Irs Deductions 2023 Over 65 Taxpayers who blind and or are age 65 or older can claim an additional standard deduction an amount that s added to the regular standard deduction for their

Standard deductions for taxpayers over 65 Taxpayers get a higher standard deduction when they turn 65 or are blind If you are both you get double the You re considered to be 65 on the day before your 65th birthday for tax year 2023 you re considered to be 65 if you were born before January 2 1959 You re allowed an

Irs Deductions 2023 Over 65

Irs Deductions 2023 Over 65

https://static.fmgsuite.com/media/InlineContent/originalSize/984f6148-60aa-49b7-971c-fb3554606b40.jpg

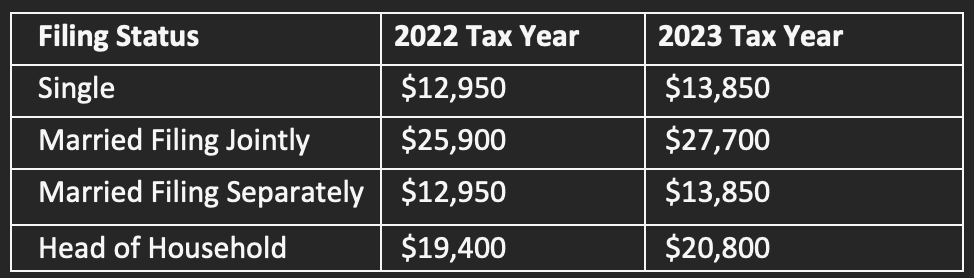

Should You Take The Standard Deduction On Your 2021 2022 Taxes

https://www.taxdefensenetwork.com/wp-content/uploads/2021/12/20212022-Standard-Deduction-.jpg

