Irs Energy Rebates Web 26 juil 2023 nbsp 0183 32 If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses

Web 28 ao 251 t 2023 nbsp 0183 32 The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 Web For an interactive guide to energy credits available under the Inflation Reduction Act visit cleanenergy gov Bonus Incentive Credits Qualifying energy projects that also meet

Irs Energy Rebates

Irs Energy Rebates

https://www.innoledlighting.com/wp-content/uploads/2018/07/Document-big-hd.png

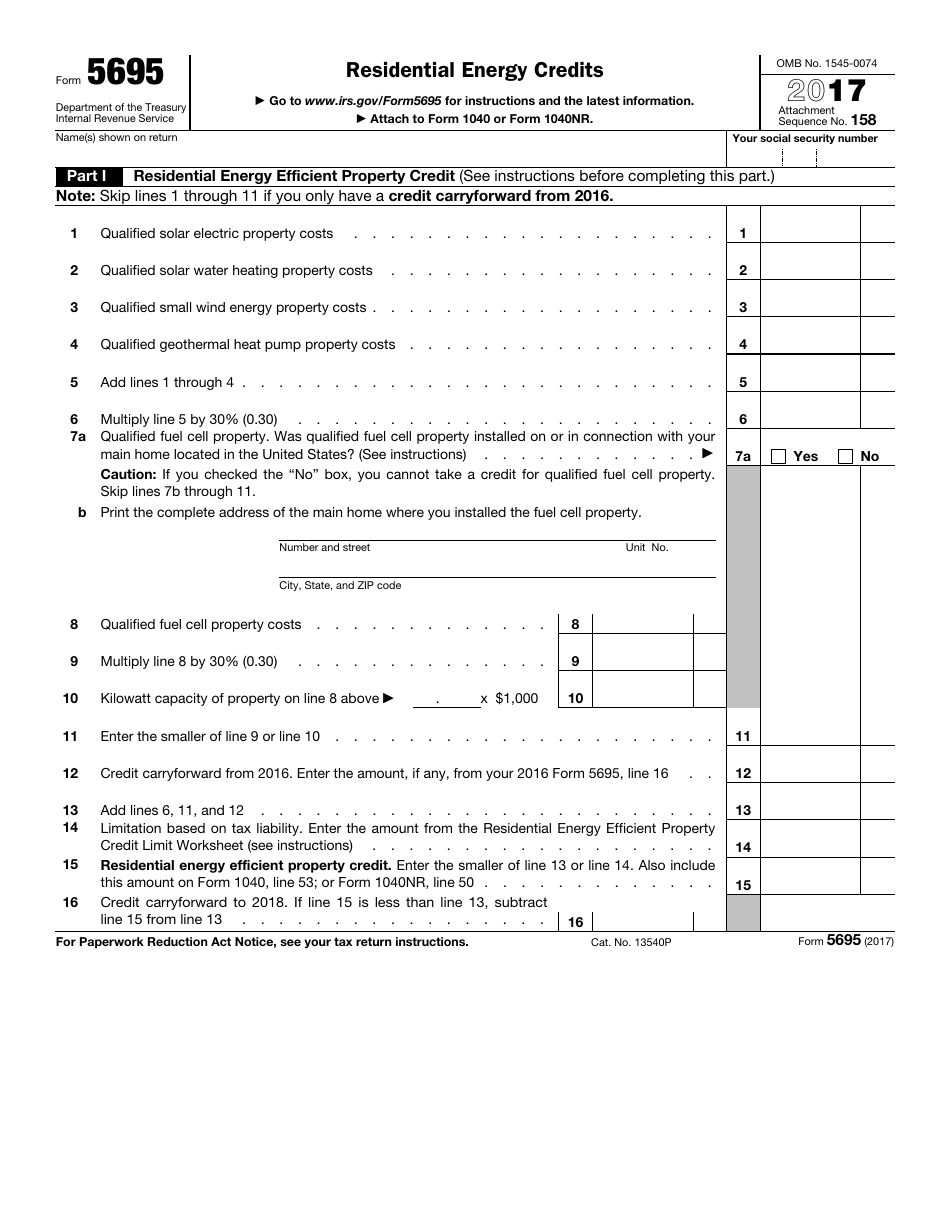

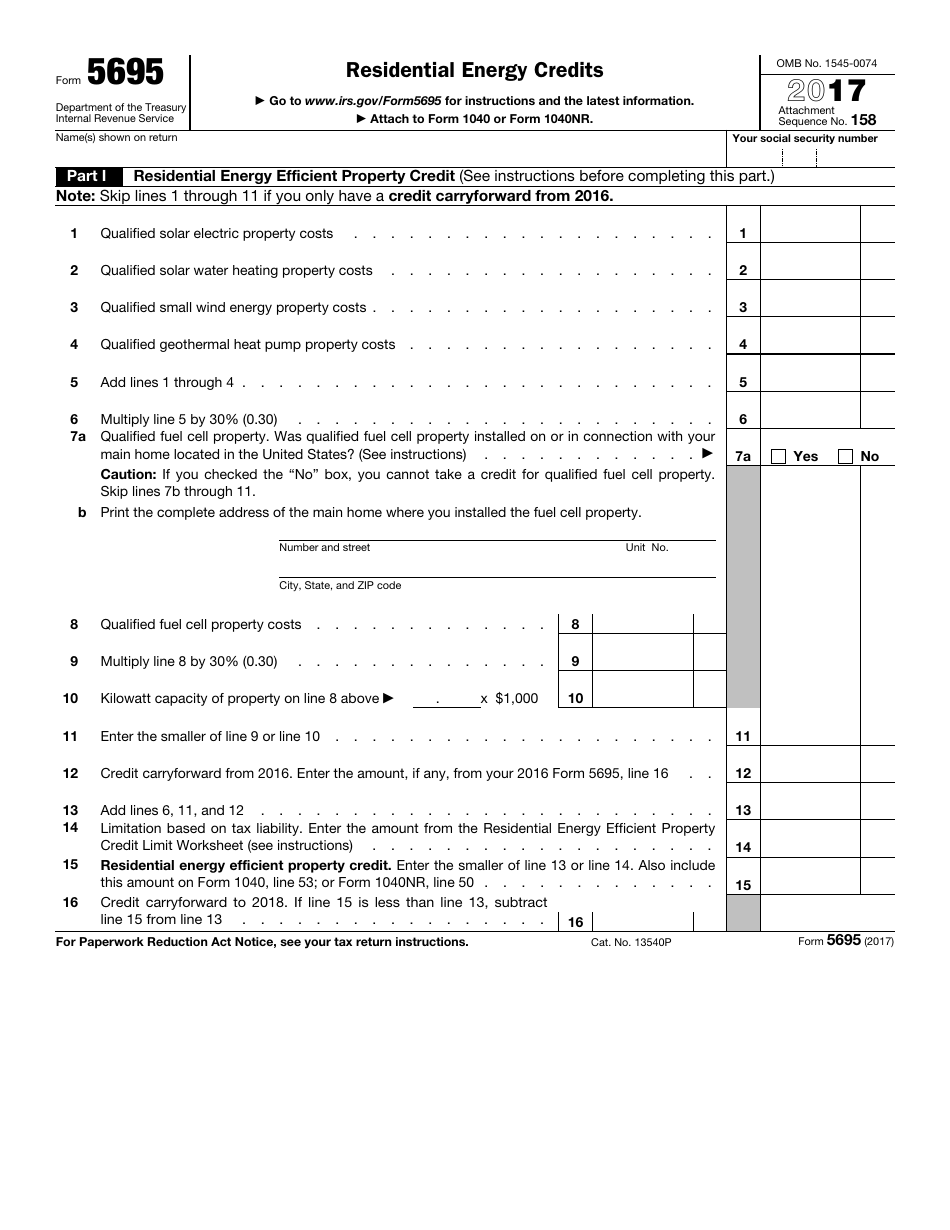

IRS Form 5695 Download Fillable PDF Or Fill Online Residential Energy

https://data.templateroller.com/pdf_docs_html/1735/17356/1735655/irs-form-5695-2017-residential-energy-credits_print_big.png

