Iras Tax Rebate Child Web QCR HCR WMCR is capped at 50 000 per child QCR HCR regardless of whether it is claimed by the father or mother will be allowed first WMCR will be limited to the

Web The WMCR amount is matched to a percentage of the mother s earned income 1st child 15 2nd child 20 3rd and subsequent child 25 for each child The total cap for Web 20 mai 2022 nbsp 0183 32 Topic H Reconciling Your Advance Child Tax Credit Payments on Your 2021 Tax Return Updated questions 1 2 9 and removed 10 Topic J Unenrolling from

Iras Tax Rebate Child

Iras Tax Rebate Child

https://pbs.twimg.com/media/Ft8kx5BXsAA6KQg.jpg

How Do I Claim The 600 Stimulus Payment For My Child That Was Born In 2020

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/660748cf-cd8f-4a74-ad8f-1bdc5f0a7f04.default.png

How Much Tax Savings For A Child Tax Walls

https://i0.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/53287756_1898285556949795_4177201277018570752_n-1.jpg?resize=654%2C960&ssl=1

Web 15 juil 2021 nbsp 0183 32 IR 2021 153 July 15 2021 WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have Web 28 mars 2023 nbsp 0183 32 If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount you re eligible to claim To

Web 28 d 233 c 2021 nbsp 0183 32 Economic Impact Payments Recovery Rebate Credit For those who received EIPs in early 2022 watch for and keep Letter 6475 that will show the total Web 7 sept 2023 nbsp 0183 32 The new limits include an increase from 5 000 to 8 000 in the first 13 weeks of enrollment in a qualifying educational program full time studies and from 2 500 to

