Ird Tax Return Calculator 5 minutes Income tax calculator This calculator will work out tax on your annual income using rates from 2010 to the current year Other ways to do this Print Last updated 13

M ori IRD numbers Ng tau IRD File my individual tax return Te tuku i t tahi puka t ke takitahi Support for families Ng tautoko i ng wh nau Managing my tax Te whakahaere 2024 25 2023 24 2024 25

Ird Tax Return Calculator

![]()

Ird Tax Return Calculator

https://is1-ssl.mzstatic.com/image/thumb/Purple116/v4/da/be/87/dabe873a-03c8-f80e-8434-507875881269/AppIcon-1x_U007emarketing-0-7-0-85-220.png/1200x630wa.png

Prepare And File Form 2290 E File Tax 2290

https://www.roadtax2290.com/images/3-3d.png

How To Show Employee s IRD Tax Code On Payslip Reckon Community

https://us.v-cdn.net/6032430/uploads/NMYG06RPU3U0/img-8186.jpg

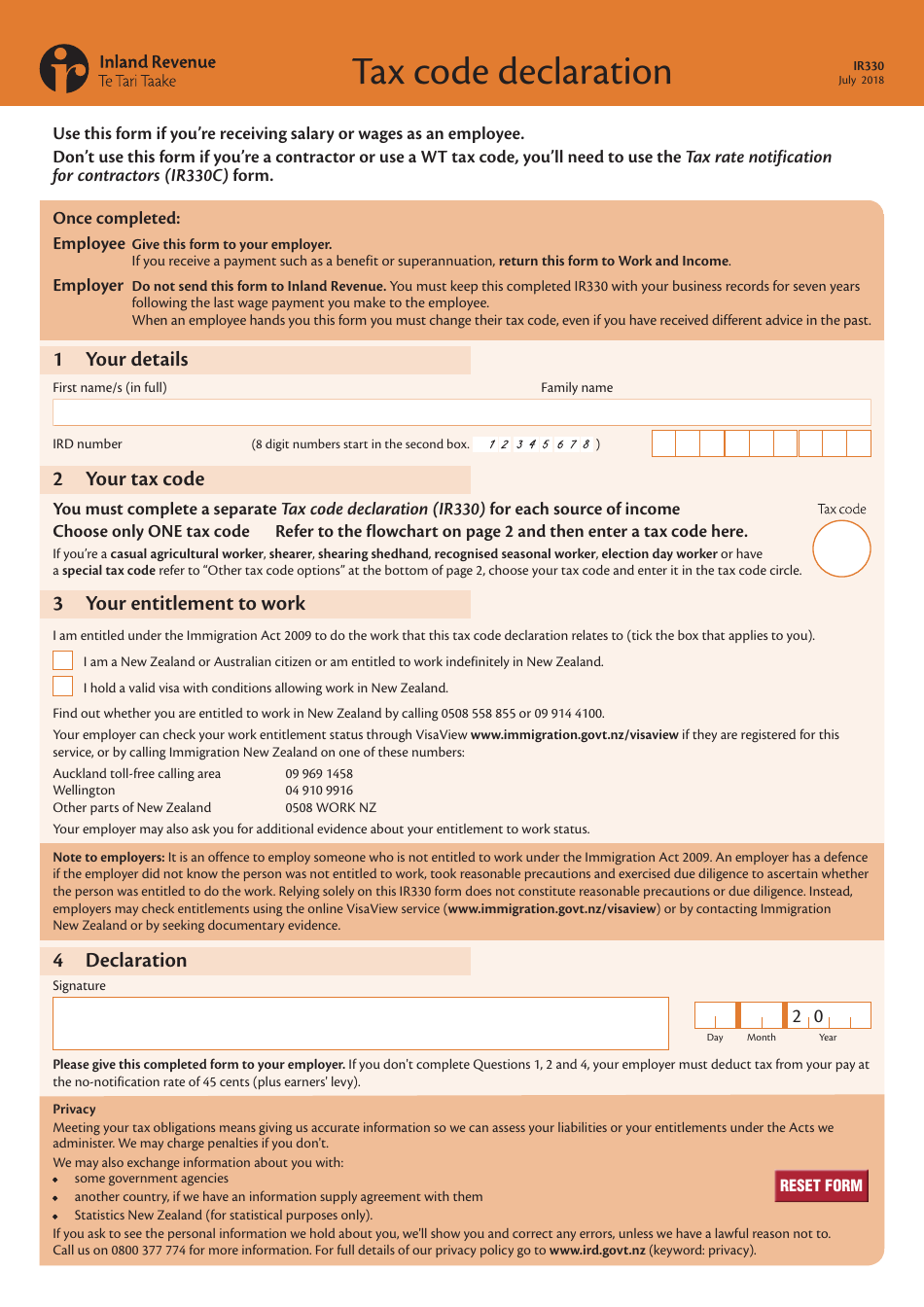

1 Enter your Monthly Fortnightly or Weekly Gross Pay Salary 2 Tick the For Year 2023 box 3 Enter your Tax Code 4 Tick the NIC box if any is deducted You will need your bank account details details of your income for the tax year details of any expenses you want to claim Types of individual expenses We ll provide you with

Ird govt nz 4 Your tax credits 43 Q34 Independent earner tax credit IETC 43 Q35 Excess imputation credits brought forward 45 Q36 Portfolio Investment Entity Tells us about your income for the year and the expenses you re claiming calculates if you re due a refund or have tax to pay The tax year is from 1 April to 31 March IR3

Download Ird Tax Return Calculator

More picture related to Ird Tax Return Calculator

Form IR330 Fill Out Sign Online And Download Fillable PDF New

https://data.templateroller.com/pdf_docs_html/1728/17289/1728951/form-ir-330-tax-code-declaration_print_big.png