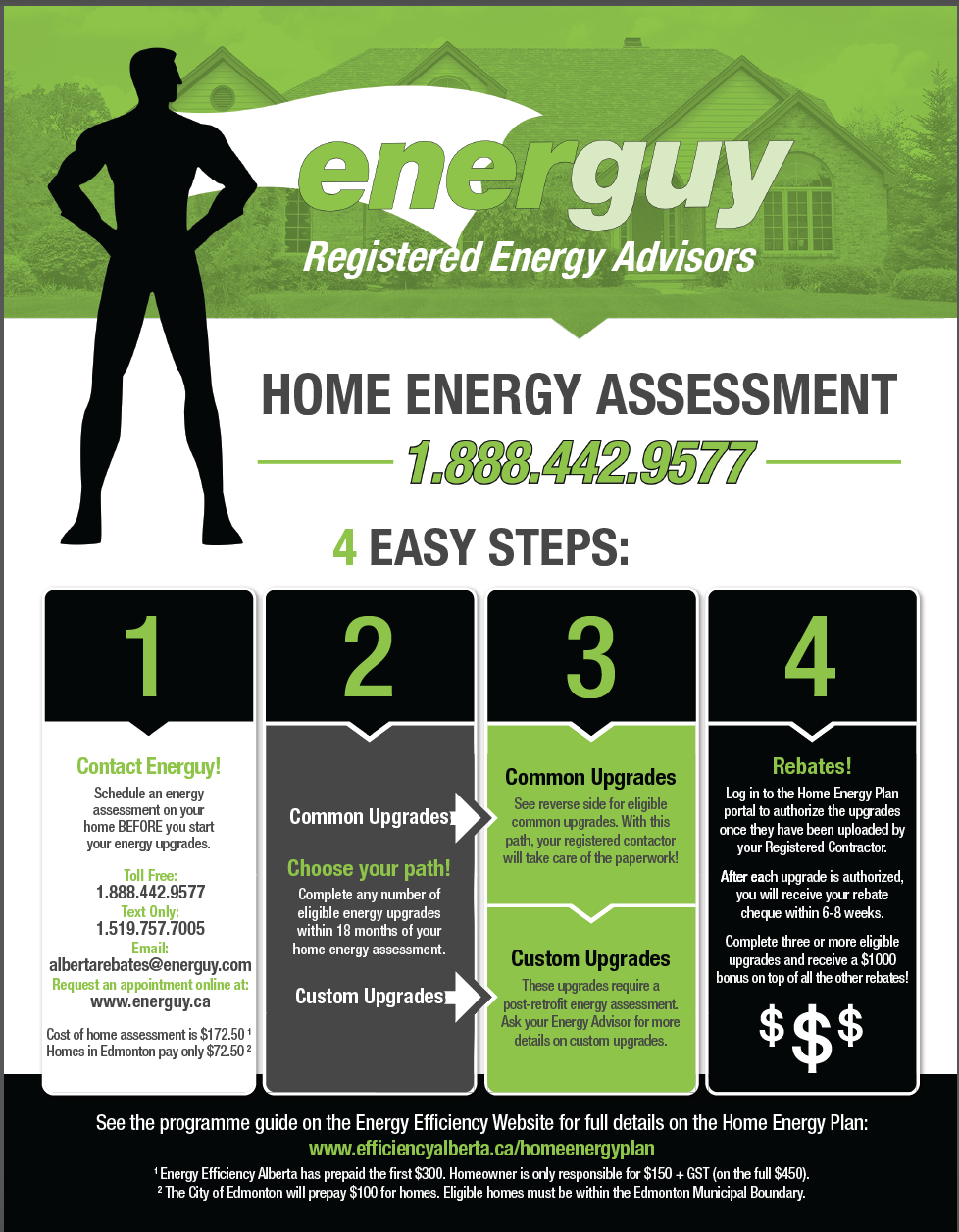

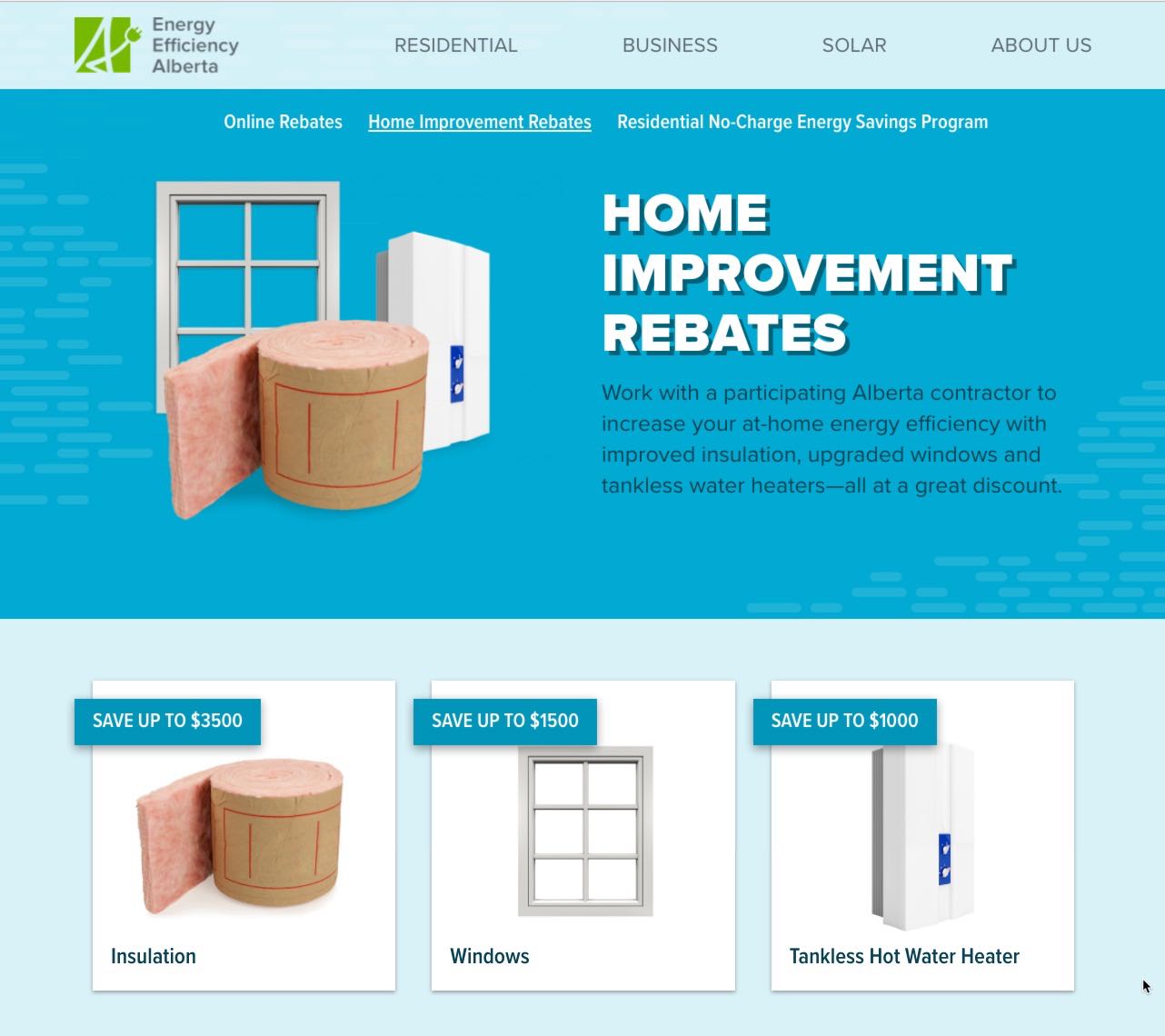

Energy Efficiency Alberta Rebates

https://www.ottohc.com/uploads/files/Images/Promotions/Energuy01.png

Web 27 avr 2021 nbsp 0183 32 In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the Web 30 d 233 c 2022 nbsp 0183 32 Federal Income Tax Credits and Incentives for Energy Efficiency The Inflation Reduction Act of 2022 provides federal tax credits and deductions that empower Americans to make homes and buildings

Web Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act of 2022 IRA amended the credits for energy efficient home Web The U S Department of Energy DOE estimates that these rebates will save households up to a 1 billion on energy bills each year and support over 50 000 U S jobs This

Download Irs Energy Rebates

More picture related to Irs Energy Rebates

Energy Rebates Don t Leave Money On The Table Schmidt Associates

https://schmidt-arch.com/wp-content/uploads/2018/02/Energy-Rebates-Charts.jpg

IRS 1040 NonFilers Stimulus Check Recovery Rebate Credit Walk Through

https://i.pinimg.com/736x/18/51/29/185129d90a4f4082ee6490b2462c4166.jpg

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/who-could-qualify-for-2nd-stimulus.jpeg

