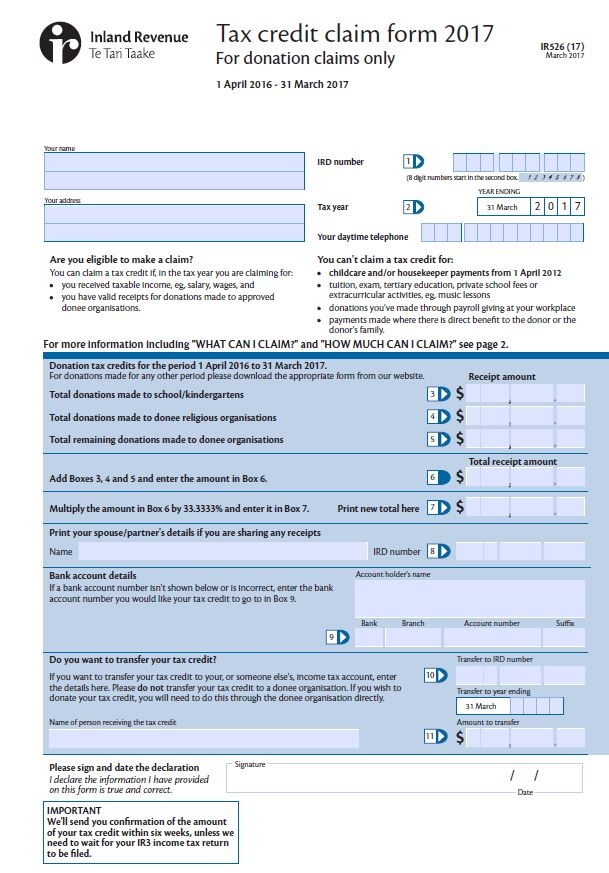

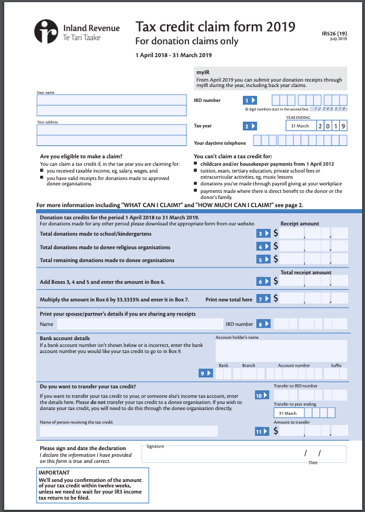

Ird Charity Rebate Form Web Name IRD number 8 Bank account details Account holder s name If a bank account number isn t shown below or is incorrect enter the bank account number you would like your tax

Web You may be eligible for a 33 33 rebate from IRD If you ve made a donation to ChildFund in any of the past four years you may be eligible for a charity tax rebate For some of Web Setting up your not for profit or charity When your not for profit does not have to pay tax on income interest or fringe benefits getting approved so people who donate to you can get

