Ird Tax Return You can submit your income tax return online by logging into https mytax cfr gov mt using your e id account Through this service you can submit your income tax form in as easier and more efficient manner

In this section you may find a general overview of personal tax related matters including information on your obligations and rights as a taxpayer More detailed tax information is given on specific subjects such as tax credits the income tax return and related forms used Through this form individuals who are required to file an income tax return can submit their return electronically

Ird Tax Return

Ird Tax Return

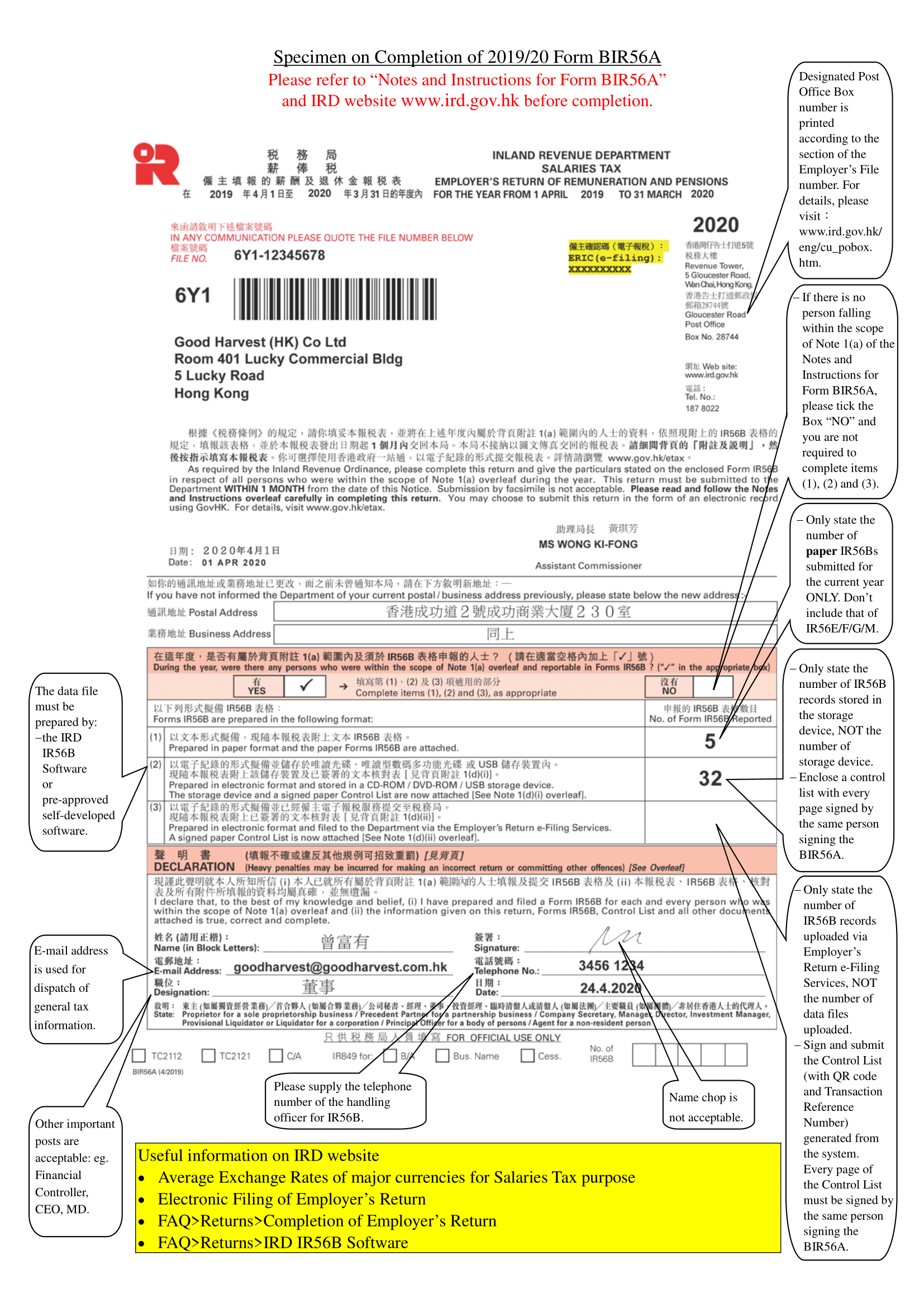

https://osome.com/content/images/size/w1300/2021/03/bir56a_completion_e-.png

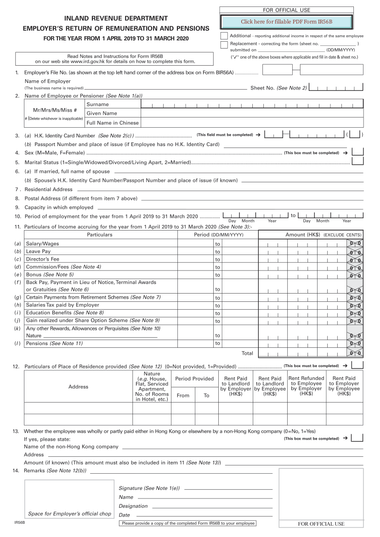

Income Tax Return For Individuals Form 1a Inland Revenue Division

https://i.pinimg.com/736x/fa/1a/1f/fa1a1fa4c6ceb700bc514657f072e3eb.jpg

What Is The Hong Kong Employer s Return BIR56A And IR56B

https://osome.com/content/images/size/w380/2021/03/ir56b_e-1.png

Welcome to the on line Services for Individuals These services include interactive facilities that enable taxpayers to Submit income tax returns as from Year of Assessment 2005 Effect self assessment income tax payments View your current tax return status and payments as from year of assessment 2003 We ll provide you with details of income you received that had tax deducted like salary or wages If you complete your tax return through myIR these details will be automatically included If we send you a paper IR3 return we ll send you a Summary of Income in the mail separately

At the end of the tax year you may need to file an Individual income tax return IR3 which tells us about your income for the year and the expenses you re claiming calculates if you re due a refund or have tax to pay The tax year is from 1 April to 31 March E Tax gives the customers of the Inland Revenue Division online access to their tax accounts and related information e Tax has features which would allow you to view tax balance check refunds status and perform a wide variety of tasks

