Irs Business Tax Credits 2022 The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities We ll

Business tax credits are money that can be subtracted dollar for dollar from owed business income taxes at state or federal levels Business tax credits IR 2022 203 November 22 2022 The Internal Revenue Service today encouraged taxpayers to take simple steps before the end of the year to make filing their 2022 federal

Irs Business Tax Credits 2022

Irs Business Tax Credits 2022

https://www.pearsoncocpa.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-17-at-11.22.53-PM-1536x1187.png

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

List Of Tax Refund Calendar 2022 Ideas Blank November 2022 Calendar

https://i2.wp.com/www.thebalance.com/thmb/r9yZNfeqALaM7mQnJMp3woJh_18=/1170x1141/filters:no_upscale():max_bytes(150000):strip_icc()/tax-form-1040-line-5a-2020-3b8663a83ed14c3e8d94db10c19b7262.PNG

Many owners of sole proprietorships partnerships S corporations and some trusts and estates may be eligible for a qualified business income QBI deduction also called the Section 199A deduction for tax years The FFCRA provides businesses with tax credits to cover certain costs of providing employees with paid sick leave and expanded family and medical leave for

This form lists each and every small business tax credit that your company might be eligible for Adding up those credits you can calculate your General During that time it might generate significant tax losses from bonus depreciation and might also generate significant amounts of three general business

