Irs 2022 Tax Standard Deduction Web Publication 501 2022 Dependents Standard Deduction and Filing Information Internal Revenue Service Home Publications Publication 501 2022 Dependents Standard Deduction and Filing Information Publication 501 Introductory Material What s New Reminders Introduction Nonresident aliens Comments and suggestions

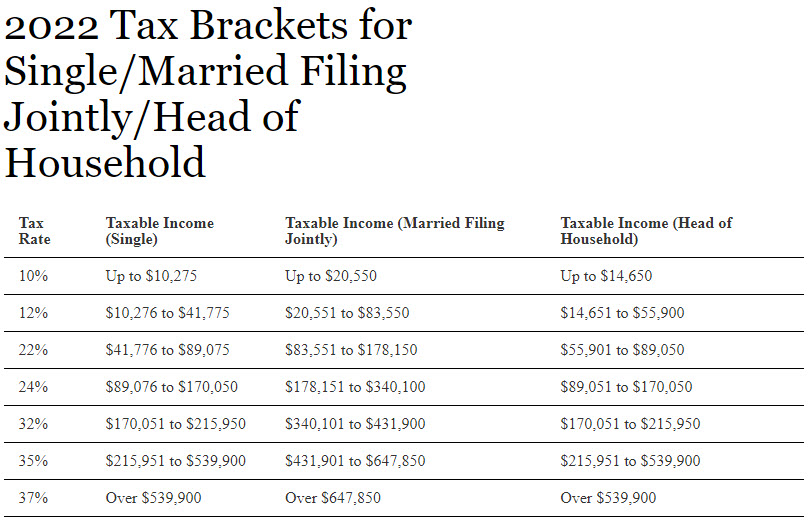

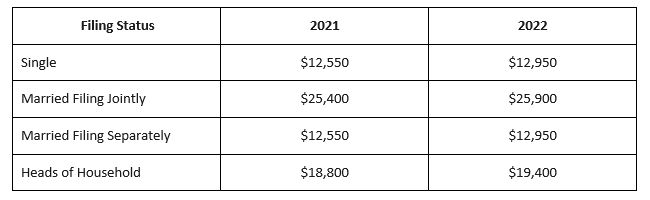

Web 10 Nov 2021 nbsp 0183 32 For single taxpayers and married individuals filing separately the standard deduction rises to 12 950 for 2022 up 400 and for heads of households the standard deduction will be 19 400 for tax year 2022 up 600 Web 10 Nov 2021 nbsp 0183 32 Read More The standard deduction amount for the 2022 tax year jumps to 12 950 for single taxpayers up 400 and 25 900 for a married couple filing jointly up 800

Irs 2022 Tax Standard Deduction

Irs 2022 Tax Standard Deduction

https://www.natlawreview.com/sites/default/files/u17444/Davis Kuelthau image 1.jpg

2022 Tax Changes Method CPA

https://methodcpa.com/wp-content/uploads/2022/09/2022-09-28_11-53-21-1.jpg

Should You Take The Standard Deduction On Your 2021 2022 Taxes

https://www.taxdefensenetwork.com/wp-content/uploads/2021/12/20212022-Standard-Deduction-.jpg

Web 11 Nov 2021 nbsp 0183 32 The standard deduction for married couples goes up to 25 900 for tax year 2022 Single filers and married individuals who file separately will get a 12 950 standard deduction and heads of Web 10 Nov 2021 nbsp 0183 32 The IRS also announced that the standard deduction for 2022 was increased to the following Married couples filing jointly 25 900 Single taxpayers and married individuals filing

