Irs Ev Tax Credit 2023 Form Complete a separate Schedule A Form 8936 for each clean vehicle placed in service during the tax year Individuals completing Parts II III or IV must also complete Part I See Note text below

Clean vehicle tax credits We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you are Planning to buy a new clean vehicle Looking to claim a credit for a new clean vehicle you already bought All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500

Irs Ev Tax Credit 2023 Form

Irs Ev Tax Credit 2023 Form

https://www.carscoops.com/wp-content/uploads/2023/01/EV-PHEV-Tax-Credit-7500-Carscoops-1024x576.jpg

What To Know About The 7 500 IRS EV Tax Credit For Electric Cars In

https://media.npr.org/assets/img/2023/01/06/gettyimages-1434797501_wide-81e5e737847555467ff1f49e67402d1a8e8c5801-s1100-c50.jpg

The New EV Tax Credit In 2023 Everything You Need To Know Updated

https://caredge.com/wp-content/uploads/2021/11/ev-tax-credit-update-2022.png

Treasury and the Internal Revenue Service released guidance and FAQs with information on how the North America final assembly requirement will work so consumers can determine what vehicles are eligible and claim a The Qualified Plug In Electric Drive Motor Vehicle Credit is a tax credit available for certain new plug in electric vehicles EVs placed in service before 2023 Namely the credit is worth up to 7 500 under Internal Revenue Code Section 30D

Effective immediately after enactment of the Inflation Reduction Act after August 16 2022 the tax credit is only available for qualifying electric vehicles for which final assembly occurred in North America Further changes to the eligibility rules will begin in 2023 The Inflation Reduction Act IRA provides new opportunities for consumers to save money on clean vehicles offering multiple incentives for the purchase or lease of electric vehicles EVs plug in hybrid vehicles fuel cell vehicles and

Download Irs Ev Tax Credit 2023 Form

More picture related to Irs Ev Tax Credit 2023 Form

How To Calculate Electric Car Tax Credit OsVehicle

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

Electric Vehicle Tax Credit 2023 Electric Vehicle Tax Credit Survives

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2022/08/GettyImages-1252669337-ev-tax-credit-electric-vehicle-tax-credit-2400x1440.jpg

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

The electric vehicle EV tax credit is a nonrefundable tax credit that Uncle Sam offers to eligible taxpayers who buy electric vehicles or plug in hybrids The EV tax credit is also sometimes called the clean vehicle tax credit Form 8936 is an IRS form taxpayers can use to claim a tax credit for an electric vehicle as long as they meet certain eligibility requirements Internal Revenue Code 30D a determines the

If you buy a new all electric plug in hybrid or fuel cell electric vehicle in 2023 or after you can claim a clean vehicle tax credit of up to 7 500 The tax credit is available to both The guidance provided for the new clean vehicle tax credit that was released on Dec 29 2022 applies between Jan 1 2023 and when the preliminary guidance on the battery sourcing requirements is released by the Treasury Department and the I R S which is expected in March 2023

Buying An Electric Car You Can Get A 7 500 Tax Credit But It Won t

https://media.npr.org/assets/img/2023/01/06/gettyimages-1243236963-1--742bba825bbd259580ed72411dbf7eae6b5409ca.jpg

C mo Funcionan Los Cr ditos Fiscales Para Veh culos Limpios Usados Y

https://blinkcharging.com/wp-content/uploads/2023/04/BlogGraphic_AprilWk2-scaled.jpg

https://www.irs.gov/pub/irs-pdf/f8936.pdf

Complete a separate Schedule A Form 8936 for each clean vehicle placed in service during the tax year Individuals completing Parts II III or IV must also complete Part I See Note text below

https://www.irs.gov/clean-vehicle-tax-credits

Clean vehicle tax credits We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you are Planning to buy a new clean vehicle Looking to claim a credit for a new clean vehicle you already bought

EV Tax Credit 2023 What s Changing With Biden s IRA The Week

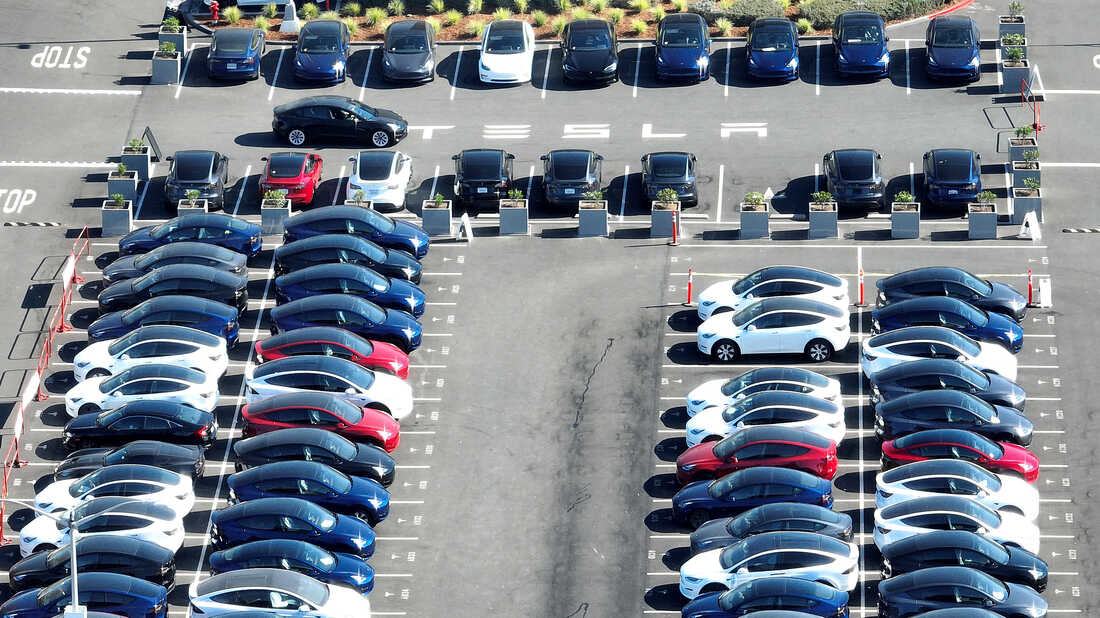

Buying An Electric Car You Can Get A 7 500 Tax Credit But It Won t

How To Get Used EV Tax Credit IRS Says Up To 4 000 Can Be Received

Learn The Steps To Claim Your Electric Vehicle Tax Credit

Ev Tax Credit 2022 Retroactive Shemika Wheatley

Tesla Warns That 7 500 Tax Credit For Model 3 RWD Will Be Reduced

Tesla Warns That 7 500 Tax Credit For Model 3 RWD Will Be Reduced

Form 8911 For 2023 Printable Forms Free Online

IRS EV Tax Credit 2023 What You Need To Know FutureEv

IRS EV Tax Credit 2023 Who Can Qualify Qualified Vehicles

Irs Ev Tax Credit 2023 Form - How to know if your car qualifies for the EV tax credit aka Clean Vehicle Tax Credit if it was delivered on or after April 18 2023