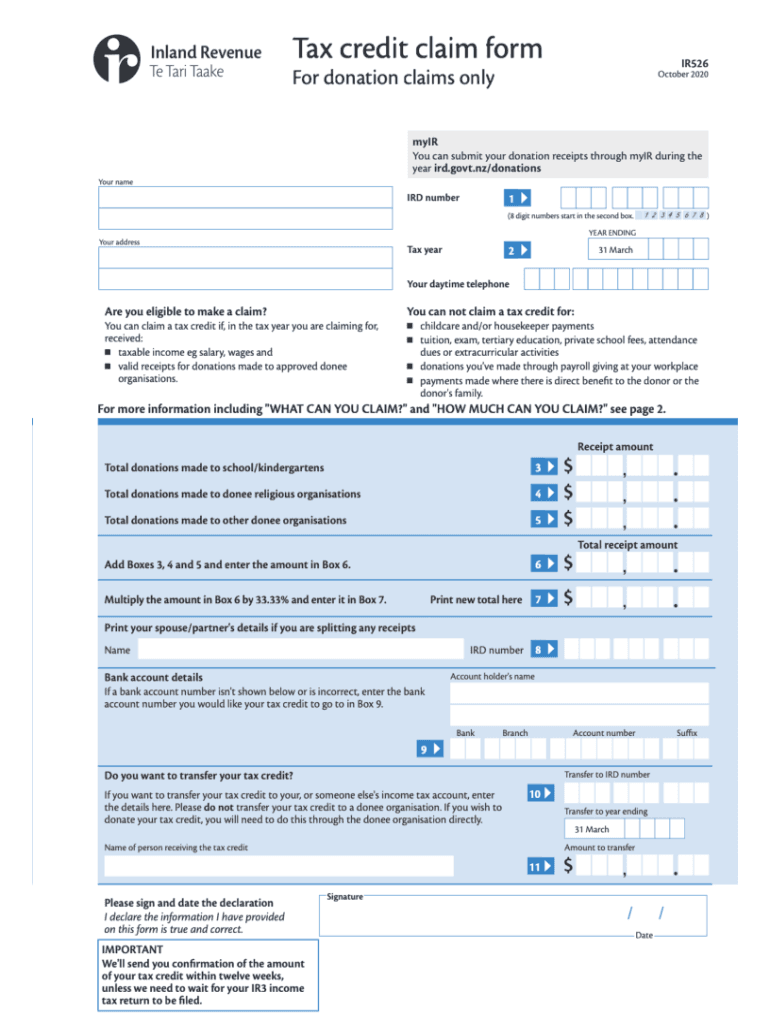

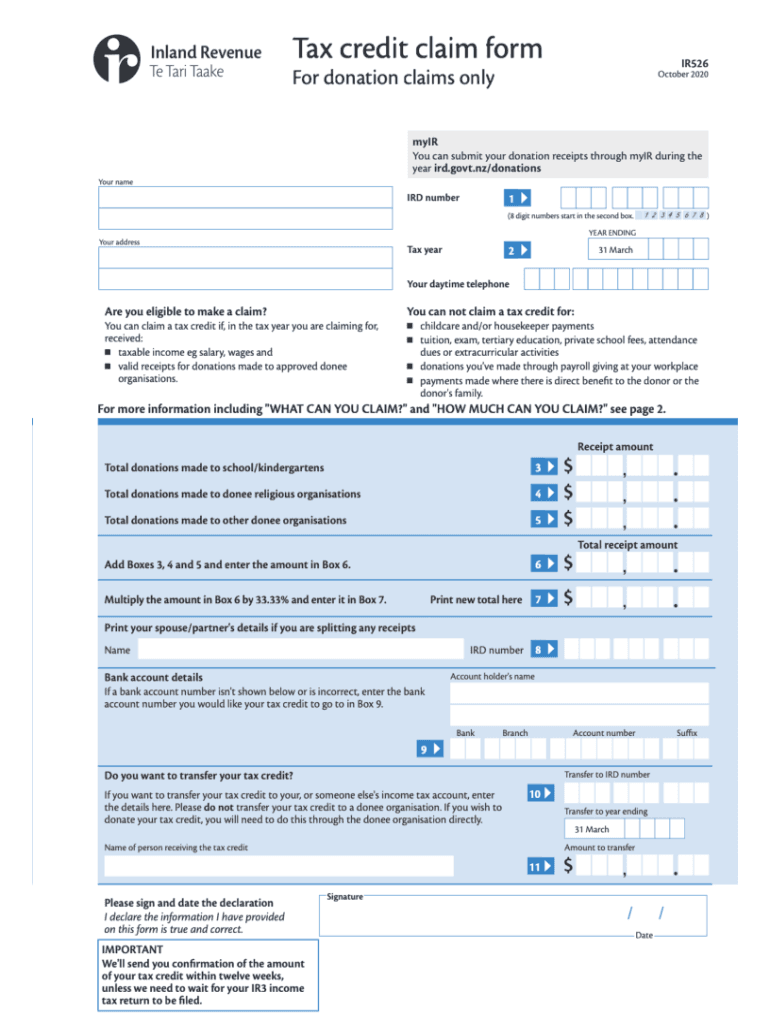

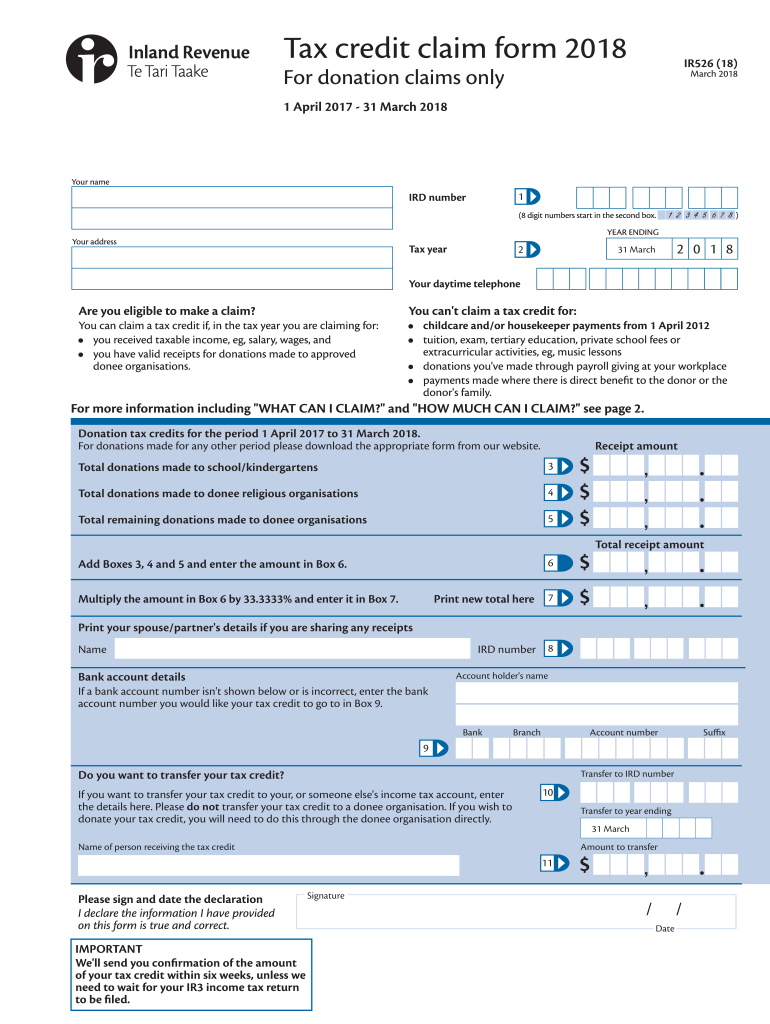

Ird Tax Rebate Form For every dollar you donate you get 33 33 cents back as a tax credit The credit reduces the amount of PAYE or withholding tax you pay Payroll giving as an employee Example Splitting donations with your spouse or partner Your taxable income is 1 000 but you have donation receipts totalling 1 500

Return Attachment 23 Tax Credit and Deduction from taxable income to Employers VOPS RA23 Return Attachment 24 Tax credit in terms of the Assistance for Research and Development RA24 Return Attachment 25 Deduction for Transportation Cost of Employees Rules RA25 Now that donation tax credits claims are able to be entered online the whole process is quicker and smoother You can start a claim form during the year This means you can upload receipts as donations are made instead of waiting to submit everything at the end of the tax year As receipts are uploaded our system runs automatic checks to

