Iras Tax Rebate For Company Web 10 janv 2023 nbsp 0183 32 Corporate Income Tax Rate Your company is taxed at a flat rate of 17 of its chargeable income This applies to both local and foreign companies Corporate

Web 22 juil 2022 nbsp 0183 32 Tax credits if any are also computed at the sub fund level Certain common tax rules are applied separately at the umbrella and sub fund levels Unabsorbed capital Web The Inland Revenue Authority of Singapore IRAS reduces your tax bill based on your company s chargeable income amount and business status Corporate Income Tax

Iras Tax Rebate For Company

Iras Tax Rebate For Company

https://www.legacytaxresolutionservices.com/2255lega/250w/cp12renglishpage001.png

Is Property Tax Rebate Taxable Iras PRORFETY

https://www.growfinancial.org/wp-content/uploads/2021/02/TaxeStrategies_Newsletter_Header_012221-03.png

10 Things All Working Mums Should Know

https://thenewageparents.com/wp-content/uploads/2015/04/Parenthood-tax-rebate.jpg

Web Under the Coronavirus Aid Relief and Economic Security Act CARES Act as originally enacted March 27 2020 the Employee Retention Credit is a refundable tax credit Web The annual contribution limit for 2023 is 6 500 or 7 500 if you re age 50 or older 2019 2020 2021 and 2022 is 6 000 or 7 000 if you re age 50 or older The annual

Web Basic Guide to Corporate Income Tax for Companies New Company Start Up Kit Tax Residency of a Company Certificate of Residence Record Keeping Requirements Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can

Download Iras Tax Rebate For Company

More picture related to Iras Tax Rebate For Company

IRS CP 11R Recovery Rebate Credit Balance Due

https://www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

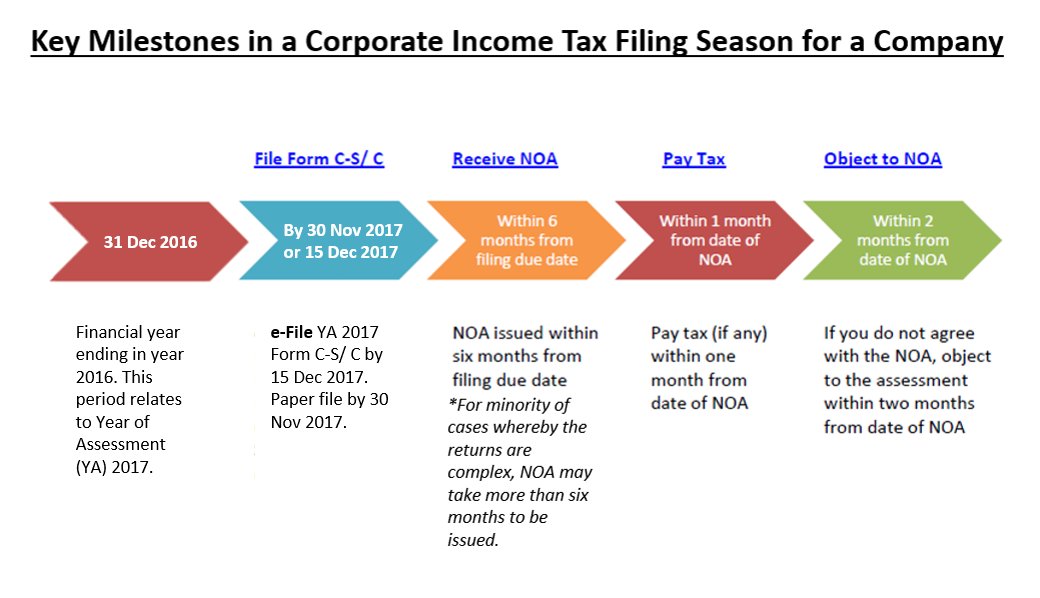

IRAS On Twitter Filed Your Company s Income Tax And Not Sure What s

https://pbs.twimg.com/media/DQwJTtpUIAASWA2.jpg

IRAs Demystified Roth IRAs Traditional IRAs 401Ks

https://s3.amazonaws.com/static-assets.m1finance.com/wp-content/uploads/2019/01/14194426/IRA-tax-deductible-contributions-1.jpg