Ird Charity Rebate Form

Ird Charity Rebate Form

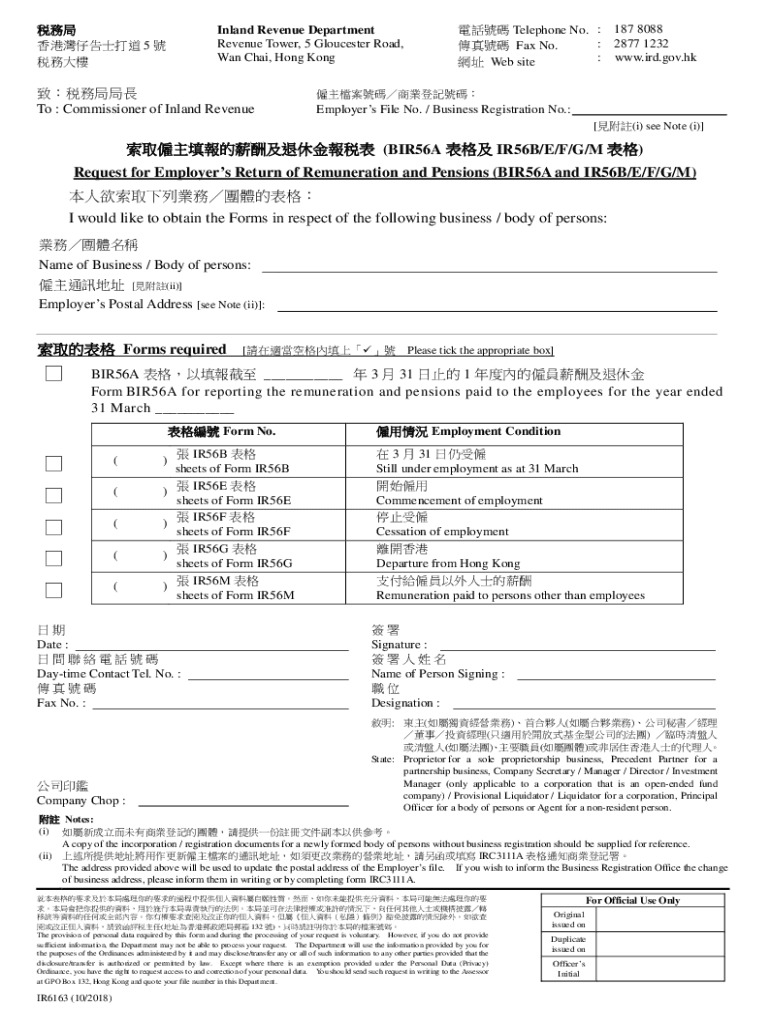

https://www.pdffiller.com/preview/543/741/543741757/large.png

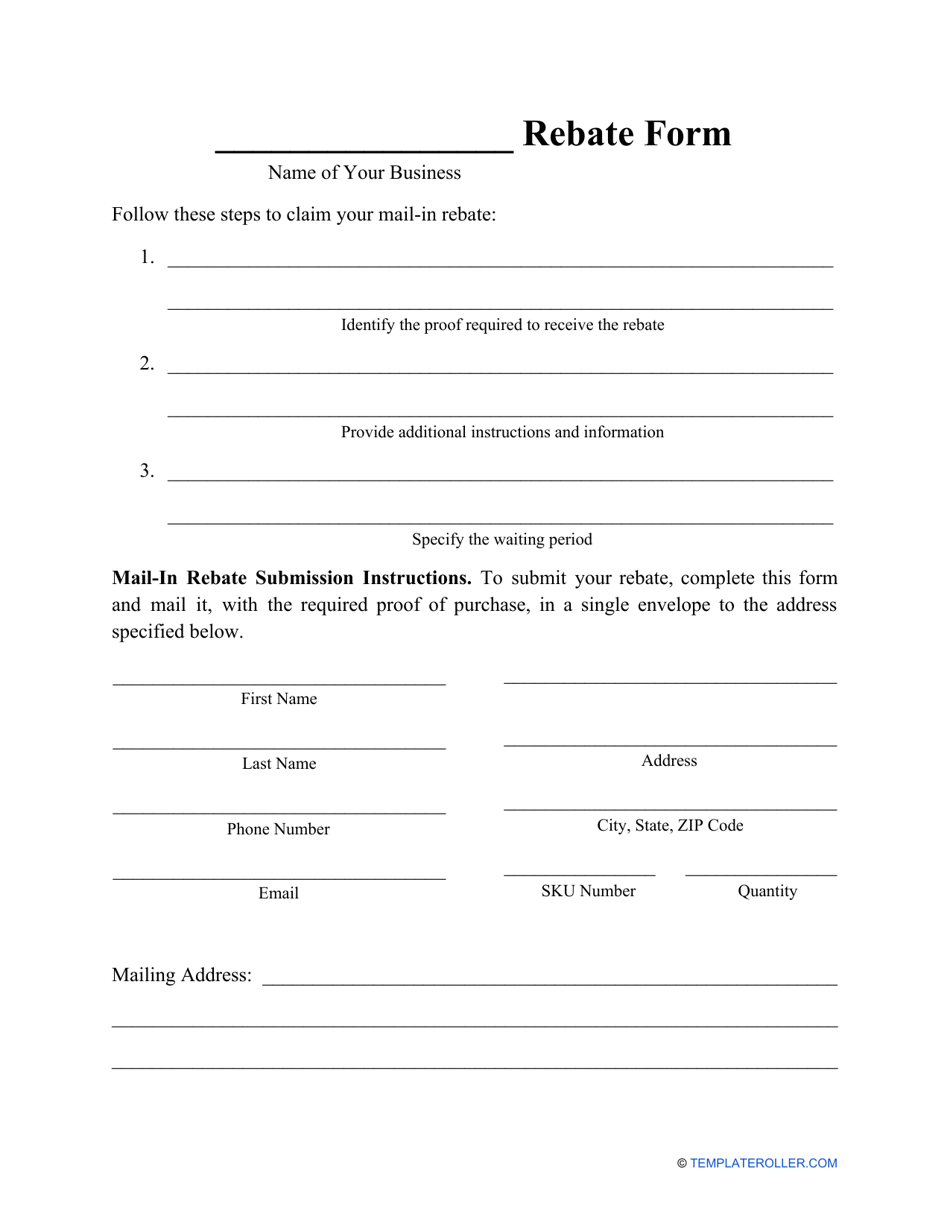

Supplier Rebate Agreement Template

https://data.templateroller.com/pdf_docs_html/2100/21003/2100371/rebate-form_print_big.png

Emigrate Or Immigrate Ir526 Form

https://www.taxback.com/resources/blogimages/20180502135506.1525258506704.09c19926c5abdbcf91642f39647.jpg

Web 30 nov 2021 nbsp 0183 32 Taxpayers including married individuals filing separate returns can claim a deduction of up to 300 for cash contributions to qualifying charities during 2021 The Web request a copy of a previously filed donation tax credit claim form Gateway service capability for donation tax credits The gateway service used for donation tax credit is the

