Iras Tax Rebate For Working Mother Web Working Mother s Child Relief WMCR You can claim WMCR if you have earned income The WMCR amount is matched to a percentage of the mother s earned income 1st

Web During Tax Season 2023 the tax reliefs for working mothers help shave a little off the tax bill Boon Hui has claimed reliefs including the Working Mother s Child Relief Qualifying Web If you are a working mother and have met all the conditions for Working Mother s Child Relief WMCR you may claim QCR HCR and WMCR on the same child QCR HCR

Iras Tax Rebate For Working Mother

Iras Tax Rebate For Working Mother

https://i2.wp.com/heartlandboy.com/wp-content/uploads/Child-Related-Reliefs-1.jpg?ssl=1

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i1.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-25-at-11.16.02-PM.png?resize=645%2C267&ssl=1

Tax Relief For Parents In Singapore

https://thenewageparents.com/wp-content/uploads/2015/03/Working-mothers-tax-relief.jpg

Web 17 f 233 vr 2023 nbsp 0183 32 According to IRAS to claim the Working Mother s Child Relief WMCR you must Be a working mother who is married divorced or widowed Single or male Web 8 mars 2023 nbsp 0183 32 Say a working mother with an annual income of S 40 000 can only claim S 6 000 in WMCR for her child with the current scheme to reduce her taxable income to S 34 000 After 1 January 2024 the

Web 13 d 233 c 2019 nbsp 0183 32 The Inland Revenue Authority of Singapore IRAS provides the Working Mother s Child Relief WMCR to working mothers in Singapore as a part of its personal tax relief programme The main Web 26 sept 2022 nbsp 0183 32 Get tax relief as a working mother in Singapore Learn about the Working Mother s Child Relief WMCR and how to qualify for this program

