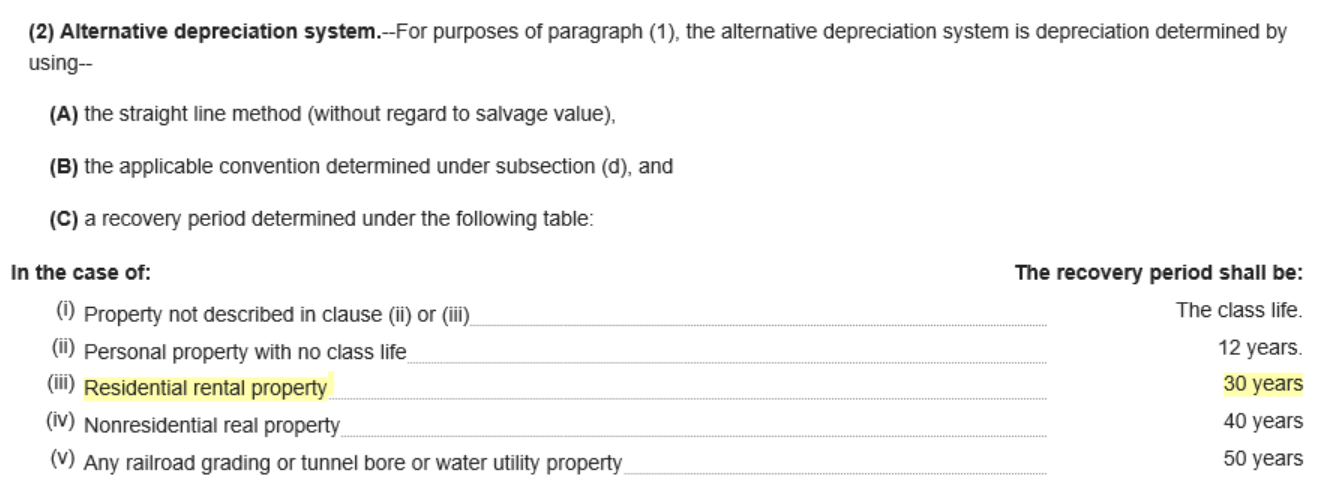

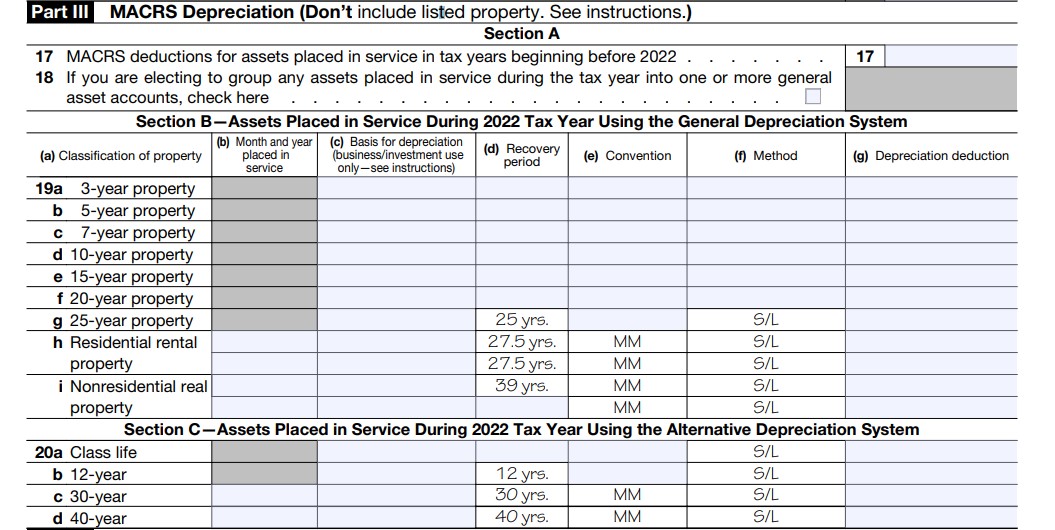

Irs Depreciation Foreign Rental Property 1 Best answer Critter 3 Level 15 Your overseas property is depreciated over a 30 year or 40 year period depending on when it was first rented instead of the 27 5 years for domestic residential properties Prior to 2018 depreciation of foreign residential property was limited to 40 years

Certainly You are required to disclose foreign properties on your US tax return in the same way that you would report any domestically owned property Read more US income tax on rental property for non residents I have a foreign rental property Do I have to report this income to the IRS Yes The IRS considers a foreign property a vacation home and rental property if you rented it out for more than 15 days and You used the property for 14 days or less during the tax year OR You used the

Irs Depreciation Foreign Rental Property

Irs Depreciation Foreign Rental Property

https://fitsmallbusiness.com/wp-content/uploads/2023/04/Screenshot_IRS-Form-4562-Part-III.jpg