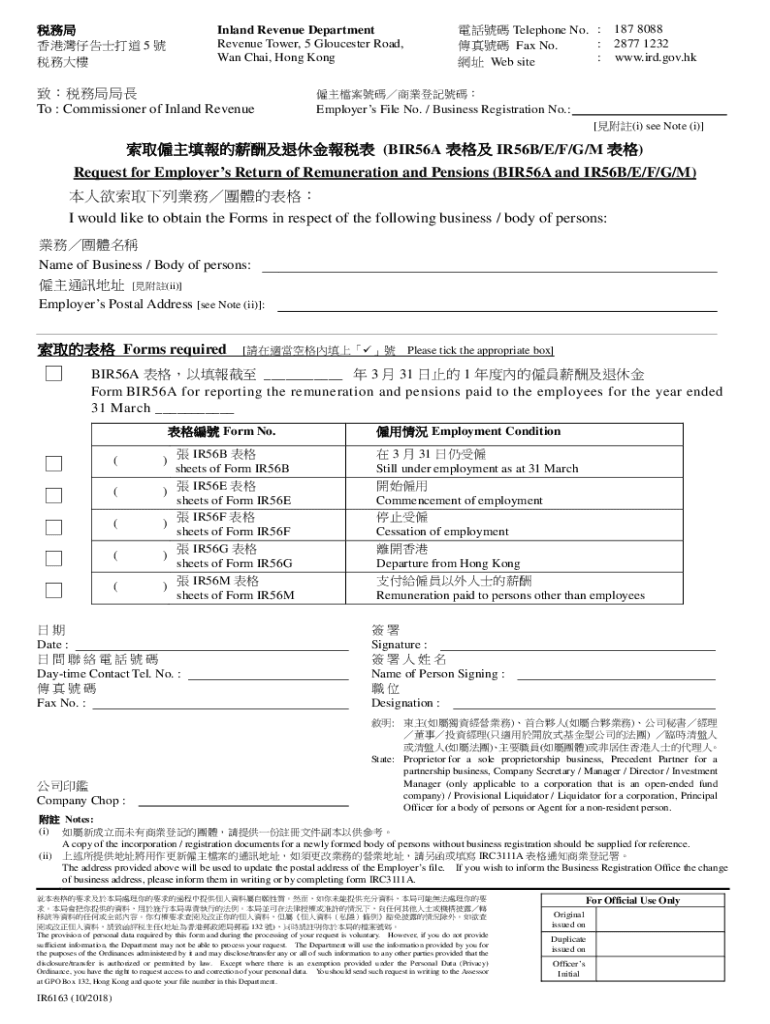

Web Facsimile Transmission of Information Form and Support Tax Information Individuals Businesses 2023 24 Budget Tax Measures Tax Concessions for Family owned Web You are able to claim your tax rebate directly with Interior Takings and donate this back to us You can do those in two pathways IRD Web based Gates You can now do this

Download Ird Charity Rebate Form

More picture related to Ird Charity Rebate Form

2020 2022 Form NZ IRD IR880 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/520/508/520508776/large.png

2019 2023 Form NZ IRD IR997 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/486/809/486809965/large.png