Download Irs Business Tax Credits 2022

More picture related to Irs Business Tax Credits 2022

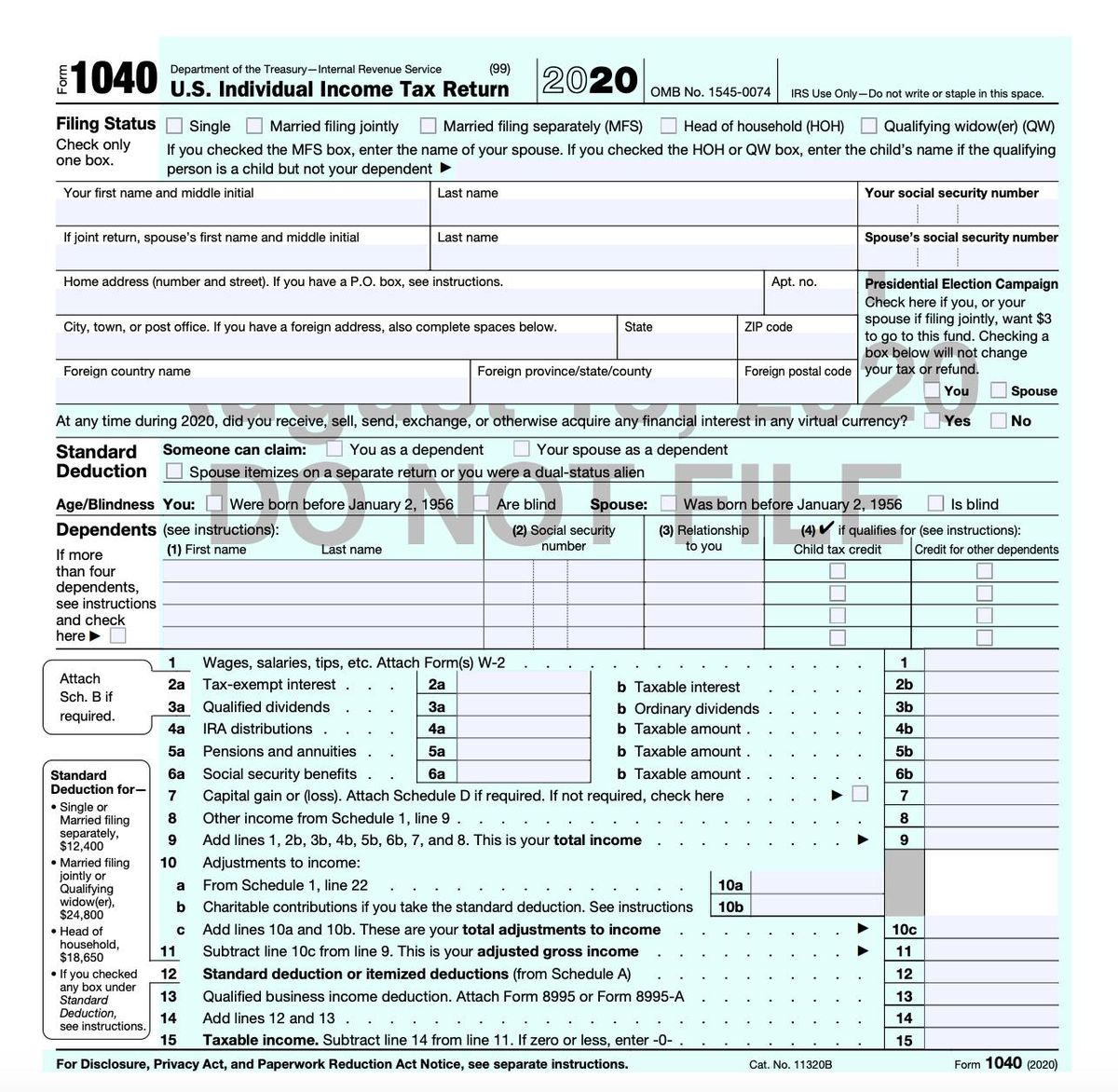

2020 Form IRS 1040 Schedule 3 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/535/781/535781050/large.png

Business Tax Credits 2022 Armanino

https://www.armaninollp.com/-/media/images/hero/business-tax-credits-2022.jpg

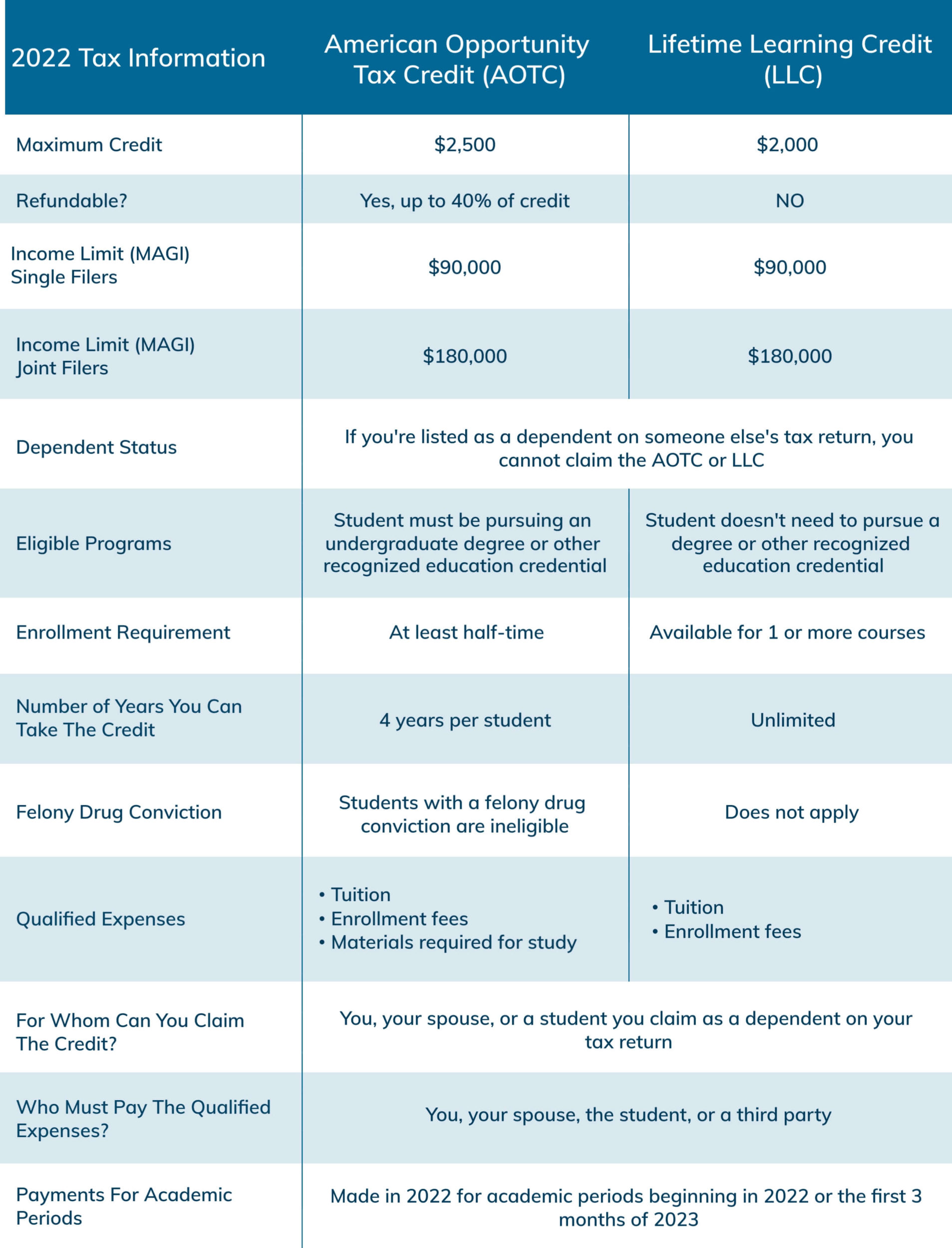

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-1907x2500.jpg

The amount of the maximum tax credit has been increased to 7 000 per employee per quarter and the level of qualifying business disruption has been reduced so that a 20 Jul 16 2022 9 09 AM PDT People eat outside of a restaurant in Fort Lauderdale Florida Chandan Khanna AFP via Getty Business tax credits and incentives can be an effective way to save

IR 2022 159 September 19 2022 The IRS today updated information on the Work Opportunity Tax Credit WOTC available to employers that hire designated categories American Rescue Plan Act ARPA 2021 tax year The credit remains at 70 of qualified wages up to a 10 000 limit per quarter so a maximum of 7 000