A Free Rental Property Depreciation Spreadsheet Template

https://wp-assets.stessa.com/wp-content/uploads/2022/09/17155135/rental-property-depreciation-spreadsheet.jpeg

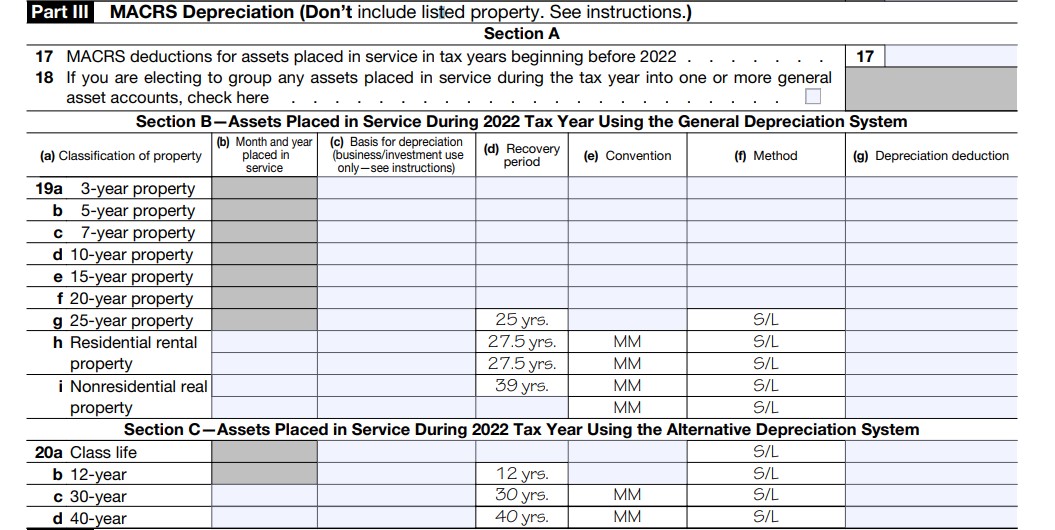

Irs Form 4562 Depreciation Worksheet

https://i.pinimg.com/originals/96/46/41/964641afebea214112caccc6261f0a2f.png

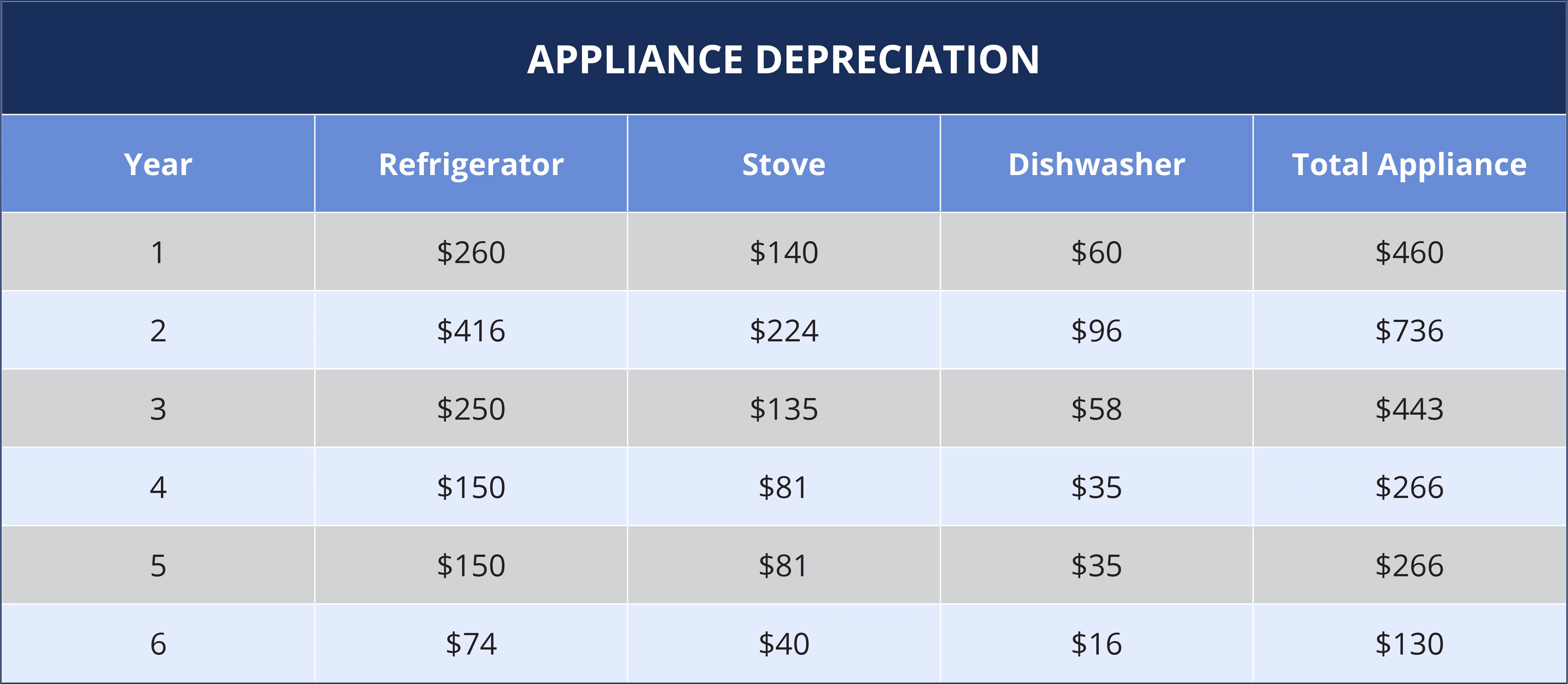

According to IRS rules a residential rental property in the US has a useful life i e a depreciation period of 27 5 years This means that expats who have a US rental property can deduct the initial cost of The IRS stipulates a 40 year straight line depreciation method for foreign rental property This means you ll evenly distribute the building cost over 40 years Depreciable Basis 264 000

Posted May 18 2021 Updated July 8 2021 Derren Joseph We have another new client coming over from another firm to have her 2020 returns done In reviewing the 2019 returns we see that the previous team depreciated her Learn how to claim mortgage interest rental expenses and capital gains on your overseas property Find out the differences and similarities between U S and foreign tax rules for personal and rental

Download Irs Depreciation Foreign Rental Property

More picture related to Irs Depreciation Foreign Rental Property

How To Calculate Depreciation Expense Irs Haiper

https://www.calt.iastate.edu/system/files/images-premium-article/macrs_2.png

How To Use Rental Property Depreciation To Your Advantage

http://www.baymgmtgroup.com/wp-content/uploads/2020/10/IMG_3499-658x400.jpg

Irs Depreciation Tables In Excel Awesome Home

https://i1.wp.com/cdn.vertex42.com/Calculators/Images/depreciation-calculator.png?resize=550%2C493&is-pending-load=1#038;ssl=1

Does the IRS Tax Foreign Rental Property How to Report Foreign Rental Income from Real Estate Other US Reporting Requirements How to Depreciate Foreign Rental Property Can You Use the Foreign Tax Credit for Foreign Rental Income Get Expert Help with Your Foreign Rental Property Taxes Foreign Rental Property Depreciation IRS Income When a U S person taxpayer has foreign rental property income they must report the income similar to how U S property rental income is reported on Schedule E But Taxpayer can also take the same types of deductions and expenses that are available to a U S property