Ird Tax Rebate Form

Ird Tax Rebate Form

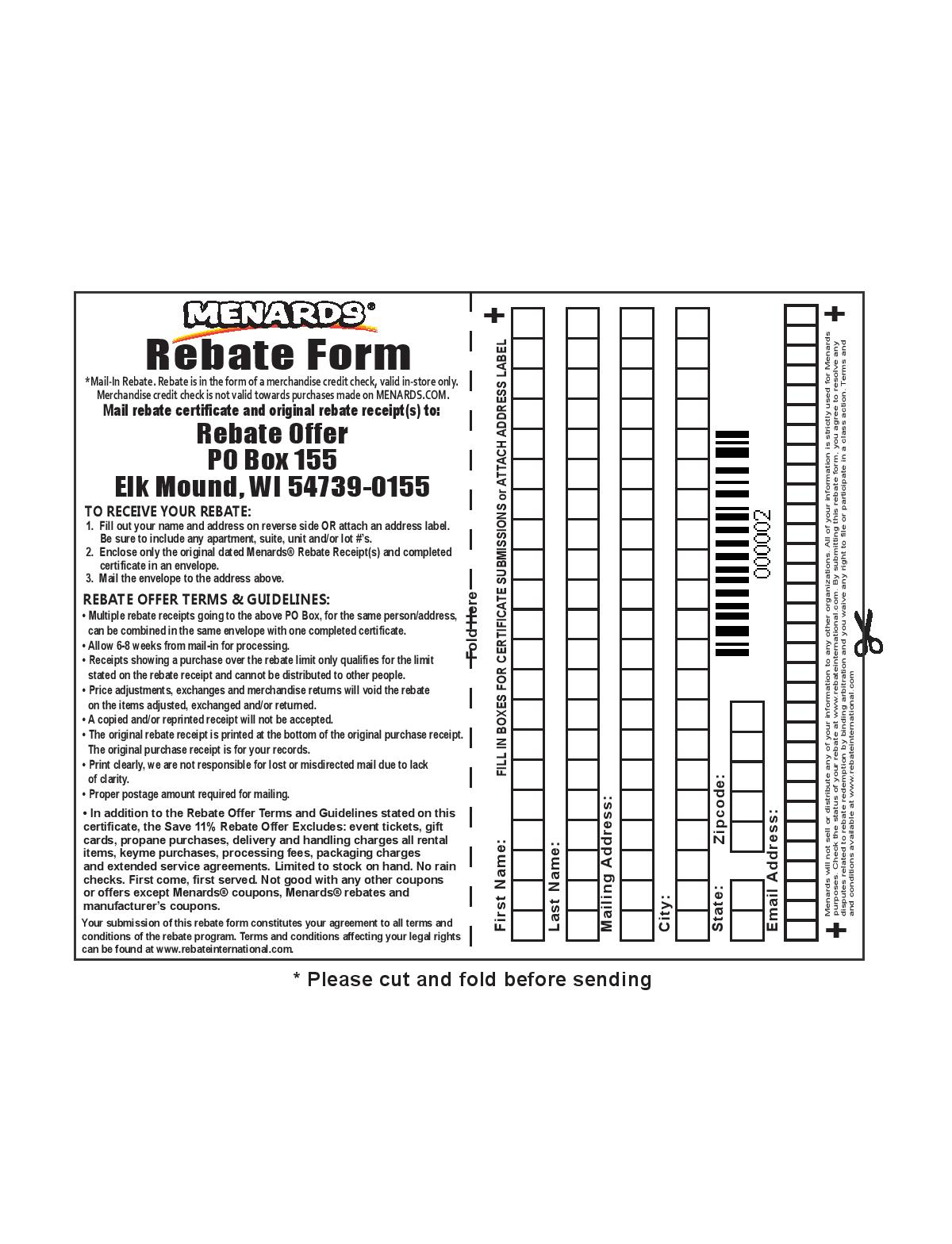

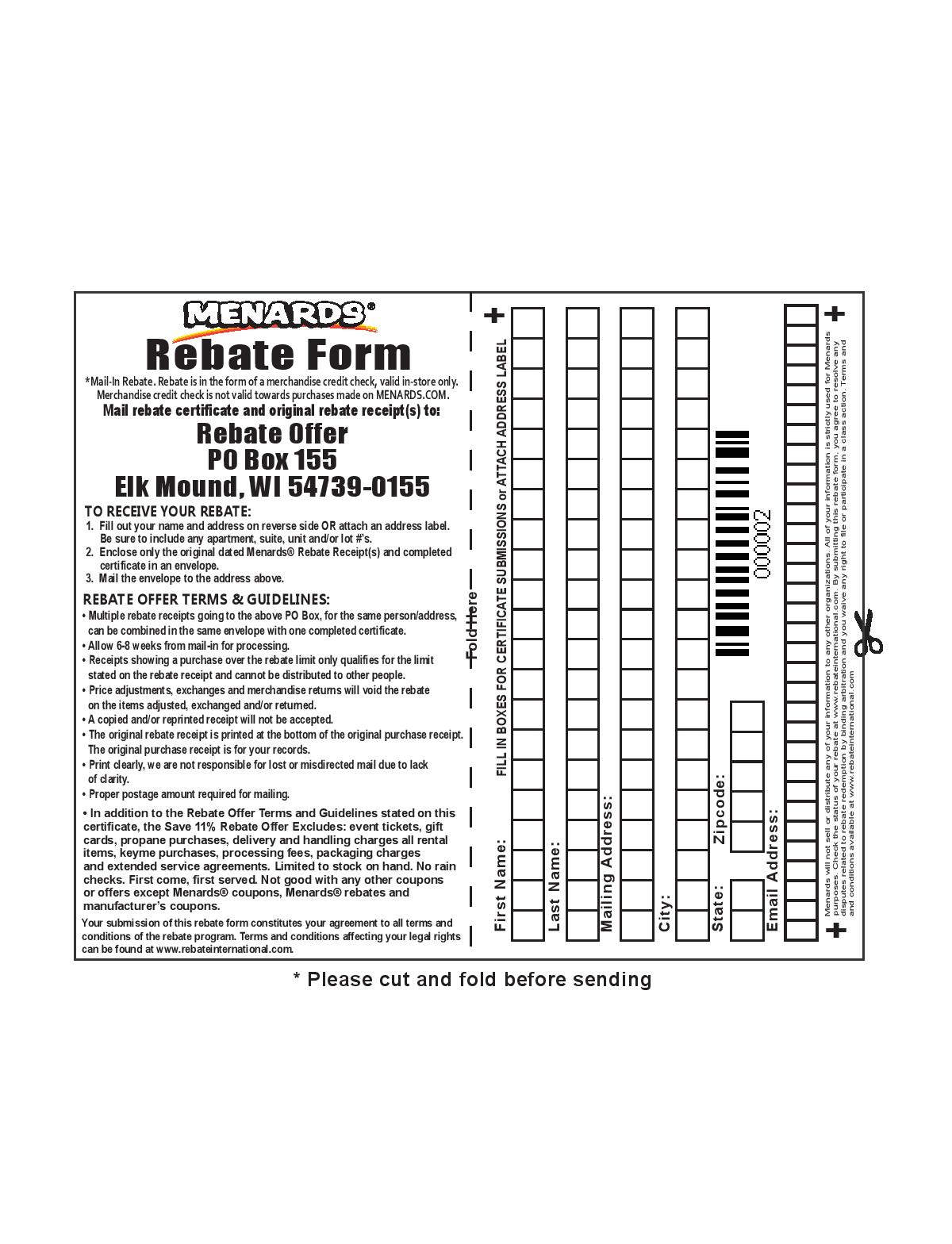

https://www.menardsrebate-form.com/wp-content/uploads/2022/09/printable-menards-rebate-form-2022.jpg

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct

https://www.the-sun.com/wp-content/uploads/sites/6/2022/04/kc-gov-little-comp.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

https://asset5.scripbox.com/wp-content/uploads/2021/05/tax-rebate.jpg

If you wish to donate your tax credit you will need to do this through the donee organisation directly 10 Transfer to year ending 31 March Name of person receiving the tax credit Amount to transfer 11 Please sign and date the declaration I declare the information I have provided on this form is true and correct Registering your client for donation tax credits We re aware many tax agents and intermediaries are having difficulties registering their clients for Donation tax credits DTC To register follow these steps From the intermediary centre Select Client registration Register client for donation tax credit Enter client s IRD number and