Download Iras Tax Rebate For Working Mother

More picture related to Iras Tax Rebate For Working Mother

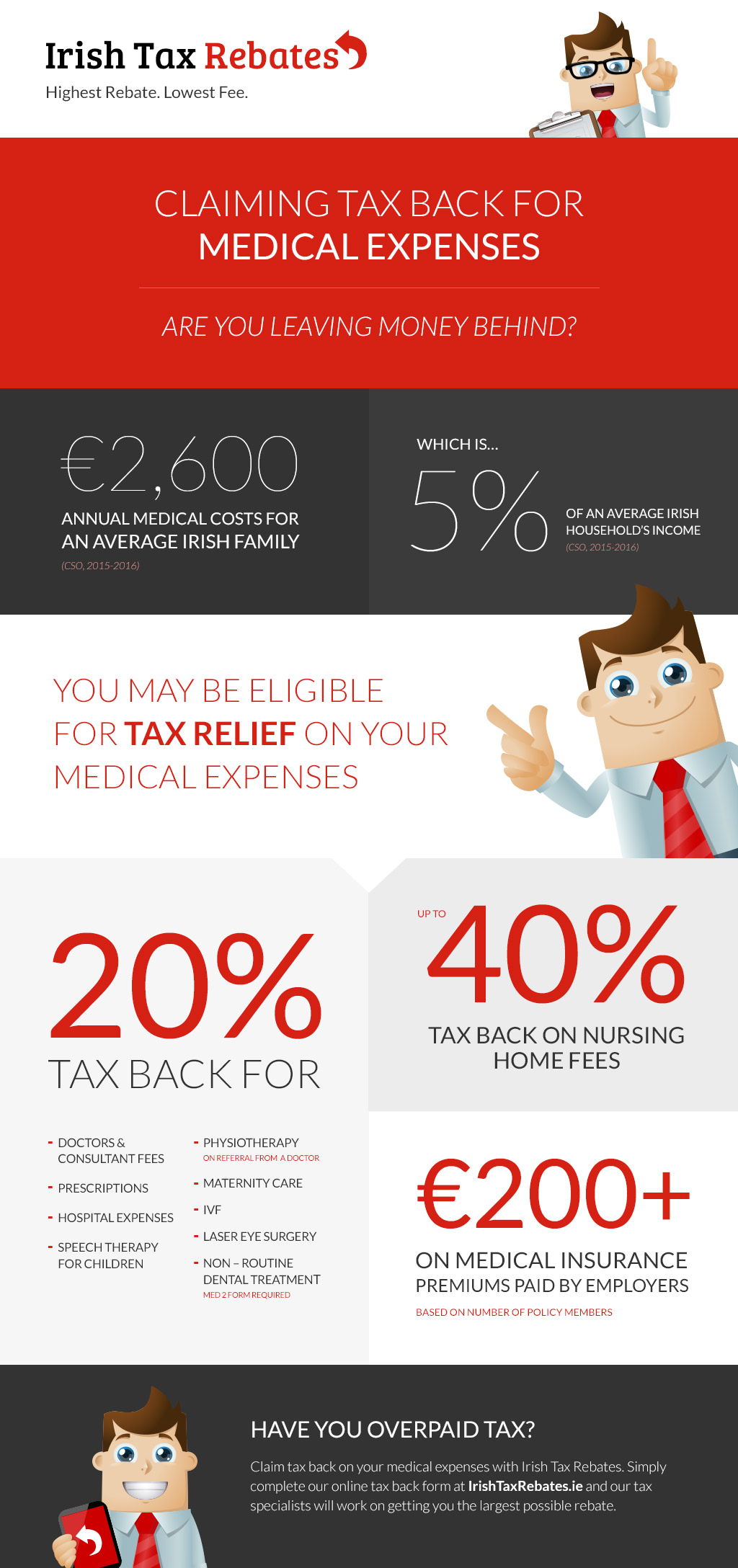

Tax Back On Medical Expenses Infographic Irish Rebates

http://blog.irishtaxrebates.ie/wp-content/uploads/2018/04/itr-infographic-1.jpg

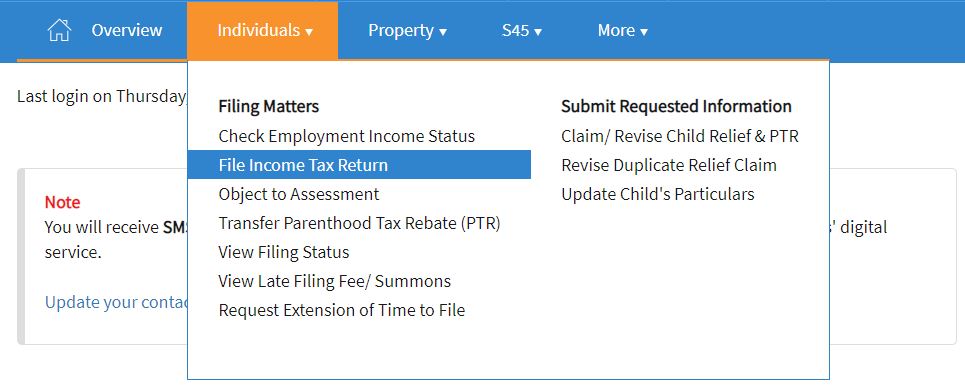

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i0.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/53287756_1898285556949795_4177201277018570752_n-1.jpg?resize=654%2C960&ssl=1

Is Property Tax Rebate Taxable Iras PRORFETY

https://www.growfinancial.org/wp-content/uploads/2021/02/TaxeStrategies_Newsletter_Header_012221-03.png

Web Qualifying For Relief To claim WMCR in the Year of Assessment YA 2020 you must satisfy these conditions in 2019 1 You are a working mother who is married divorced Web The annual contribution limit for 2023 is 6 500 or 7 500 if you re age 50 or older 2019 2020 2021 and 2022 is 6 000 or 7 000 if you re age 50 or older The annual

Web 30 mai 2023 nbsp 0183 32 Key Takeaways An IRA can help your child or grandchild save for retirement a first home or educational expenses While both traditional and Roth IRAs Web 29 juin 2023 nbsp 0183 32 Contributions to your individual retirement accounts IRAs that are Traditional IRAs or Roth IRAs are generally limited to a certain annual dollar amount 6 500 for

Government Rebate Program Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/11/983/11983077/large.png

MP Tries 3 Times For Tax Rebate And Child Relief For Single Unwed

https://theindependent.sg/wp-content/uploads/2020/02/Screen-Shot-2020-02-29-at-12.34.17-PM-1024x450.png

https://www.iras.gov.sg/taxes/individual-income-tax/basics-of...

