Irish Tax Rebates Office Web Want to know more Contact us using the details below check our FAQs or get in touch for a chat 059 8634794 info irishtaxrebates ie 1 Leinster Street Athy Co Kildare

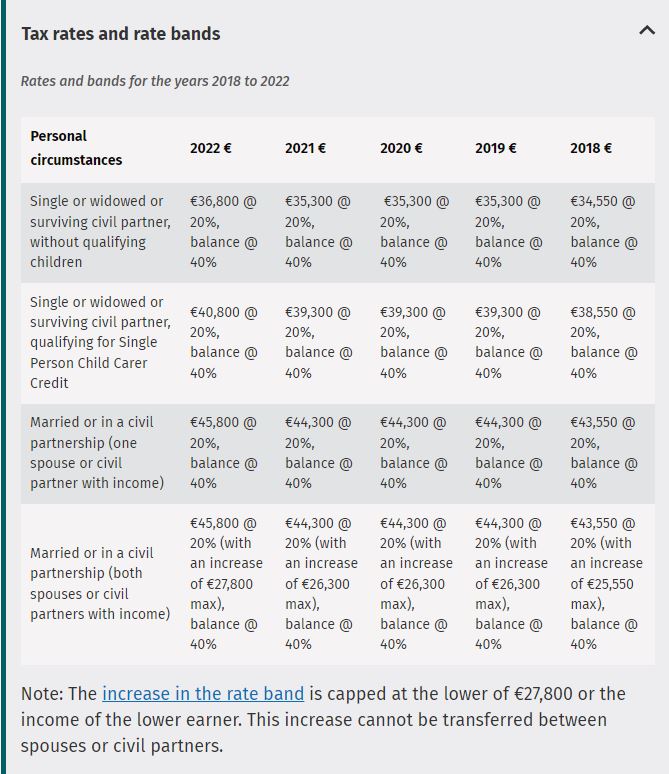

Web Hiring and paying employees returns paying tax benefit in kind social welfare payments employee expenses PAYE modernisation Property Buying and selling Local Property Tax Stamp Duty Home Renovation Web Health expenses Calculating your Income Tax Rent Tax Credit Tax rates bands and reliefs Differences between tax credits reliefs and exemptions Real Time Credits Land