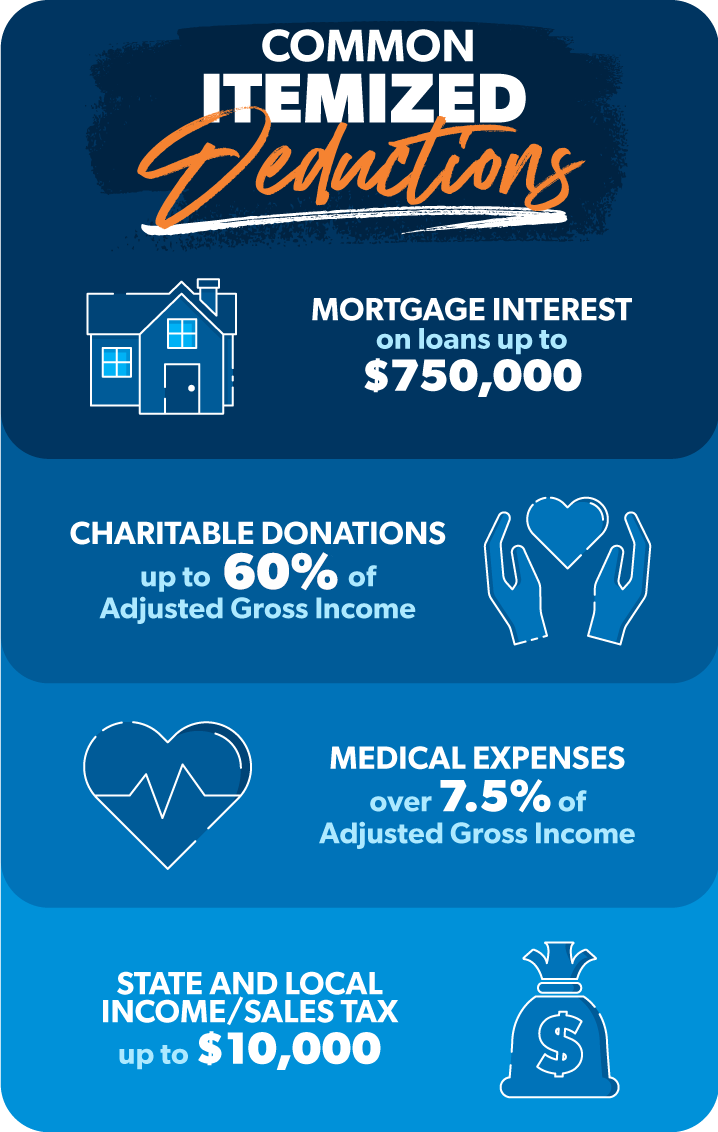

Itemized Vs Standard Tax Deductions Pros And Cons 2023

https://cdn.ramseysolutions.net/media/blog/taxes/personal-taxes/itemizing-vs-standard-deduction.png

If you are 65 or older and blind the extra standard deduction for 2024 is 3 900 if you are single or filing as head of household It s 3 100 per qualifying individual if you are married If you were born before January 2 1959 you re considered to be 65 or older at the end of 2023 If your spouse died in 2023 see Death of spouse later If you re preparing a

Taxpayers who are blind or at least age 65 can claim an additional standard deduction of 1 500 per person for 2023 up from the 1 400 in tax year 2022 or 1 850 if they are unmarried and not a For taxpayers 65 or older you can add 1 500 to your standard deduction for 2023 if you are married This increases to 1 850 if you are unmarried or a surviving