Download Ird Tax Return

More picture related to Ird Tax Return

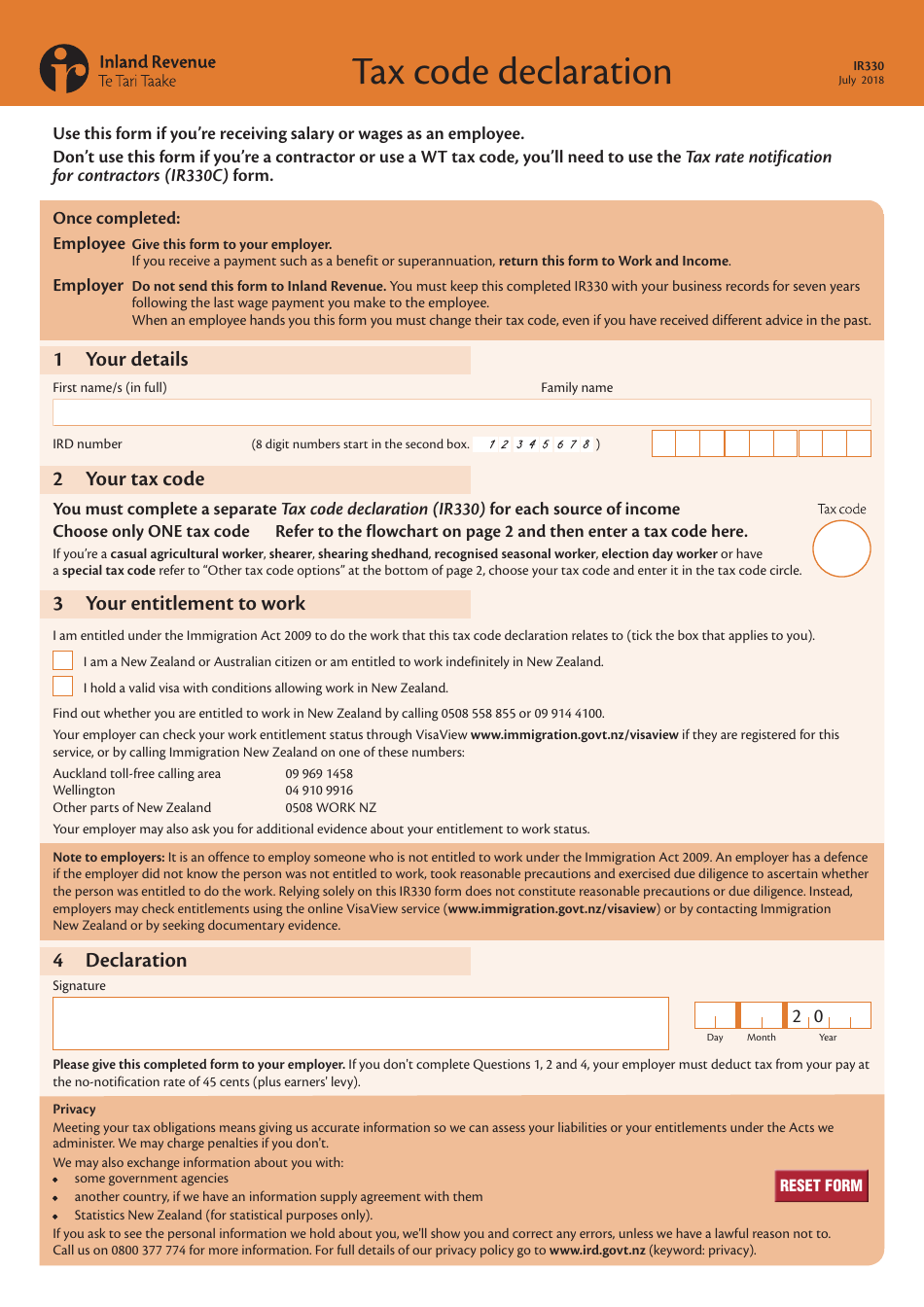

2021 Form NZ IR330 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/572/207/572207136/large.png

Hong Kong Tax Return Startupr hk

https://lh4.googleusercontent.com/ncAVen36DnK1SKlYuSzCrQwWc2uDHXtOmPtikBGCUyZ0qFUz8WhPjEH6gda0VbqKbNtG6AwF9DoekMQbLxl6-bad9KpcTa7_WsuJpADllTBx2OmZoT7c7ZoHDI8xzf2GY9K-ykqG

Form IR330 Fill Out Sign Online And Download Fillable PDF New

https://data.templateroller.com/pdf_docs_html/1728/17289/1728951/form-ir-330-tax-code-declaration_print_big.png