Download Iras Tax Rebate Child

More picture related to Iras Tax Rebate Child

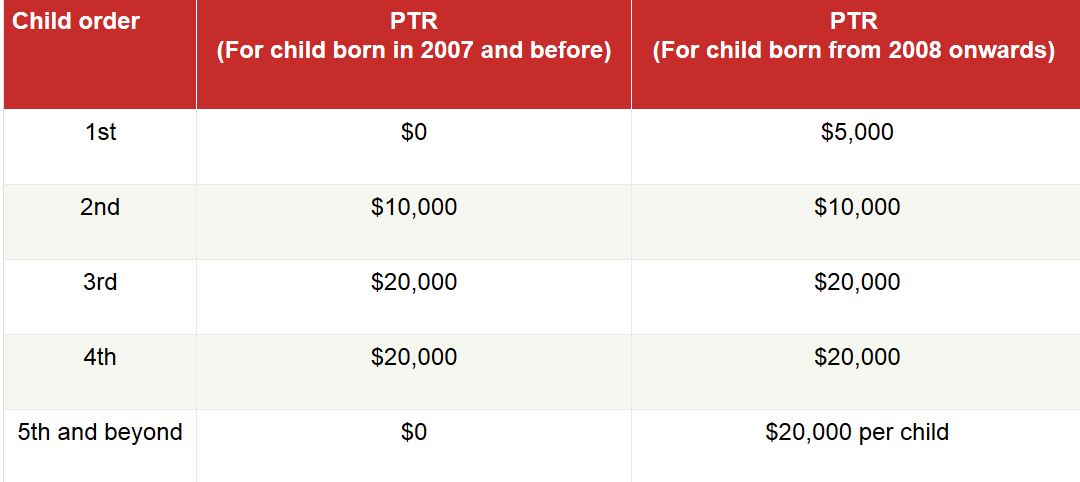

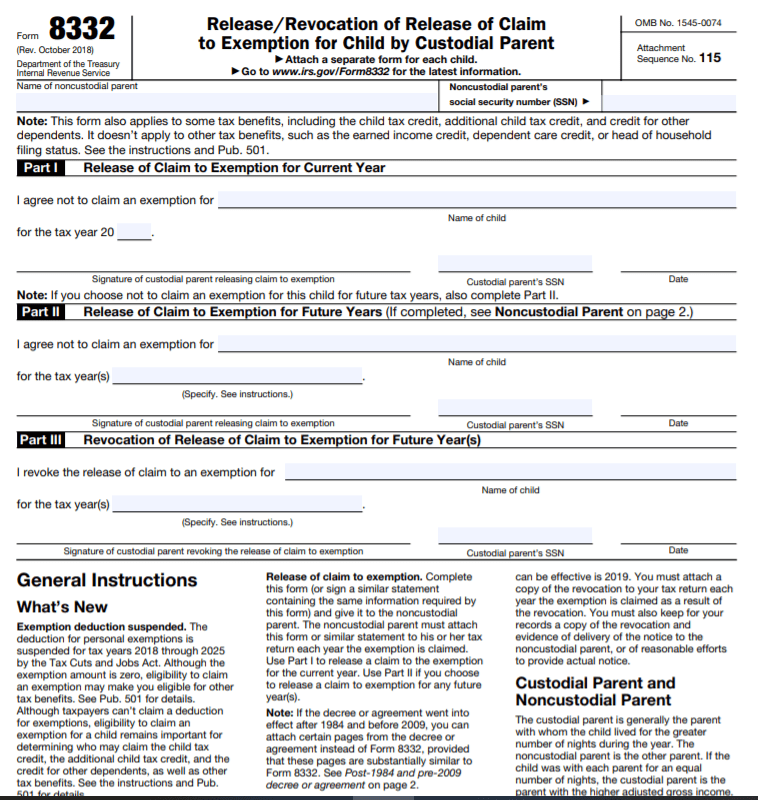

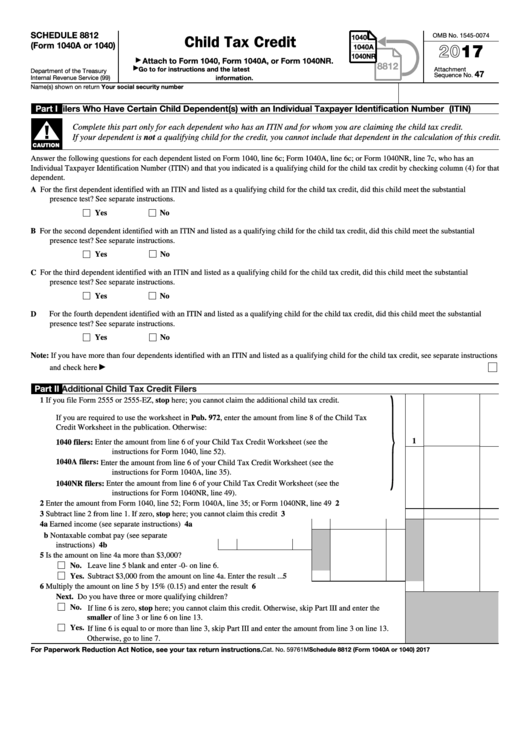

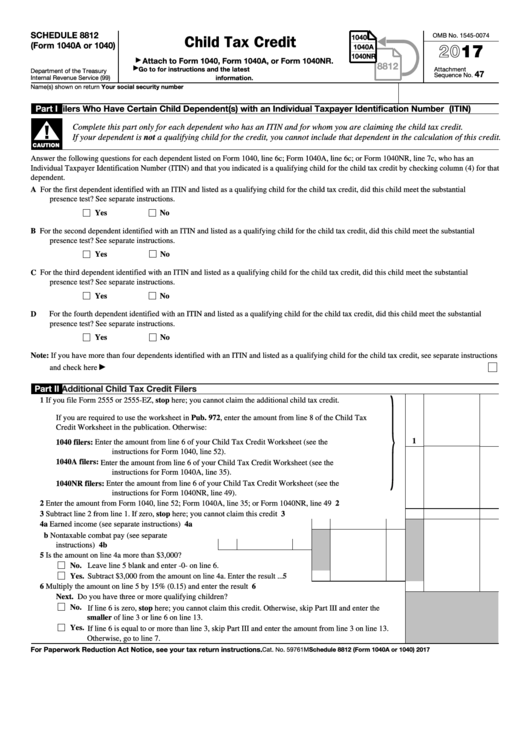

Child Tax Credits Form IRS Free Download

https://www.formsbirds.com/formimg/child-tax-credits-form/781/child-tax-credits-form-irs-l1.png

MP Tries 3 Times For Tax Rebate And Child Relief For Single Unwed

https://theindependent.sg/wp-content/uploads/2020/02/Screen-Shot-2020-02-29-at-12.34.17-PM-1024x450.png

Are YOU Eligible For The CT Child Tax Rebate

https://www.cthousegop.com/ackert/wp-content/uploads/sites/3/2022/06/Child-Tax-Rebate-July-2022.png

Web 30 mai 2023 nbsp 0183 32 quot If a child keeps a Roth until age 59 189 under today s rules any withdrawal will be tax free In retirement they would likely be in a much higher bracket so would Web 13 janv 2022 nbsp 0183 32 If no one can claim you as a dependent for 2021 and you are otherwise eligible you can claim the 2021 Recovery Rebate Credit on your 2021 tax return

