Irs Cp13 Recovery Rebate Credit Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit amount will be reduced if the adjusted gross income AGI amount is less than these amounts above but is more than

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web 13 janv 2022 nbsp 0183 32 FAQs about eligibility for claiming the Recovery Rebate Credit These updated FAQs were released to the public in Fact Sheet 2022 27PDF April 13 2022

Irs Cp13 Recovery Rebate Credit

Irs Cp13 Recovery Rebate Credit

https://printablerebateform.net/wp-content/uploads/2022/10/What-Does-The-Recovery-Rebate-Form-Look-Like.png

IRS Stimulus Update Recovery Rebate Credit Error Letter s Understanding

https://i.ytimg.com/vi/vB9MImg_UAI/maxresdefault.jpg

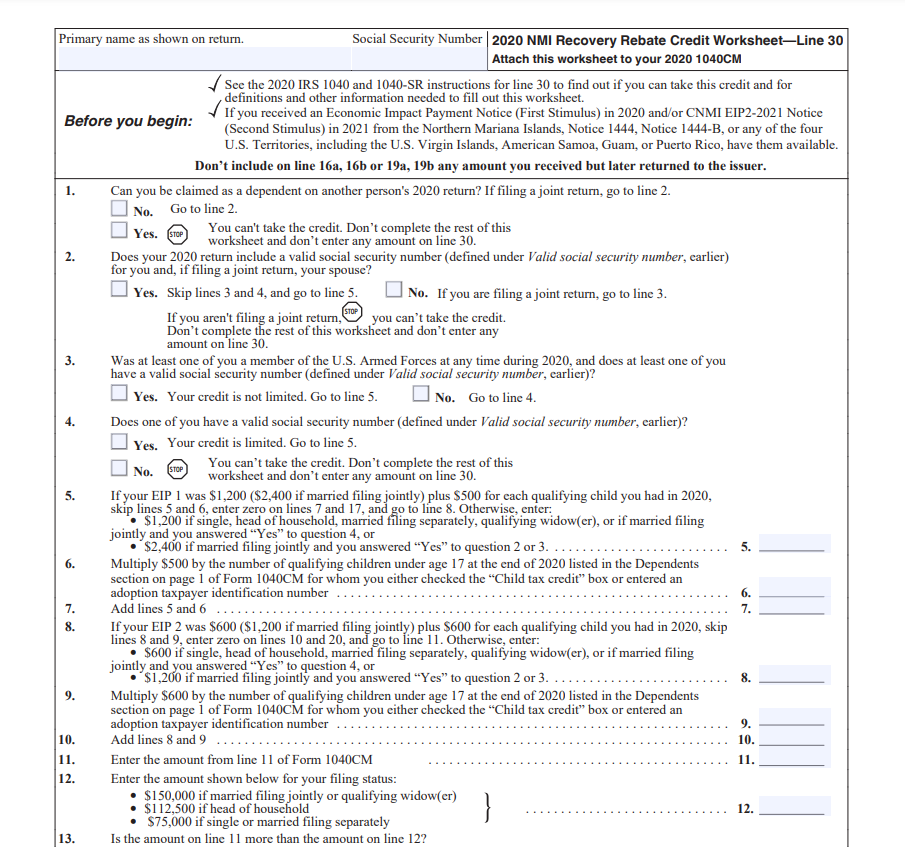

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-recovery-rebate-3.png?w=530&ssl=1

Web 10 d 233 c 2021 nbsp 0183 32 If you entered an amount on line 30 of your 2020 tax return but made a mistake in calculating the amount the IRS will calculate the correct amount of the Web 17 ao 251 t 2021 nbsp 0183 32 Should we agree with IRS Notice CP13 stating that we are not eligible for the Recovery Rebate Credit on our 2020 return Can you explain why Turbo Tax added

Web 4 sept 2022 nbsp 0183 32 The IRS will send a letter to you in the event that the credit is not used correctly For 2021 Federal income tax returns will be eligible to receive the Recovery Web 28 f 233 vr 2023 nbsp 0183 32 If you write to us include a copy of the notice along with your correspondence or documentation We ll reverse most changes we made if we reduced

Download Irs Cp13 Recovery Rebate Credit

More picture related to Irs Cp13 Recovery Rebate Credit

What If I Did Not Receive Eip Or Rrc Detailed Information

https://stimulusmag.com/wp-content/uploads/2022/12/what-is-the-irs-recovery-rebate-credit.jpg

IRSnews On Twitter Share IRS Information About The Recovery Rebate

https://pbs.twimg.com/media/Ft8kx5BXsAA6KQg.jpg

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

https://www.usatoday.com/gcdn/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?width=1320&height=990&fit=crop&format=pjpg&auto=webp

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web IRS tax refund update Recovery rebate error notices sent The Internal Revenue Service sent 5 million correction notices to filers who claimed a Recovery Rebate Credit but it

Web 13 janv 2022 nbsp 0183 32 IR 2022 13 January 13 2022 WASHINGTON The Internal Revenue Service today issued frequently asked questions FAQs for the 2021 Recovery Rebate Web The 2021 RRC amount was 1 400 or 2 800 in the case of a joint return plus an additional 1 400 per each dependent of the taxpayer for all U S residents with

How To Fill Out Form To Get Stimulus Check Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

How Do I Claim The Recovery Rebate Credit On My Ta

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/e3d7f0ce-2b70-4164-b921-f7ef2ca8a52f.default.png

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-h...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit amount will be reduced if the adjusted gross income AGI amount is less than these amounts above but is more than

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-questions-an…

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Irs Recovery Rebate Credit Recovery Rebate

How To Fill Out Form To Get Stimulus Check Printable Rebate Form

1040 Rebate Recovery Recovery Rebate

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

The Recovery Rebate Credit Calculator MollieAilie

Stimulus Checks IRS Letter Explains If You Qualify For Recovery Rebate

Stimulus Checks IRS Letter Explains If You Qualify For Recovery Rebate

2022 Irs Recovery Rebate Credit Worksheet Rebate2022 Rebate2022

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

Irs Recovery Rebate Credit For College Students IRSUKA Recovery Rebate

Irs Cp13 Recovery Rebate Credit - Web 17 ao 251 t 2021 nbsp 0183 32 Should we agree with IRS Notice CP13 stating that we are not eligible for the Recovery Rebate Credit on our 2020 return Can you explain why Turbo Tax added