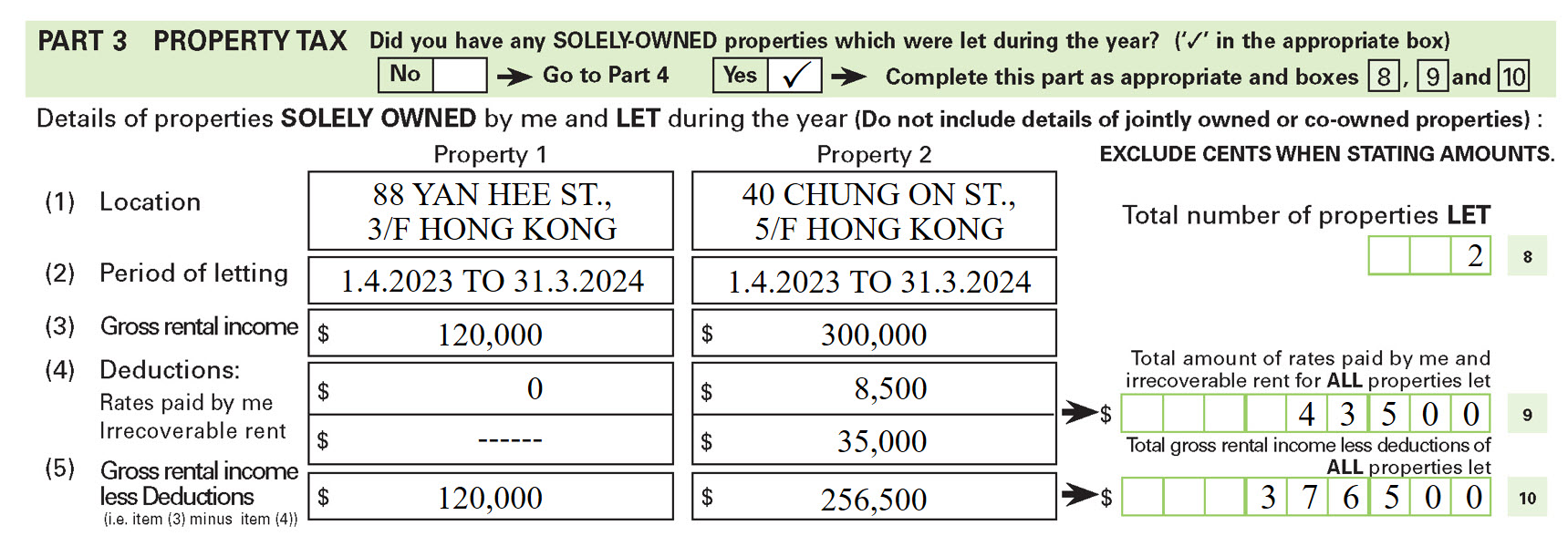

This is the place to start to get familiar with the e Services for Filing of return The process overviews present the steps required to perform the different processes manually or online If this is your first time this is the best place to start Tax Return Individuals should be filed within 1 month from the date of issue of the Tax Return if the taxpayer did not solely own any unincorporated business during the year of assessment or within 3 months from the date of issue of the Tax Return if the taxpayer solely owned any unincorporated business during the year of assessment or

[desc-10] [desc-11]

Hong Kong Tax Return Startupr hk

https://lh5.googleusercontent.com/Af99uBQdaKp3XAWVEe1qwDs-HM-N-Cz0rv_vmg-lzkadg7xU-NaEw_E0s-gkTYzMkJWTfa_dKGW4gPEwIYUQyjJMsHuGFs2zAtS7LKc3cRmRAS_Lwssp9jCE9DirNS1MkjNiAN_3