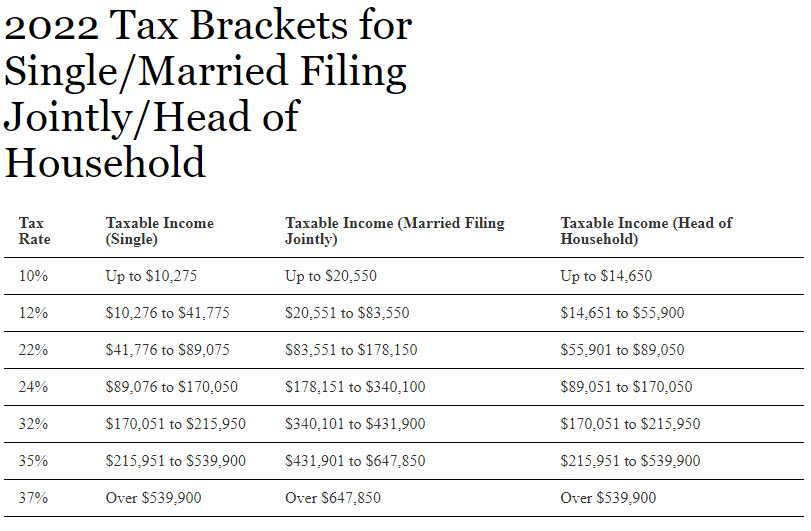

Web 10 Nov 2021 nbsp 0183 32 The IRS recently released the new inflation adjusted 2022 tax brackets and rates Explore updated credits deductions and exemptions including the standard deduction amp personal exemption Alternative Minimum Tax AMT Earned Income Tax Credit EITC Child Tax Credit CTC capital gains brackets qualified business income Web The standard deduction is a specific dollar amount that reduces the amount of income on which you re taxed Your standard deduction consists of the sum of the basic standard deduction and any additional standard deduction amounts for age and or blindness

Download Irs 2022 Tax Standard Deduction

More picture related to Irs 2022 Tax Standard Deduction

California Individual Tax Rate Table 2021 2022 Brokeasshome

https://imageio.forbes.com/specials-images/imageserve/618be39f8dd74be3a7c319d4/Married-Separately-tax-rates-2022/960x0.jpg?height=440&width=711&fit=bounds

2023 Tax Brackets Explained IMAGESEE

https://www.theoasisfirm.com/wp-content/uploads/2022/10/IRS-Tax-Bracket-Adjustment-for-2023.png

2022 Federal Tax Brackets And Standard Deduction Printable Form

https://i2.wp.com/financialsamurai.com/wp-content/uploads/2021/11/2022-income-tax-rates-married-filing-jointly.png?fit=1456,9999

Web 11 Jan 2022 nbsp 0183 32 The standard deduction amount depends on the taxpayer s filing status whether they are 65 or older or blind and whether another taxpayer can claim them as a dependent Taxpayers who are age 65 or older on the last day of the year and don t itemize deductions are entitled to a higher standard deduction Web There s one big caveat to these 2022 numbers Democrats are still trying to pass the now 1 85 trillion Build Back Better Act and the latest November 3 legislative text includes income tax surcharges on the rich as well as an 80 000 cap up from 10 000 for state and local tax deductions Earlier versions included cutting the estate

Web 17 Nov 2022 nbsp 0183 32 Personal Exemptions Standard Deductions Limitation on Itemized Deductions Personal Exemption Phaseout Thresholds and Statutory Marginal Tax Rates 2023 Personal Exemption and Phaseout Web 27 Feb 2023 nbsp 0183 32 Your Guide to Tax Year 2022 Deductions Learn how tax deductions work and which ones you might be able to take for tax year 2022 By Jessica Walrack Edited by Barri Segal Feb

2022 Tax Brackets Irs Head Of Household Debra Fisher Info

https://images.squarespace-cdn.com/content/v1/572ff08b044262a7f8c2405e/3b92837f-50b6-494c-b785-1c9788951a6b/MFJ_Single.png

IRS Standard Deduction For 2022 Tax Year Fingerlakes1

https://www.fingerlakes1.com/wp-content/uploads/2022/01/irs-standard-deduction-for-2022-tax-year.jpg

https://www.irs.gov/publications/p501

Web Publication 501 2022 Dependents Standard Deduction and Filing Information Internal Revenue Service Home Publications Publication 501 2022 Dependents Standard Deduction and Filing Information Publication 501 Introductory Material What s New Reminders Introduction Nonresident aliens Comments and suggestions

https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments...

Web 10 Nov 2021 nbsp 0183 32 For single taxpayers and married individuals filing separately the standard deduction rises to 12 950 for 2022 up 400 and for heads of households the standard deduction will be 19 400 for tax year 2022 up 600

United States Income Tax IRS Provides Tax Inflation Adjustments For

2022 Tax Brackets Irs Head Of Household Debra Fisher Info

2022 Tax Rates Standard Deduction Amounts To Be Prepared In 2023

IRS Tax Brackets 2021 Table Federal Withholding Tables 2021

2022 Federal Tax Brackets And Standard Deduction Printable Form

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

2021 Vs 2022 Tax Brackets Latest News Update

New 2023 IRS Income Tax Brackets And Phaseouts

Tax Form Itemized Deduction Worksheet

Irs 2022 Tax Standard Deduction - Web The standard deduction is a specific dollar amount that reduces the amount of income on which you re taxed Your standard deduction consists of the sum of the basic standard deduction and any additional standard deduction amounts for age and or blindness