Irs Child Care Meal Allowance 2022 Instead of tracking every penny you spend on food for the children or adults in your care you can use the standard meal and snack rates 2022 Rates by LocationBreakfast

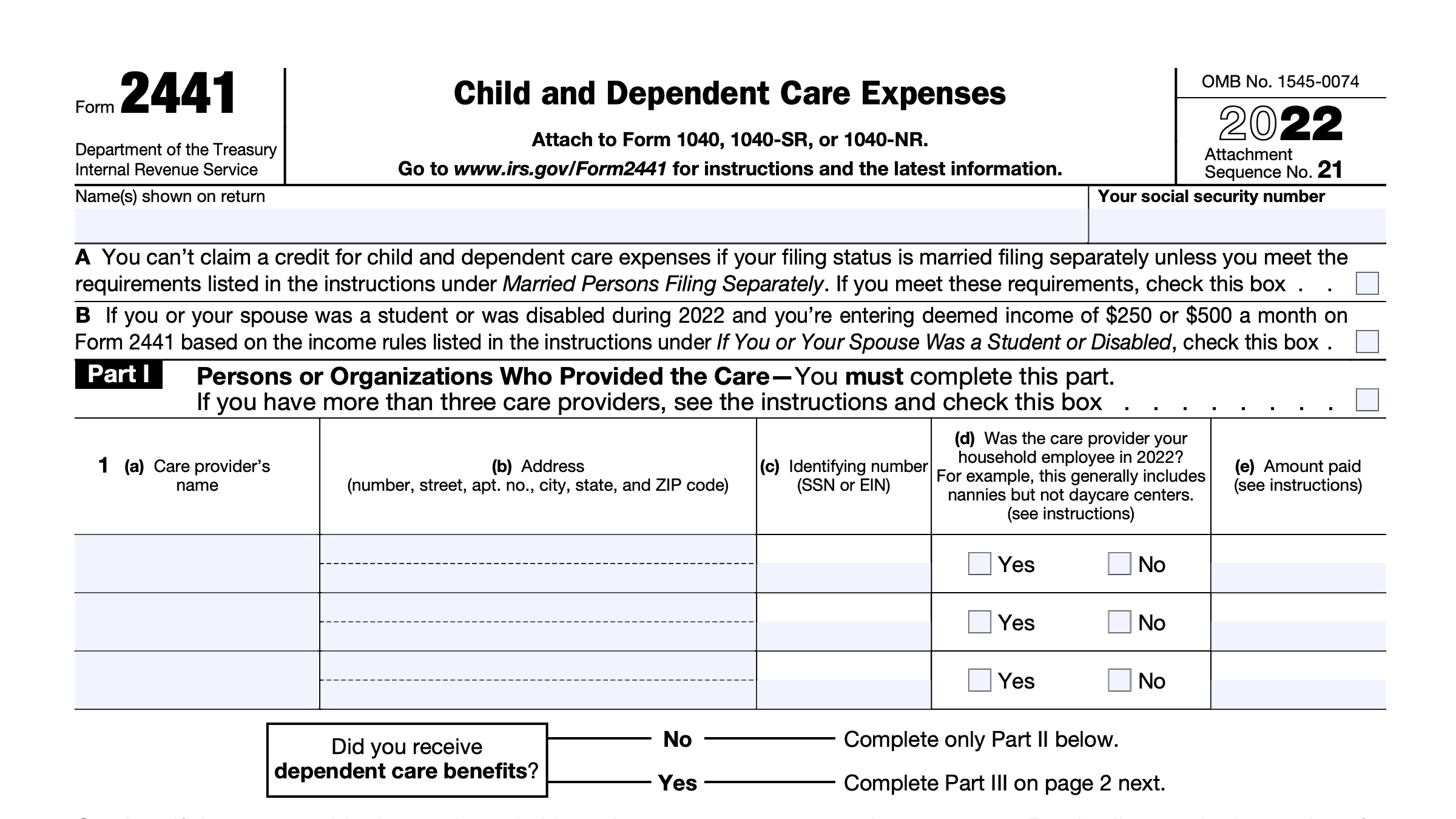

Your new spouse s earned income for the year was 2 000 You paid work related expenses of 3 000 for the care of your 5 year old child and qualified to claim the credit The amount of expenses you use to figure Per diem allowances for lodging meal and incidental expenses or for meal and incidental expenses only that are paid to any employee on or after October 1 2022 for travel

Irs Child Care Meal Allowance 2022

Irs Child Care Meal Allowance 2022

https://www.brighthorizons.com/resources/-/media/BH-New/ENews-Images/Widen-181106-B2C-5403-healthy-eating-guide-1155x867.ashx