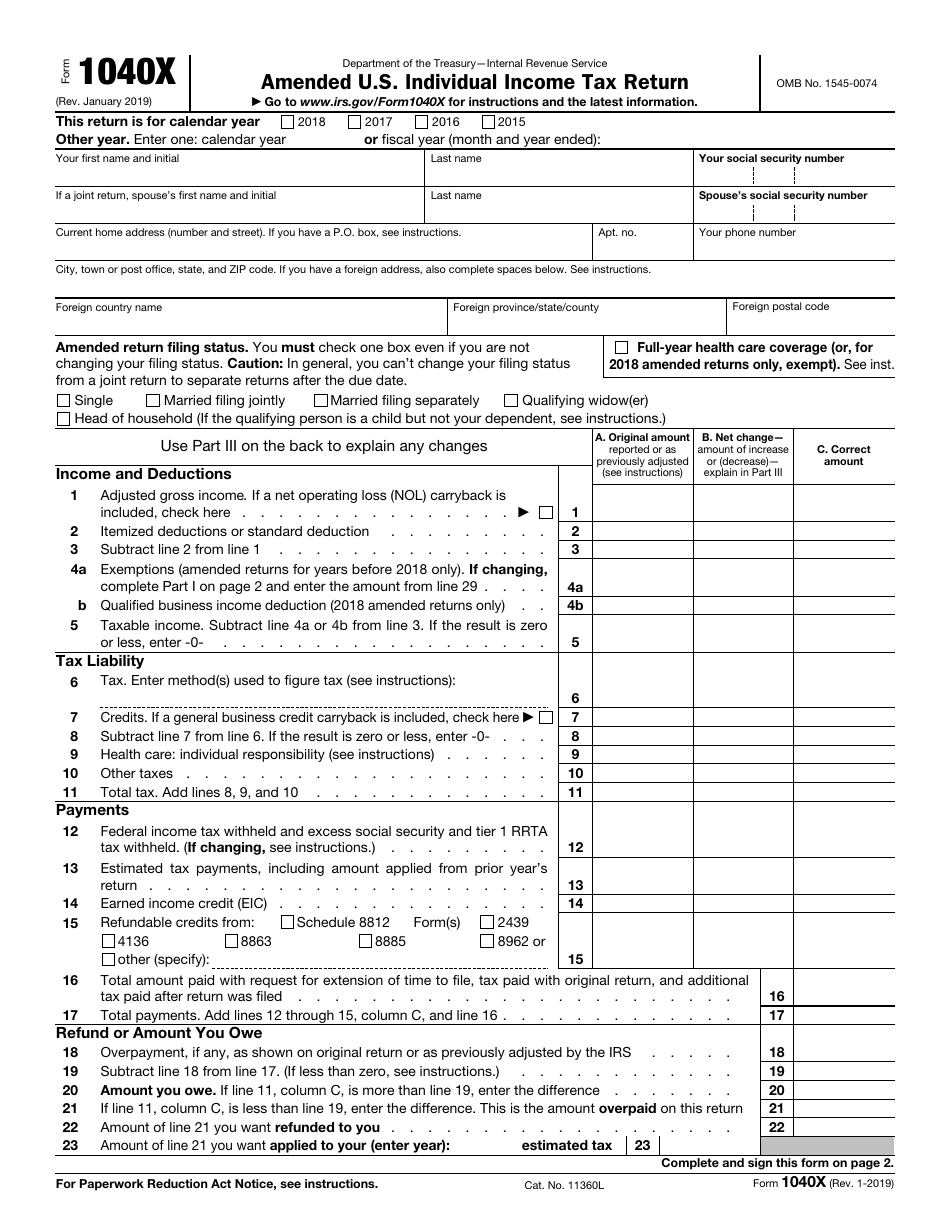

Form 1040x Printable Printable Forms Free Online

https://data.templateroller.com/pdf_docs_html/1862/18621/1862187/irs-form-1040x-amended-u-s-individual-income-tax-return_print_big.png

https://cfr.gov.mt/en/individuals/Pages/Online-Individuals-Return.aspx

You can submit your income tax return online by logging into https mytax cfr gov mt using your e id account Through this service you can submit your income tax form in as easier and more efficient manner

https://cfr.gov.mt/en/inlandrevenue/personaltax/...

In this section you may find a general overview of personal tax related matters including information on your obligations and rights as a taxpayer More detailed tax information is given on specific subjects such as tax credits the income tax return and related forms used

