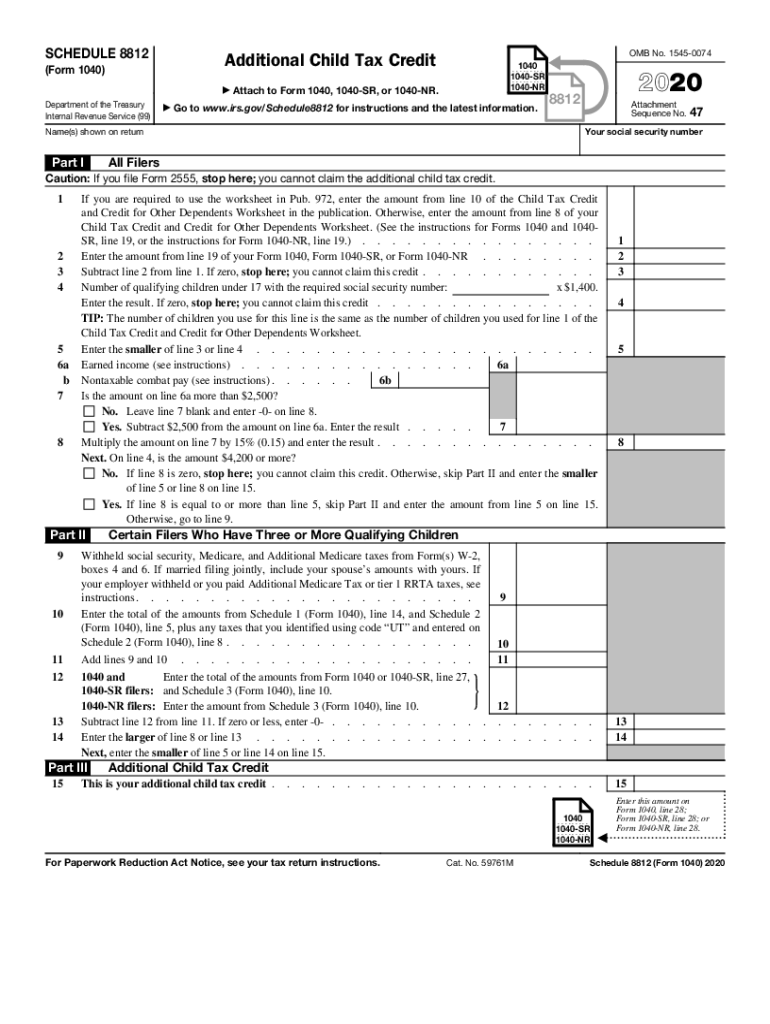

Irs Child Tax Credit 2023 Chart Use Schedule 8812 Form 1040 to figure your child tax credit CTC credit for other dependents ODC and additional child tax credit ACTC The CTC and ODC are nonrefundable credits The ACTC is a refundable credit

FS 2021 10 July 2021 Starting July 15 millions of American families will automatically begin receiving monthly Child Tax Credit payments from the Treasury Department and the IRS The IRS offers child tax credits to help parents and guardians offset some of the costs of raising a family If you have a dependent who isn t your direct child you may also be eligible to claim a credit

Irs Child Tax Credit 2023 Chart

Irs Child Tax Credit 2023 Chart

https://www.wiztax.com/wp-content/uploads/2022/10/3.png

Irs Eitc Release Date 2024 Alicia Meredith

https://www.taxproadvice.com/wp-content/uploads/irs-earned-income-credit-table.gif

Child Tax Credit 2022 Income Limit Phase Out TAX

https://indianapublicmedia.org/images/news-images/child-tax-credit.jpg

See how much the 2023 child tax credit is worth how to claim it on your federal tax return and differences in the child tax credit 2023 vs 2022 s credit Tax credit per child for 2023 The maximum tax credit per qualifying child is 2 000 for children under 17 For the refundable portion of the credit or the additional child tax

Right now unless Congress makes last minute changes the 2023 child tax credit is worth up to 2 000 per qualifying child However the credit is not fully refundable which means that The child must Be under 17 at the end of the tax year Meet the relationship and residency tests for uniform definition of a qualifying child see the Child Related Tax Benefits Comparison Chart Not provide more than half of