Meal Allowance Rates S K Income Tax Accounting Inc

https://skincometax.com/wp-content/themes/customized/images/headers/1/31741-29732-23189-350.jpg

What Are IRS Meal Allowances Per Diem Rates For Tax Payers

https://www.freshbooks.com/wp-content/uploads/2022/01/[email protected]

Introduction The purpose of this publication is to provide information on figuring and claiming the deduction for business use of your home The term home includes a The 2022 2023 rates reflect a higher annual adjustment for food costs and a temporary increase of 0 10 per meal and snack served as authorized by Congress in

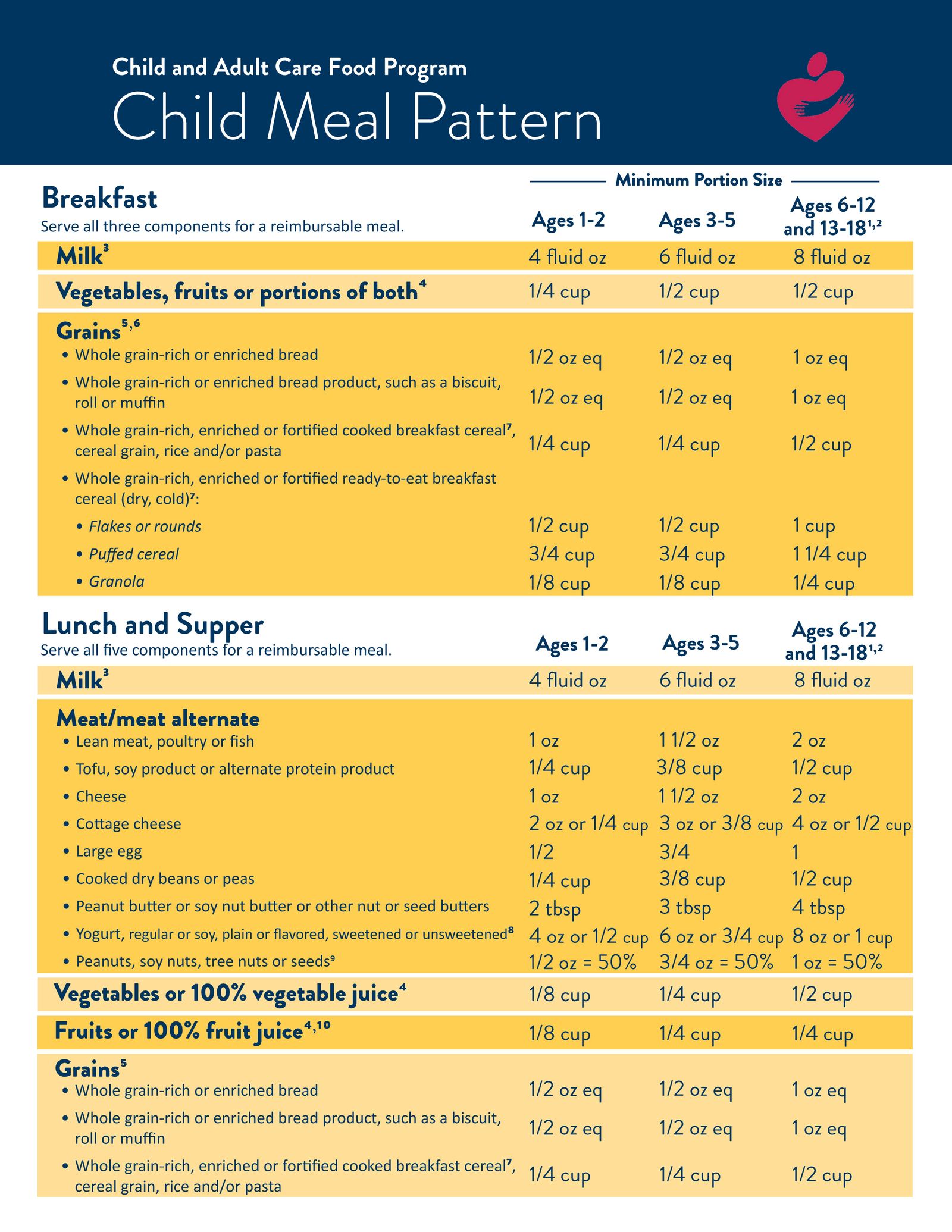

Use the Tier I rate as of January of each year For instance when doing taxes for 2023 you will use the 2022 2023 rates released in July of 2022 If your expenses exceed that Governing the Child and Adult Care Food Program Overall reimbursement rates this year for the Child and Adult Care Food Program increased compared to last

