Irs Code For Solar Tax Credit Web 28 Aug 2023 nbsp 0183 32 About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable energy for your home such as solar wind geothermal biomass fuel cells or battery storage you may qualify for a tax credit

Web For qualified fuel cell property see Lines 7a and 7b later You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property biomass fuel Web 5695 Department of the Treasury Internal Revenue Service Residential Energy Credits Go to www irs gov Form5695 for instructions and the latest information Attach to Form 1040 1040 SR or 1040 NR OMB No 1545 0074 2022 Attachment Sequence No 158 Name s shown on return Your social security number Part I Residential Clean Energy Credit

Irs Code For Solar Tax Credit

Irs Code For Solar Tax Credit

https://www.leafscore.com/wp-content/uploads/2022/08/federal-solar-tax-credit-inflation-reduction-act-scaled.jpg

The Solar Tax Credit Explained 2022 YouTube

https://i.ytimg.com/vi/u46G0bvoXlY/maxresdefault.jpg

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGGUgZShlMA8=&rs=AOn4CLD0u4VMgupTPJWuWOaZRVksaroCPw

Web 29 Dez 2023 nbsp 0183 32 Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 If you make energy improvements to your home tax credits are available for a portion of qualifying expenses Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar credits but are

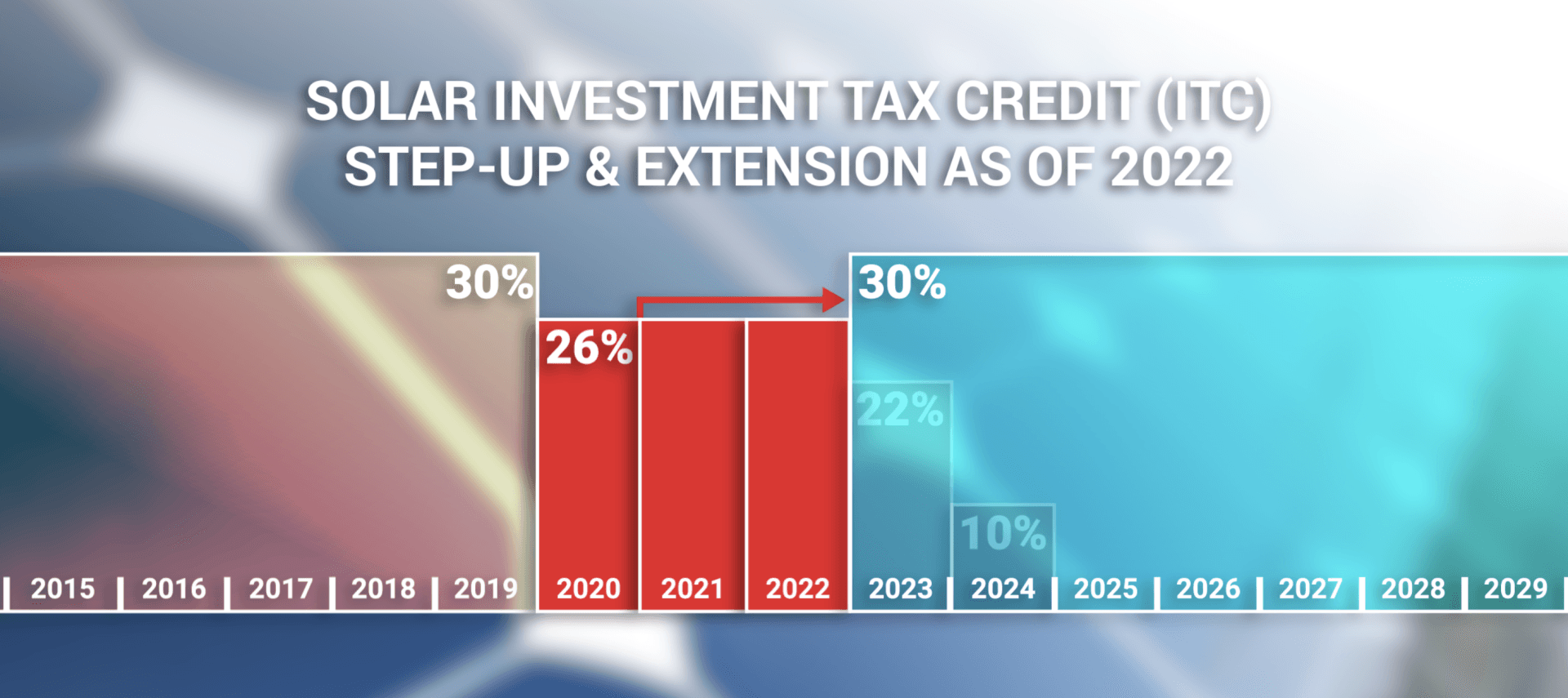

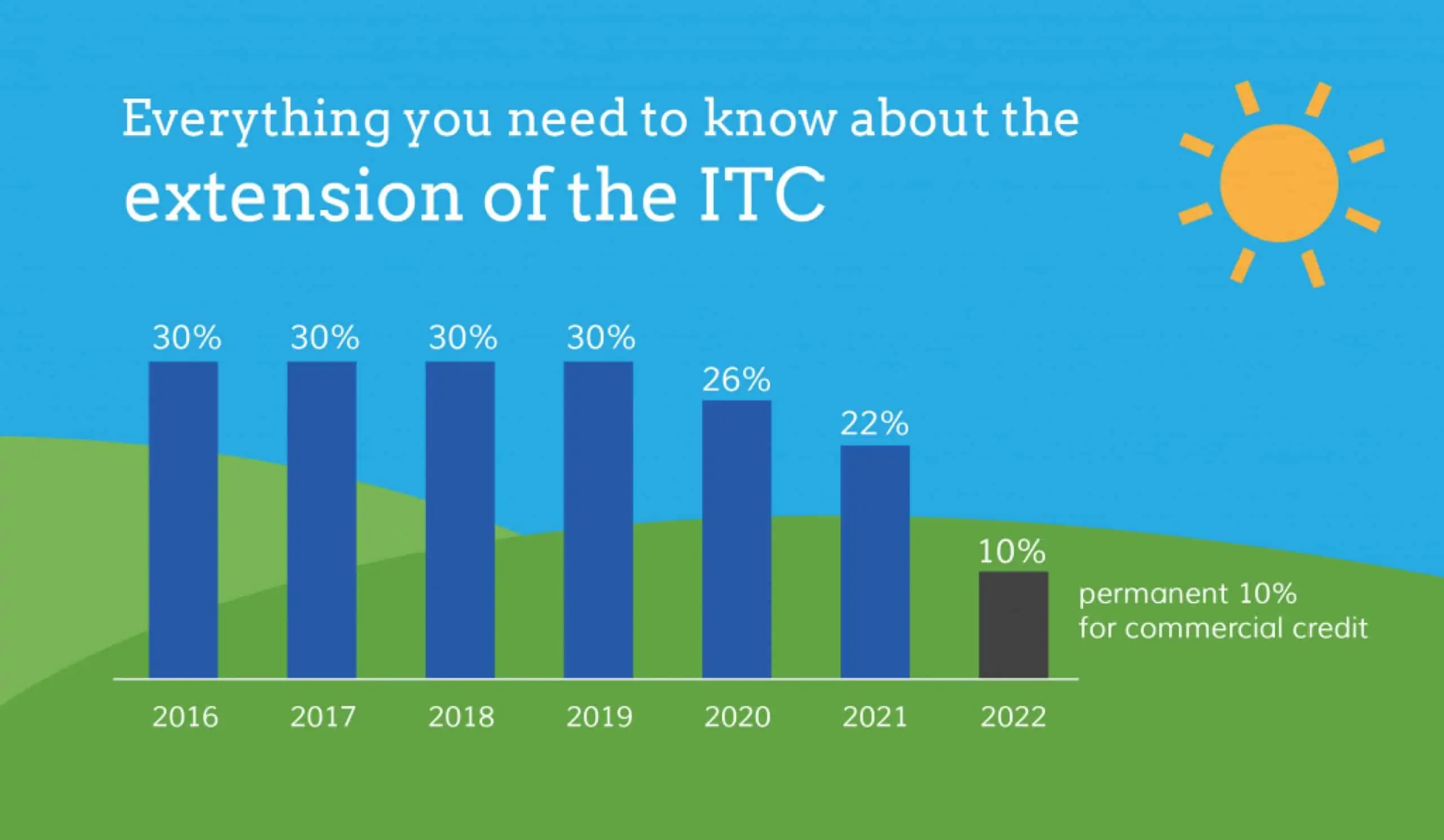