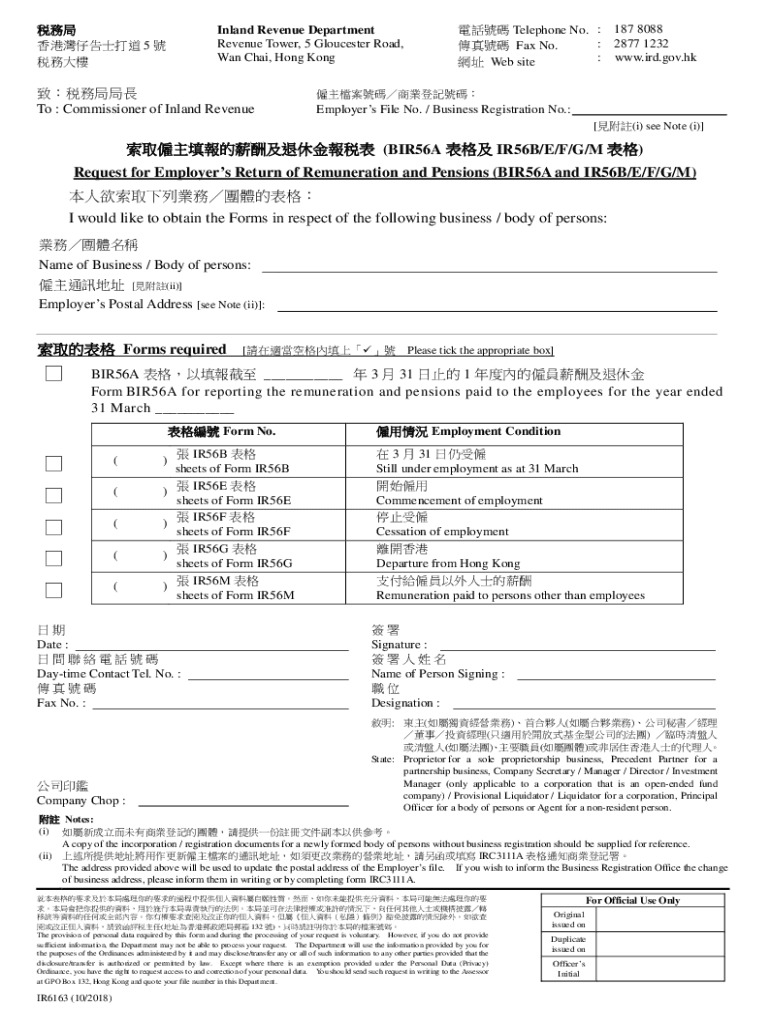

Supplementary Form S20 Tax concessions for family owned investment holding vehicle IR 1478 IR1478 Taxation on specified foreign sourced income TIN and or Access Code by existing eTAX user or person with tax file in IRD IR 6163 Request for Employer s Return of Remuneration and Pensions taxctr1 ird gov hk IR 6167 Estimates Statement of Estimated Income Tax Payable Year of Assessment 2023 2024 Statement of Estimated Income Tax Payable Year of Assessment 2022 2023 Interim Estimate of Value Added Tax on Supply of Financial Services 1 st Six Months of

Download Ird Tax Rebate Form

More picture related to Ird Tax Rebate Form

-Published-VAT-Purchase-and-Sales-Book-New-Format.png)

Inland Revenue Department IRD Published VAT Purchase And Sales Book

https://www.collegenp.com/uploads/2021/07/Inland-Revenue-Department-(IRD)-Published-VAT-Purchase-and-Sales-Book-New-Format.png