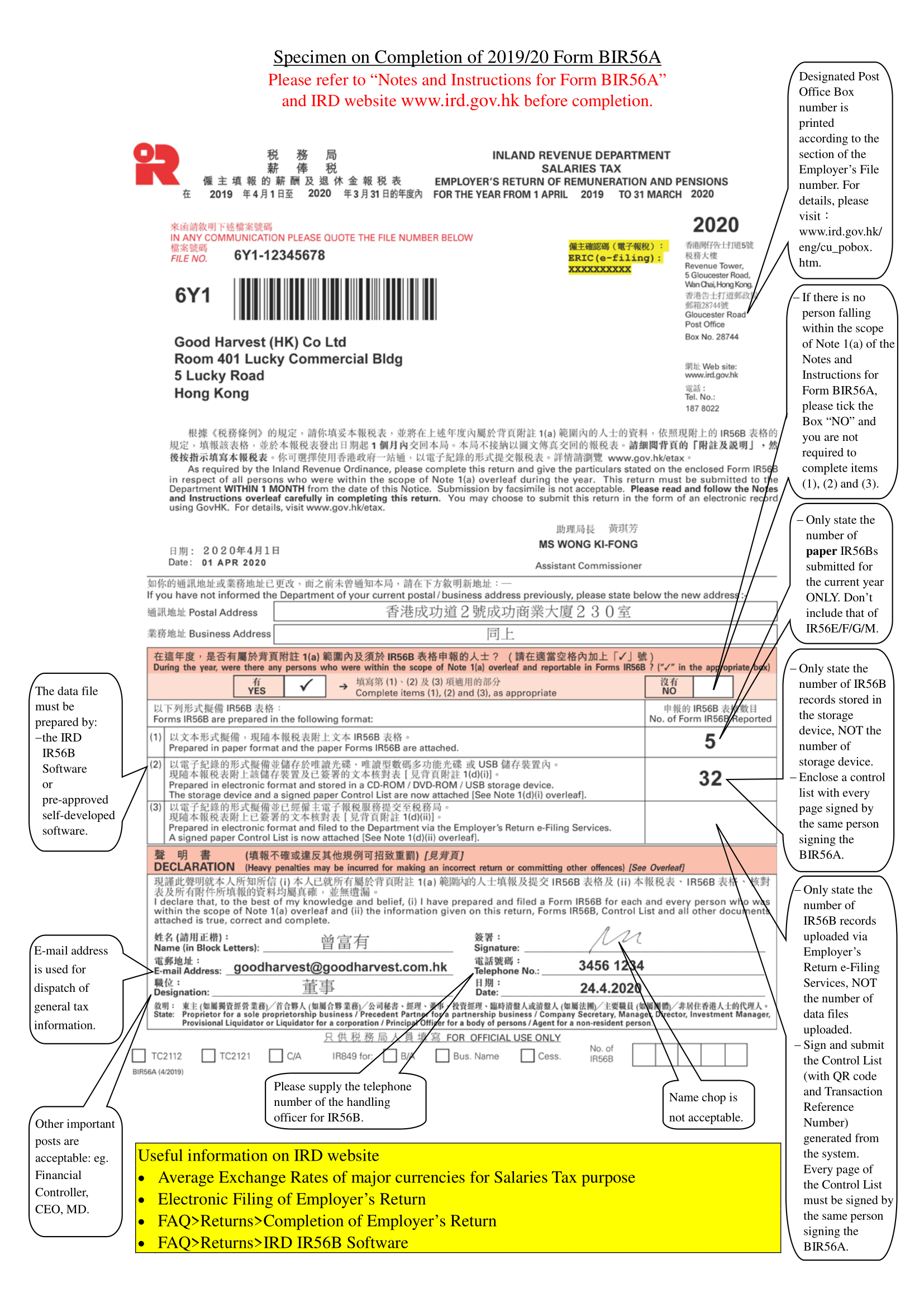

New Hire Report Form Idaho NewHireForm

https://www.newhireform.net/wp-content/uploads/2022/08/what-is-the-hong-kong-employers-return-bir56a-and-ir56b-1.png

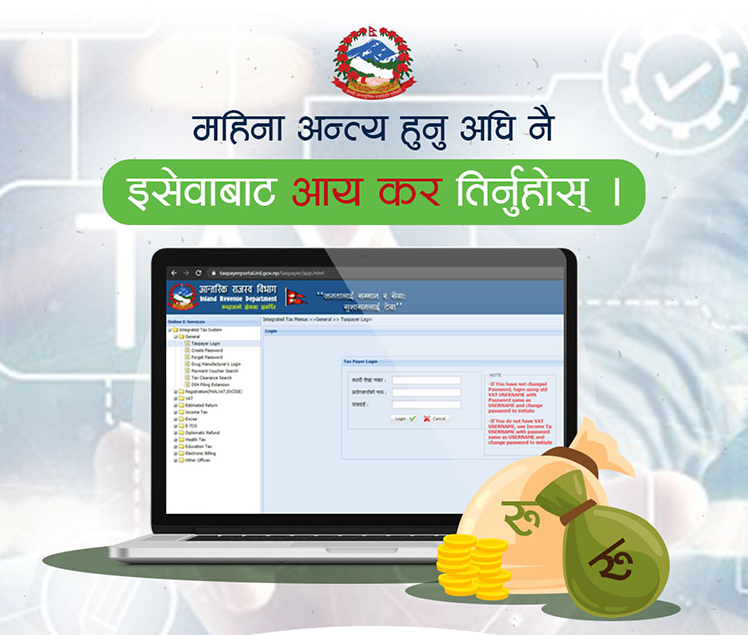

Here s How You Can Pay IRD Taxes Via ESewa Enepsters

https://www.enepsters.com/wp-content/uploads/2021/01/137648143_10158489843088283_4048450240001621196_o.jpg

This calculator uses the new IRD rates post March 31st 2023 and does include the new 39 personal tax rate on remaining income over 180 000 To use the FY23 PAYE Conditions of use For more info on government services go to

Please input the total number of dependant s for the type of allowance claimed by you and your spouse where applicable No of dependant s claimed Of the dependant s Salaries Income The total income should be net of allowable expenses and depreciation allowances Assessable value of all your property ies let Solely owned Jointly