Irish Tax Rebates Office

Irish Tax Rebates Office

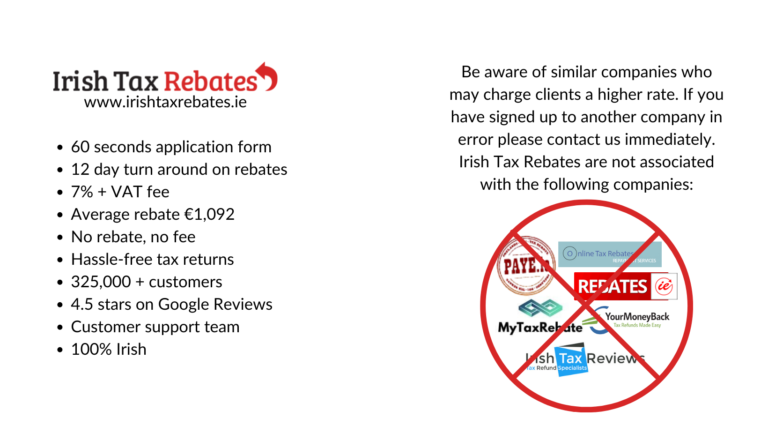

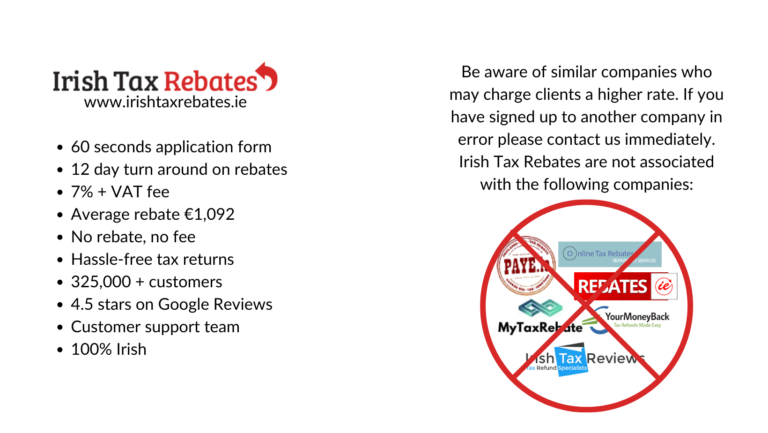

https://blog.irishtaxrebates.ie/wp-content/uploads/2020/03/Revoked-768x433.png

Your Guide To PAYE Taxes In Ireland

https://www.taxback.com/resources/blogimages/rates_b.PNG

Irish Tax Rebates Claim Your Tax Back

https://www.irishtaxrebates.ie/img/open_graph/itrog.jpg

Web Central Repayments Office CRO Tax relief schemes for persons with disabilities including relief on vehicles fuel and appliances VRT Export Refund Scheme marine diesel Web Irish VAT registered traders reclaiming VAT from European Union EU Member States Apply for the Help to Buy HTB incentive Apply for refund of Value Added Tax VAT on

Web Irish Tax Rebates Claim Your Tax Back Have you already registered with Irish Tax Rebates Already Applied If you have already applied for a rebate with Irish Tax Rebates there should be no need to apply again Web Tax rates bands and reliefs The following tables show the tax rates rate bands and tax reliefs for the tax year 2023 and the previous tax years Calculating your Income Tax

Download Irish Tax Rebates Office

More picture related to Irish Tax Rebates Office

Put 1 000 Back In Your Pocket Irish Tax Rebates YouTube

https://i.ytimg.com/vi/Zc5oyVXrmhY/maxresdefault.jpg

Irish Tax Rebates We Do The Checking You Get The Cheque YouTube

https://i.ytimg.com/vi/kULnmAVqClw/maxresdefault.jpg

More Tax Credits More Rebates Education Magazine

https://i0.wp.com/educationmagazine.ie/wp-content/uploads/2022/10/bbb-Irish-Tax-Rebates.jpg?fit=1200%2C800&ssl=1

Web You are not entitled to claim tax relief if you bring work home from the office outside of normal working hours for example in the evenings or at weekends More information on Web 19 d 233 c 2018 nbsp 0183 32 The department recognises the need to keep the tax and revenue base broad while reducing the rate of tax on work and other activities in order to achieve

Web 1 Fill and sign our 60 second online form 2 We complete our comprehensive tax review within 12 working days 3 We send you your tax rebate by bank transfer or cheque The Web 9 f 233 vr 2022 nbsp 0183 32 See A guide to self assessment to learn how to register for tax and how to pay your tax See the Starting a business section for starting a business in Ireland Can you