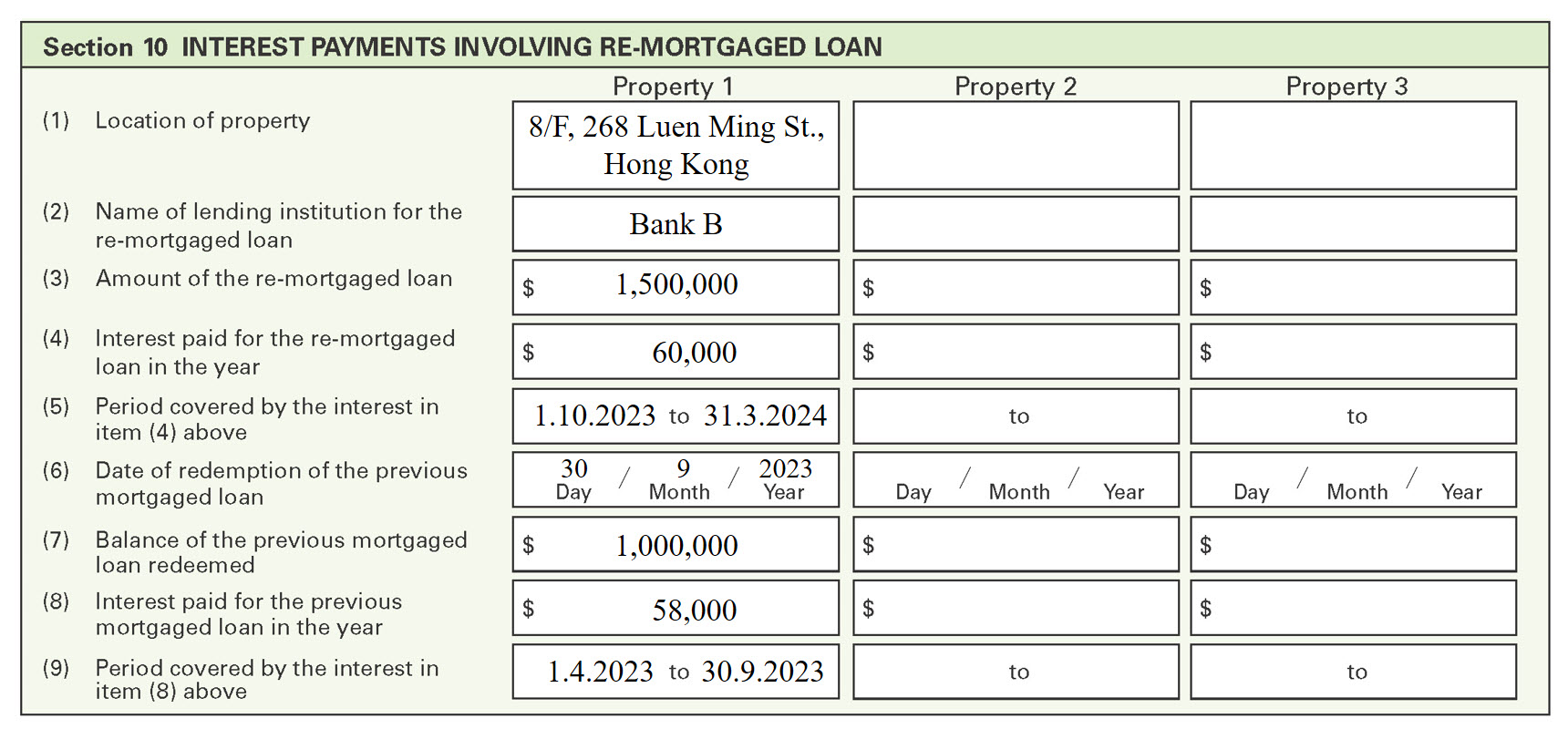

FAQ On Completion Of Tax Return Individuals

Hong Kong Tax Return Startupr hk

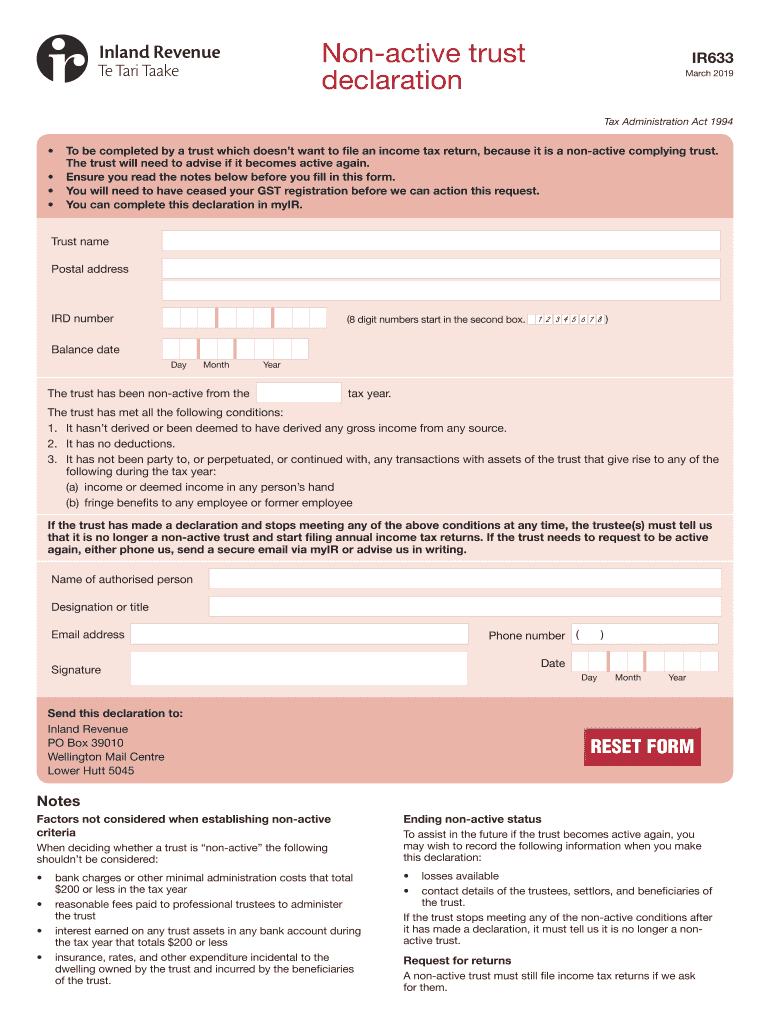

NZ IRD IR633 2019 2021 Fill And Sign Printable Template Online US

