Irs And State Tax Rebates Web 7 sept 2023 nbsp 0183 32 IRS weighs in on state rebate payments picture of the IRS Internal Revenue Service sign In most cases according to the IRS taxpayers who receive special state

Web 9 f 233 vr 2023 nbsp 0183 32 The Tax Policy Center a nonprofit research group counts 18 states that sent one time income tax rebates in 2022 Arkansas California Colorado Connecticut Web 3 f 233 vr 2023 nbsp 0183 32 Feb 3 2023 The IRS is aware of questions involving special tax refunds or payments made by states in 2022 we are working with state tax officials as quickly

Irs And State Tax Rebates

Irs And State Tax Rebates

https://preview.redd.it/irs-says-california-most-state-tax-rebates-arent-considered-v0-tf7njp3brgha1.jpg?width=923&format=pjpg&auto=webp&s=5a97cf7329a57d5101bc108f01408f61132b4551

IRS Says State Issued Stimulus Payments Are Not Taxable CPA Practice

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2023/02/1040-2022-IRS-from-PDF.png

Breaking Down The Rebate Will The IRS Make People Pay Taxes On State

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA17jiv6.img?h=630&w=1200&m=6&q=60&o=t&l=f&f=jpg

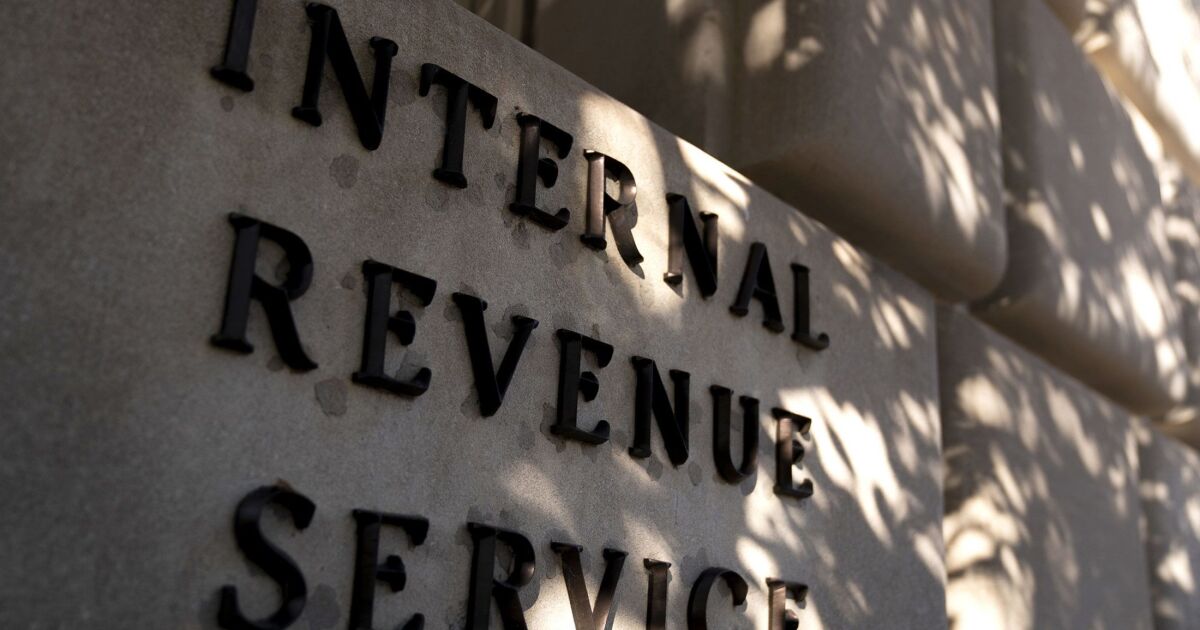

Web 10 f 233 vr 2023 nbsp 0183 32 Tax season is underway but millions of filers who received state tax rebates or payments are in limbo after the IRS told taxpayers to pause on filing returns The Web 30 ao 251 t 2023 nbsp 0183 32 The IRS exempted many state tax refunds and rebates from tax and expanded on guidance it gave in early 2023 about payments you need to include on your

Web 13 f 233 vr 2023 nbsp 0183 32 A person who pays 5 000 in state taxes then receives a 1 000 rebate check is in effect paying 4 000 in state taxes says Jared Walczak vice president of Web Il y a 12 heures nbsp 0183 32 State stimulus check 2023 update Clarity from the IRS on so called state stimulus checks is essential because millions of taxpayers across the U S have