Web 19 ao 251 t 2022 nbsp 0183 32 The IRA s 4 28 billion High Efficiency Electric Home Rebate Program will provide an upfront rebate of up to 8 000 to install heat pumps that can both heat and Web 30 d 233 c 2022 nbsp 0183 32 Under the Inflation Reduction Act of 2022 federal income tax credits for energy efficiency home improvements will be available through 2032 A broad selection of ENERGY STAR certified equipment is eligible

Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can

Rebates Pederson HVAC Inc 618 588 2402

https://pedersonhvac.com/wp-content/uploads/2017/02/rebates.jpg

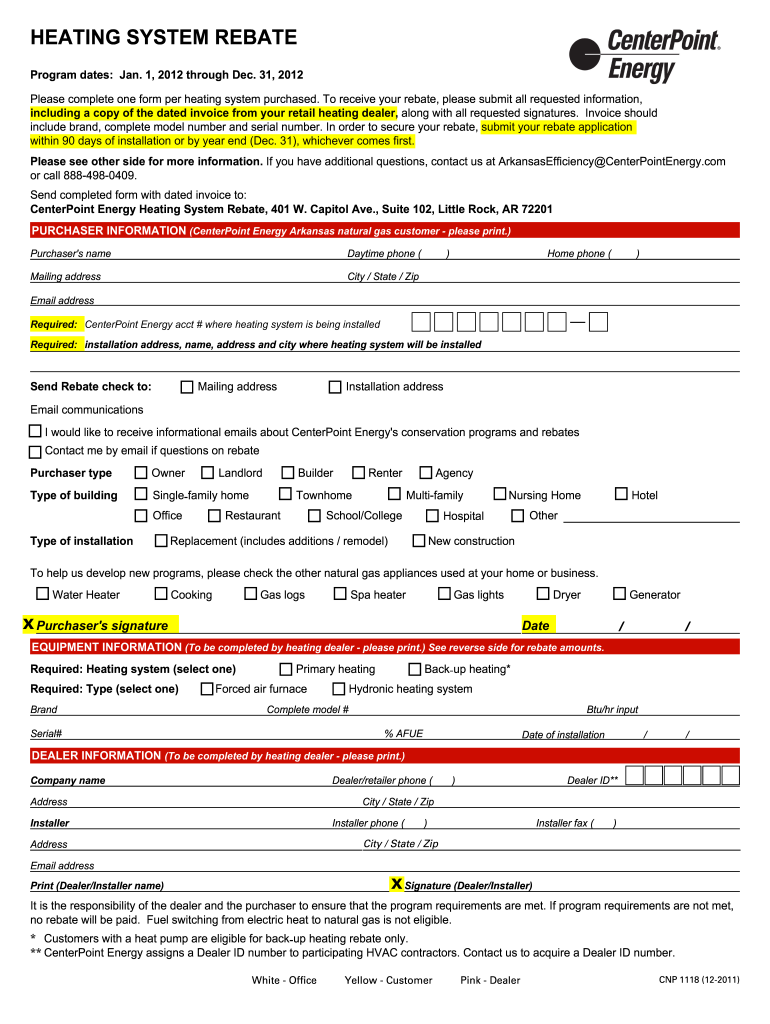

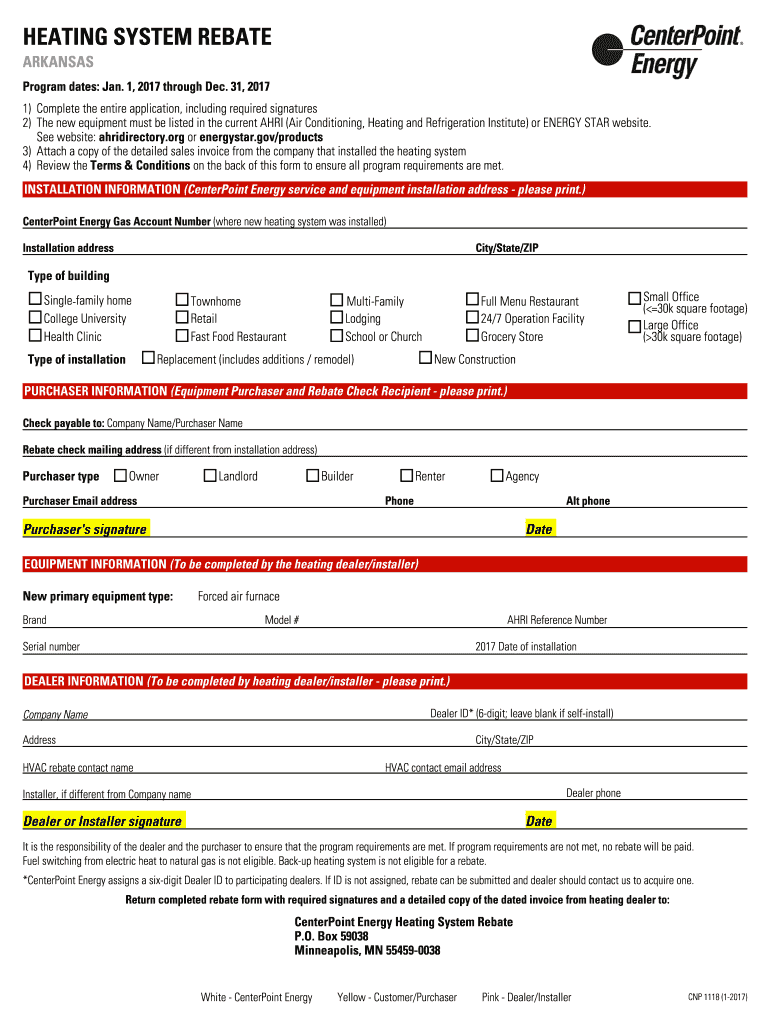

Centerpoint Energy Rebate Forms Fill Out And Sign Printable PDF

https://www.signnow.com/preview/6/360/6360648/large.png