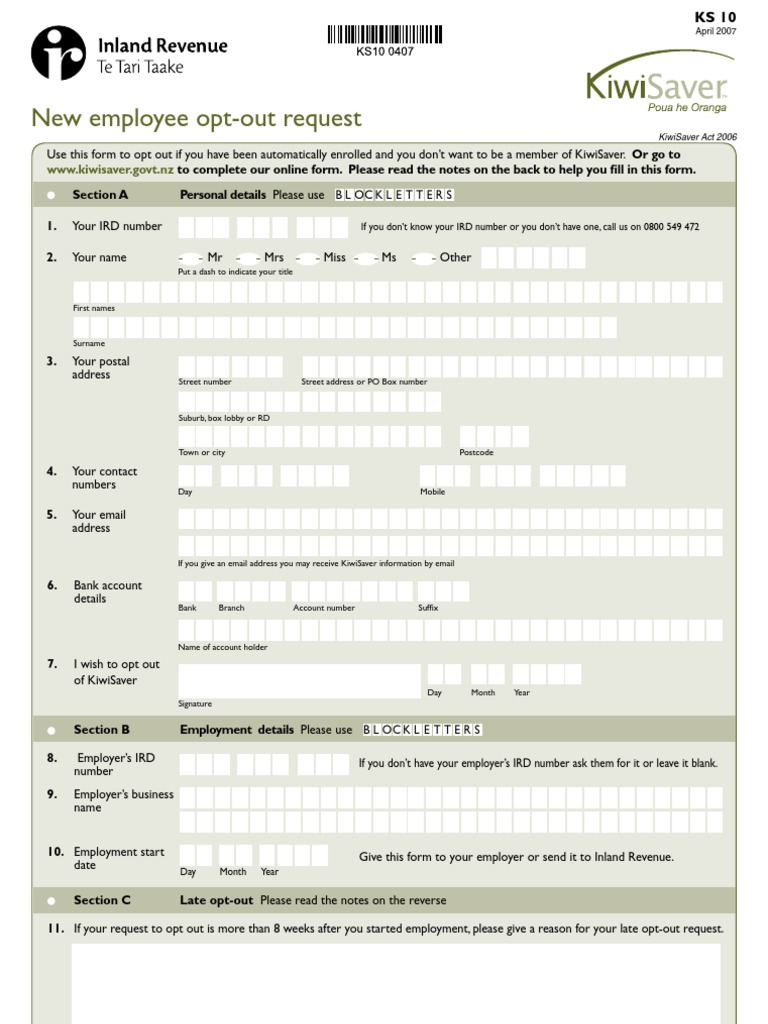

Ird Form PDF Address Geography Government Information

https://imgv2-2-f.scribdassets.com/img/document/73458022/original/0af19f1936/1631438308?v=1