While rental property ownership abroad can be a profitable investment foreign rental property depreciation and IRS income guidelines can also be tricky to decipher on your own Following IRS guidelines is an important matter and you need to get it right the first time If you are a foreign person or firm and you sell or otherwise dispose of a U S real property interest the buyer or other transferee may have to withhold income tax on the amount you receive for the property including cash the fair market value of other property and any assumed liability

IRS Tracked Political Groups After Approving Exemptions

https://www.gannett-cdn.com/-mm-/82ffc9445913bf37fd54f624dad8cfc4fce29087/c=0-285-4455-2801/local/-/media/USATODAY/test/2013/09/18/1379529842000-AP-IRS-Investigation.jpg?width=3200&height=1808&fit=crop&format=pjpg&auto=webp

Depreciation Of Foreign Rental Property HTJ Tax

https://htj.tax/wp-content/uploads/image-5-2.png

https://ttlc.intuit.com/community/investments-and...

1 Best answer Critter 3 Level 15 Your overseas property is depreciated over a 30 year or 40 year period depending on when it was first rented instead of the 27 5 years for domestic residential properties Prior to 2018 depreciation of foreign residential property was limited to 40 years

https://www.ptireturns.com/blog/income-tax-foreign...

Certainly You are required to disclose foreign properties on your US tax return in the same way that you would report any domestically owned property Read more US income tax on rental property for non residents I have a foreign rental property Do I have to report this income to the IRS Yes

Understanding Foreign Rental Property Depreciation And IRS Income

IRS Tracked Political Groups After Approving Exemptions

IRS Chief Inappropriate Screening Was Broad

Macrs Depreciation Table 2017 39 Year My Bios

Understanding Foreign Rental Property Depreciation And IRS Income

Irs Home Depreciation Calculator Atikkmasroaniati

Irs Home Depreciation Calculator Atikkmasroaniati

Depreciation Calculator For Refrigerator FrancisJosan

Oversight Committee Holds Hearing Into IRS Conferences

Free 6 Depreciation Schedule Examples Samples In Pdf Doc Excel Hot

Irs Depreciation Foreign Rental Property - According to IRS rules a residential rental property in the US has a useful life i e a depreciation period of 27 5 years This means that expats who have a US rental property can deduct the initial cost of