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Web 26 juil 2023 nbsp 0183 32 If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Web 28 ao 251 t 2023 nbsp 0183 32 The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032

Energy Efficiency Rebates Green Energy Futures

Rebates Pederson HVAC Inc 618 588 2402

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

2017 2022 Form AR CNP 1118 Fill Online Printable Fillable Blank

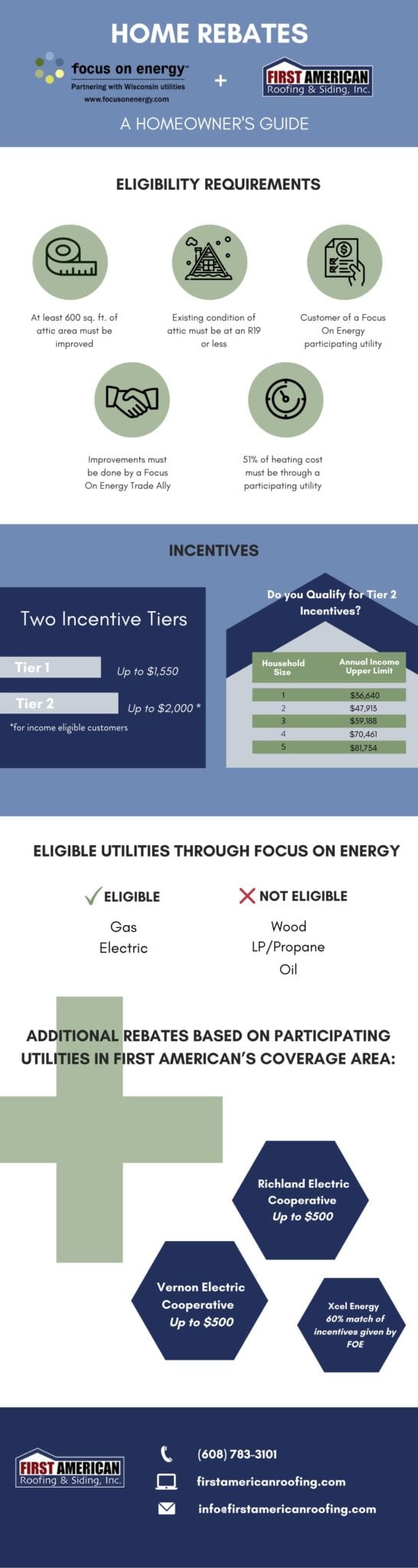

Focus On Energy A Wisconsin Homeowner s Guide To Rebates

Energy Efficiency Rebates And Incentives Carolina Home Performance Inc

Energy Efficiency Rebates And Incentives Carolina Home Performance Inc

Nonbusiness Energy Credit Form

Energy Rebates Mr Wilson Air PumpRebate

Dominion Energy Rebate Form By State Printable Rebate Form

Irs Energy Rebates - Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer