Irs Energy Star Rebates Web 30 d 233 c 2022 nbsp 0183 32 Information updated 12 30 2022 The Inflation Reduction Act of 2022 provides federal tax credits and deductions that empower Americans to make homes and buildings more energy efficient to help

Web 28 ao 251 t 2023 nbsp 0183 32 The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 Web 26 juil 2023 nbsp 0183 32 You can claim either the Energy Efficient Home Improvement Credit or the Residential Energy Clean Property Credit for the year when you make qualifying

Irs Energy Star Rebates

Irs Energy Star Rebates

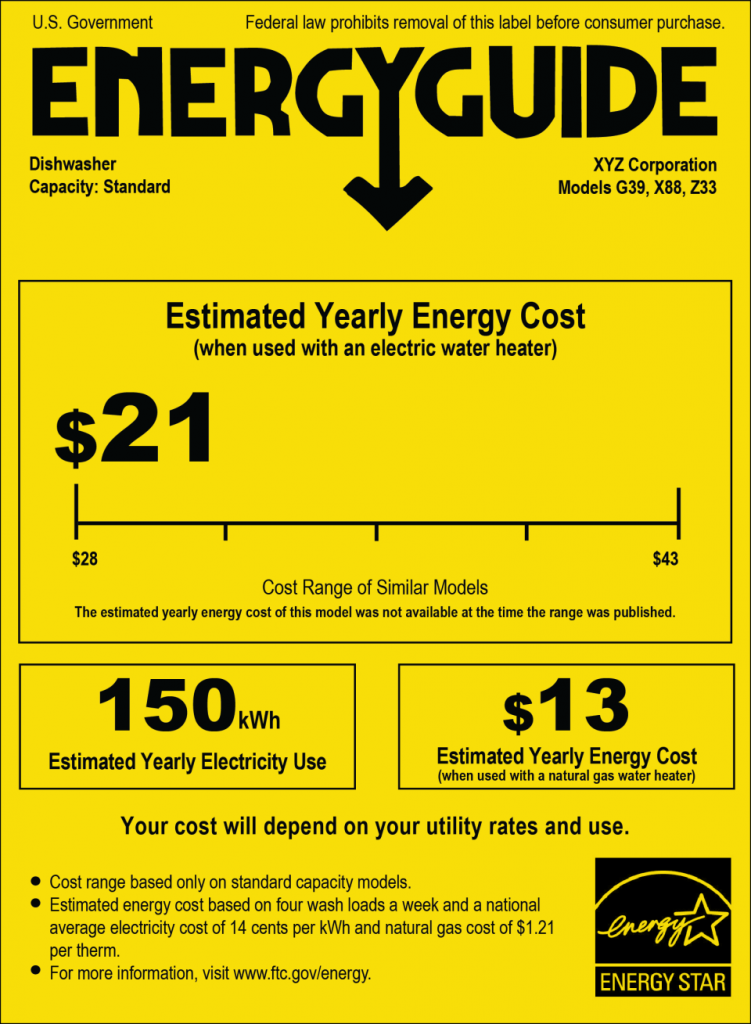

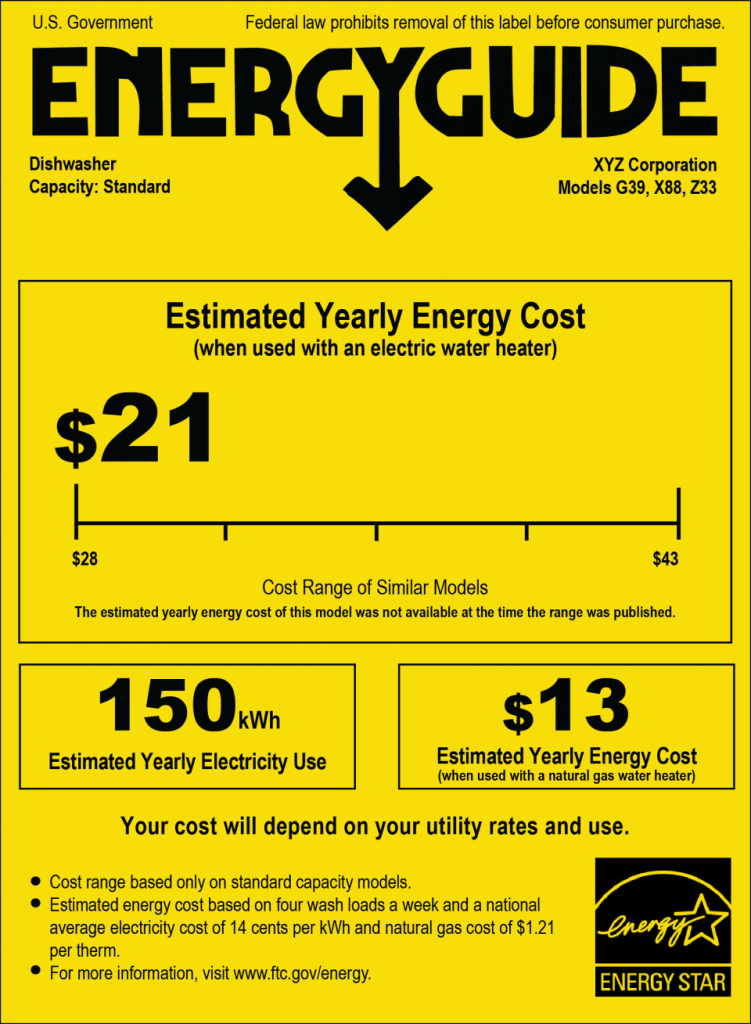

https://www.consolidated.coop/wp-content/uploads/2023/03/Energy-Guide-751x1024.png

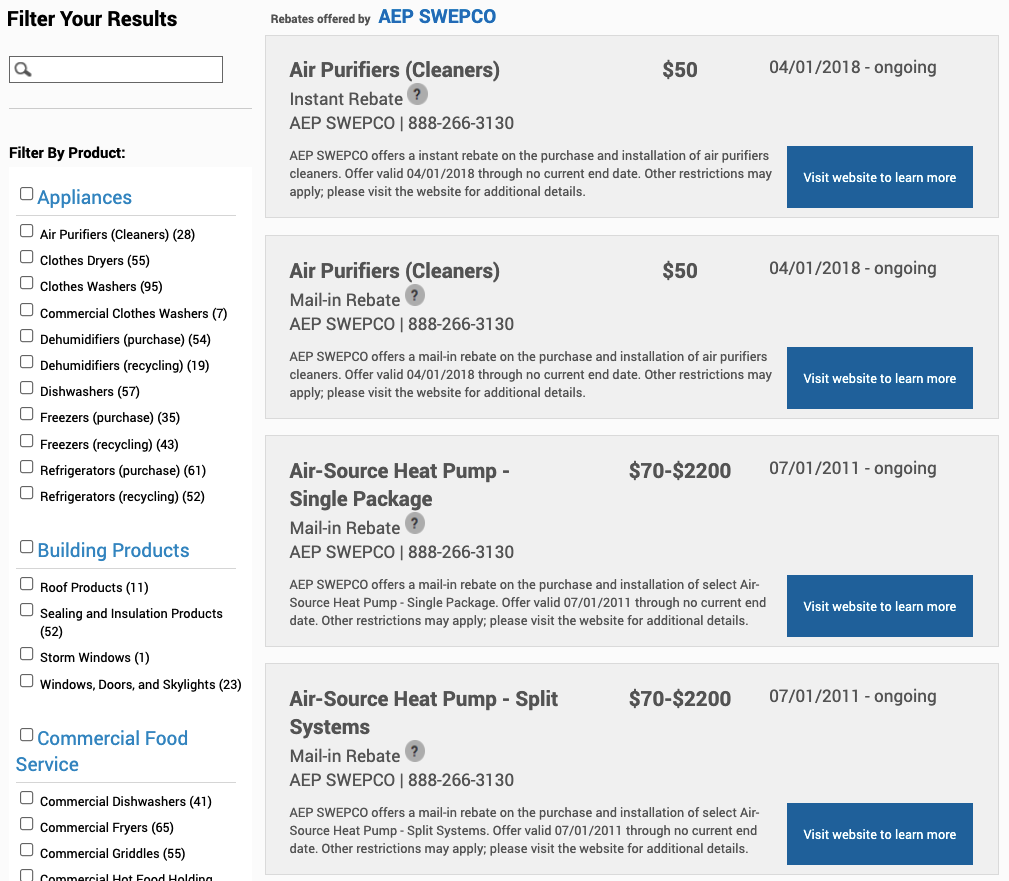

Energy Star Rebates Save Money On Energy Efficient Upgrades USRebate

https://i0.wp.com/www.usrebate.com/wp-content/uploads/2023/05/Energy-Star-Rebates.png?resize=910%2C513&ssl=1

Energy Star Appliance Tax Credit 2022 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/04/Energy-Star-Appliance-Rebate-2022.png

Web As amended by the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200 Web 30 d 233 c 2022 nbsp 0183 32 Under the Inflation Reduction Act of 2022 federal income tax credits for energy efficiency home improvements will be available through 2032 A broad selection of ENERGY STAR certified equipment is eligible

Web 27 avr 2021 nbsp 0183 32 In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the Web Here are the highlights of ENERGY STAR certified equipment that is eligible for the tax credits Products That Qualify Central air conditioning 300 for air conditioners recognized as ENERGY STAR Most Efficient Air