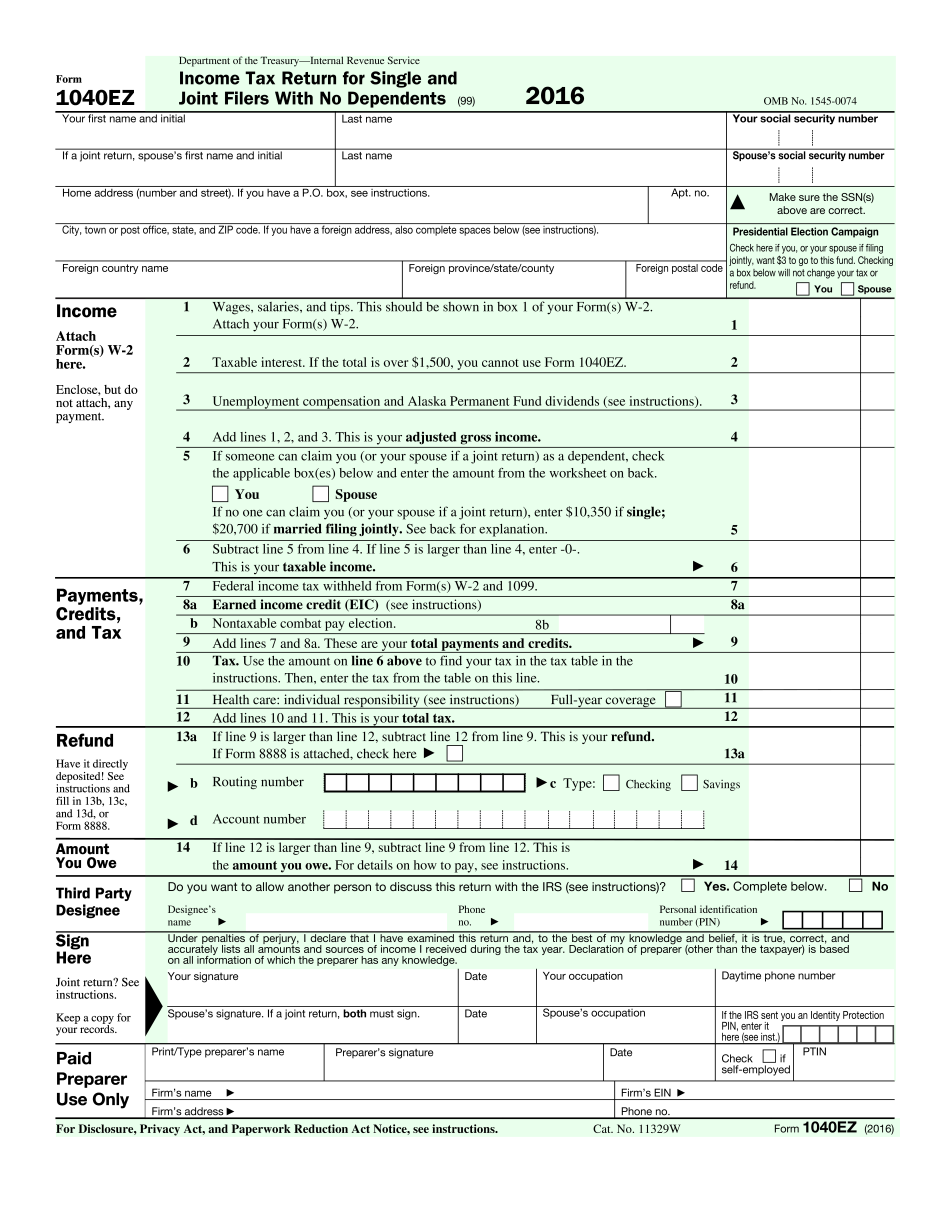

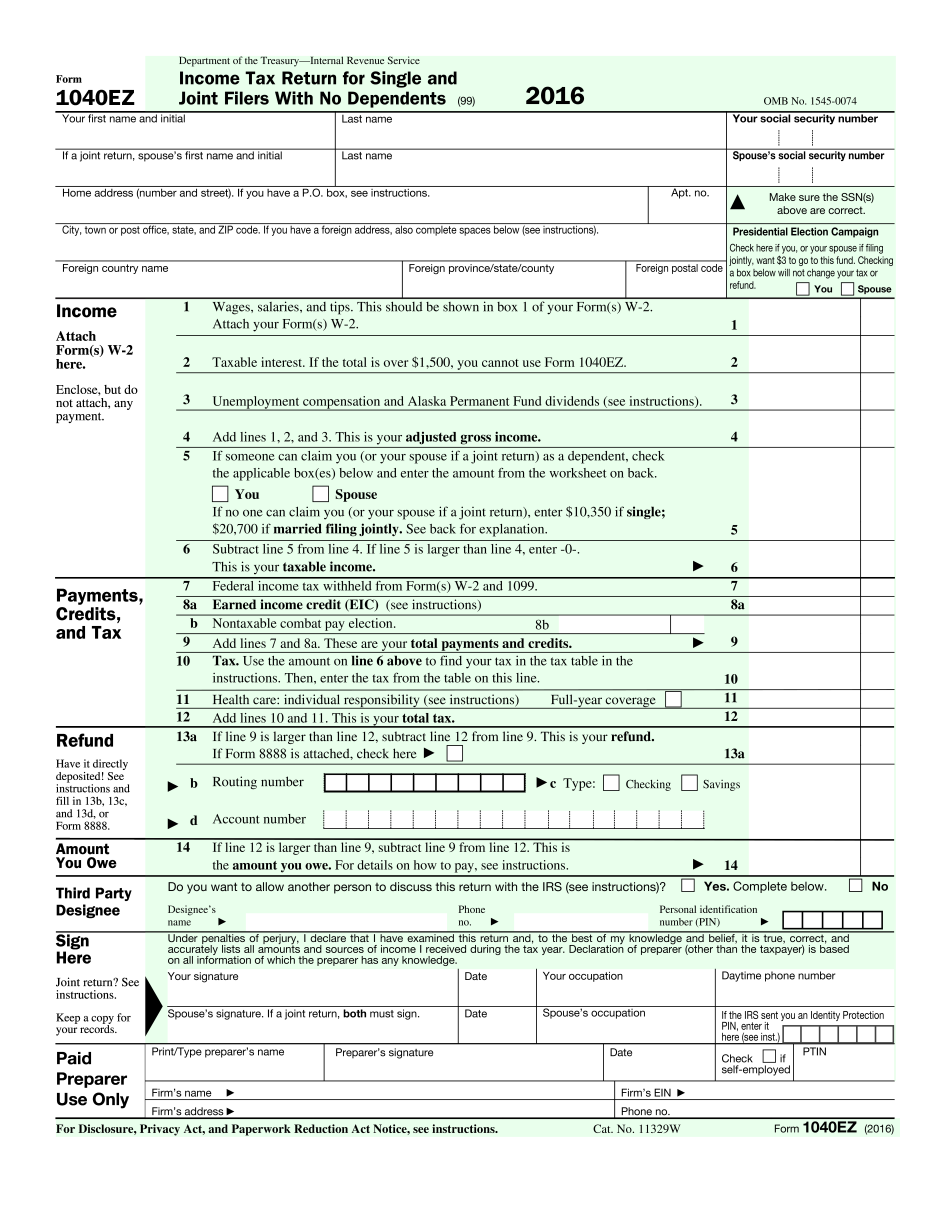

IRS 1040 EZ 2024 Form Printable Blank PDF Online

https://www.pdffiller.com/preview/393/13/393013384/big.png

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

https://www.houseloanblog.net/wp-content/uploads/2021/12/220003_SM_BLOG_Homeowner-Tax-Breaks-2022-CHART.jpg

https://www.irs.gov/credits-and-deductions-under...

The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities We ll

https://www.armanino.com/articles/business-tax-credits-2022

Business tax credits are money that can be subtracted dollar for dollar from owed business income taxes at state or federal levels Business tax credits