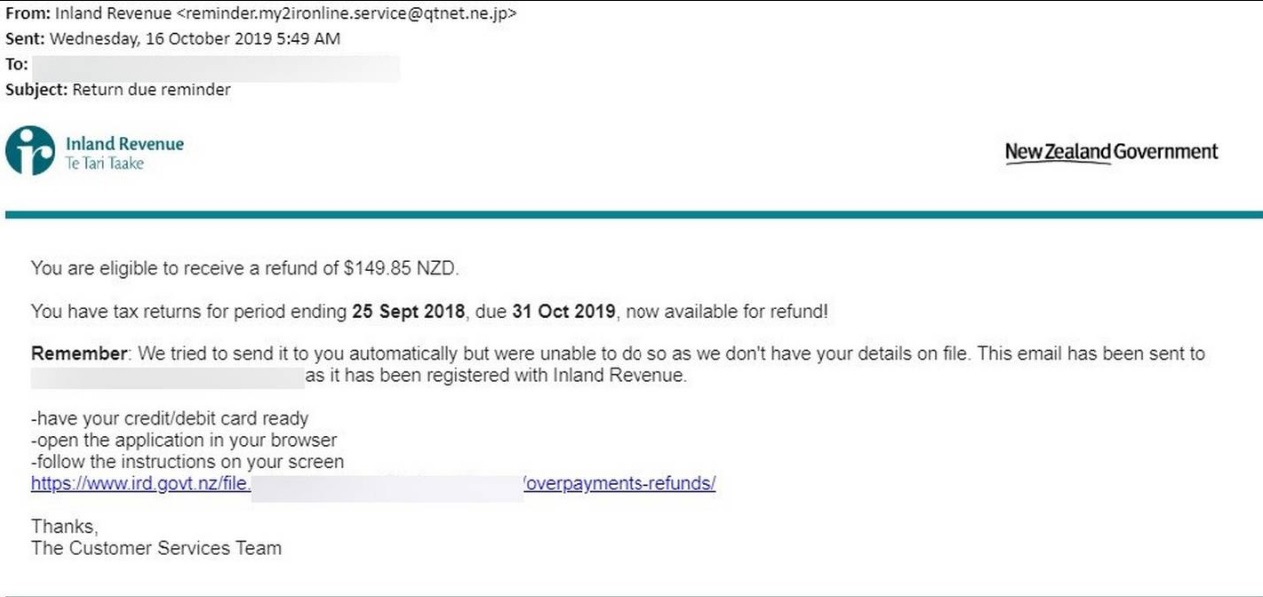

IRD Scam Emails eerily Similar Star News

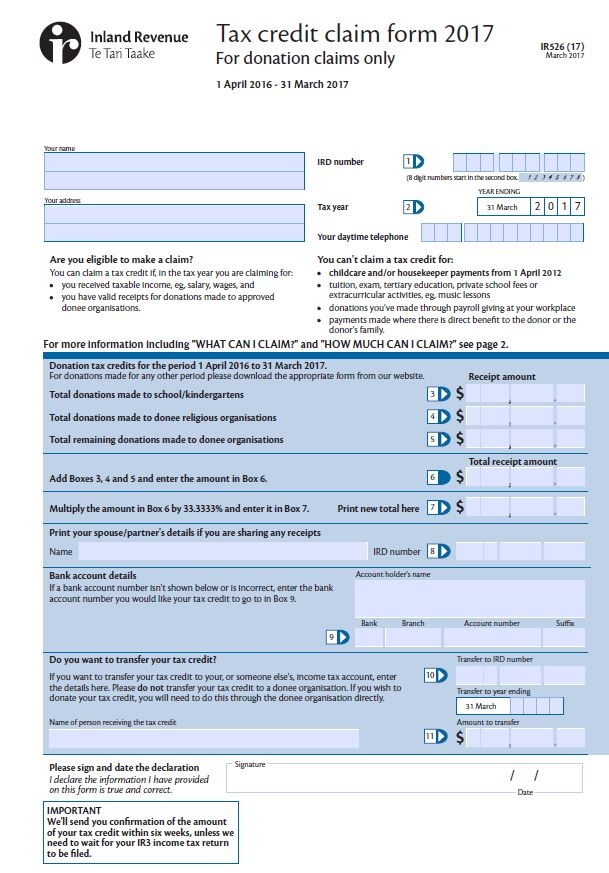

Emigrate Or Immigrate Ir526 Form

IRD Tax Return Form Fill Out And Sign Printable PDF Template SignNow

IRD Tax Return Form Fill Out And Sign Printable PDF Template SignNow

