Irs Ev Rebate List Web 16 ao 251 t 2022 nbsp 0183 32 List of vehicles that are eligible for a 30D clean vehicle tax credit and the amount of the qualifying credit if purchased between 2010 and 2022 If you bought a

Web Beginning January 1 2023 if you buy a qualified previously owned electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Irs Ev Rebate List

Irs Ev Rebate List

https://images-stag.jazelc.com/uploads/theautopian-m2en/irs-tax-credits-topshot.jpg

IRS EV Tax Credit 2023 Who Can Qualify Qualified Vehicles

https://badisoch.in/wp-content/uploads/2023/01/gdfdhgbng.jpg

Nearly Half Of Ottawa s EV Rebate Funds Gone In Just 8 Months 1 3

https://i.gaw.to/content/photos/40/86/408699_Ottawa_la_moitie_des_fonds_pour_le_rabais_aux_VE_s_envole_en_8_mois.jpg

Web Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used Web 19 juil 2023 nbsp 0183 32 The Inflation Reduction Act of 2022 overhauled the EV tax credit adding income limits price caps and a requirement that battery components and minerals meet domestic sourcing guidelines to

Web 23 mars 2023 nbsp 0183 32 Battery electric vans SUVs and trucks qualify for the revised credit if their MSRP is below 80 000 while other EVs that don t fall in the above category mostly passenger cars have an Web The Inflation Reduction Act broke the credit into two halves You can claim 3 750 if at least half of the value of your vehicle s battery components are manufactured or

Download Irs Ev Rebate List

More picture related to Irs Ev Rebate List

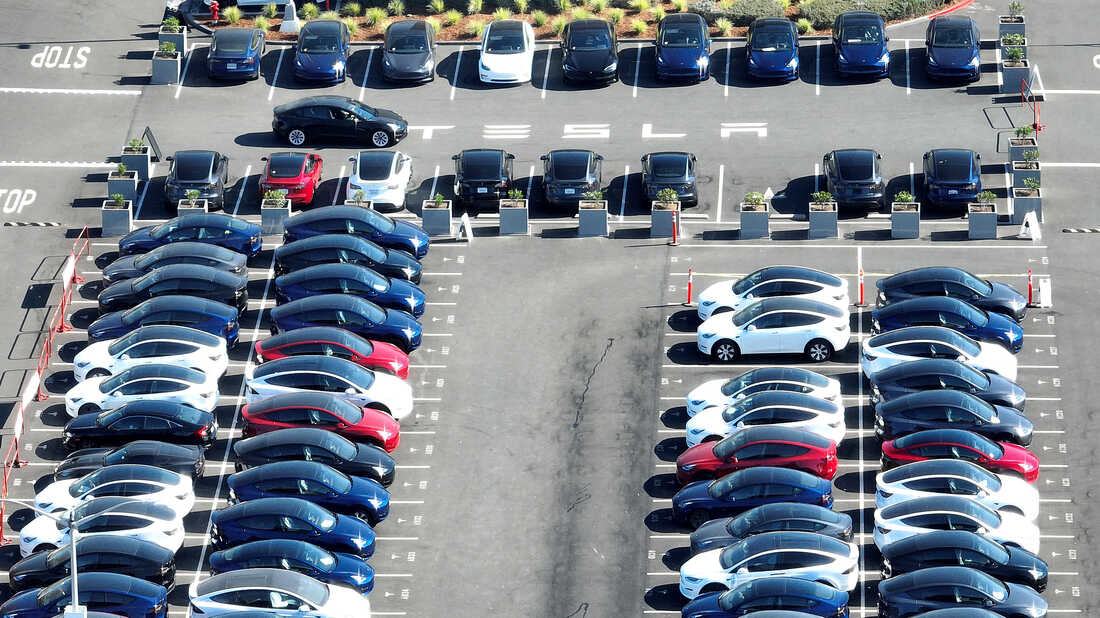

What To Know About The 7 500 IRS EV Tax Credit For Electric Cars In

https://media.npr.org/assets/img/2023/01/06/gettyimages-1434797501_wide-81e5e737847555467ff1f49e67402d1a8e8c5801-s1100-c50.jpg

How To Get Used EV Tax Credit IRS Says Up To 4 000 Can Be Received

https://1734811051.rsc.cdn77.org/data/images/full/417353/how-to-get-used-ev-tax-credit-irs-says-up-to-4-000-can-be-received-qualifications-other-details.jpg

IRS Changes EV Tax Credit Vehicle Classifications Here s The New List

https://www.carscoops.com/wp-content/uploads/2023/02/khjglfghj-1024x576.jpg

Web 16 ao 251 t 2022 nbsp 0183 32 WASHINGTON Following President Biden s signing the Inflation Reduction Act into law today the U S Department of the Treasury and Internal Revenue Service Web 17 ao 251 t 2022 nbsp 0183 32 Vehicles Placed in Service After December 31 2022 For up to date information on eligibility requirements for the Clean Vehicle Credit or for additional detail

Web 17 avr 2023 nbsp 0183 32 Federal Tax Credits for Plug in Electric and Fuel Cell Electric Vehicles Placed into Service on or after April 18 2023 Vehicle Model Year Web Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax

2023 Wie Der IRS Das Inflationsminderungsgesetz Ignorierte Und Die

https://cleantechnica.com/files/2023/01/IRS-EV-Tax-Credit.png

Tesla Model Y Exceeds Government EV Rebate Thresholds CarExpert

https://images.carexpert.com.au/resize/3000/-/app/uploads/2022/06/tesla-model-y-price-1.jpg

https://www.irs.gov/credits-deductions/manufacturers-and-models-for...

Web 16 ao 251 t 2022 nbsp 0183 32 List of vehicles that are eligible for a 30D clean vehicle tax credit and the amount of the qualifying credit if purchased between 2010 and 2022 If you bought a

https://www.irs.gov/credits-deductions/manufacturers-and-models-of...

Web Beginning January 1 2023 if you buy a qualified previously owned electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for

NZ EV Rebate Clean Car Discount For Hybrid Electric Cars Driveline

2023 Wie Der IRS Das Inflationsminderungsgesetz Ignorierte Und Die

BC EV Rebate A Step In The Right Direction Ultra Lithium Inc ULT

/cloudfront-us-east-1.images.arcpublishing.com/tgam/DVLEJQURHJKMDLZZCYJGGAAPXY.jpg)

Canada Looks To Overhaul EV Rebate Program To Include More Expensive

California EV Rebate Program Soon To End Drive Tesla

Used Electric Vehicle Rebate Program Overview Peninsula Clean Energy

Used Electric Vehicle Rebate Program Overview Peninsula Clean Energy

More Than 30 Governmental Entities Begin To Electrify Their Fleets

Tesla Tax Credit 2021 Nj Imposing Logbook Lightbox

California EV Rebate Program What Has Changed In 2022

Irs Ev Rebate List - Web 5 sept 2023 nbsp 0183 32 The IRA remedies this Beginning in 2023 qualifying used EV purchases can fetch taxpayers a credit of up to 4 000 limited to 30 of the car s purchase price Some