Download Irs Child Care Meal Allowance 2022

More picture related to Irs Child Care Meal Allowance 2022

Irs 2019 Daycare Daily Meal Allowance Carfare me 2019 2020

https://static.wixstatic.com/media/aa2f30_da4d40dc511a4612a3a4175d6f656304~mv2.jpg/v1/fill/w_630,h_257,al_c,q_80,usm_0.66_1.00_0.01/aa2f30_da4d40dc511a4612a3a4175d6f656304~mv2.jpg

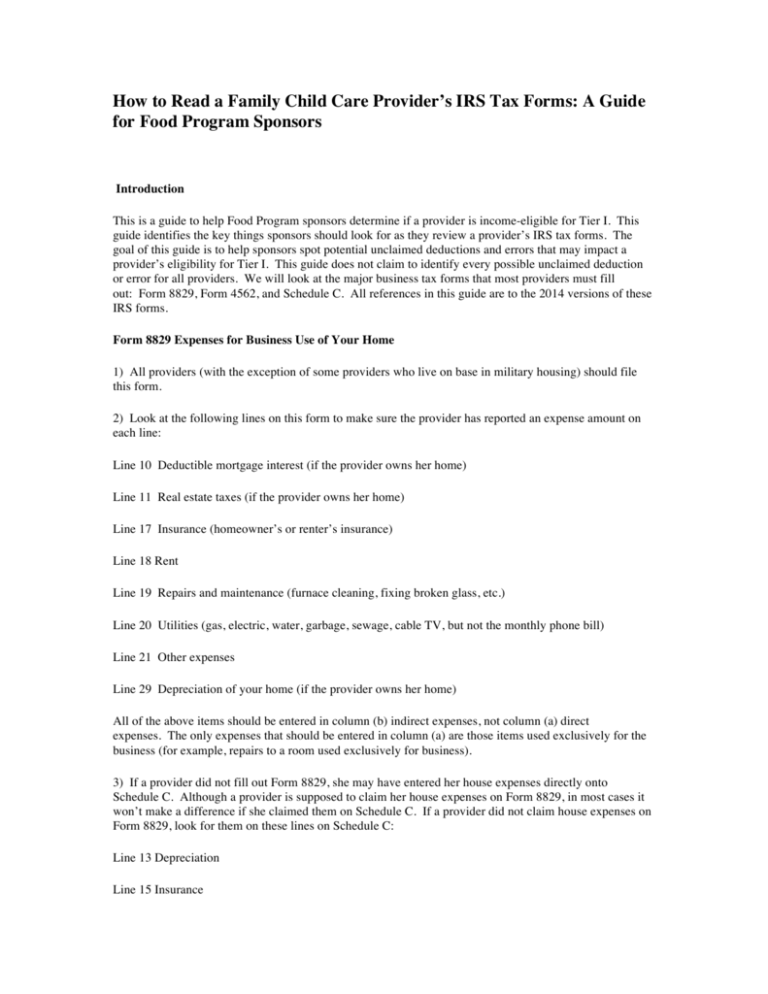

How To Read A Family Child Care Provider s IRS Tax Forms

https://s3.studylib.net/store/data/008804141_1-ac74ce251cd1b8c7c5b654a62106b429-768x994.png

IRS Child Care Tax Credit For Summer Bressler Company CPA s

https://www.bresslercompany.com/wp-content/uploads/bfi_thumb/dummy-transparent-o9stoppar3k88ndkbhsvwybhe6mwzne1byxeuwfmpa.png

The IRS standard meal allowance rate for 2022 used in these calculations is based on the Tier I rate as of January 1 2022 This rate is used for all meals and snacks served The standard meal allowance rates apply regardless of whether a family child care provider is reimbursed for food costs in whole or in part under the CACFP or under any

