Irs Form 1040 Charitable Contributions Charitable contributions to qualified organizations may be deductible if you itemize deductions on Schedule A Form 1040 Itemized Deductions PDF To see if the organization you have contributed to qualifies as a charitable organization for income tax deductions use Tax Exempt Organization Search

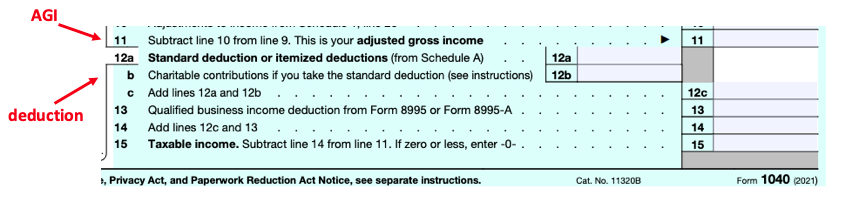

Charitable contribution tax information search exempt organizations eligible for tax deductible contributions learn what records to keep and how to report contributions find tips on making donations Charitable contributions must be claimed as itemized deductions on Schedule A of IRS Form 1040 The 60 AGI ceiling on charitable cash contributions to qualified charities applies for tax years

Irs Form 1040 Charitable Contributions

Irs Form 1040 Charitable Contributions

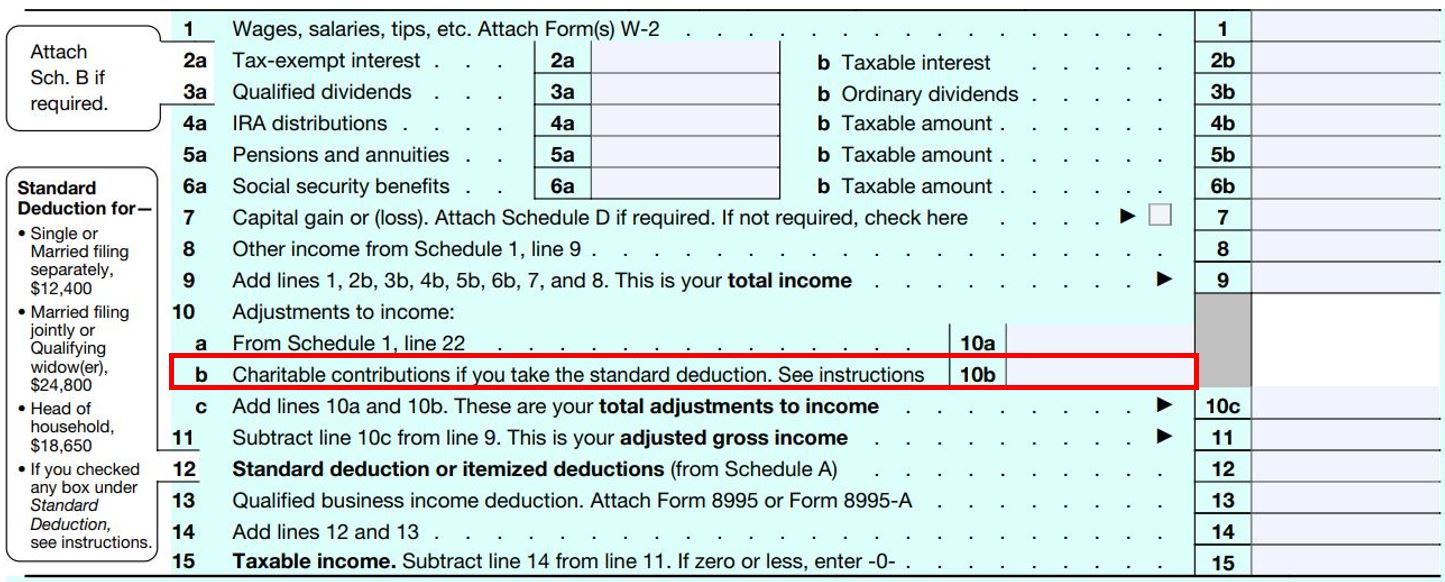

https://i0.wp.com/pastorswallet.com/wp-content/uploads/2021/02/1040-Above-the-line-Charitable-deduction.png?fit=759%2C761&ssl=1

The IRS Encourages Taxpayers To Consider Charitable Contributions

https://www.irs.gov/pub/image/acl-charitable-contributions-870.jpg

IRS Form 1040 Schedule A Charitable Donations 2018 Saline Journal

https://salinejournal.com/wp-content/uploads/2018/07/IRS-Form-1040-Schedule-A-Charitable-Donations-Saline-Journal.jpg

