Iras Tax Deduction For Donation

More picture related to Iras Tax Deduction For Donation

Income Tax Deduction On Donation Who Is Eligible For Deduction U s 80G

https://neerajbhagat.com/blog/wp-content/uploads/2021/09/Gradient113-800x419.png

By Giving Greater Relief To The Highest Earners The Charitable

http://www.wipsociology.org/wp-content/uploads/2018/08/14859716011_234bfe3cdb_k.jpg

Information On Section 80G Of Income Tax Act Ebizfiling

https://ebizfiling.com/wp-content/uploads/2021/12/Section-80G-Deduction.png

Financially donating money from your IRA can confer a significant tax benefit For current retirees under ordinary circumstances you must itemize your taxes in order to take a charitable giving deduction Charitable contribution tax information search exempt organizations eligible for tax deductible contributions learn what records to keep and how to report contributions find tips on making donations

The charitable contributions deduction allows taxpayers to deduct donations of cash and property given to qualified charitable organizations There are Internal Revenue Service IRS limits An Individual Retirement Account IRA is a tax advantaged way to grow your nest egg Here are the key choices to make

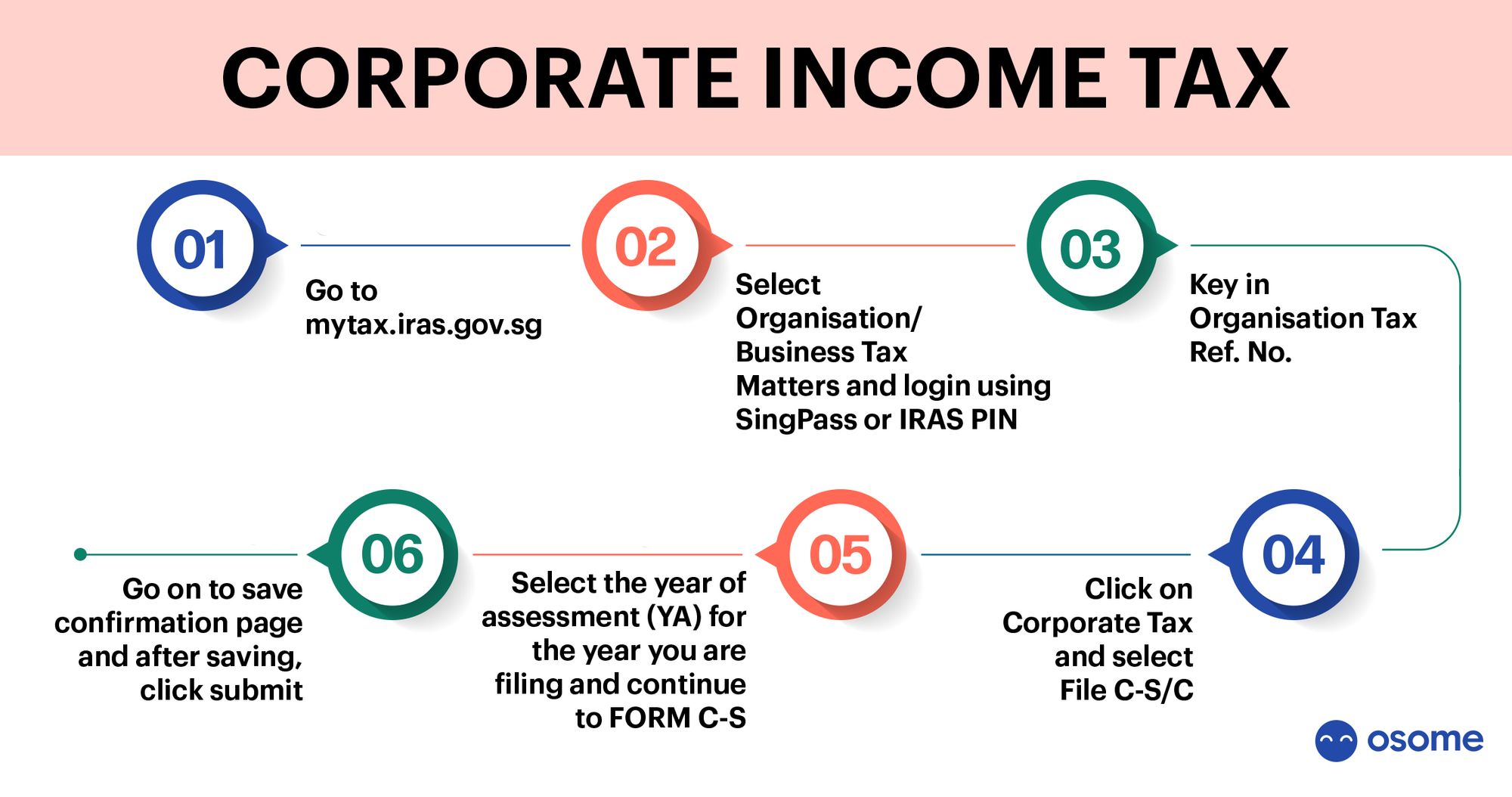

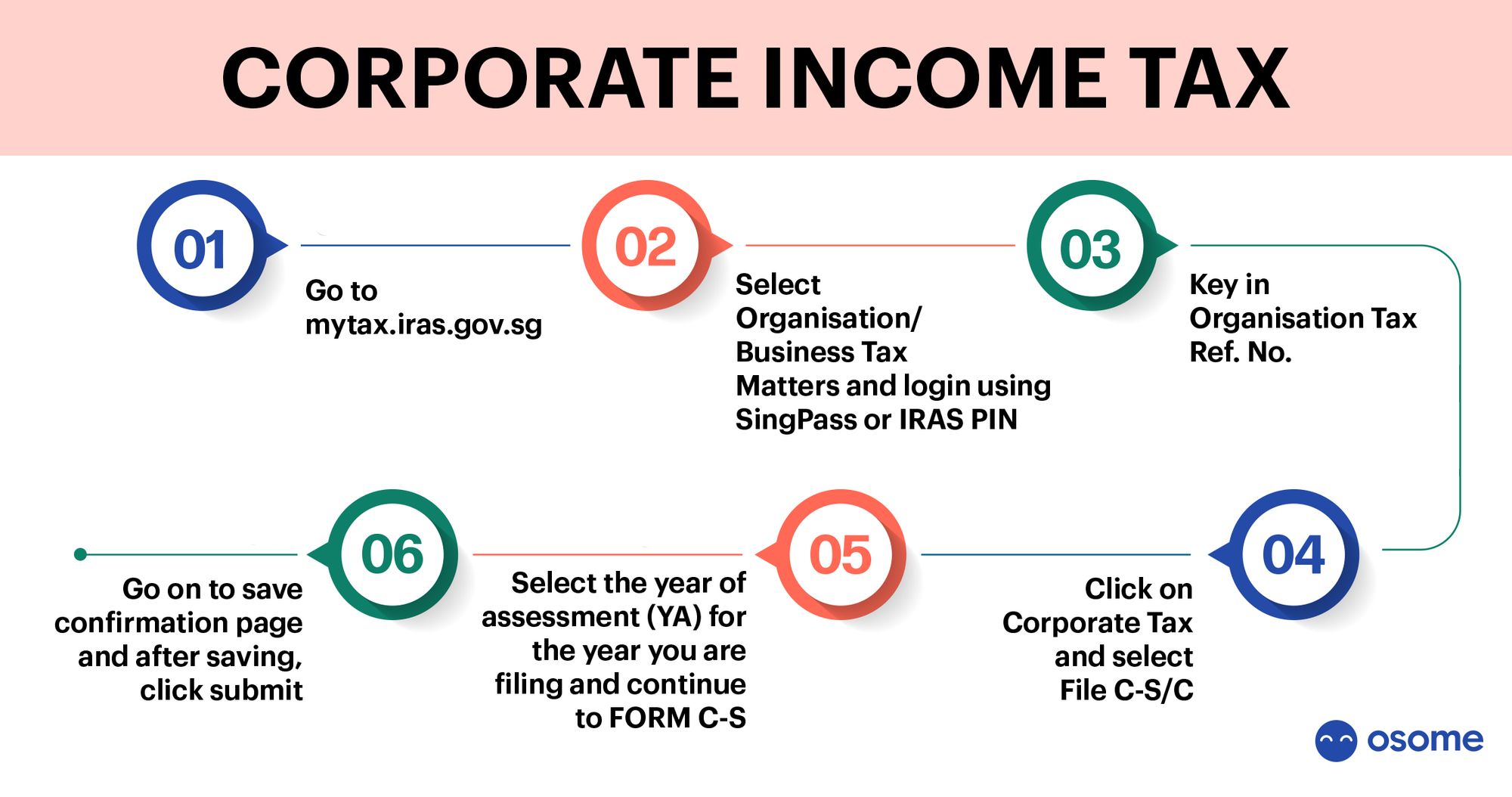

Singapore Company s Annual Filing Requirements ACRA IRAS

https://osome.com/content/images/2021/09/Corporate-Income-Tax-Filing-Process-Scheme.jpeg