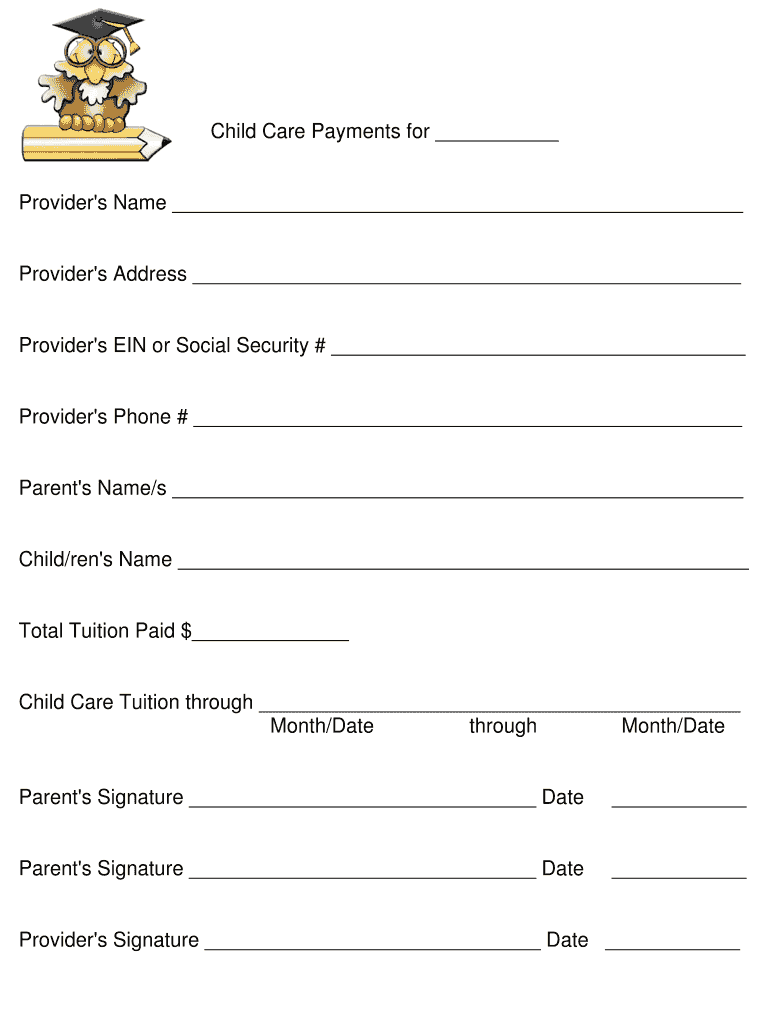

If you paid someone to care for your child or other qualifying person so you and your spouse if filing jointly could work or look for work you may be able to take the Instead of tracking every penny you spend on food for the children or adults in your care you can use the standard meal and snack rates 2022 Rates by Location Breakfast