How To Use Aadhaar Card For Electronic Tax Return Verification

https://www.kanakkupillai.com/learn/wp-content/uploads/2022/09/How-to-use-Aadhaar-Card-for-Electronic-Tax-Return-Verification-1.png

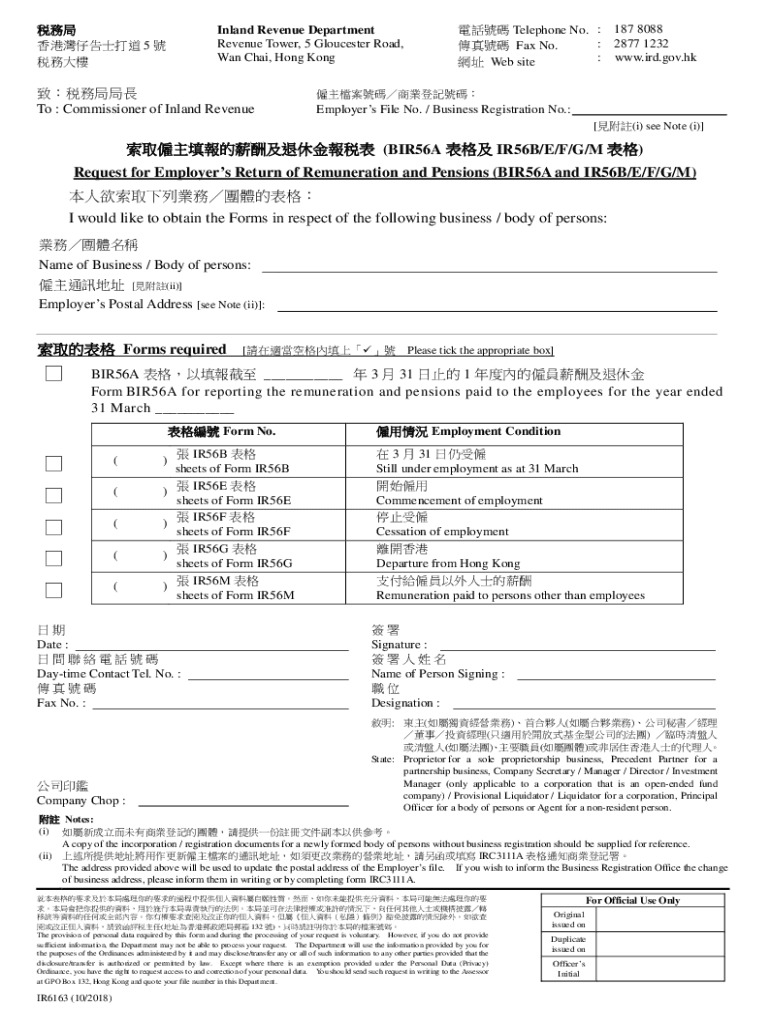

HK IRD IR6163 2018 2022 Fill And Sign Printable Template Online US

https://www.pdffiller.com/preview/543/741/543741757/large.png

https://www.ird.govt.nz/income-tax/income-tax-for...

5 minutes Income tax calculator This calculator will work out tax on your annual income using rates from 2010 to the current year Other ways to do this Print Last updated 13

https://www.ird.govt.nz/index/calculators-and-tools

M ori IRD numbers Ng tau IRD File my individual tax return Te tuku i t tahi puka t ke takitahi Support for families Ng tautoko i ng wh nau Managing my tax Te whakahaere