Web Working Mother s Child Relief WMCR You can claim WMCR if you have earned income The WMCR amount is matched to a percentage of the mother s earned income 1st

https://www.iras.gov.sg/.../how-working-mums-can-reduce-their-tax-bill

Web During Tax Season 2023 the tax reliefs for working mothers help shave a little off the tax bill Boon Hui has claimed reliefs including the Working Mother s Child Relief Qualifying

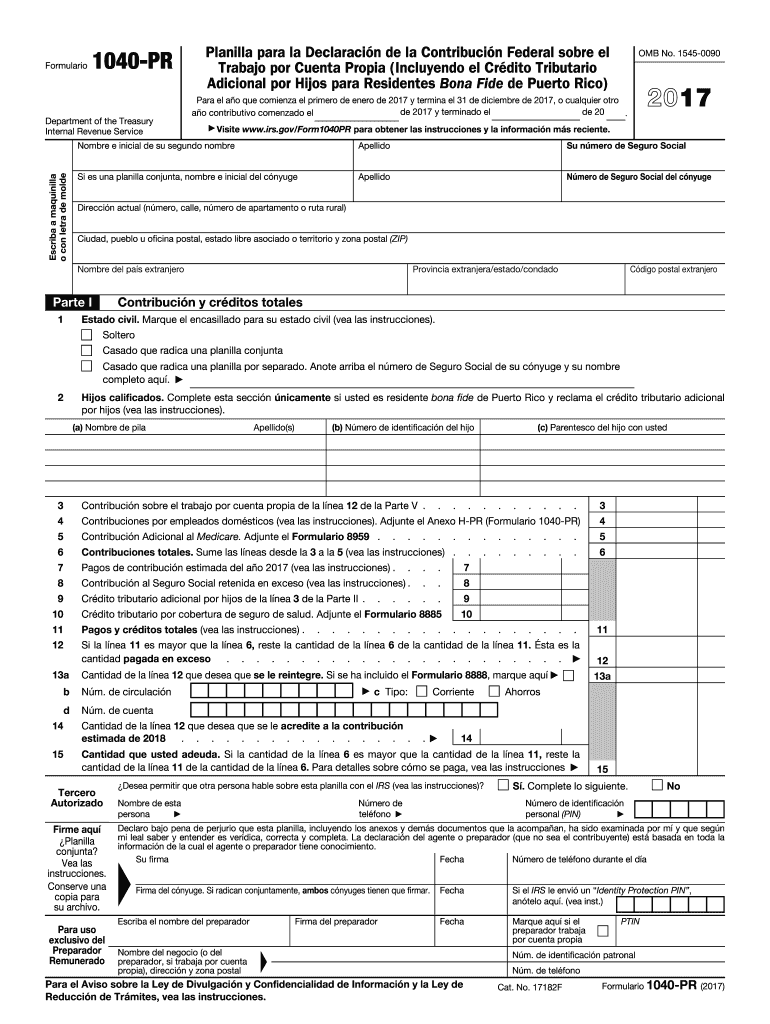

1040pr 2017 Form Fill Out Sign Online DocHub

Government Rebate Program Fill Out Sign Online DocHub

How To Further Optimise Your SRS Account Financially Independent

IRAs Demystified Roth IRAs Traditional IRAs 401Ks

Parenthood Tax Rebate Guide For Singapore Parents

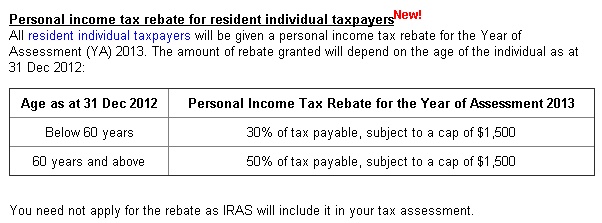

Bulicenas Singapore Tax Rebates

Bulicenas Singapore Tax Rebates

Claiming Tax Back When Working From Home Tax Rebates

IRAS The Parenthood Tax Rebate And Qualifying Child Facebook

REMINDER Illinois Tax Rebate Program Filing Due Date Is October 17

Iras Tax Rebate For Working Mother - Web 9 mars 2023 nbsp 0183 32 Say a working mother with an annual income of 40 000 can only claim 6 000 in WMCR for her child with the current scheme to reduce her taxable income to