Child Care Tax Center Childcare Business Childcare Opening A Daycare

https://i.pinimg.com/originals/4a/99/f8/4a99f8a6778f45826bd77504c9673031.jpg

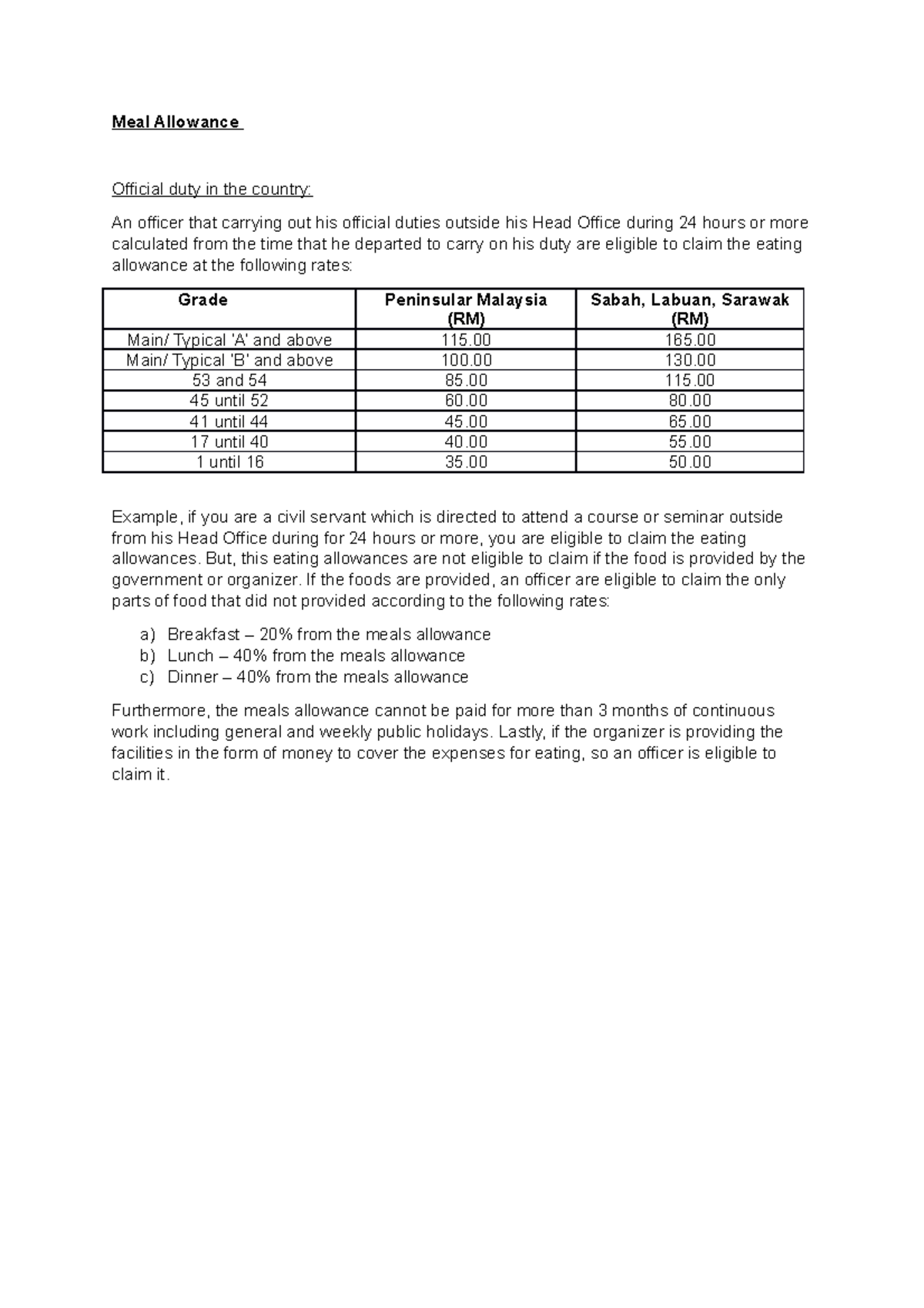

Meal Allowance General Order In Malaysia Meal Allowance Official Duty

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/877be2bcd3e4ec7fb9b19bb0c9a386f8/thumb_1200_1698.png

https://dha-cpa.com/wp-content/uploads/2022/02/Day...

Instead of tracking every penny you spend on food for the children or adults in your care you can use the standard meal and snack rates 2022 Rates by LocationBreakfast

https://www.irs.gov/publications/p503

Your new spouse s earned income for the year was 2 000 You paid work related expenses of 3 000 for the care of your 5 year old child and qualified to claim the credit The amount of expenses you use to figure

2022 Form IRS 2441 Fill Online Printable Fillable Blank PdfFiller

Child Care Tax Center Childcare Business Childcare Opening A Daycare

Child Meal Patterns Meal Pattern Guidelines Getting Started Child

Daycare Statement Template

HMRC Meal Allowance Rates For 2022 Pleo Blog

Child And Dependent Care Credit 2022 2022 JWG

Child And Dependent Care Credit 2022 2022 JWG

2022 Education Tax Credits Are You Eligible

Form 2441 2023 Printable Forms Free Online

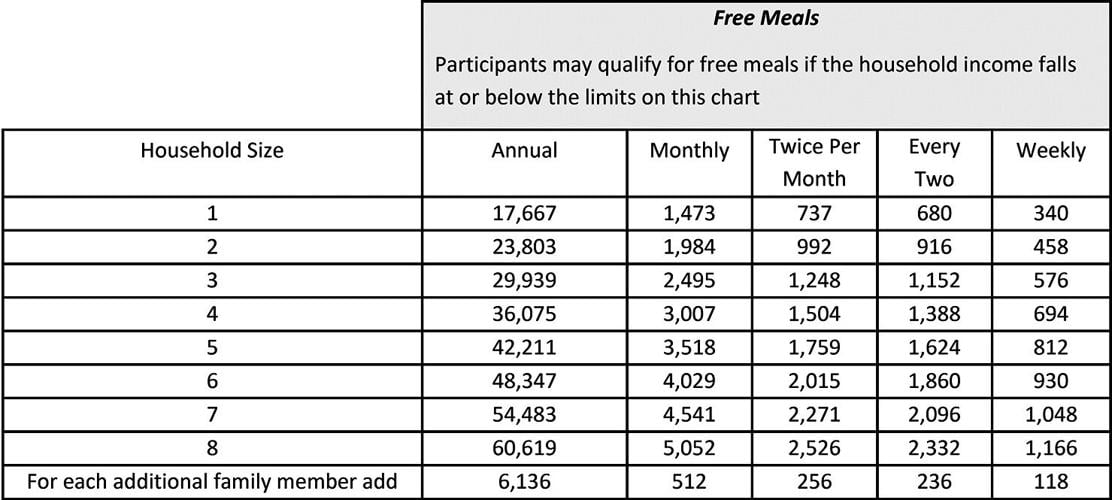

Income Guidelines For 2022 2023 Free And Reduced Price Lunch

Irs Child Care Meal Allowance 2022 - Meals Daycare businesses can deduct the cost of meals provided to children The government provides standard meal rates for breakfast lunch dinner