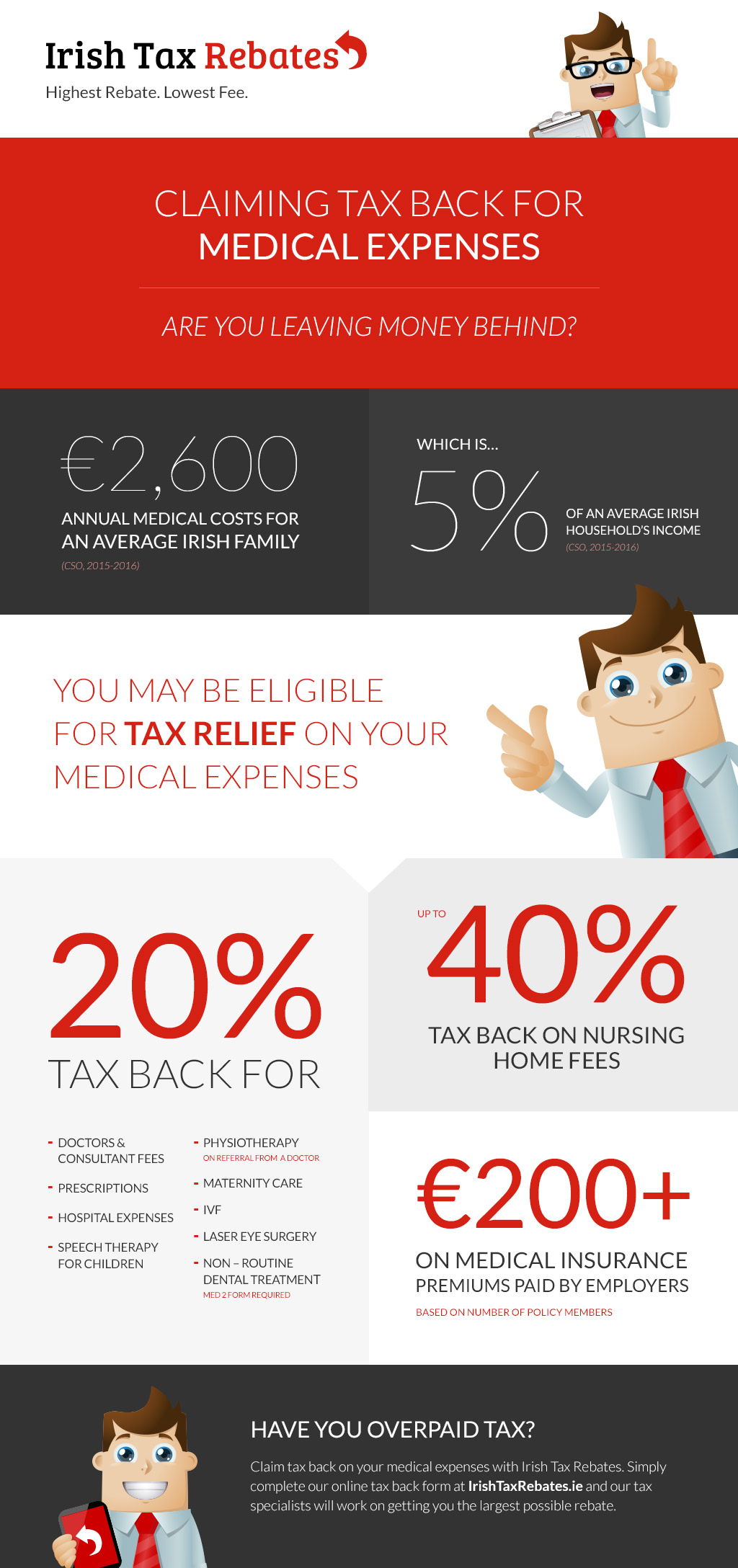

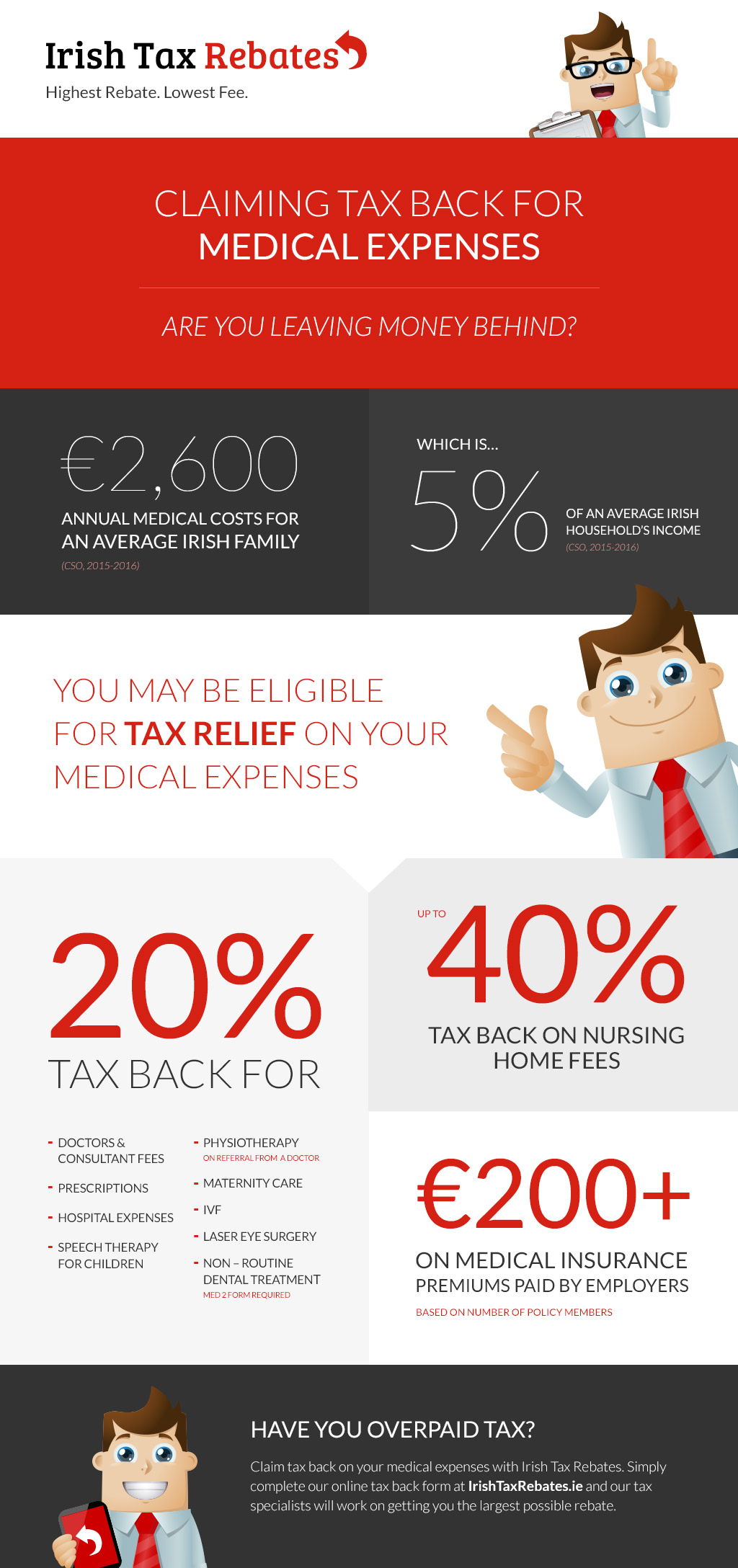

Tax Back On Medical Expenses Infographic Irish Rebates

http://blog.irishtaxrebates.ie/wp-content/uploads/2018/04/itr-infographic-1.jpg

Claiming Tax Back FAQ s Irish Tax Rebates

http://blog.irishtaxrebates.ie/wp-content/uploads/2015/10/itr-infographic-faq.jpg

https://www.irishtaxrebates.ie/contact

Web Want to know more Contact us using the details below check our FAQs or get in touch for a chat 059 8634794 info irishtaxrebates ie 1 Leinster Street Athy Co Kildare

https://www.revenue.ie/en

Web Hiring and paying employees returns paying tax benefit in kind social welfare payments employee expenses PAYE modernisation Property Buying and selling Local Property Tax Stamp Duty Home Renovation

Irish Tax Rebates How It Works YouTube

Tax Back On Medical Expenses Infographic Irish Rebates

Paying Tax In Ireland What You Need To Know

Irish Tax Rebates Sign Partnership With Athy Gfc

Consult Tax Experts To Claim Tax Back Irish Tax Rebates

Irish Tax Tips Your Irish Tax Rebates Resource

Irish Tax Tips Your Irish Tax Rebates Resource

More Tax Credits More Rebates Education Magazine

Irish Tax Rebates Contact Us To Claim Tax Back

Irish Tax Rebates Reviews Read Customer Service Reviews Of

Irish Tax Rebates Office - Web Irish VAT registered traders reclaiming VAT from European Union EU Member States Apply for the Help to Buy HTB incentive Apply for refund of Value Added Tax VAT on