Web 18 f 233 vr 2020 nbsp 0183 32 If a company s chargeable income is SGD250 000 for YA2020 the total income exempted from tax would be SGD125 000 SGD75 000 SGD 50 000 and final Web 8 sept 2023 nbsp 0183 32 IR 2023 166 Sept 8 2023 Capitalizing on Inflation Reduction Act funding and following a top to bottom review of enforcement efforts the Internal Revenue

Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed Web On 20 July 2020 the Inland Revenue Authority of Singapore IRAS published on its website guidance on the tax treatment of many of the support measures introduced to assist

How Do I Claim The Recovery Rebate Credit On My Ta

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/e3d7f0ce-2b70-4164-b921-f7ef2ca8a52f.default.png

Government Rebate Program Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/11/983/11983077/large.png

https://joduct.com/article/iras-corporate-tax-rates

Web 10 janv 2023 nbsp 0183 32 Corporate Income Tax Rate Your company is taxed at a flat rate of 17 of its chargeable income This applies to both local and foreign companies Corporate

https://www.incorp.asia/singapore/guides/vcc-tax-treatment-page

Web 22 juil 2022 nbsp 0183 32 Tax credits if any are also computed at the sub fund level Certain common tax rules are applied separately at the umbrella and sub fund levels Unabsorbed capital

IRS 1040 NonFilers Stimulus Check Recovery Rebate Credit Walk Through

How Do I Claim The Recovery Rebate Credit On My Ta

Illinois Unemployment 941x Fill Out Sign Online DocHub

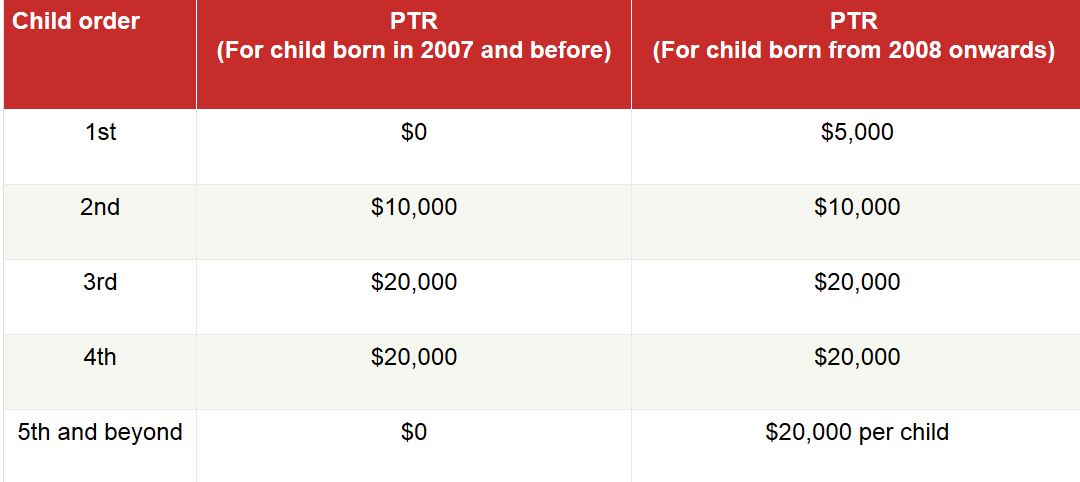

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

Iras Singapore Tax What Iras Wants To Know About Your Company Blog

1099 Form Ohio Printable Printable World Holiday

1099 Form Ohio Printable Printable World Holiday

3 Ways For Fast And Easy Filing This Corporate Tax Season 2022 SME

Recovery Rebate Credit Worksheet Example Studying Worksheets

IRAS Tax Savings For Married Couples And Families

Iras Tax Rebate For Company - Web The annual contribution limit for 2023 is 6 500 or 7 500 if you re age 50 or older 2019 2020 2021 and 2022 is 6 000 or 7 000 if you re age 50 or older The annual