Eligible individuals must make their elections with their 2021 Form 1040 or Form 1040 SR Corporate limit increased to 25 of taxable income To deduct a charitable contribution taxpayers must itemize deductions on Schedule A of Form 1040 How the Charitable Contributions Deduction Works Donations to a qualified charity are

Feb 29 2024 Publication 526 Cat No 15050A Charitable Contributions For use in preparing 2023 Returns Get forms and other information faster and easier at IRS gov English IRS gov Korean IRS gov Spanish Espa ol IRS gov Russian P IRS gov Chinese IRS gov Vietnamese Ti ng Vi t Contents Taxpayers must itemize their deductions on Schedule A for the year in which they made the contribution in order to take a charitable contribution deduction IRS Publication 526 Charitable Contributions PDF provides information on making contributions to charities

Download Irs Form 1040 Charitable Contributions

More picture related to Irs Form 1040 Charitable Contributions

A 2020 Charitable Giving Strategy You Don t Want To Miss

https://financialdesignstudio.com/wp-content/uploads/2020/12/2020-Form-1040-With-Charitable-Deduction.jpg

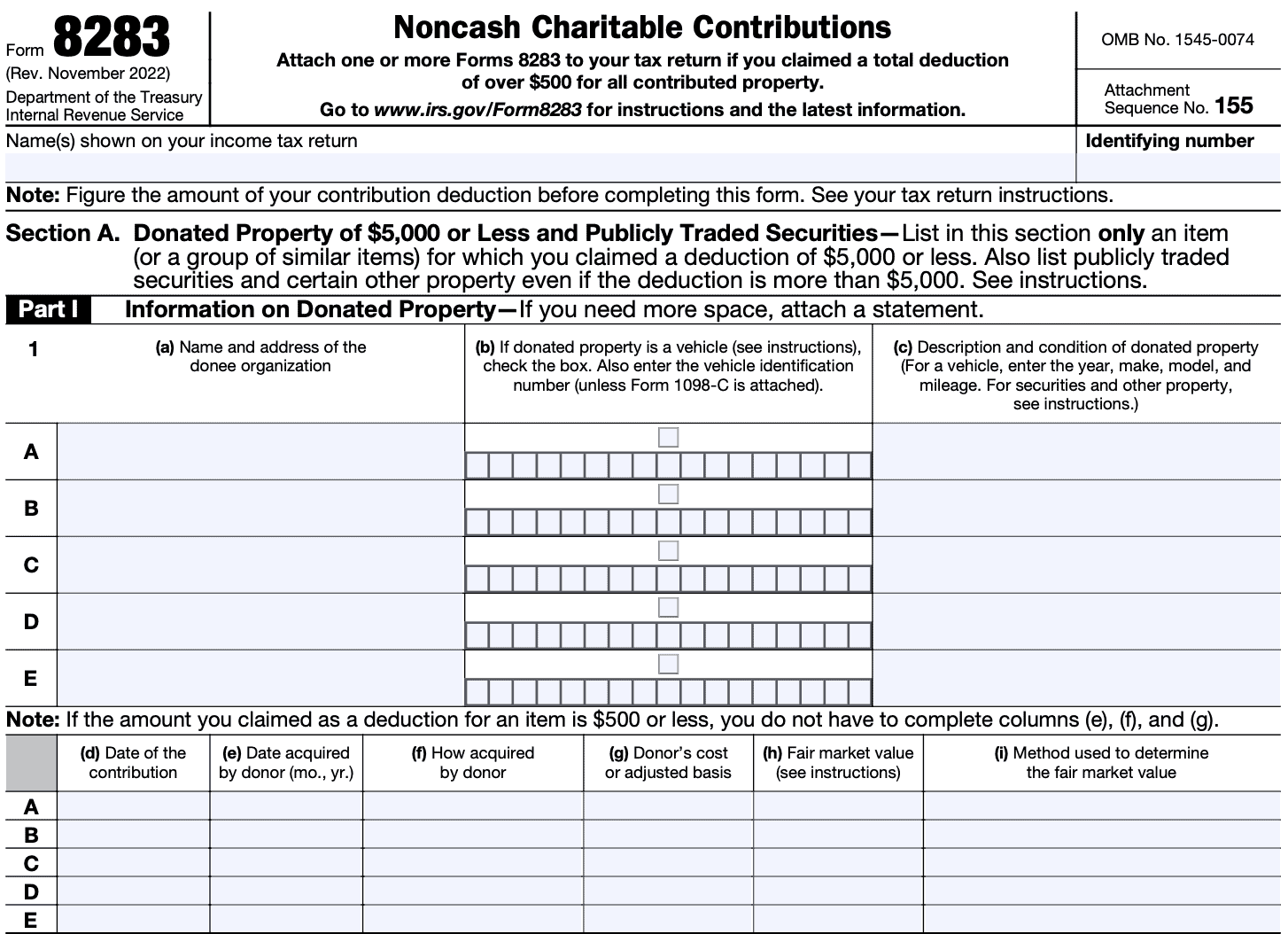

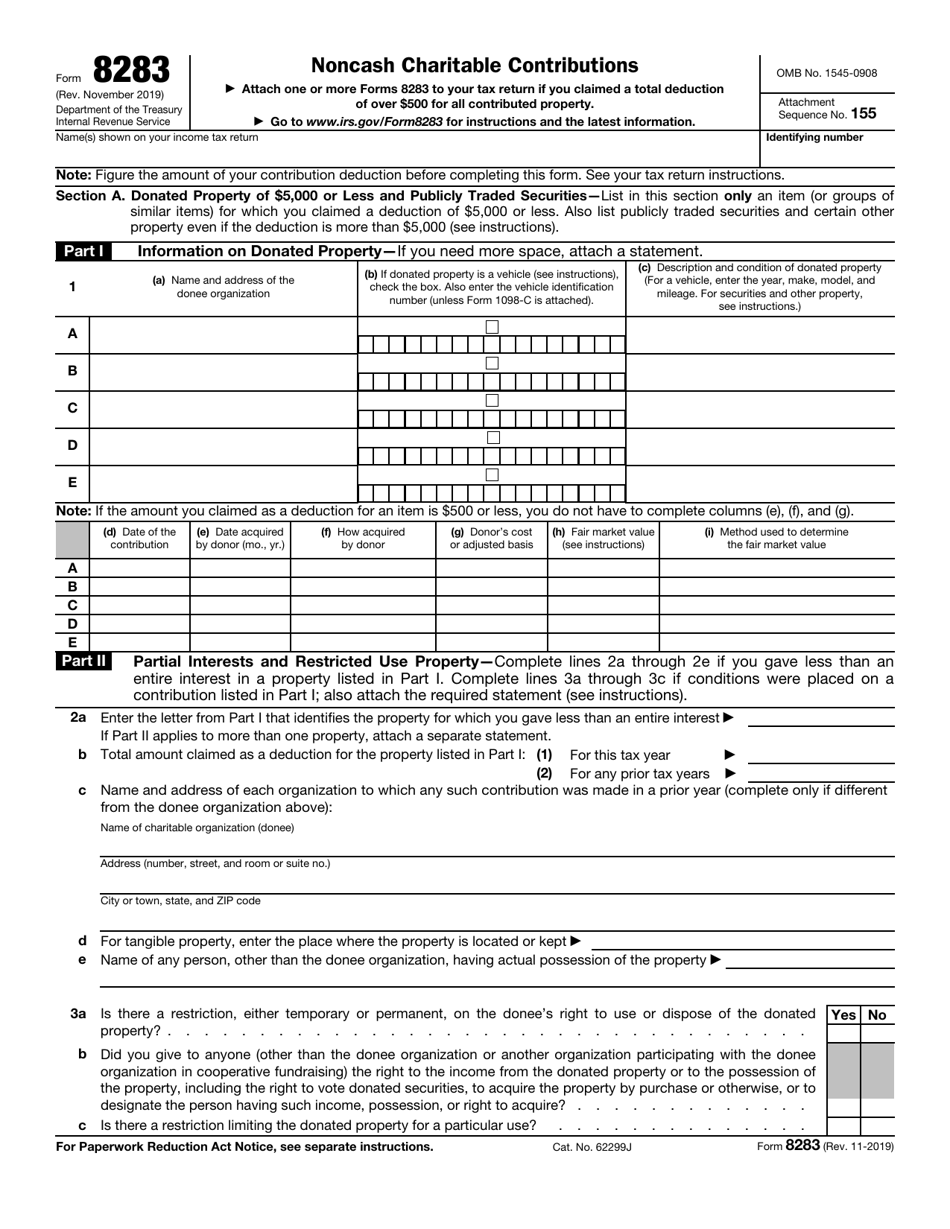

IRS Form 8283 Instructions Noncash Charitable Contributions

https://www.teachmepersonalfinance.com/wp-content/uploads/2023/03/irs_form_8283_section_a.png