Download Irs And State Tax Rebates

More picture related to Irs And State Tax Rebates

List Of Tax Refund Calendar 2022 Ideas Blank November 2022 Calendar

https://i2.wp.com/epicsidegigs.com/wp-content/uploads/2019/11/2020-IRS-Refund-Schedule-768x459.jpg

IRS Says California Most State Tax Rebates Aren t Taxable Income

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA17lDJ6.img

Rick Telberg On Twitter IRS Says Special State Payments And Tax

https://pbs.twimg.com/media/FopIpFaaMAAH7rB.jpg

Web 11 avr 2023 nbsp 0183 32 Taxpayers can see a listing of individual states and the federal tax treatment of their special state refunds or rebates listed on this State Payments chart In addition Web 11 f 233 vr 2023 nbsp 0183 32 The IRS announced Friday that most relief checks issued by states last year aren t subject to federal taxes providing 11th hour guidance as tax returns start to pour in A week after telling

Web 30 ao 251 t 2023 nbsp 0183 32 IR 2023 158 Aug 30 2023 The IRS today provided guidance on the federal tax status of refunds of state or local taxes and certain other payments made by Web 6 f 233 vr 2023 nbsp 0183 32 The IRS is aware of questions involving special tax refunds or payments made by states in 2022 we are working with state tax officials as quickly as possible

Receive IRS Tax Rebates Payments 2023

https://images.unsplash.com/photo-1550565118-3a14e8d0386f?ixid=MnwyNTE2NnwwfDF8c2VhcmNofDE5fHxtb25leXxlbnwwfHx8fDE2NzY1NTYxNDQ&ixlib=rb-4.0.3&q=85&w=2160

IRS Tells Millions Who Received State Rebates Don t File Just Yet

https://wehco.media.clients.ellingtoncms.com/imports/adg/photos/203577712_IRSbuilding_0_ORIG_t800.jpg?90232451fbcadccc64a17de7521d859a8f88077d

https://finance.yahoo.com/news/2023-state-rebate-check-taxed-1415000…

Web 7 sept 2023 nbsp 0183 32 IRS weighs in on state rebate payments picture of the IRS Internal Revenue Service sign In most cases according to the IRS taxpayers who receive special state

https://www.nytimes.com/2023/02/09/your-money/irs-state-tax-rebates.html

Web 9 f 233 vr 2023 nbsp 0183 32 The Tax Policy Center a nonprofit research group counts 18 states that sent one time income tax rebates in 2022 Arkansas California Colorado Connecticut