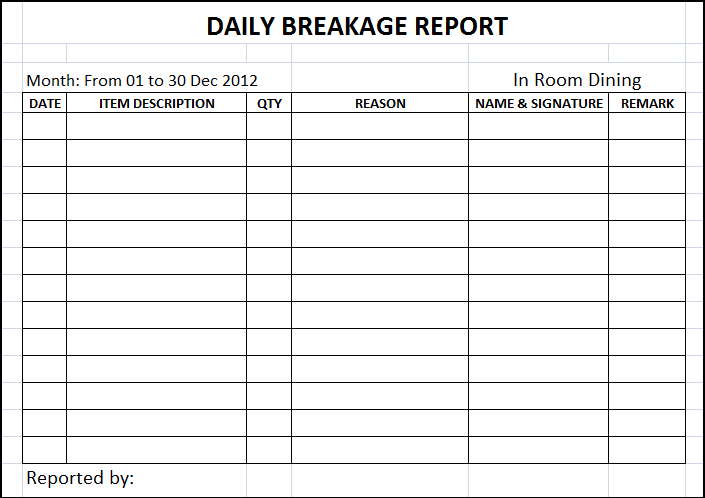

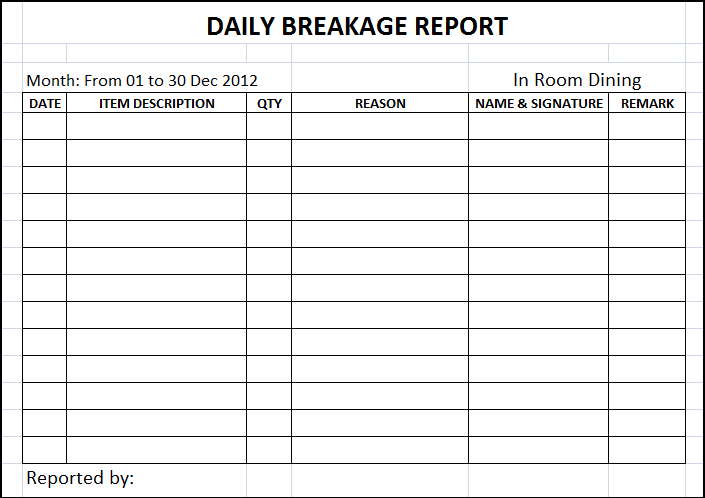

IRD Form In Room Dining

http://inroomdining.weebly.com/uploads/1/1/3/6/11364701/9330776_orig.png?1

Web Yes we can provide you with a tax deductible receipt for your rebate Email us at donations compassion nz or phone 04 383 7769 with your name IRD number address and the amount transferred Inland Web e Application for Preparation for IR56 Form s due Using Employer s Self developed Software Check Extension Scheme For Tax Representative Intelligence Security

Web Have you considered donating your tax refund to Variety the Children s Charity For every donation you make over 5 00 you will have received a receipt With these receipts you Web 25 f 233 vr 2023 nbsp 0183 32 Money from an individual retirement account IRA can be donated to charity What s more if you ve reached the age where you need to take required

IRD Form In Room Dining

http://inroomdining.weebly.com/uploads/1/1/3/6/11364701/7010468_orig.png?0

2013 Ir 526 Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/22/585/22585933/large.png

https://www.ird.govt.nz/-/media/project/ir/home/documents/f…

Web Name IRD number 8 Bank account details Account holder s name If a bank account number isn t shown below or is incorrect enter the bank account number you would like your tax

https://childfund.org.nz/pages/claiming-your-ird-charity-tax-rebate

Web You may be eligible for a 33 33 rebate from IRD If you ve made a donation to ChildFund in any of the past four years you may be eligible for a charity tax rebate For some of

IRD FORM Address Geography Government Information Free 30 day

IRD Form In Room Dining

Property Tax Rebate Application Printable Pdf Download

HK IRD IR56F 2013 Fill And Sign Printable Template Online US Legal

Ir526 Fill Out Sign Online DocHub

Home Depot 11 Rebate Match Form Printable Rebate Form

Home Depot 11 Rebate Match Form Printable Rebate Form

Donate Your Tax Return To UNICEF NZ

All About Mail In Rebates Part 2 The Do s And Don ts Of Submitting

Receipt Template For 501 C Donation Pretty Receipt Forms

Ird Charity Rebate Form - Web Facsimile Transmission of Information Form and Support Tax Information Individuals Businesses 2023 24 Budget Tax Measures Tax Concessions for Family owned