Charitable Contributions Tax Strategies Fidelity Charitable

https://www.fidelitycharitable.org/content/dam/fc-public/shared/images/glasses-pencil-tax-form.jpg.transform/viewport-share-image/image.20211105.jpeg

Keep track of all your taxable donations and itemize them on Schedule A Form 1040 Cash or property donations of 250 or more require a receipt from the charity Fill out and attach Form 8283 Noncash Charitable Contributions to your tax return if you have over 500 in donated property or goods A Guide to Tax Deductions for Charitable Donations Here s how your philanthropic giving can lower your tax bill By Erica Sandberg Edited by Barri Segal Reviewed by Tanza Loudenback

A Form 1040 return with limited credits is one that s filed using IRS Form 1040 only with the exception of the specific covered situations described below Roughly 37 of taxpayers are eligible Charitable contributions to qualified organizations may be deductible if you itemize deductions on Schedule A Form 1040 Itemized Deductions To see if the organization you have contributed to qualifies as a charitable organization for income tax deductions use Tax Exempt Organization Search

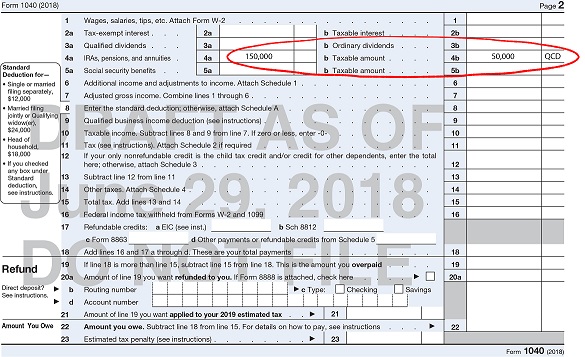

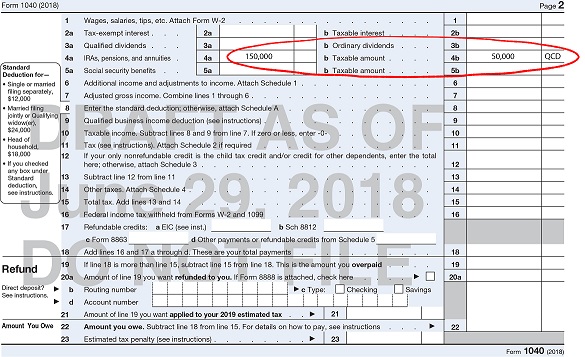

Claiming A Charitable IRA Gift On The 1040 Form Sharpe Group

https://sharpenet.com/wp-content/uploads/2017/01/2018-1040-QCD-Example-sm.jpg

Deducting Charitable Contributions Abbot Tax Service Inc

https://www.abbottaxservice.com/wp-content/uploads/2016/07/form-1040.jpg

https://www. irs.gov /credits-deductions/individuals...

Charitable contributions to qualified organizations may be deductible if you itemize deductions on Schedule A Form 1040 Itemized Deductions PDF To see if the organization you have contributed to qualifies as a charitable organization for income tax deductions use Tax Exempt Organization Search

https://www. irs.gov /charities-non-profits/charitable-contributions

Charitable contribution tax information search exempt organizations eligible for tax deductible contributions learn what records to keep and how to report contributions find tips on making donations

IRS Form 2848 What Internal Revenue Service Form 2848 Is How To

Claiming A Charitable IRA Gift On The 1040 Form Sharpe Group

Form 1040 U S Individual Income Tax Return 2015 MbcVirtual Income

Progressive Charlestown Local Charities Lose Tax exempt Status

Tax 101 2021 Charitable Contributions Becker

Charitable Contributions And How To Handle The Tax Deductions

Charitable Contributions And How To Handle The Tax Deductions

Download IRS Form 8283 Noncash Charitable Contributions Printable

Form 8889 2023 Printable Forms Free Online

IRS Form 8283 Download Fillable PDF Or Fill Online Noncash Charitable

Irs Form 1040 Charitable Contributions - Feb 29 2024 Publication 526 Cat No 15050A Charitable Contributions For use in preparing 2023 Returns Get forms and other information faster and easier at IRS gov English IRS gov Korean IRS gov Spanish Espa ol IRS gov Russian P IRS gov Chinese IRS gov Vietnamese Ti ng Vi t Contents