California Individual Tax Rate Table 2021 20 Brokeasshome

IRS 1040 EZ 2024 Form Printable Blank PDF Online

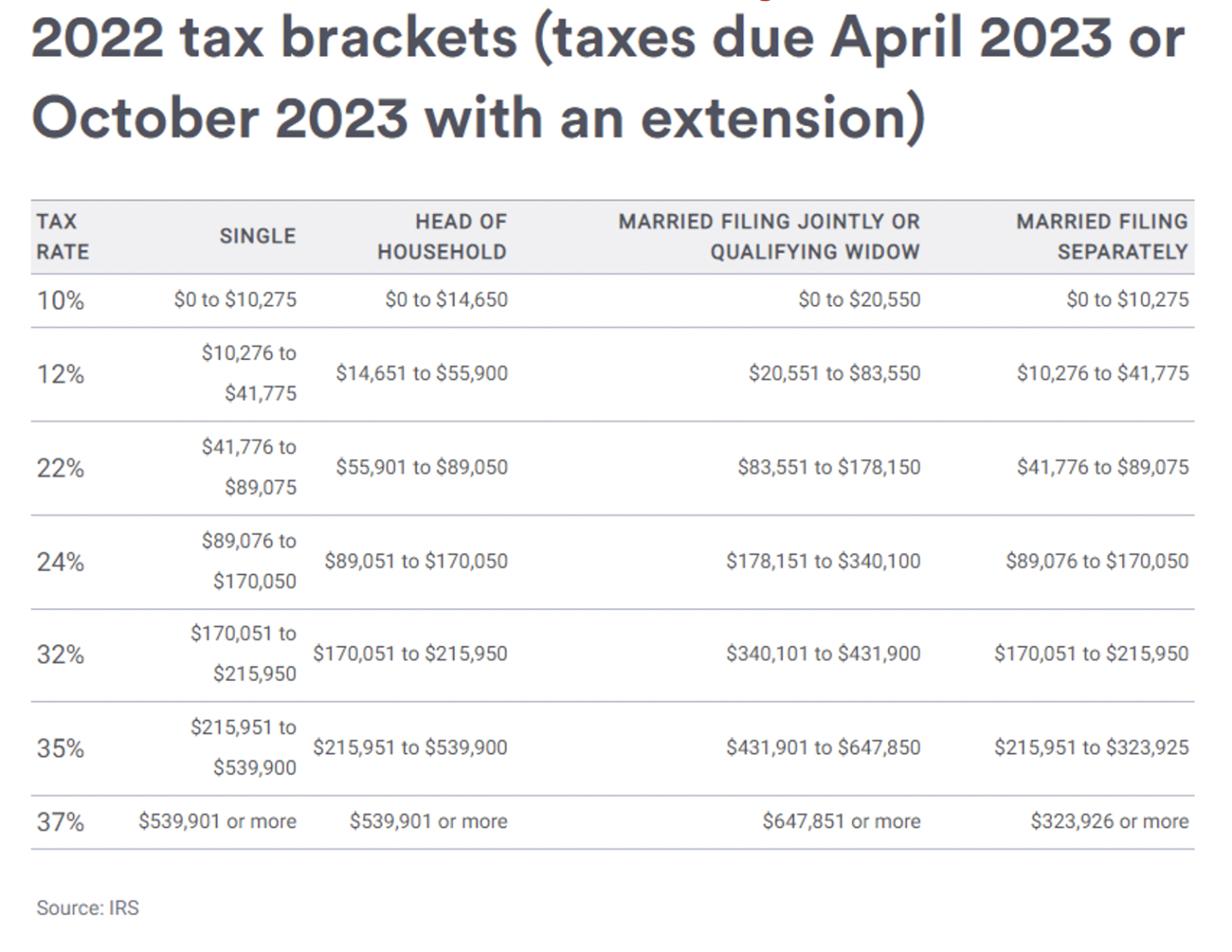

2023 Taxes Clarus Wealth

Tax Filing 2021 Deadline Is It Possible To Request An Extension AS USA

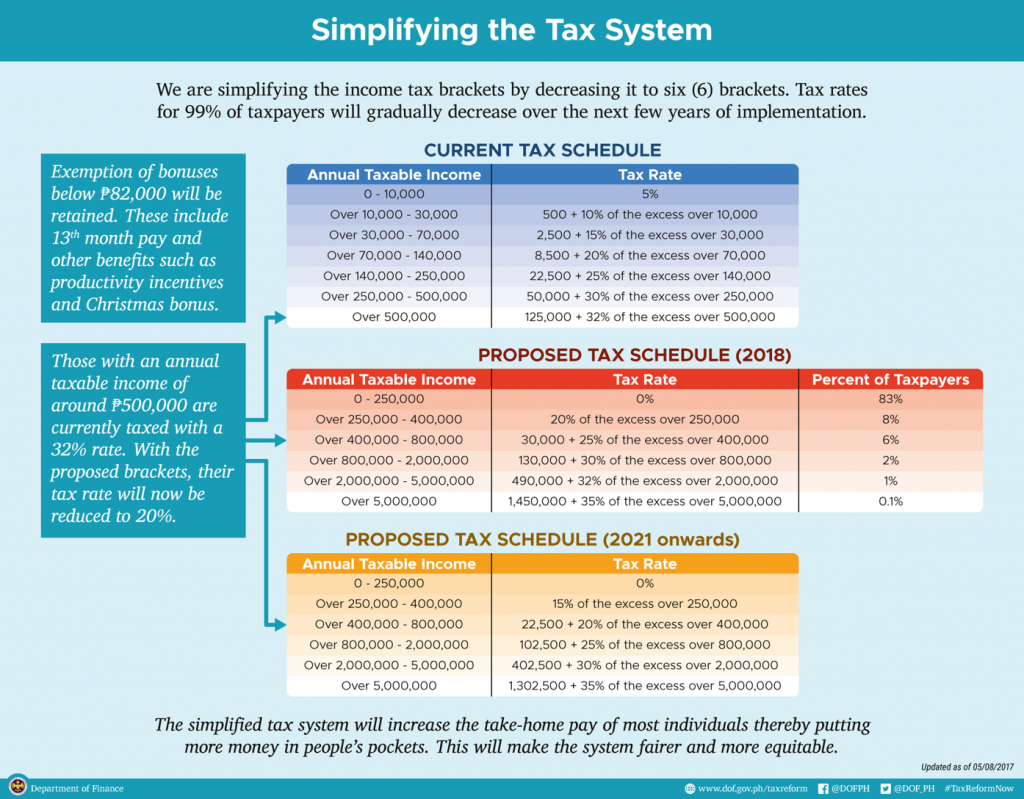

Proposed Tax Schedule Blogwatch

Here s The Average IRS Tax Refund Amount By State GOBankingRates

Here s The Average IRS Tax Refund Amount By State GOBankingRates

2022 1040 ES Form And Instructions 1040ES

Irs Tax Forms 2021 Printable Example Calendar Printable

What Is Rate Of Social Security Tax And Medicare Tax

Irs Business Tax Credits 2022 - You can get a tax credit for employee wages paid between March 12 2020 and January 1 2021 The maximum tax credit is 5 000 per employee you retain Most