Download Irs Deductions 2023 Over 65

More picture related to Irs Deductions 2023 Over 65

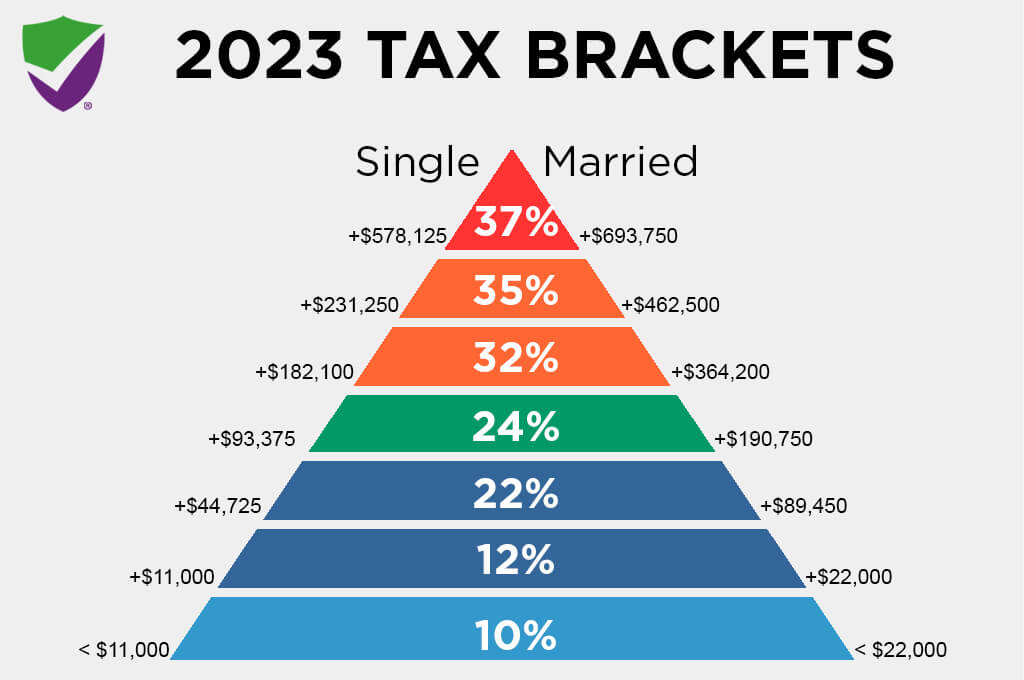

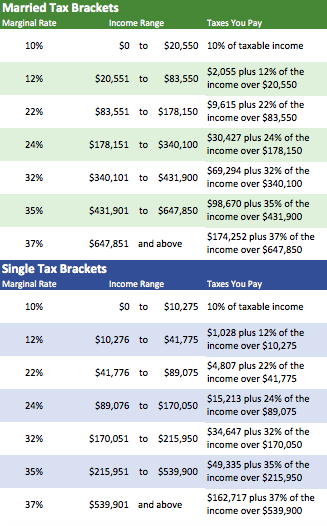

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

https://www.wiztax.com/wp-content/uploads/2022/10/3.png

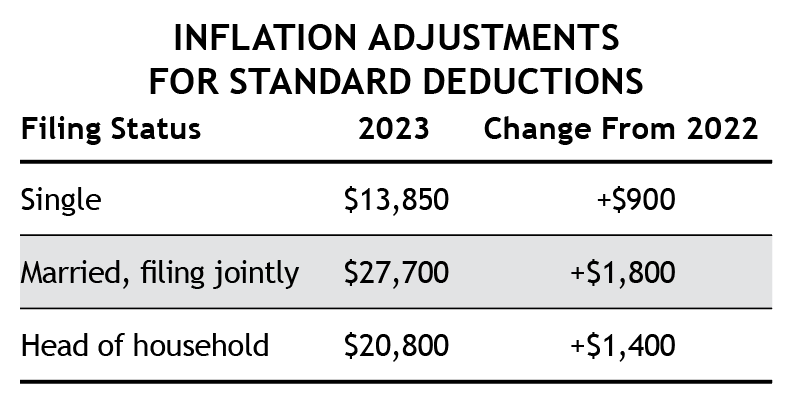

Inflation Adjusted Tax Provisions May Boost Your 2023 Take Home Pay

https://soundmindinvesting.com/assets/articles/l1-inflation-adjusted-standard-ded-2023.png

2022 And 2023 Tax Thresholds HKP Seattle

https://www.hkpseattle.com/wp-content/uploads/2022/11/image-1.png

The additional standard deduction for someone who is 65 or older will rise to 1 500 per person from 1 400 in 2022 if that senior is unmarried the additional deduction will be 1 850 in Seniors struggling to make ends meet may save some money when they do their 2023 taxes by claiming the extra tax deduction Here s how it works

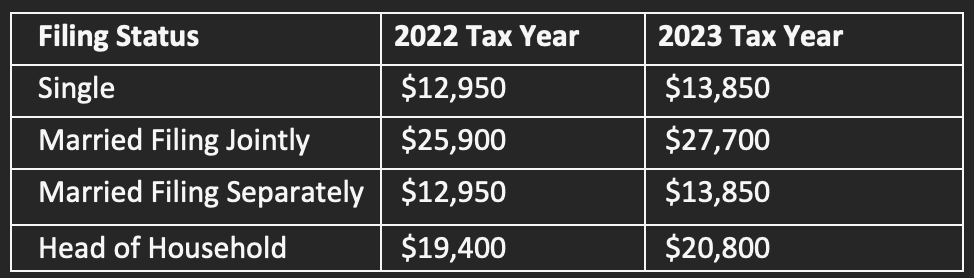

The standard deduction amounts for 2023 are 27 700 Married Filing Jointly or Qualifying Surviving Spouse increase of 1 800 20 800 Head of Household For 2023 the IRS standard deduction for seniors is 13 850 for those filing single or married filing separately 27 700 for qualifying widows or married filing jointly