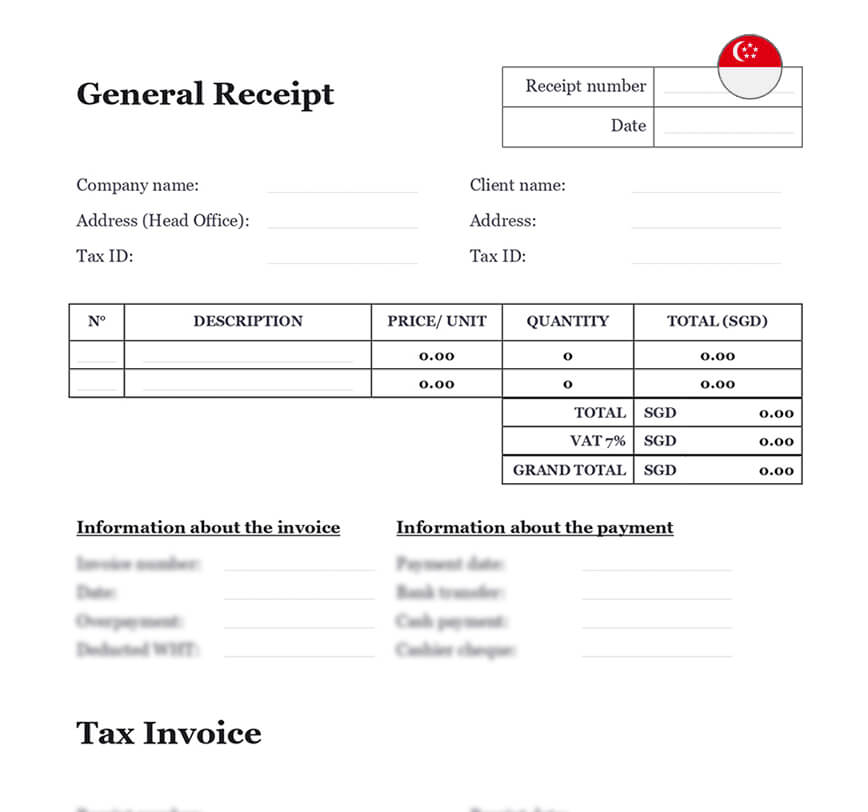

General Receipt Form In Singapore Download Template docx

https://singapore.themispartner.com/wp-content/uploads/general-receipt-singapore.jpg

https://www.iras.gov.sg/media/docs/default-source/...

2 1 IPCs and Grant makers may use this guide to determine whether the contribution which they receive should a be regarded as a donation or sponsorship and b if the contribution is considered a donation whether the donation qualifies for enhanced tax deduction for income tax purposes

https://www.iras.gov.sg/media/docs/default-source/...

Donation of service is not eligible for tax deduction except under the Corporate Volunteer Scheme CVS where businesses that send their employees to volunteer and provide services at IPCs can claim 2 5 times tax deduction on qualifying expenditures

Donation Tax Calculator Giving NUS Yong Loo Lin School Of Medicine

Singapore Company s Annual Filing Requirements ACRA IRAS

Printable Itemized Deductions Worksheet

How To Maximize Your Charity Tax Deductible Donation WealthFit

Get Our Printable Tax Deductible Donation Receipt Template Receipt

IRAS How To Read Your Annual Bill And Valuation Notice

IRAS How To Read Your Annual Bill And Valuation Notice

Chapter VI A 80G Deduction For Donation To Charitable Institution

/tax-deduction-for-charitable-donations-57a5e46a3df78cf459cd2099.jpg)

Charitable Giving Take Advantage Of The Tax Deduction

This Year Only Tax Deductible Donations Aren t Just For Itemizers

Iras Tax Deduction For Donation - Making a QCD can benefit the taxpayer by reducing their taxable income while they support qualifying charitable organizations of their choice The taxpayer doesn t have to worry about meeting the standard deduction or itemizing deductions with a QCD Financial institutions report QCDs on Form 1099 R for the calendar year the distribution occurs