1 My Salaries Income Includes Bonus Allowance And Commission How

How To Use Aadhaar Card For Electronic Tax Return Verification

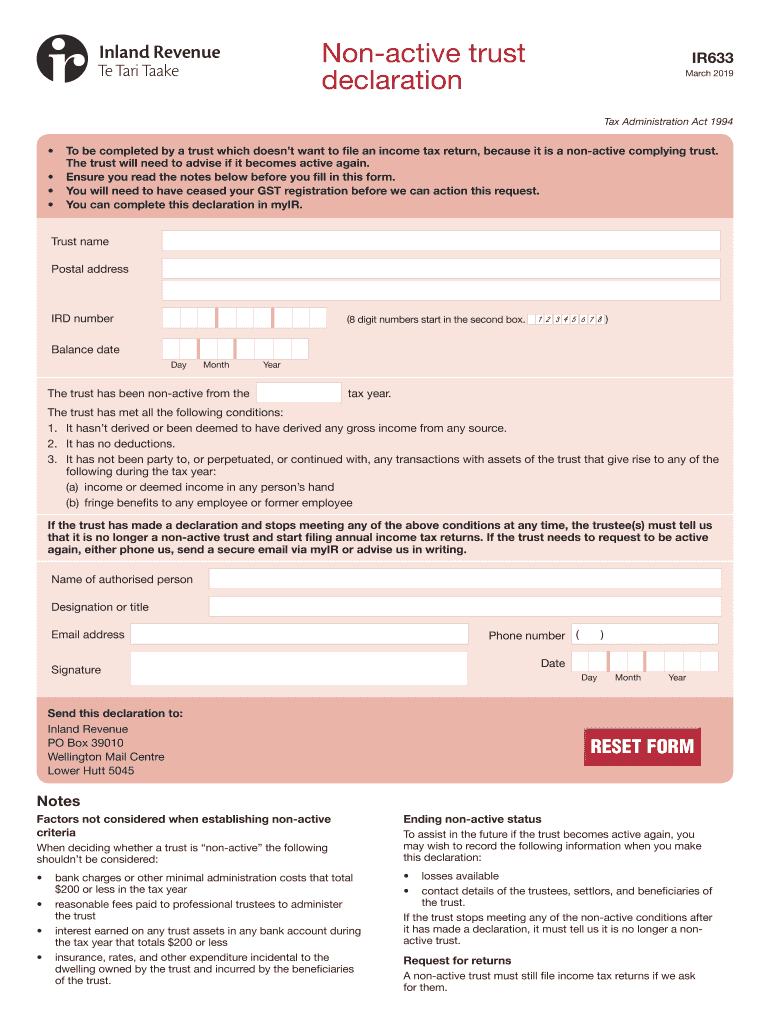

NZ IRD IR633 2019 2021 Fill And Sign Printable Template Online US

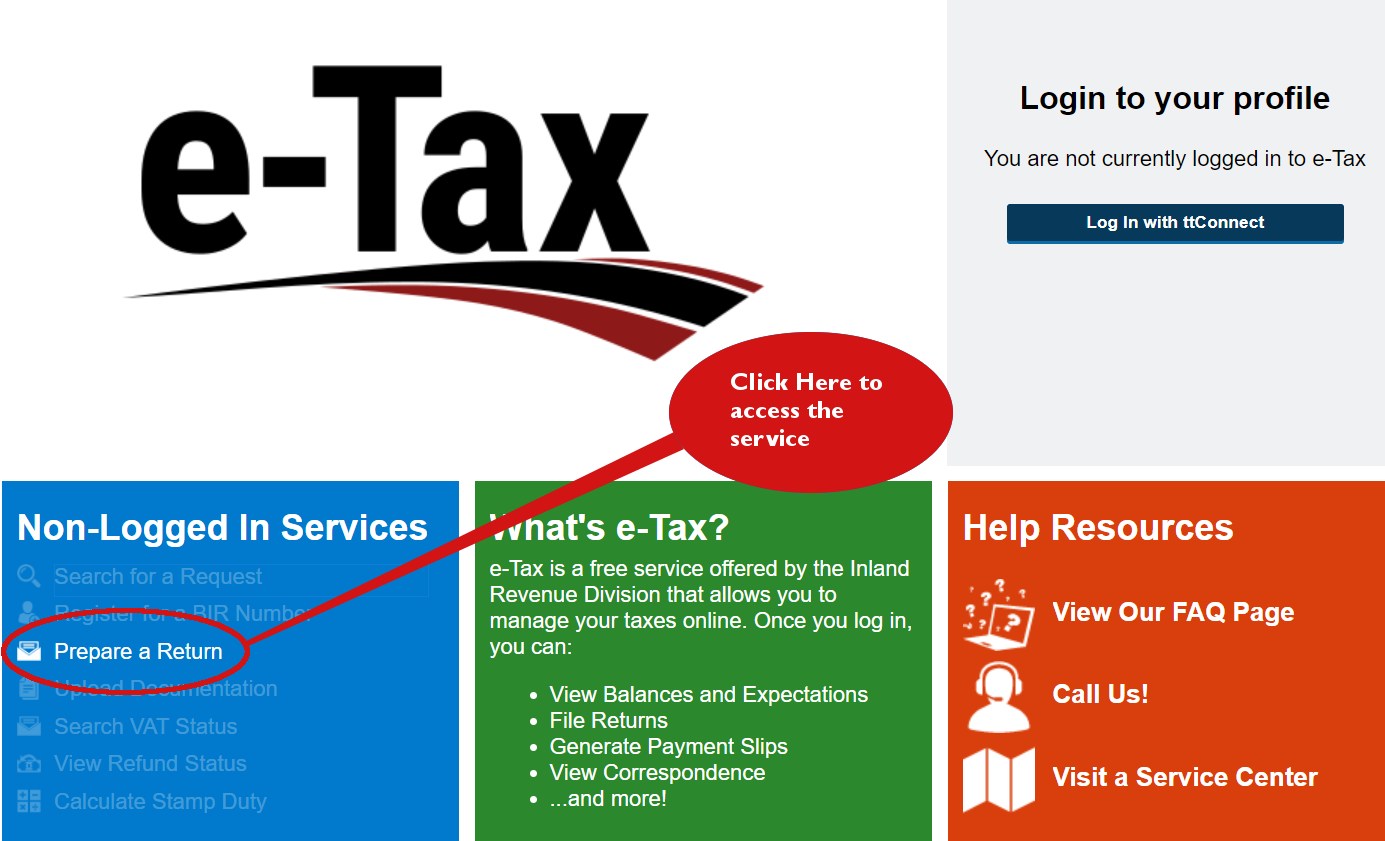

IRD E Tax Non Logged In Returns FAQs

Income Tax Return For Individuals Form 1a Inland Revenue Division

Tax Rates For The 2024 Year Of Assessment Just One Lap