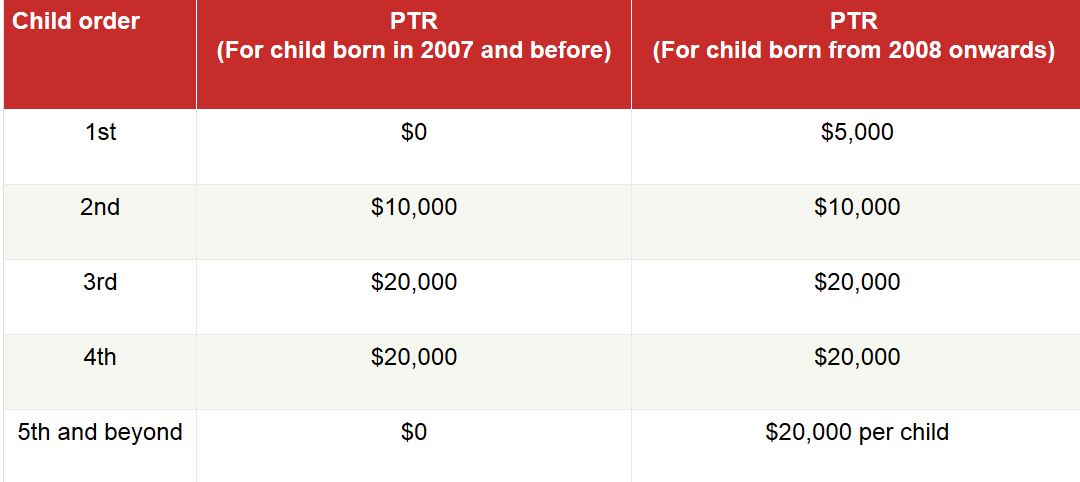

Web IRAs and the Kiddie Tax Under the kiddie tax rules for 2012 the investment income of a child 1 who is under the age of 18 regardless of the amount of the child s earned Web The amount of rebate is as follows 3rd amp subsequent children The PTR can be offset against either or your spouse s income tax

10 Things All Working Mums Should Know

https://thenewageparents.com/wp-content/uploads/2015/04/Parenthood-tax-rebate.jpg

IRAS Tax Savings For Married Couples And Families

https://www.iras.gov.sg/media/images/default-source/uploadedimages/pages/tax-savings.png?sfvrsn=80db0649_0

https://www.iras.gov.sg/taxes/individual-income-tax/basics-of...

Web QCR HCR WMCR is capped at 50 000 per child QCR HCR regardless of whether it is claimed by the father or mother will be allowed first WMCR will be limited to the

https://www.iras.gov.sg/taxes/individual-income-tax/basics-of...

Web The WMCR amount is matched to a percentage of the mother s earned income 1st child 15 2nd child 20 3rd and subsequent child 25 for each child The total cap for

Child Tax Credits Form IRS Free Download

10 Things All Working Mums Should Know

Child Tax Credits Irs 3 Ways To Claim A Child Tax Credit WikiHow

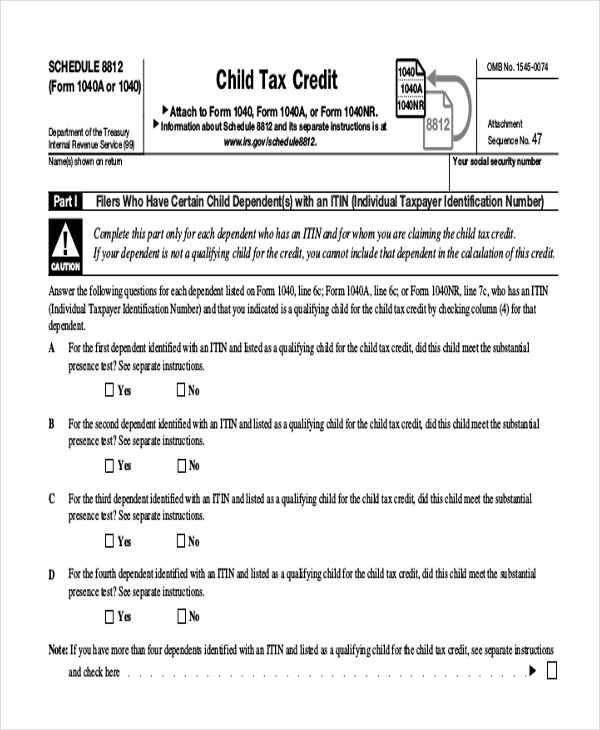

2020 Form IRS 1040 Schedule 8812 Fill Online Printable Fillable

IRS Form 8332 How Can I Claim A Child The Handy Tax Guy

Worksheet 8812

Worksheet 8812

Child Tax Credit Worksheet Claiming The Recovery Rebate Credit

IRAS The Parenthood Tax Rebate And Qualifying Child Facebook

Irs Child Tax Credit Problems Alreda

Iras Tax Rebate Child - Web 28 mars 2023 nbsp 0183 32 If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount you re eligible to claim To