2022 State Of Illinois Tax Rebates EzTaxReturn Blog

Receive IRS Tax Rebates Payments 2023

Mass Tax Rebate Check

If You Got Inflation Relief From Your State The IRS Wants You To Wait

Missouri State Tax Rebate 2023 Printable Rebate Form

Washington State Tax Rebate Printable Rebate Form

Washington State Tax Rebate Printable Rebate Form

IRS Flummoxed By State Rebate Rules Flipboard

Illinois Property Tax Rebate Form 2023 Printable Rebate Form

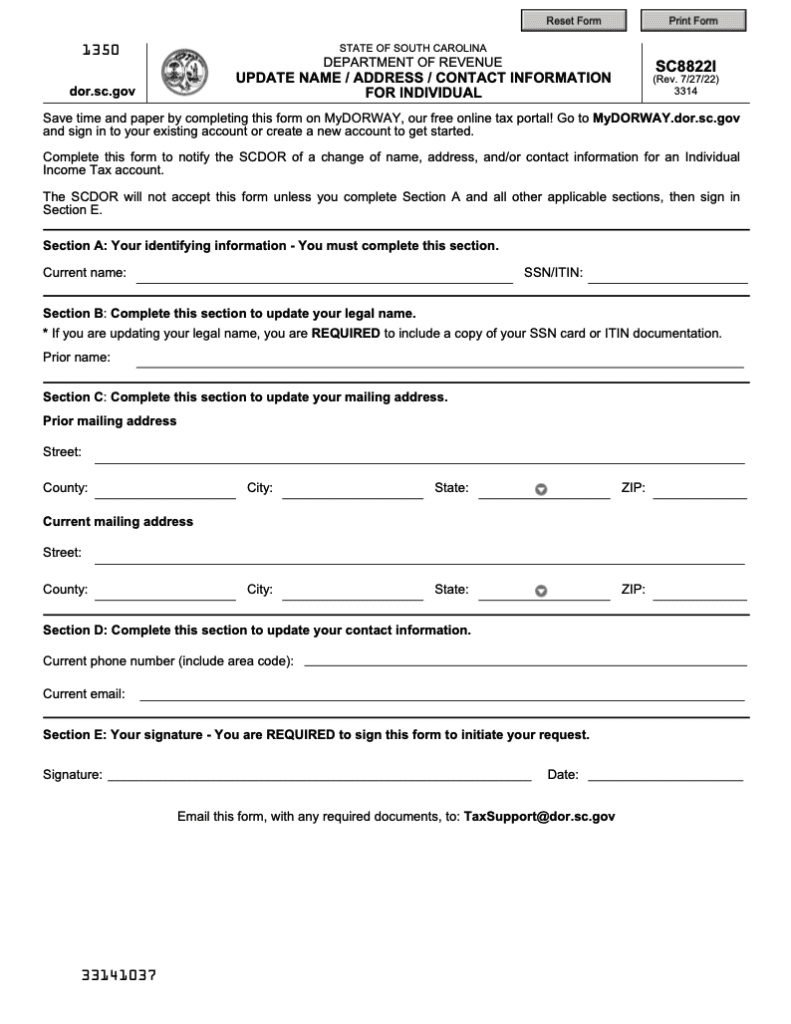

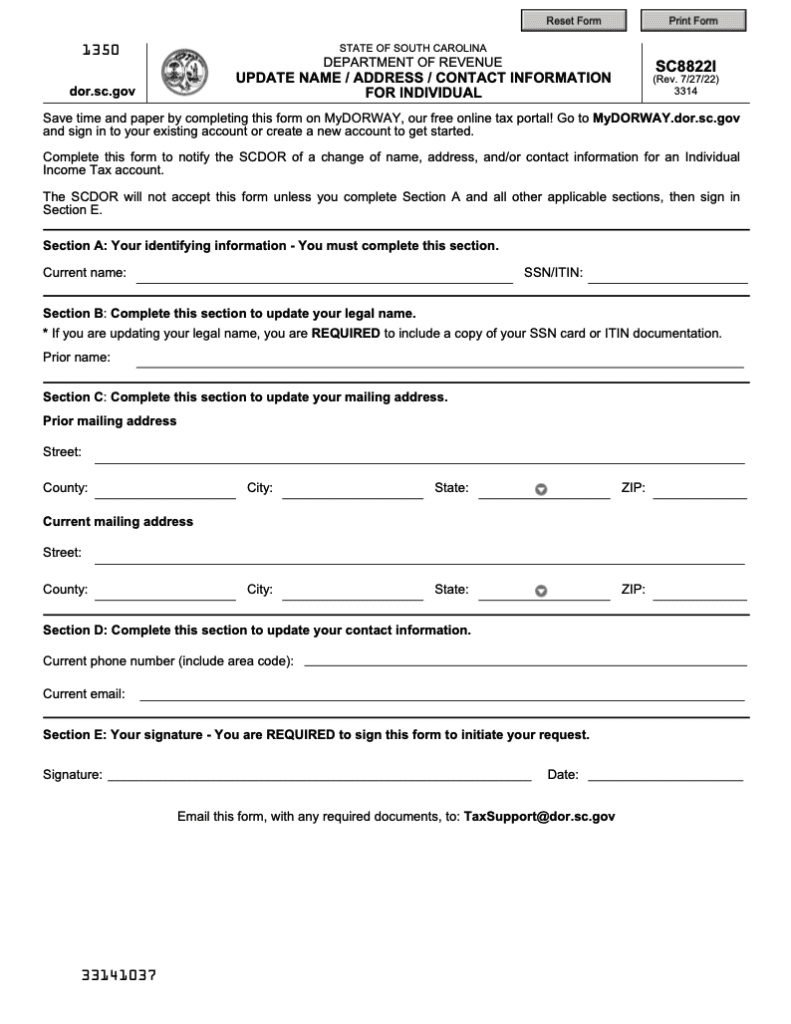

Will The IRS Tax South Carolina State Rebates Likely Not Wltx

Irs And State Tax Rebates - Web 24 juil 2023 nbsp 0183 32 February 13th update On Friday evening the IRS announced that rebates in most states would not be taxed but that payments from Georgia Massachusetts South