FAQ On Completion Of Tax Return Individuals

IRS Letter 1615 Mail Overdue Tax Returns H R Block

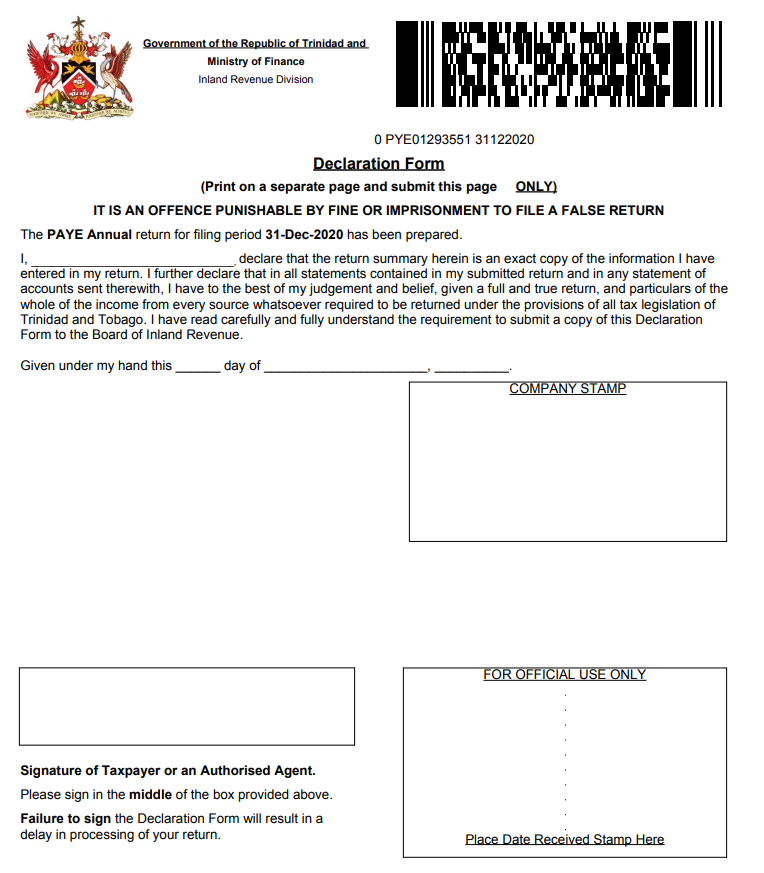

IRD PAYE Annual Return Non Logged In Guide Printing The

Ird Tax Return - [desc-14]