Posts Tagged 2023 Federal Tax Brackets PriorTax Blog

https://www.blog.priortax.com/wp-content/uploads/2022/12/2023-tax-brackets.png

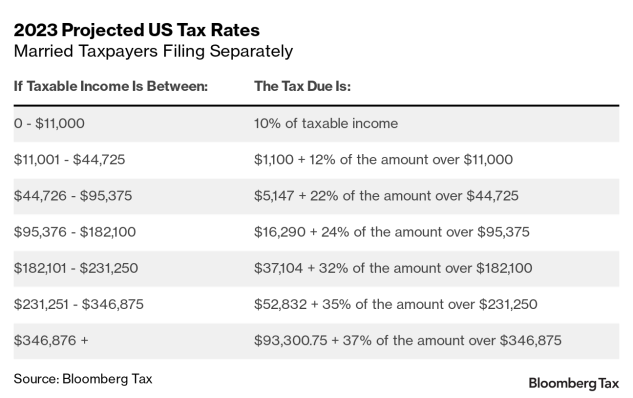

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/7781350/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Ff6%2F55%2F424ec7204eb0a2c37e5b5b03010c%2Fvisual-data-toaster-charts-20218f0ea76c4c31b4c9725e3c7eca91-export.png

https://www.forbes.com/advisor/taxes/standard-deduction

Taxpayers who blind and or are age 65 or older can claim an additional standard deduction an amount that s added to the regular standard deduction for their

https://www.usatoday.com/.../standard-deductions-2023

Standard deductions for taxpayers over 65 Taxpayers get a higher standard deduction when they turn 65 or are blind If you are both you get double the

IRS Inflation Adjustments Taxed Right

Posts Tagged 2023 Federal Tax Brackets PriorTax Blog

Standard Deduction 2020 Age 65 Standard Deduction 2021

Tax Rates Absolute Accounting Services

California Individual Tax Rate Table 2021 20 Brokeasshome

Small Business Expenses Tax Deductions 2023 QuickBooks

Small Business Expenses Tax Deductions 2023 QuickBooks

2022

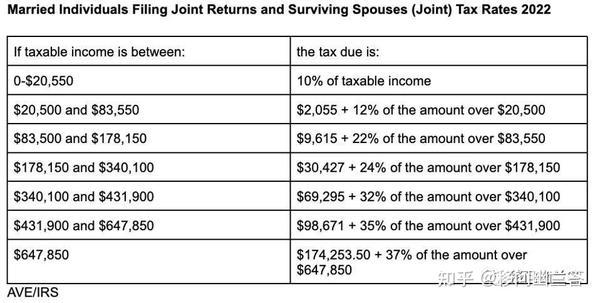

IRS 2022 Tax Tables Deductions Exemptions Purposeful finance

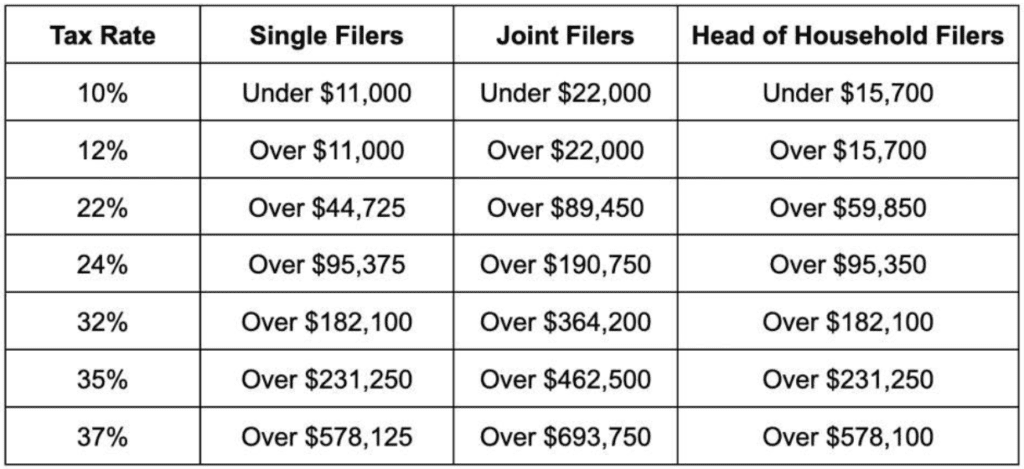

2023 Tax Bracket Changes And IRS Annual Inflation Adjustments

Irs Deductions 2023 Over 65 - If you were born before January 2 1959 you re considered to be 65 or older at the end of 2023 If your spouse died in 2023 see Death of spouse later If you re preparing a