Download Irs Energy Star Rebates

More picture related to Irs Energy Star Rebates

Energy Star Appliances Rebates Explained

https://www.webstaurantstore.com/images/articles/553/energy-star-header.jpg

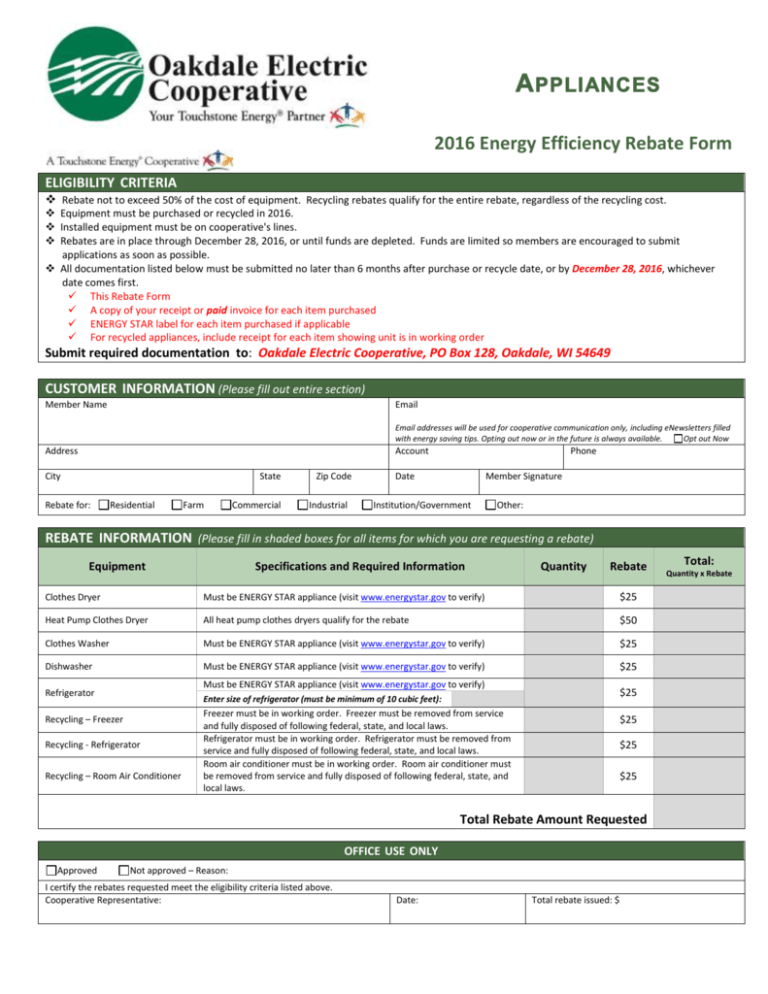

Application Energy Star Rebate Form

https://s3.studylib.net/store/data/007063414_1-7c0c1ae81a07f163c48ffd165d883f6f-768x994.png

Air Conditioner Help For Low Income Families Free Air Conditioning

https://i1.wp.com/www.eia.gov/consumption/residential/reports/images/acb_fig1_lg.png

Web Starting in 2023 income tax credit amounts will increase and new rebates should become available for making improvements to your home that save energy and support a clean energy future Combined with utility Web Product Rebate Finder Enter your zip code to find rebates and other special offers on ENERGY STAR certified products available in your area

Web 30 d 233 c 2022 nbsp 0183 32 The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope Web 25 janv 2023 nbsp 0183 32 Jan 25 2023 Knowledge While ENERGY STAR supplies some information about tax credits here the tax credits are administered by the IRS You will have to claim

Welcome Two Rivers Wisconsin

https://www.two-rivers.org/sites/default/files/styles/banner_sub/public/imageattachments/banner/1981/energy-star-rebate-banner-new.png?itok=mztNwyLQ

Foster Appliance Promotions

https://foster-appliance.markupfactory.com/assets/foster-appliance/UtilityCoRebate copy.jpeg

https://www.energystar.gov/about/federal_tax…

Web 30 d 233 c 2022 nbsp 0183 32 Information updated 12 30 2022 The Inflation Reduction Act of 2022 provides federal tax credits and deductions that empower Americans to make homes and buildings more energy efficient to help

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Web 28 ao 251 t 2023 nbsp 0183 32 The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032

Dominion Energy Star Rebate

Welcome Two Rivers Wisconsin

ENERGY STAR Rebates For Restaurant Equipment KaTom Restaurant Supply

Check Out The New ENERGY STAR Rebate Available From OEC At Www

Promotions Rebates Water Heater Rescue And Plumbing Services Save

Energy Star Rebates And Incentives

Energy Star Rebates And Incentives

Information About Equipment Efficiency Sustainability sep

National Grid Rebate Form Beautiful Energy Star Certified Leds

Energy Star Rebates City Of Redwood Falls

Irs Energy Star Rebates - Web 16 f 233 vr 2023 nbsp 0183 32 ENERGY STAR certifies energy efficient products in over 75 categories which meet strict energy efficiency specifications set by the U S EPA to save you