Download Irs Child Tax Credit 2023 Chart

More picture related to Irs Child Tax Credit 2023 Chart

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/2022-10/Summary-ITC-and-PTC-Values-Table.png

Earned Income Credit Calculator 2021 DannielleThalia

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T05-0195.gif

Tax Filing 2022 Eitc Latest News Update

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T10-0248.GIF

How much is the tax credit per child The maximum tax credit per child is 2 000 for tax year 2023 The maximum credit is set to increase with inflation in 2024 and 2025 How many This CHILDucator will let you know if you qualify for the Child Tax Credit and or the Other Dependent Tax Credit on your 2023 Tax Return the amounts are also included The Additional Child Tax Credit or ACTC requires information that is based on your 2023 Tax Return

Taxpayers can claim the 2024 child tax credit on the tax return they will file in 2025 If you still need to file your 2023 tax return that was due April 15 2024 or is due Oct 15 The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements 1 age 2 relationship 3 support 4 dependent status 5 citizenship 6 length of residency and 7 family income You and or

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-scaled.jpg

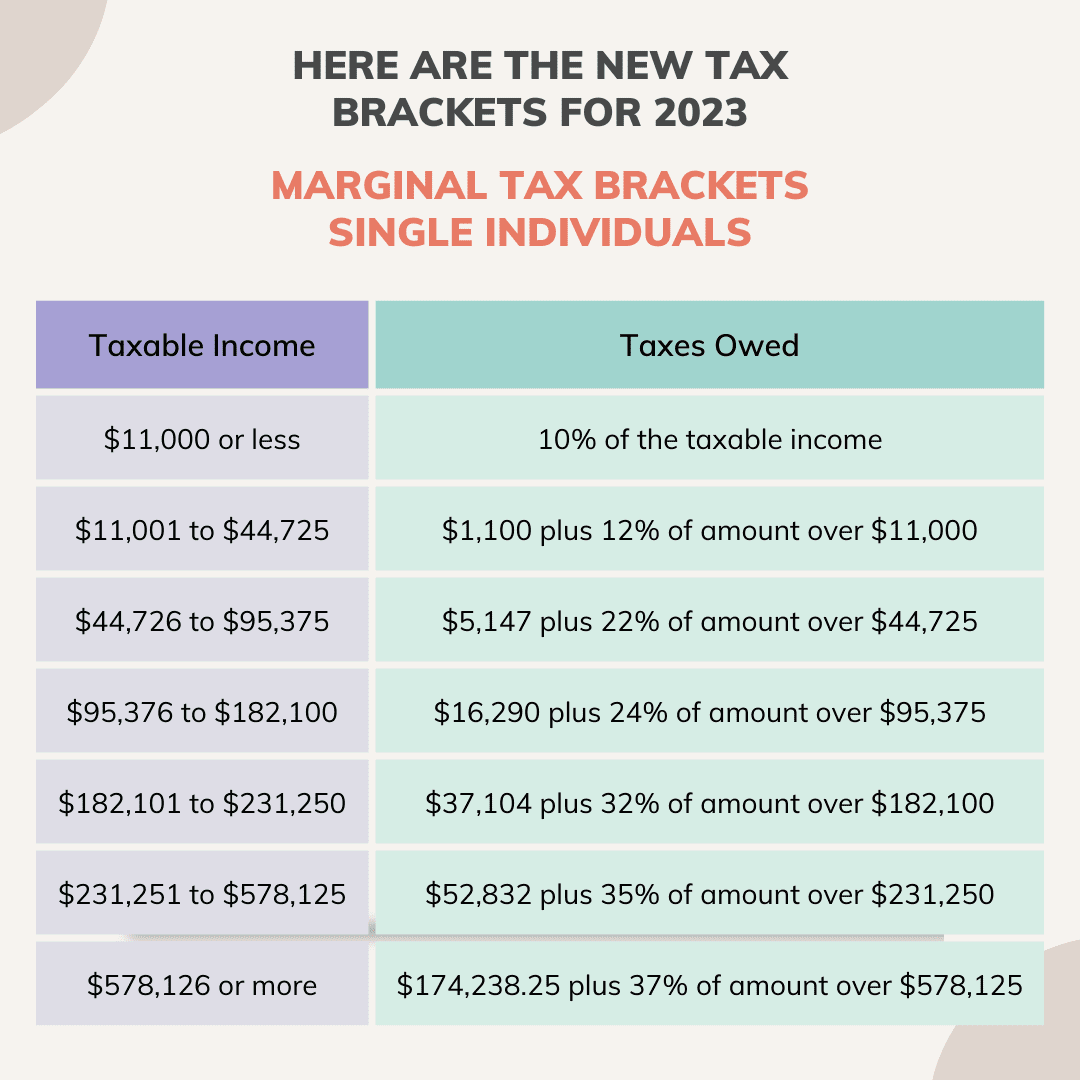

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/4d55bc1/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2F21%2F13%2F3b31d5704e9fa71733f5f49524bd%2Fb22189fd0c8f4b6c8d791ab8728170de

https://www.irs.gov/instructions/i1040s8

Use Schedule 8812 Form 1040 to figure your child tax credit CTC credit for other dependents ODC and additional child tax credit ACTC The CTC and ODC are nonrefundable credits The ACTC is a refundable credit

https://www.irs.gov/newsroom/child-tax-credit-most...

FS 2021 10 July 2021 Starting July 15 millions of American families will automatically begin receiving monthly Child Tax Credit payments from the Treasury Department and the IRS

