Irs Deductions 2023 The IRS announced the annual inflation adjustments for more than 60 tax provisions including the standard deduction tax rates and energy efficient commercial buildi

Introduction This publication discusses some tax rules that affect every person who may have to file a federal income tax return It answers some basic questions who must file The IRS has released the standard deduction amounts for 2024 which increase the amounts that will be available on 2023 tax returns

Irs Deductions 2023

Irs Deductions 2023

https://www.worksheeto.com/postpic/2009/10/small-business-tax-deduction-worksheet_449384.png

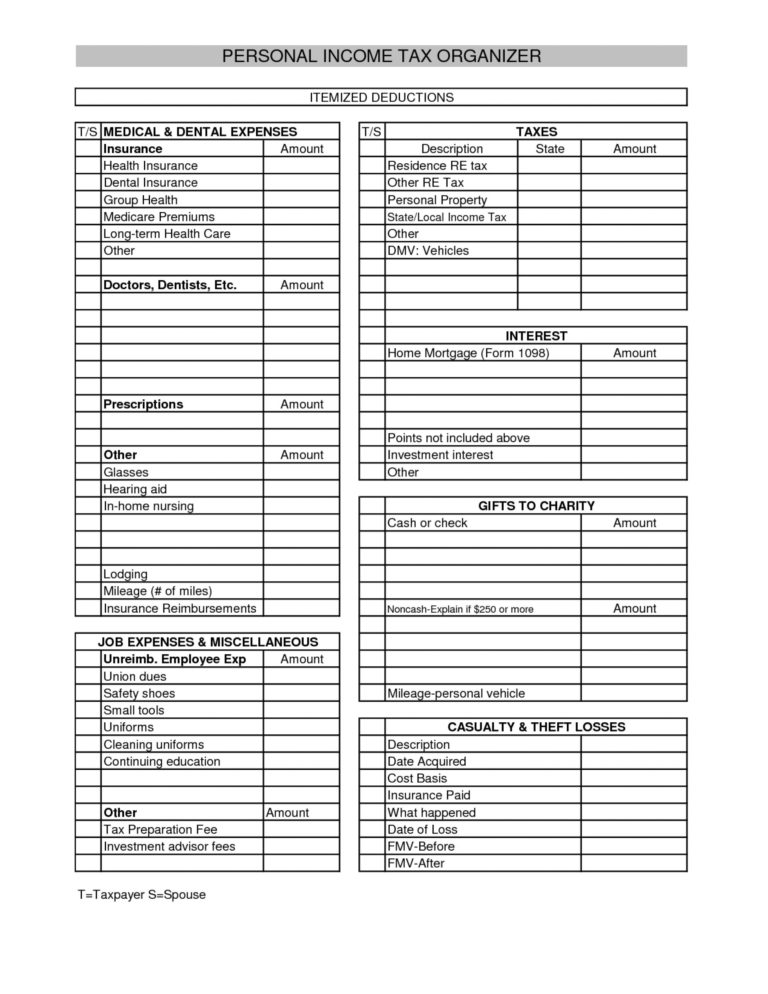

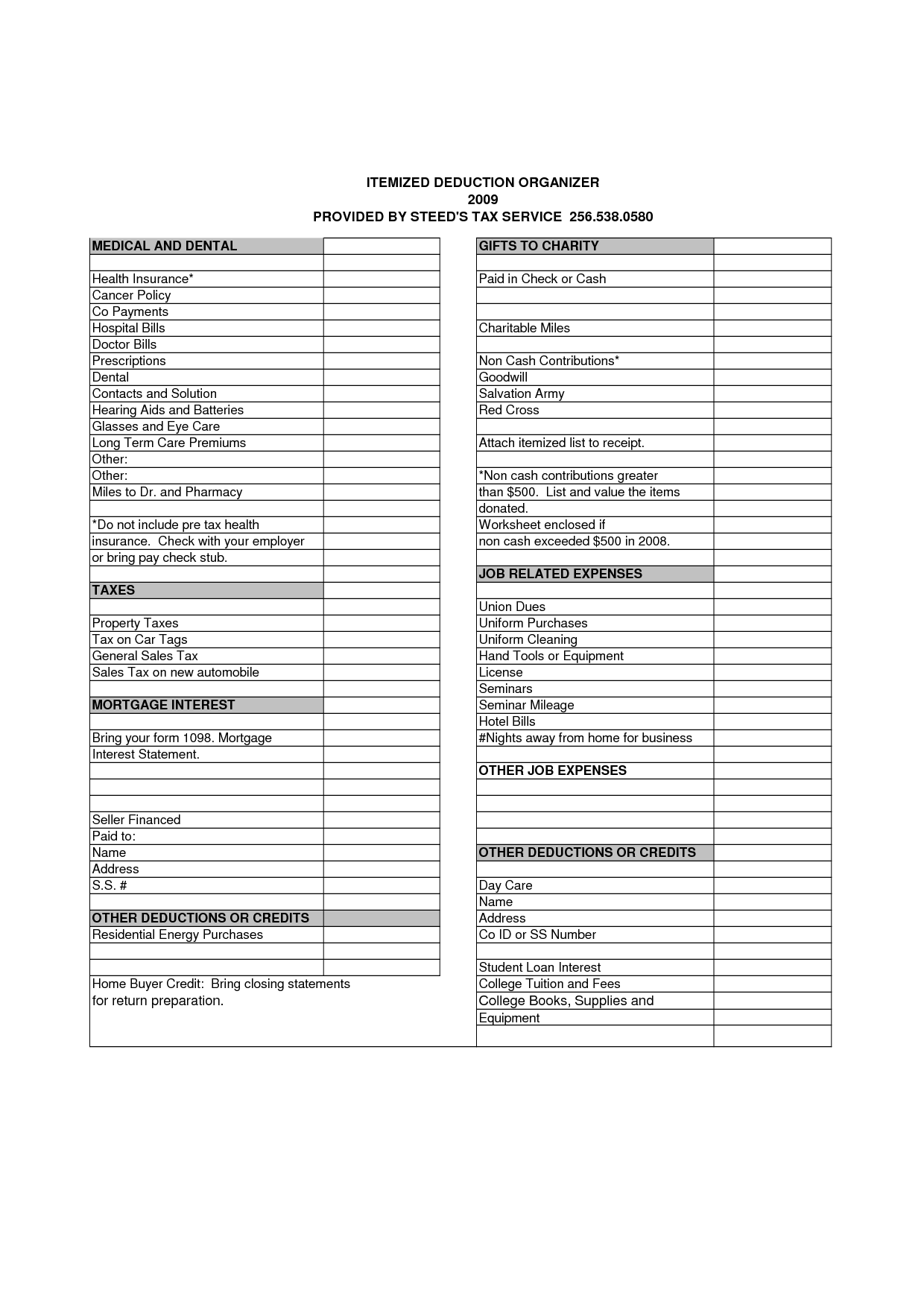

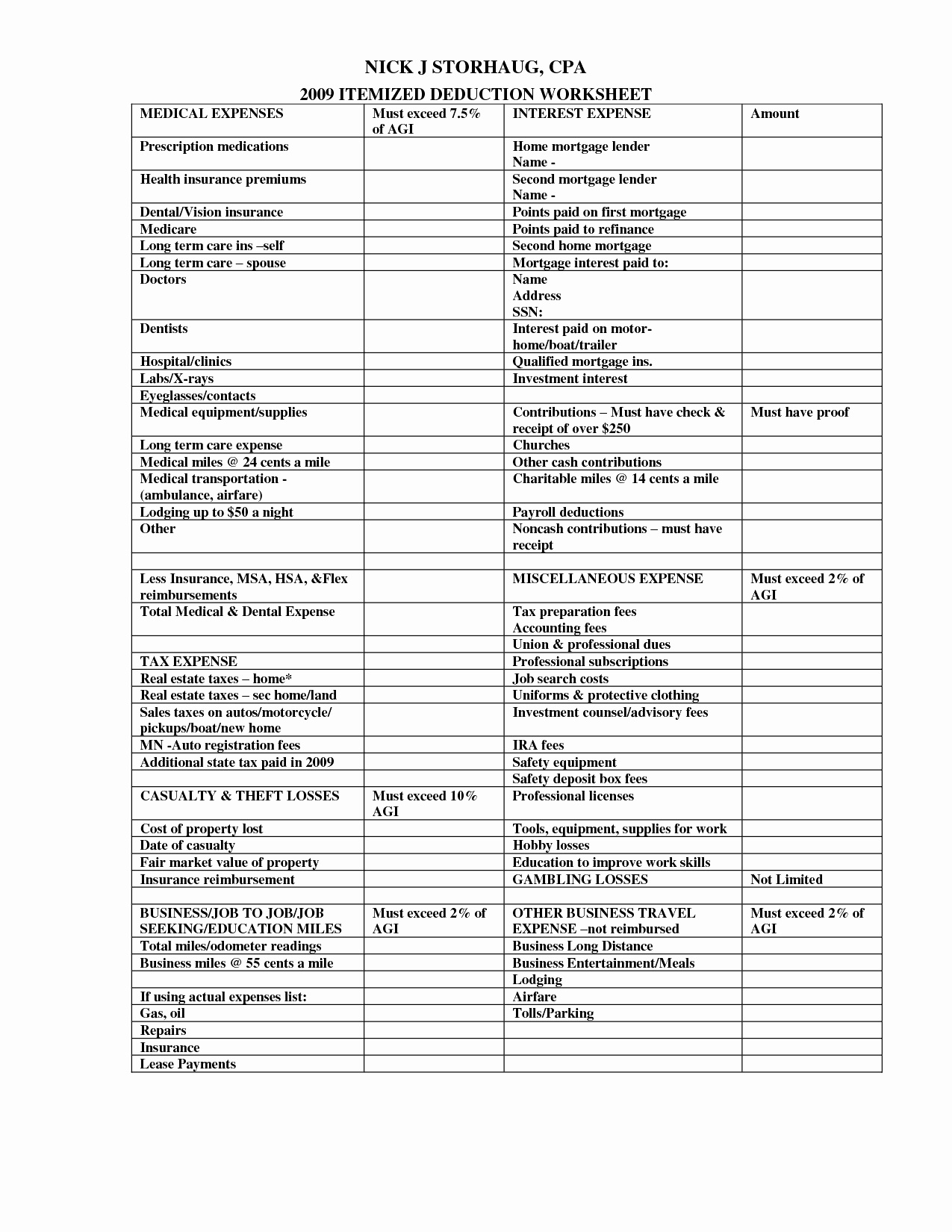

Tax Deductions Checklist Printable How To Organize Taxed What Can I

https://www.worksheeto.com/postpic/2009/10/list-itemized-tax-deductions-worksheet_449386.png

Deductions Worksheet Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/82/664/82664161/large.png

Each year the IRS releases the updated standard deduction amounts which vary by tax filing status Itemized deductions are qualified expenses you can subtract from your adjusted gross income Find out the federal income tax brackets rates standard deduction and other adjustments for inflation for tax year 2023 The IRS uses the Chained Consumer Price Index C CPI to update the tax

The standard deduction amounts for 2023 are Single 13 850 Married filing jointly 27 700 Head of household 20 800 Married filing separately if eligible The 2023 standard deduction for single taxpayers and married filing separately will be 13 850 This is a jump of 900 from the 2022 standard deduction