Tax Rates For The 2024 Year Of Assessment Just One Lap

Proof Of Income Template Income Standard Deduction Proof

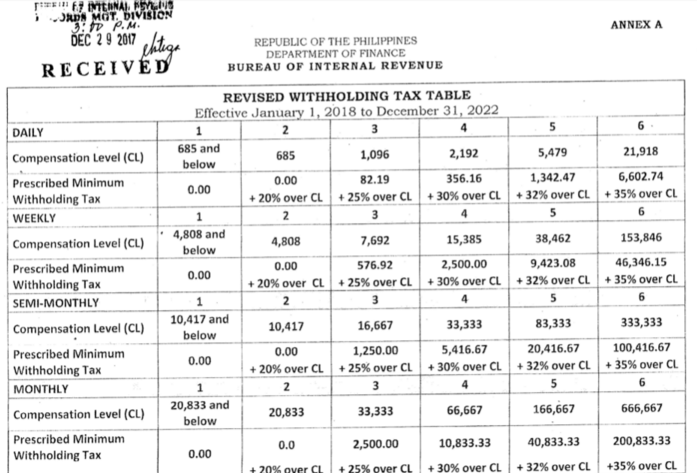

2023 Payroll Withholding Calculator LesleyMehek

A Business Owner s Guide To Salary Tax Returns BIR60 Sleek Hong Kong

Ird Tax Return Calculator - 1 Enter your Monthly Fortnightly or Weekly Gross Pay Salary 2 Tick the For Year 2023 box 3 Enter your Tax Code 4 Tick the NIC box if any is deducted