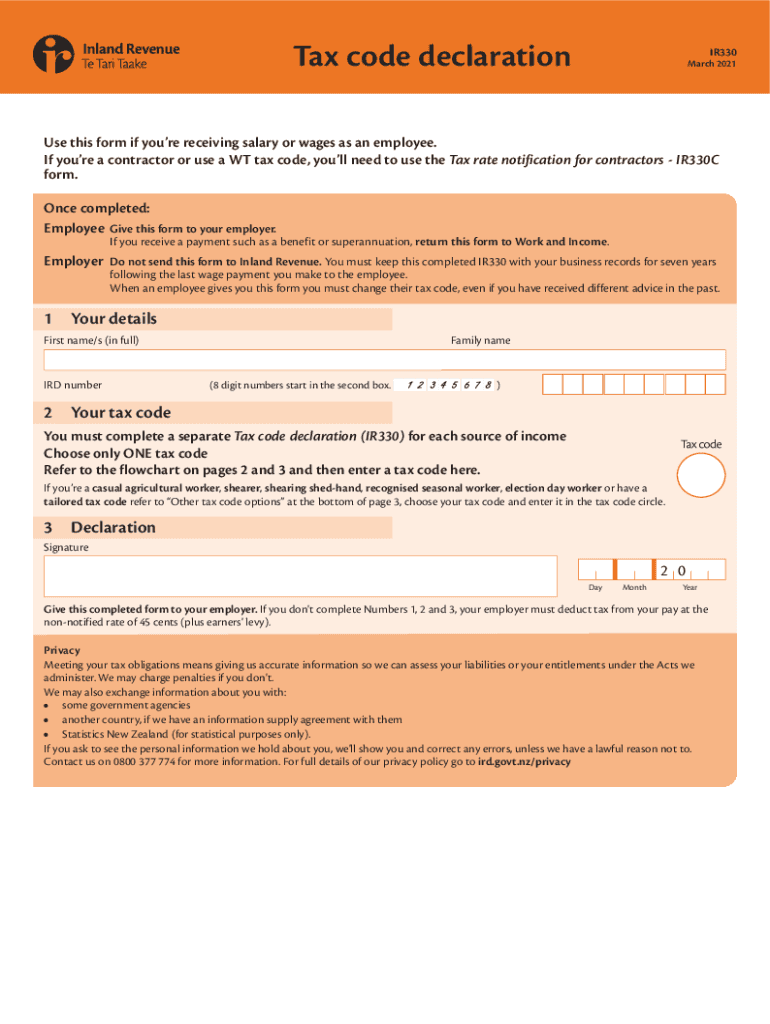

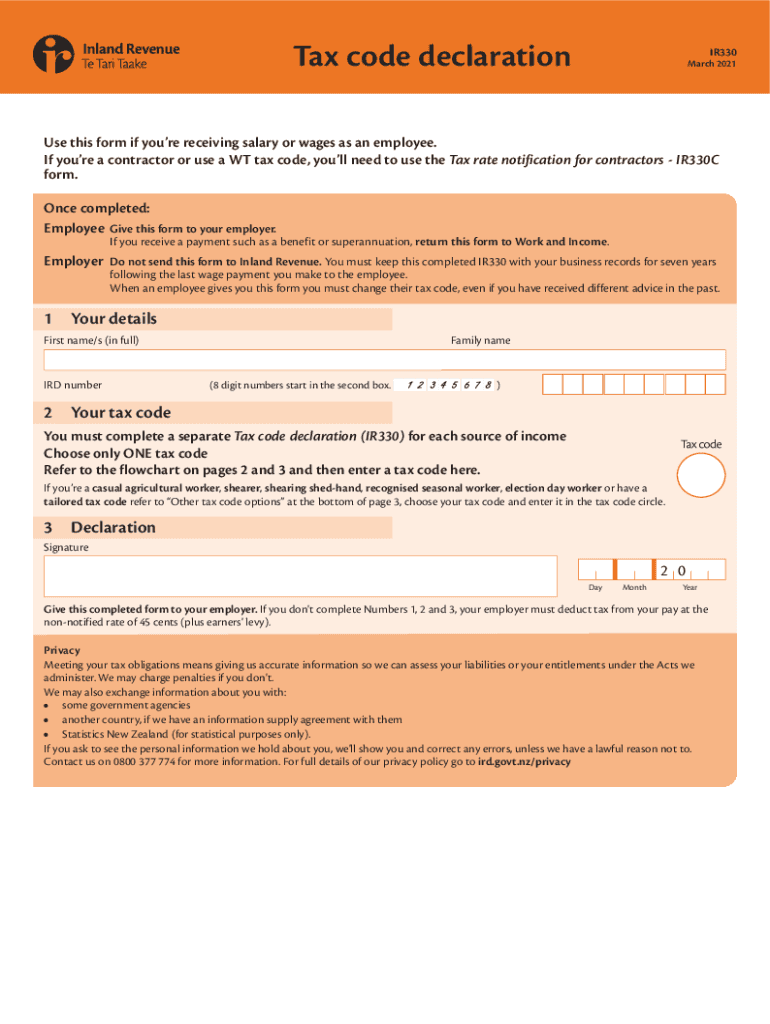

IR330 Form 1 Student Loan Taxes

https://imgv2-1-f.scribdassets.com/img/document/321797908/original/914f3c5611/1571250401?v=1

In his 2024 25 Budget the Financial Secretary proposed the following measures Reducing profits tax salaries tax and tax under personal assessment for the year of assessment 2023 24 Implementing a two tiered standard rates regime for salaries tax and tax under personal assessment Providing tax deduction for lease reinstatement costs Refund of Tax Tax overpaid will be refunded to you by way of a refund cheque Refund cheque is generally posted to your last known postal address by ordinary mail To avoid delays you are reminded to notify us of the change of your postal address promptly

Visit our Online Services Portal to Register File and Pay for your taxes and services Visit Online Services Portal Use this tool to find out what you need to do to get a tax refund rebate if you ve paid too much Income Tax

Ir330 Form Fill Out And Sign Printable PDF Template AirSlate SignNow

https://www.signnow.com/preview/572/207/572207136/large.png

How To Get An IRD Tax Number Inland Revenue New Zealand

https://www.backpackerboard.co.nz/images/pages/nz-pagefull-37.jpg

https://www.ird.govt.nz/income-tax/income-tax-for...