2024 Child Tax Credits Form Fillable Printable PDF Forms Handypdf

2022 Education Tax Credits Are You Eligible

IRS Update To Child Tax Credit Letter Fort Myers Naples MNMW

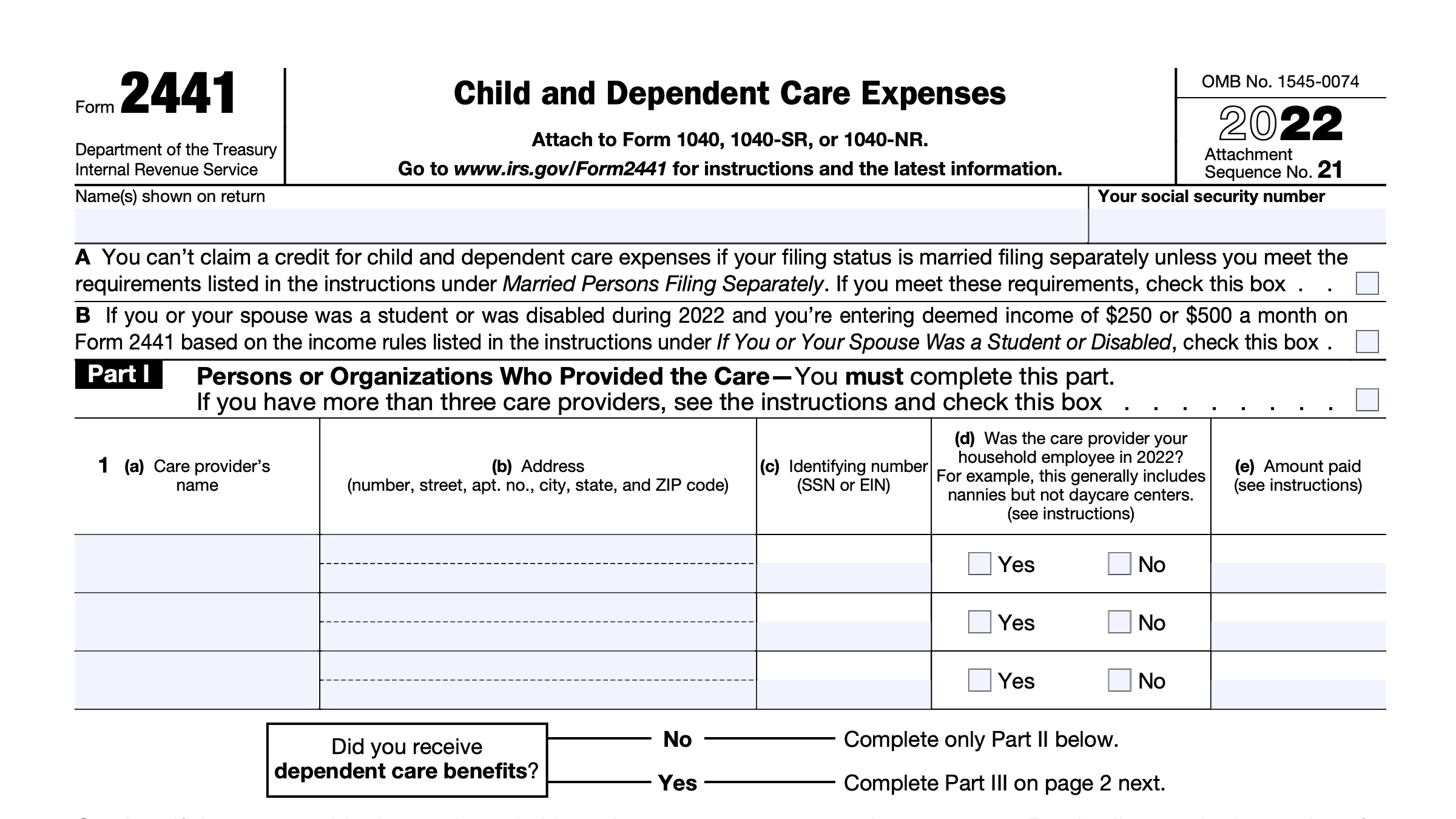

IRS Form 2441 Instructions Child And Dependent Care Expenses

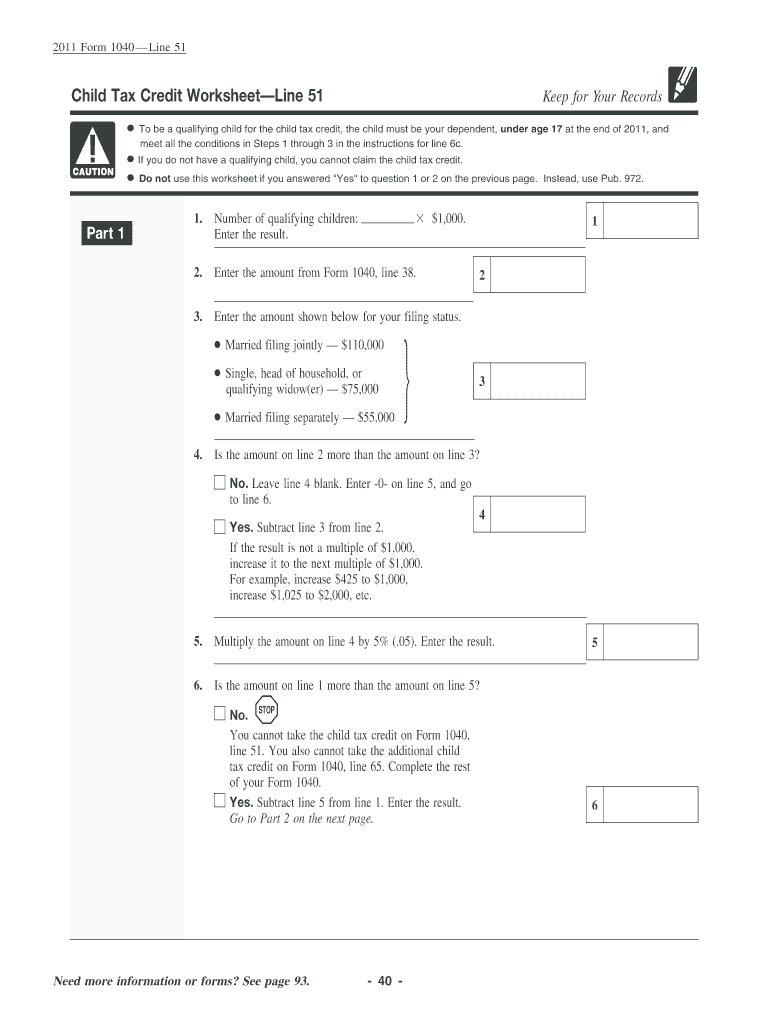

Child Tax 2011 2024 Form Fill Out And Sign Printable PDF Template

Create A Magic Experience Of Clients Leads And Work Associates Part I

Create A Magic Experience Of Clients Leads And Work Associates Part I

Child Tax Deduction 2011 2024 Form Fill Out And Sign Printable PDF

Form 8812 Fill Out Sign Online DocHub

NYS Can Help Low income Working Families With Children By Increasing

Irs Child Tax Credit 2023 Chart - Right now unless Congress makes last minute changes the 2023 child tax credit is worth up to 2 000 per qualifying child However the credit is not fully refundable which means that