Download Irs Deductions 2023

More picture related to Irs Deductions 2023

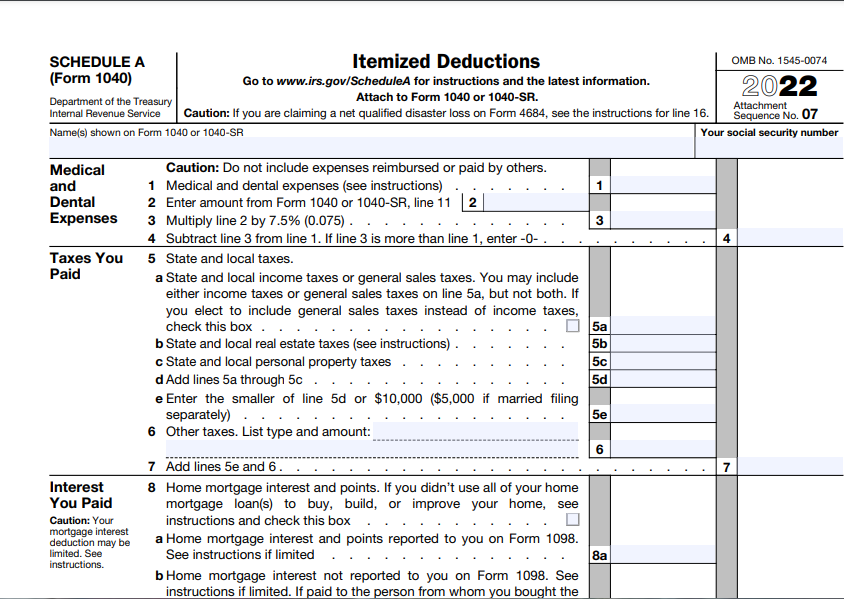

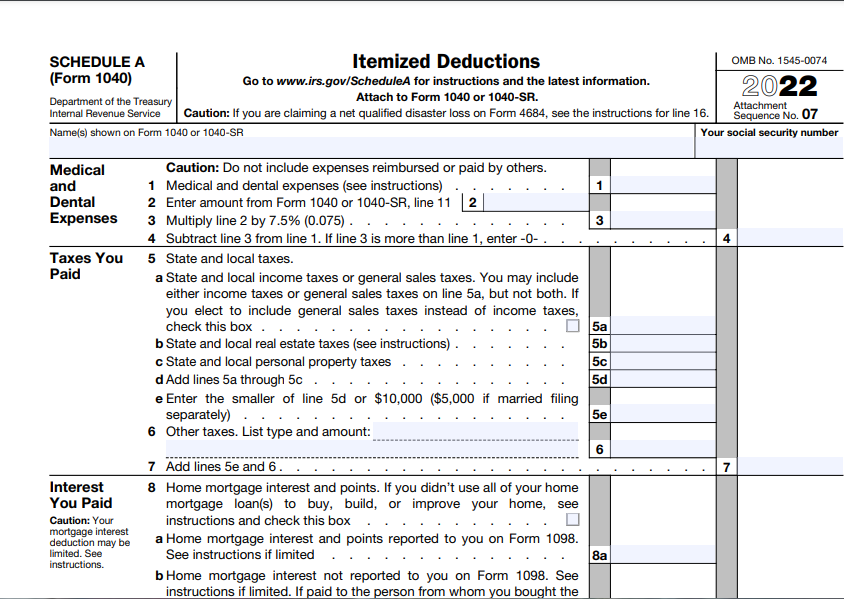

What Your Itemized Deductions On Schedule A Will Look Like After Tax Reform

https://static.wixstatic.com/media/a0cdf0_fee8a278a3ea4e6090ad643baf4eb21b~mv2.jpg/v1/fit/w_960%2Ch_1000%2Cal_c%2Cq_80/file.jpg

Irs Itemized Deductions Worksheet Db excel

https://db-excel.com/wp-content/uploads/2019/09/itemized-deductions-worksheet-yooob-768x994.jpg

Resources

http://tax29.com/wp-content/uploads/2016/11/Tax29-Self-Employed-Deduction-List.png

The most noteworthy increases are about 7 for standard deduction amounts income tax brackets and the Earned Income Tax Credit EITC for tax year 2023 Understand how these increases impact Tax deductions can lower the amount of income that is subject to tax Here s more on how tax deductions work plus 22 tax breaks that might come in handy

Standard Deduction 2023 2024 How Much It Is When to Take It The 2024 standard deduction for tax returns filed in 2025 is 14 600 for single filers 29 200 for joint filers or 21 900 for February 23 2023 The IRS Announces New Tax Numbers for 2023 Each year the IRS updates the existing tax code numbers for items that are indexed for inflation This

2024 Income Tax Brackets And Deductions Allowed Kyla Tillie

https://image.cnbcfm.com/api/v1/image/107136825-1666125851699-6clBX-marginal-tax-brackets-for-tax-year-2023-single-individuals_1.png?v=1666125859

List Of Itemized Deductions Worksheet

https://i.pinimg.com/originals/55/f9/87/55f987a2df592c60959f58557847afd6.jpg

https://www.irs.gov › newsroom

The IRS announced the annual inflation adjustments for more than 60 tax provisions including the standard deduction tax rates and energy efficient commercial buildi

https://www.irs.gov › publications

Introduction This publication discusses some tax rules that affect every person who may have to file a federal income tax return It answers some basic questions who must file