For every dollar you donate you get 33 33 cents back as a tax credit The credit reduces the amount of PAYE or withholding tax you pay Payroll giving as an employee Example Splitting donations with your spouse or partner Your taxable income is 1 000 but you have donation receipts totalling 1 500

https://cfr.gov.mt/en/inlandrevenue/personaltax/...

Return Attachment 23 Tax Credit and Deduction from taxable income to Employers VOPS RA23 Return Attachment 24 Tax credit in terms of the Assistance for Research and Development RA24 Return Attachment 25 Deduction for Transportation Cost of Employees Rules RA25

Fillable Online Property Tax Rebate Form Fax Email Print PdfFiller

Ir330 Form Fill Out And Sign Printable PDF Template AirSlate SignNow

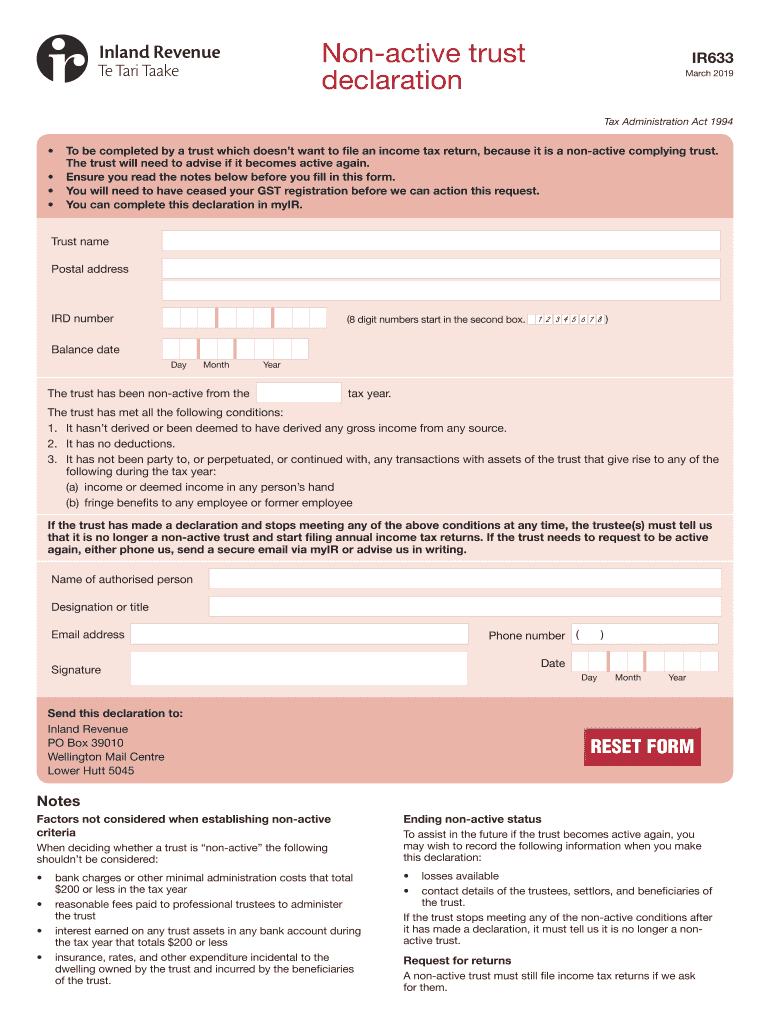

NZ IRD IR633 2019 2021 Fill And Sign Printable Template Online US

IRD Number Application Non resident offshore

Fill Free Fillable Tax Code Declaration Use This Form If Youre

Ir526 Form Fill Out And Sign Printable PDF Template AirSlate SignNow

Ir526 Form Fill Out And Sign Printable PDF Template AirSlate SignNow

HK IRD IR6163 2018 2022 Fill And Sign Printable Template Online US

How To Show Employee s IRD Tax Code On Payslip Reckon Community

Ir526 2018 2024 Form Fill Out And Sign Printable PDF Template

Ird Tax Rebate Form - The Inland Revenue Amendment Tax Deductions for Domestic Rents Ordinance 2022 was enacted on 30 June 2022 to provide for new deduction for domestic rent with effect from the year of assessment 2022 23 The implementation framework of the new deduction is as follows Eligible Persons