Web The Inflation Reduction Act provides for an increase to the energy investment credit under Internal Revenue Code Section 48 for qualifying solar and wind facilities benefitting certain low income communities Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

Download Irs Code For Solar Tax Credit

More picture related to Irs Code For Solar Tax Credit

Solar Tax Credit What You Need To Know NRG Clean Power

https://nrgcleanpower.com/wp-content/uploads/2022/05/ITC-Step-Down-2022-01.png

Solar Tax Credit

https://lirp.cdn-website.com/af303f9d/dms3rep/multi/opt/Screen+Shot+2022-12-11+at+5.33.42+PM-1920w.png

Federal Solar Tax Credit Extended At 26 To 2023 Technicians For

https://images.squarespace-cdn.com/content/v1/550788b1e4b0985f434d4037/1608669084346-LX3EC97L9CO6X7YQ8MMF/Photos_Overall_Array_Capture_All_Modules-1.jpg

Web 19 Okt 2023 nbsp 0183 32 The residential solar energy credit is worth 30 of the installed system costs through 2032 26 in 2033 22 in 2034 and expires after that What is the Residential Clean Energy Credit In an effort to encourage Americans to use solar power the US government offers tax credits for solar systems Web In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500

Web 22 Nov 2023 nbsp 0183 32 You enter the total tax you owe before credits in line 1 of the worksheet and the amounts of any fully refundable credits on the lines within step 2 adding them all on the final line Then subtract the amount on line 2 from the amount on line 1 to get your final tax liability on line 3 This is the total amount you can claim for the solar Web your federal tax credit For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing the system your federal tax credit would be calculated as follows 18 000 0 30 5 400 State Tax Credit State tax credits for installing solar

Guidance For Solar Tax Credit Prevailing Wage And Apprenticeship

https://pv-magazine-usa.com/wp-content/uploads/sites/2/2022/11/IRSimage-1200x579.jpg

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Web 28 Aug 2023 nbsp 0183 32 About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable energy for your home such as solar wind geothermal biomass fuel cells or battery storage you may qualify for a tax credit

https://www.irs.gov/instructions/i5695

Web For qualified fuel cell property see Lines 7a and 7b later You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property biomass fuel

The Federal Solar Tax Credit Increased Extended Solaria

Guidance For Solar Tax Credit Prevailing Wage And Apprenticeship

Solar Tax Credit Guide And Calculator

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

Federal Investment Solar Tax Credit Guide Learn How To Claim The

Federal Investment Solar Tax Credit Guide Learn How To Claim The

Beginning Of The End Of The Solar Tax Credit Sunline Energy

The Federal Solar Tax Credit What You Need To Know 2022

Congress Gets Renewable Tax Credit Extension Right Institute For

Irs Code For Solar Tax Credit - Web The Inflation Reduction Act provides for an increase to the energy investment credit under Internal Revenue Code Section 48 for qualifying solar and wind facilities benefitting certain low income communities