Pin Di Worksheet

2024 Income Tax Brackets And Deductions Allowed Kyla Tillie

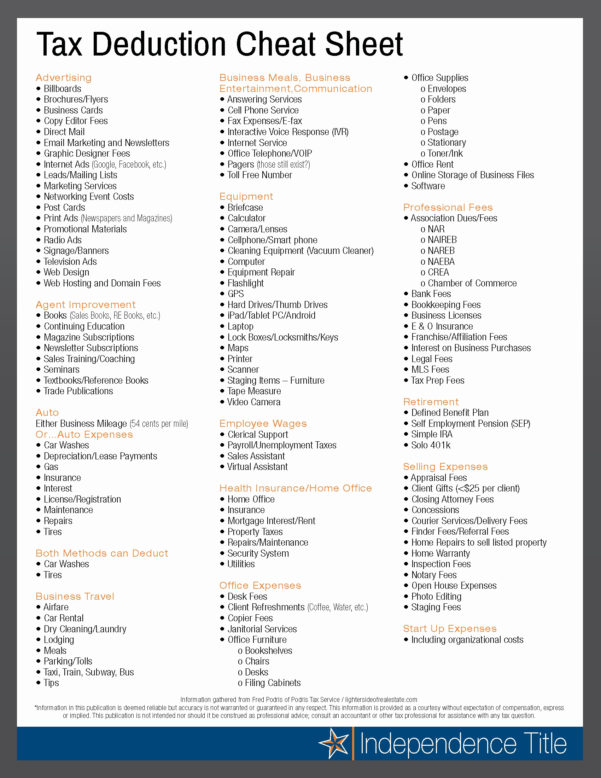

Small Business Tax Deductions Worksheet 2022

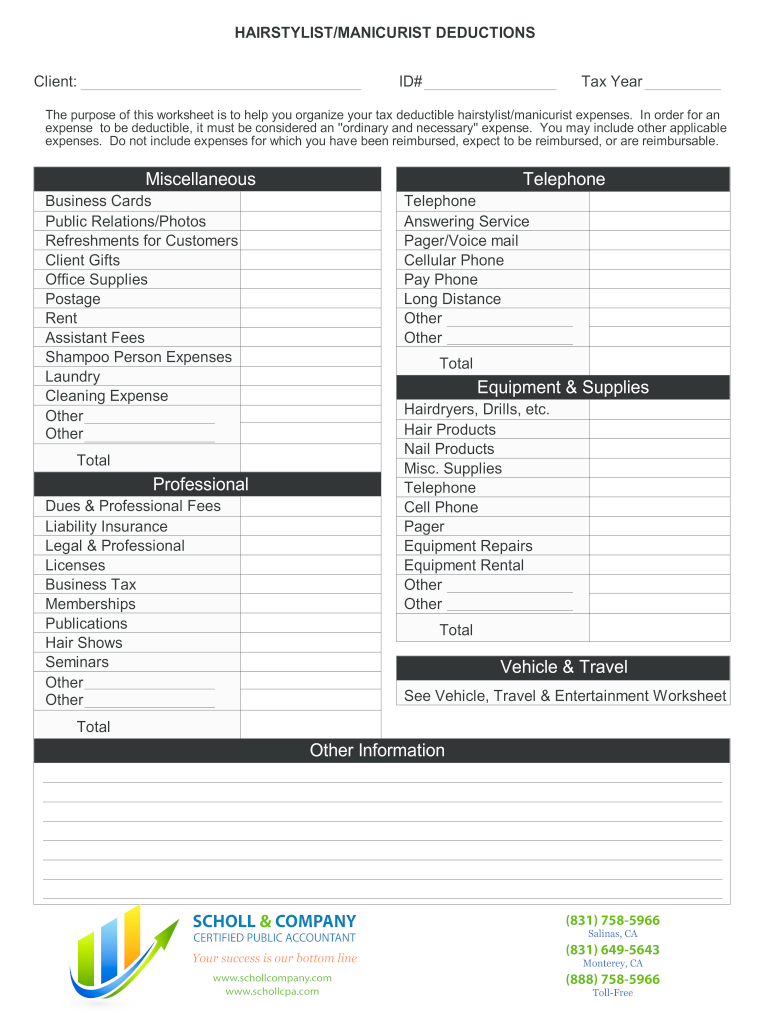

Hair Stylist Tax Deduction Worksheet PDF AirSlate SignNow

Worksheets A Allowances

IRS Form 1040 Schedule A Itemized Deductions Forms Docs 2023

IRS Form 1040 Schedule A Itemized Deductions Forms Docs 2023

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

Printable Small Business Tax Deductions Worksheet

Business Itemized Deductions Worksheet Beautiful Business Itemized For

Irs Deductions 2023 - Each year the IRS releases the updated standard deduction amounts which vary by tax filing status Itemized deductions are qualified expenses you can subtract from your adjusted gross income